Ethereum (ETH) Analysis Report: Next 24 Hours and This Week

1. Options Data

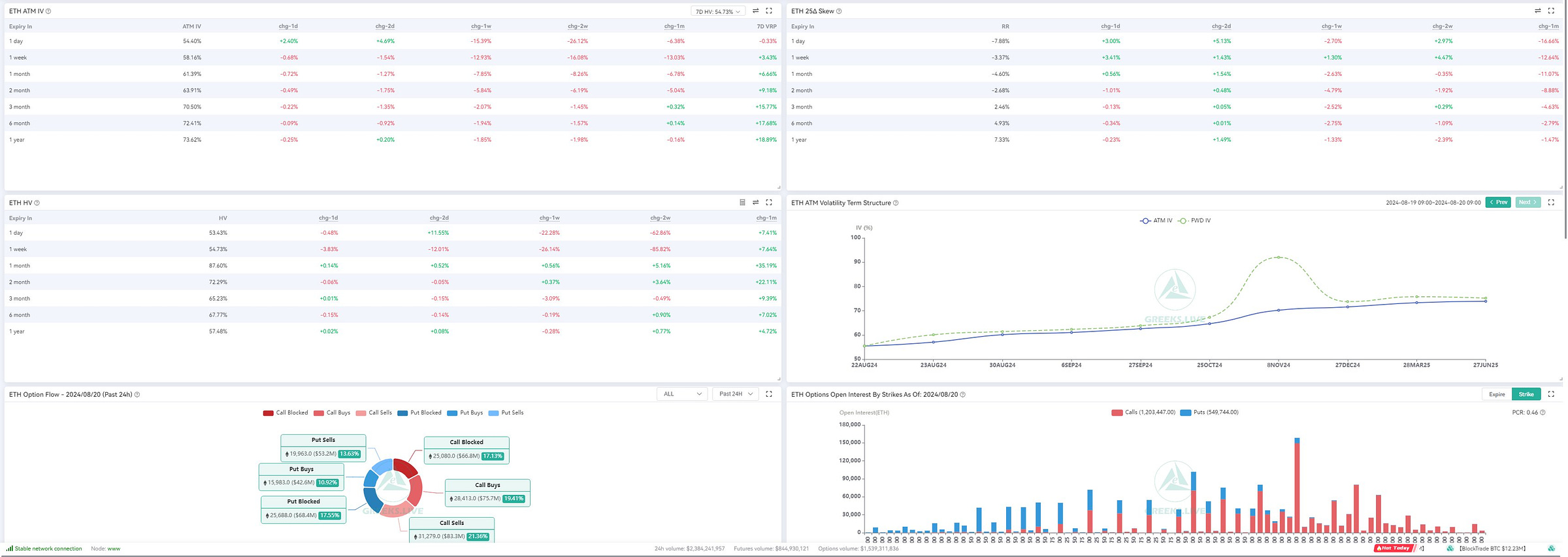

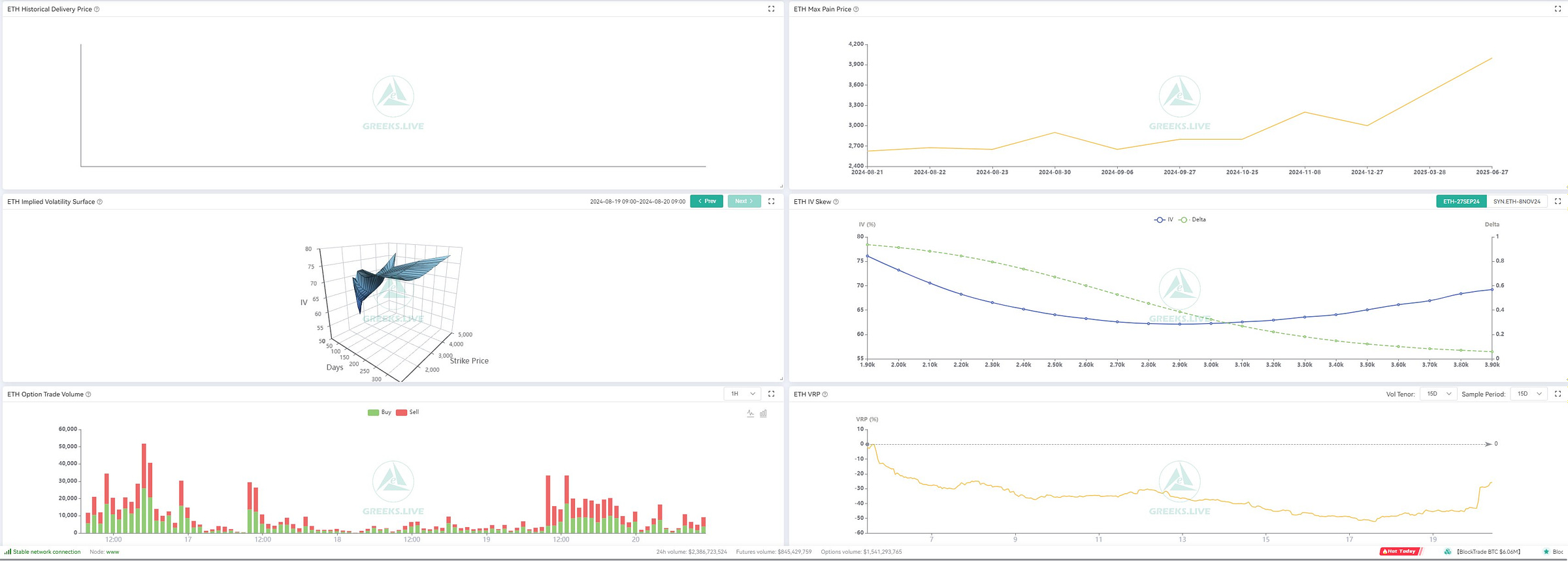

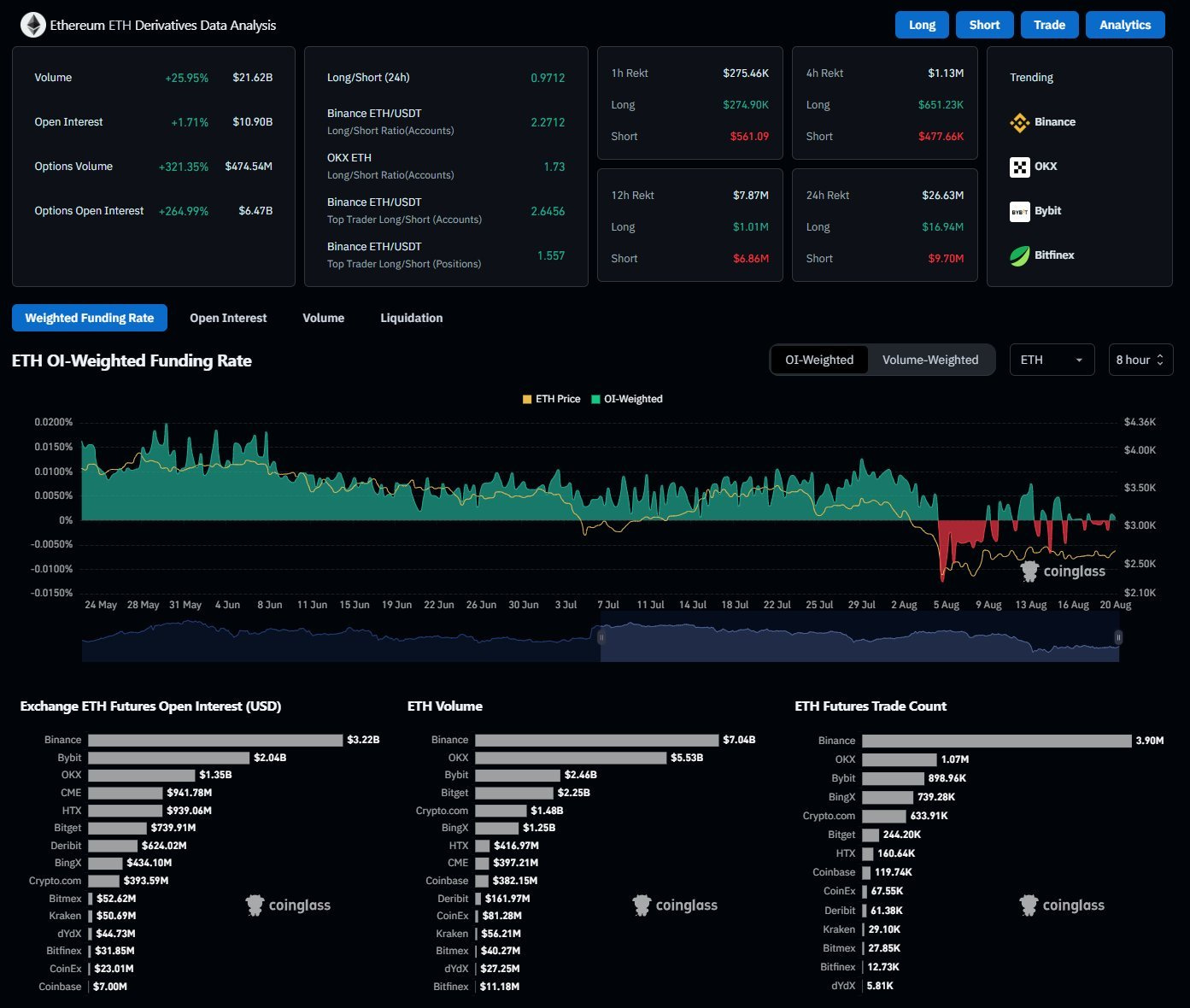

In the past 24 hours, ETH has seen a significant increase in options activity, with a 25.95% rise in volume and a 264.99% increase in open interest. The growing interest in ETH options suggests that market participants are actively positioning themselves for potential volatility or directional moves in the near term.

Implied Volatility (IV): The 1-day IV stands at around 54.40%, which is slightly elevated, indicating expectations of significant price swings in the next 24 hours. For the week, the IV for 1-week options is approximately 58.16%, reflecting moderate expectations of price volatility.

Skew: The 25d skew for 1-day options shows a slight positive bias, suggesting that traders are slightly more inclined to buy calls over puts, indicating a mildly bullish sentiment for the immediate term. However, for the 1-week period, the skew is relatively neutral, indicating balanced sentiment between bullish and bearish bets.

