Potential Bearish Shift: A Cautious Outlook for Bitcoin Traders

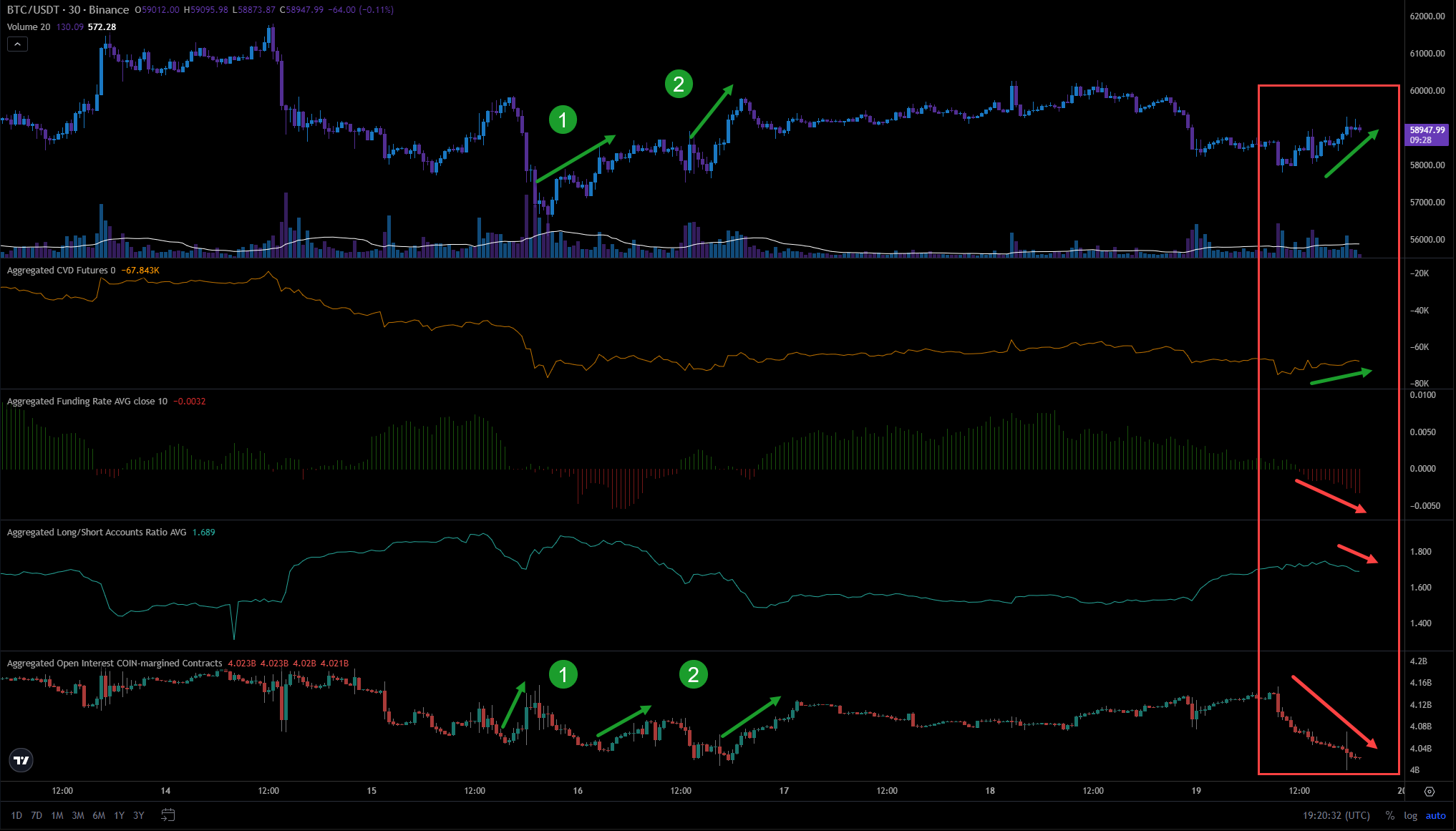

Analyzing Dropping Funding Rates and Declining Open Interest on Coin Margin Amidst a Possible Volatile Reversal

Dear everyone,

Something is brewing here, and my suspicion is that it will likely be bearish. Although I’m getting positive signals from my indicators, these don't always have an immediate impact on the price and can be delayed.

What’s making me cautious is that the funding rate keeps dropping, which is generally bullish, but the open interest for coin-margined futures is also decreasing, which is unusual. Typically, you don’t use BTC to short BTC, but rather to go long. People usually short BTC with stablecoins. This suggests someone might be closing their longs and accumulating stablecoin shorts, causing the funding rate and the long/short ratio to drop.

I’ve closed my margin long and am waiting for a potential dip to re-enter. However, I won’t open a short with stablecoins either.

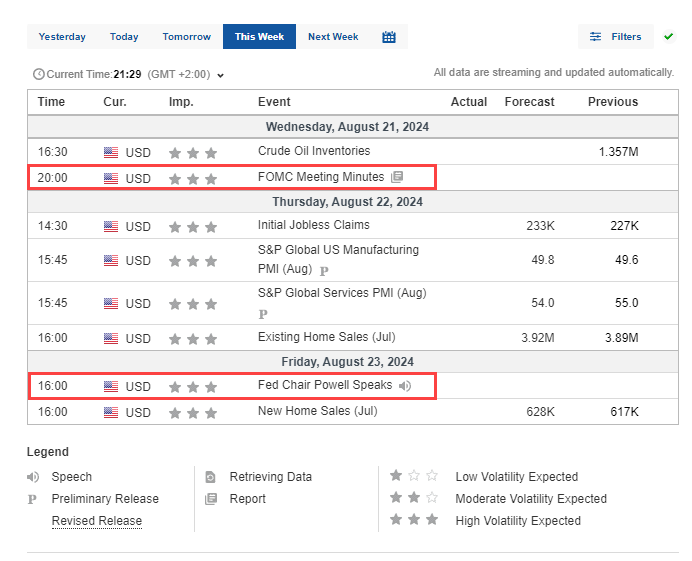

I expect increased volatility on Wednesday, which aligns with this scenario. The price could be pushed down quickly until Wednesday, only to spike upwards, liquidating retail traders who are already talking about BTC over $30,000.

This is just one possible scenario, but the timing fits. So, be cautious out there.