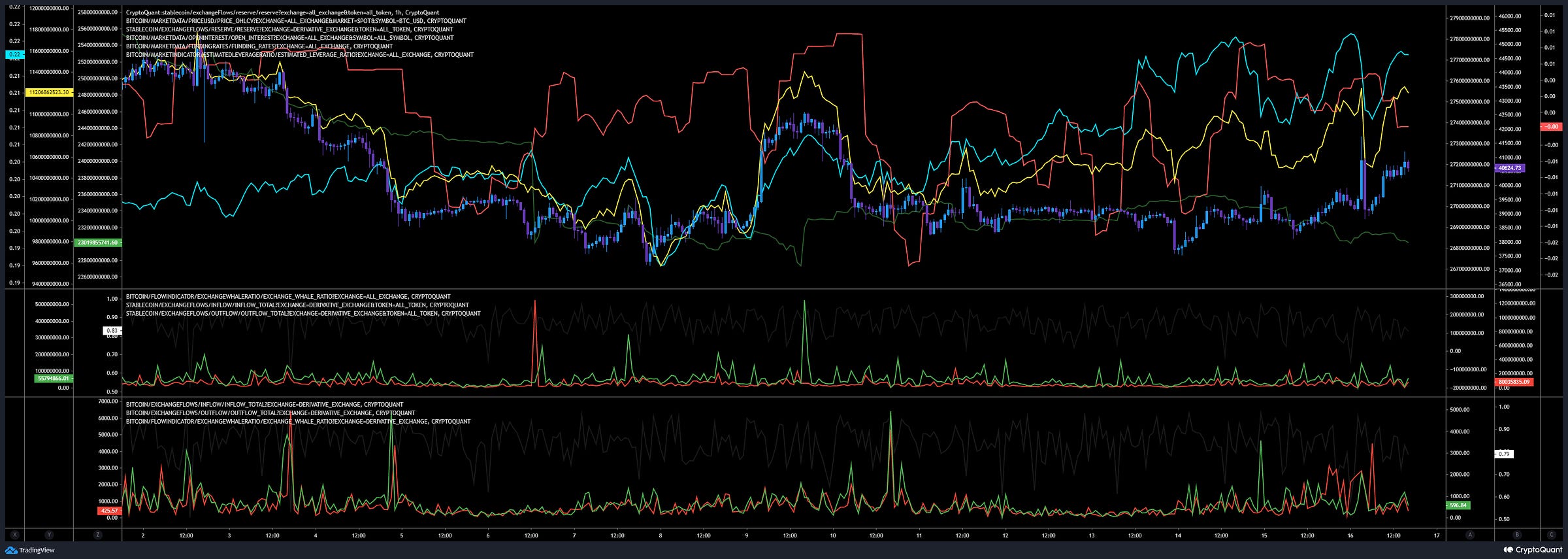

Today live Updates via Twitter due FOMC Meeting results!

The Billing is still in Pause. Nobody has to pay anything at the moment!

The market situation can change quick today.

As we have seen in the past, FOMC could generate some volatility. Something I don’t expect due the fact that FED don’t have many options anymore.

50BPS rates should be priced in. At the moment we can expect x6 rate hikes, x3 in 2022 and x3 in 2023. They expect to reduce their balances sheets by $800bn in 2022 and $1.1tr in 2023.

The inflation keeps rising and even I think the FED could announce one more rate hike, 7 instead of 6, I don’t think that could have a big impact to the markets.

That would explain why option traders are trading strategies where they expect less volatility.

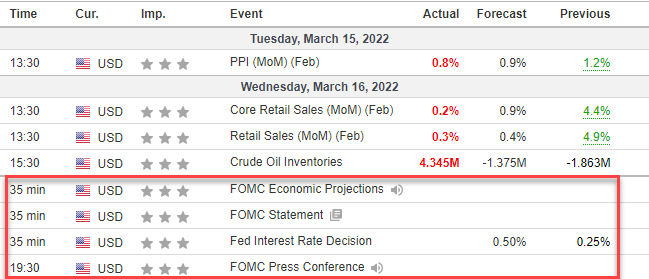

However, let us check the current data in a quick view.