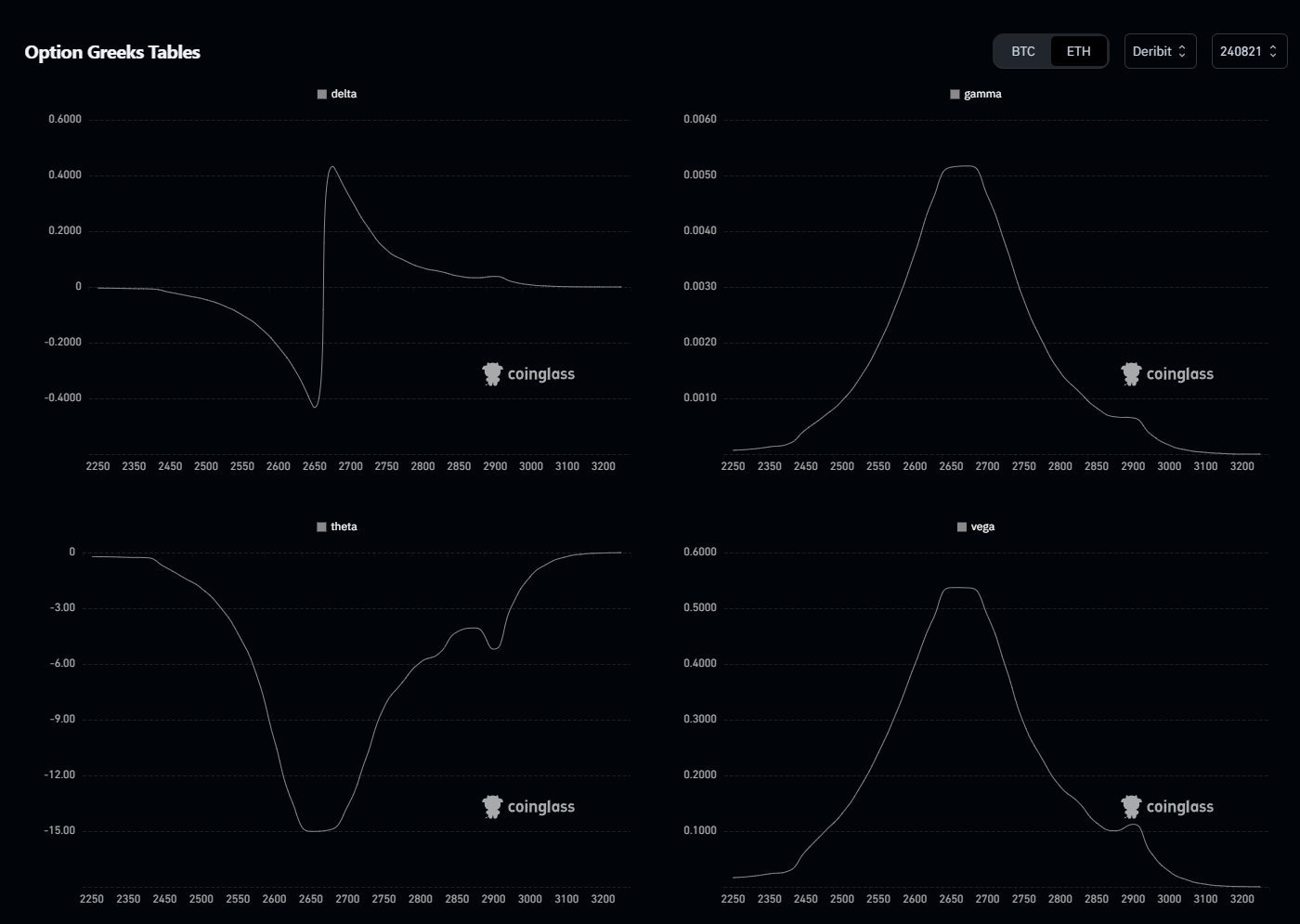

Open Interest Distribution: The highest concentration of open interest is around the $2,650 and $2,700 strike prices. This concentration suggests these levels are critical psychological barriers and could serve as significant support or resistance zones in the short term.

Put/Call Ratio: The current Put/Call ratio is leaning slightly towards calls, with a ratio below 1, indicating a generally bullish outlook. However, this ratio should be monitored closely as a sharp increase in put options could indicate a shift towards a more bearish outlook.

2. Futures Data

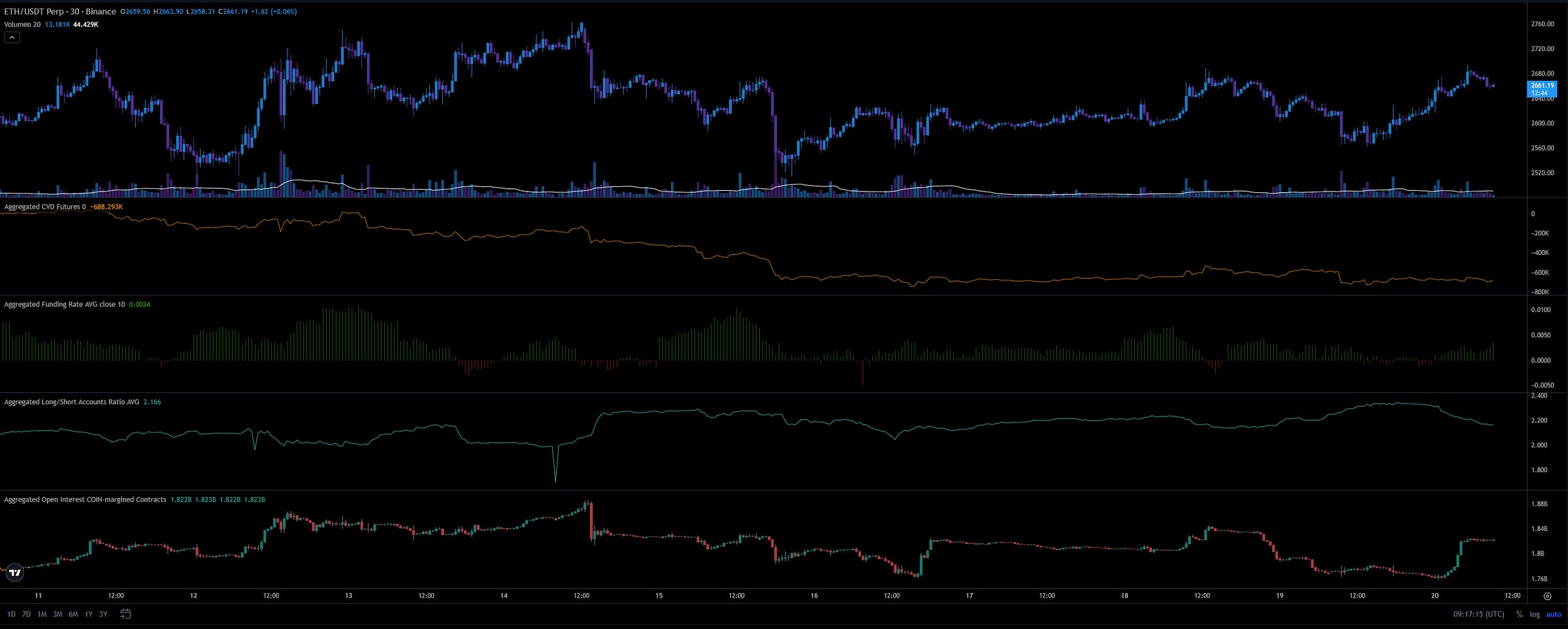

Futures data for ETH also shows strong market activity, with a noticeable increase in both volume and open interest.

Volume and Open Interest: ETH Futures on major exchanges like Binance and Bybit have seen a rise in volume by 25.95%, indicating increased trading activity. The open interest has increased by 11.71%, suggesting that traders are maintaining their positions, anticipating significant price movement.

Funding Rate: The funding rate remains slightly positive across most exchanges, which indicates that there is a mild bias towards long positions in the futures market. However, it's crucial to note that funding rates have shown brief periods of negativity, especially on HTX, which could suggest short-term bearish pressure.