Here nothing new. Whales ratio hourly not showing any signs of potential big pump coming.

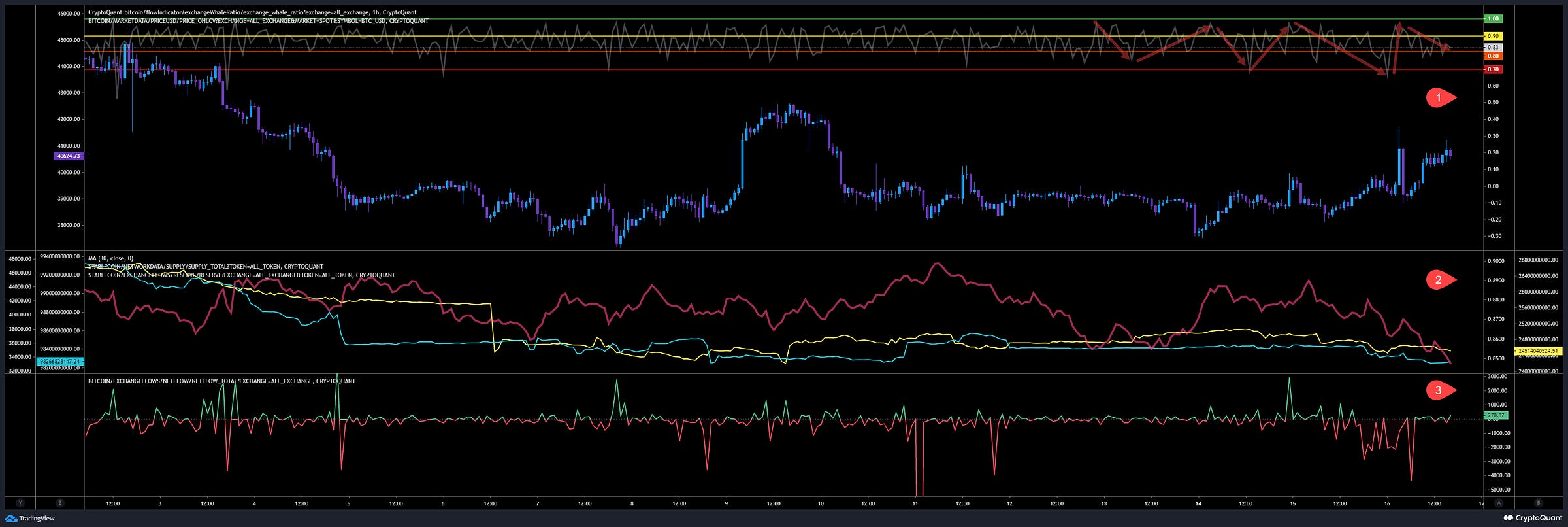

Funding rates rising, while open interests and leverage ratio declining. No big in- or outflows, neither in BTC nor stablecoins detected yet.