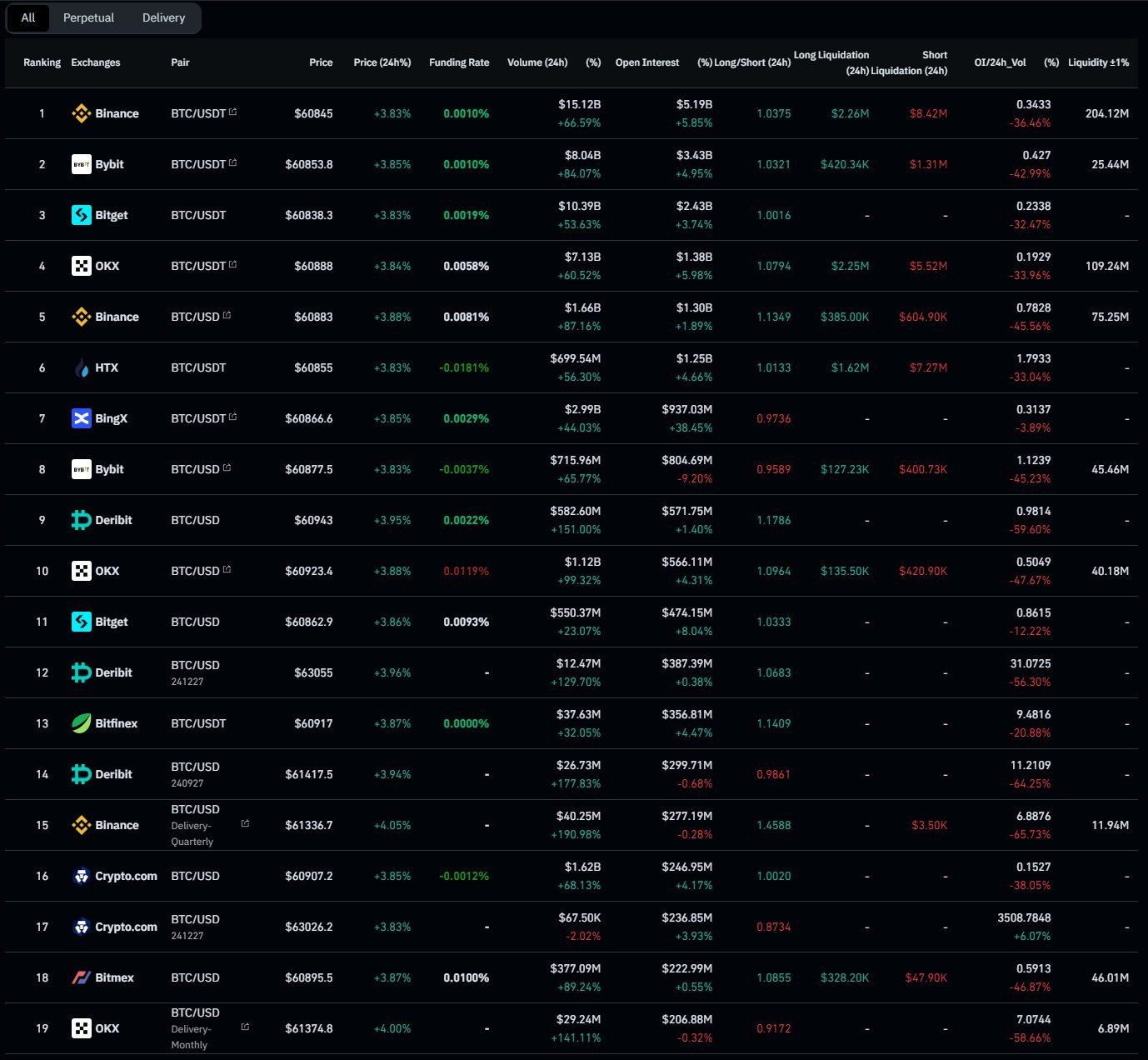

Long/Short Ratios: The 24-hour long/short ratio on Binance is 0.9712, indicating a nearly balanced market with a slight bias towards shorts. On other exchanges like Bybit, the ratio is above 1, showing a stronger preference for longs.

Liquidations: There have been significant liquidations, particularly on the short side, suggesting that while there is bearish sentiment, sudden upward price movements could trigger short squeezes, leading to rapid price increases.