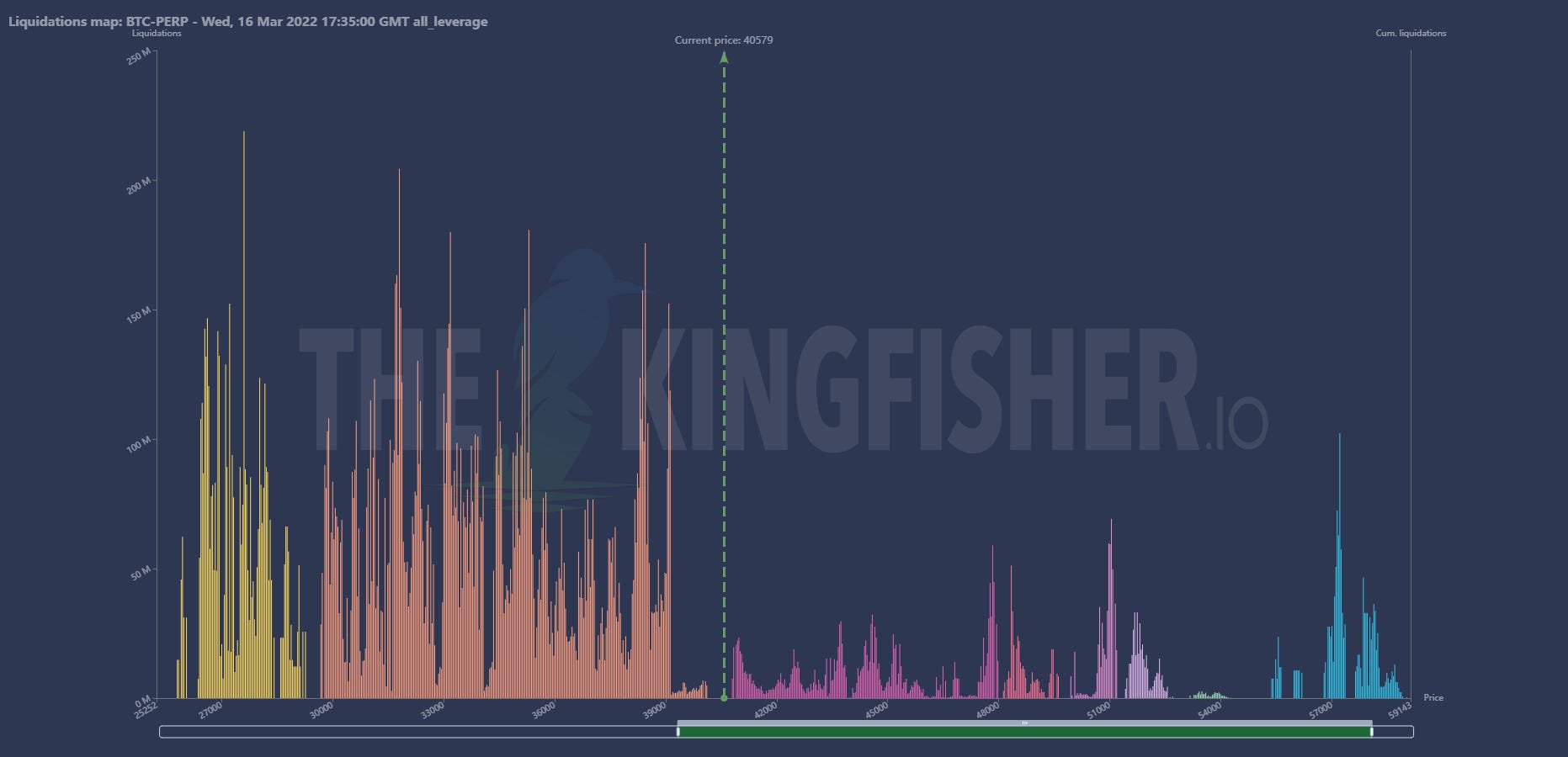

Longs showing here a bigger liquidation volume. Almost no volume on short side.

FTX leading in limiting and controlling the price imo. They shifted the upper wall to 43.5k. Their lower walls still at 35k.

Kraken also showing 2 interesting walls. At 44k and 39k.

Binance Perp pushing the price down, while limiting at 38.9k.

Okex Perp also here limiting the way up at 44.5k.

In my opinion no big volatility will happen as expected by option traders. But I expect a bearish price action soon. Whales ratio daily, as mentioned yesterday, too high and constantly! For me 42k would be a nice entry for my short. In case we lift up more heading 44k I would add more funds to my short with low leverage.