3. Technical Analysis (TA)

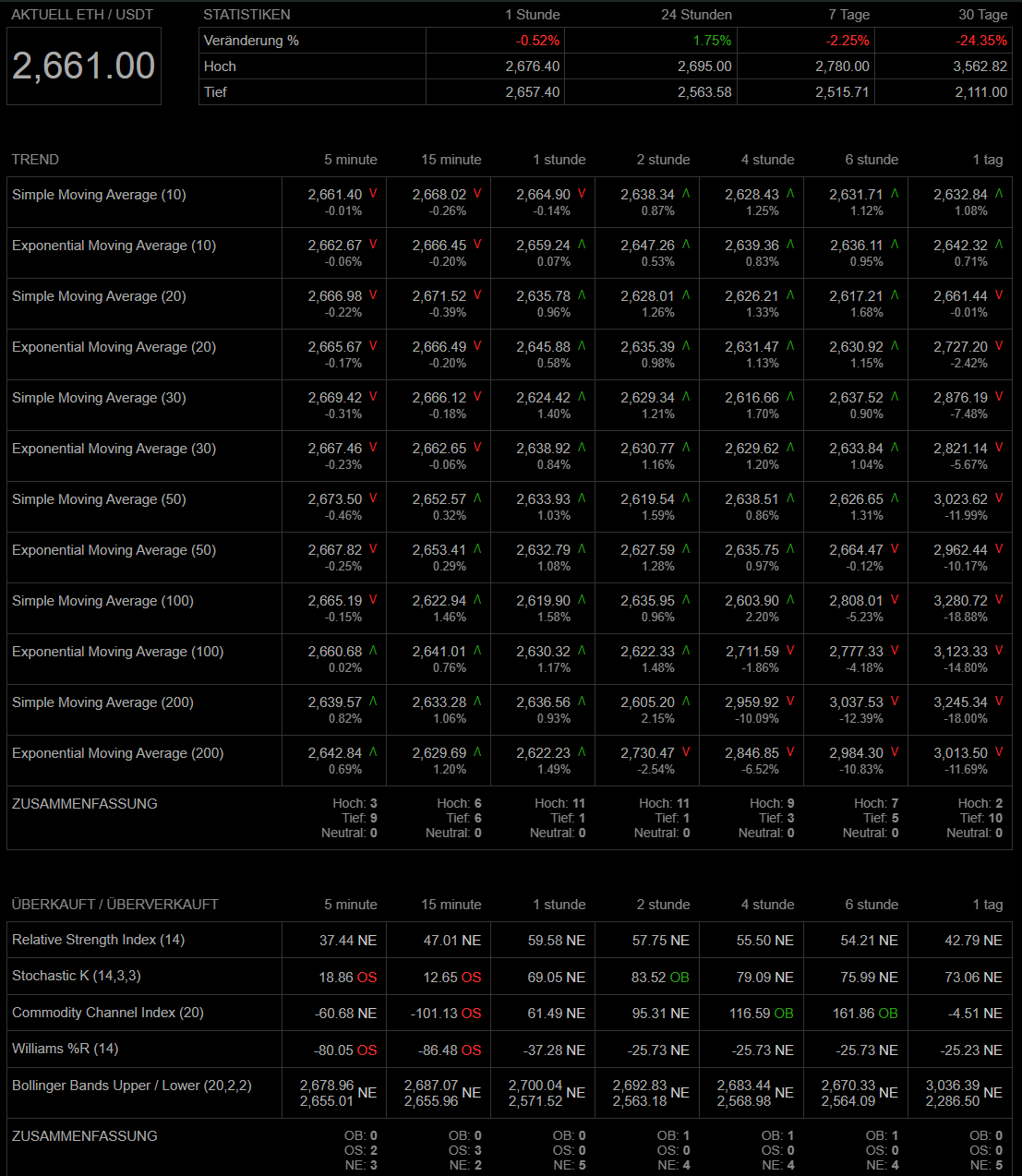

Price Action: ETH is currently trading around $2,661, having seen some recovery from recent lows around $2,560. The price is hovering near key resistance levels at $2,700, which also aligns with high open interest strike prices in the options market.

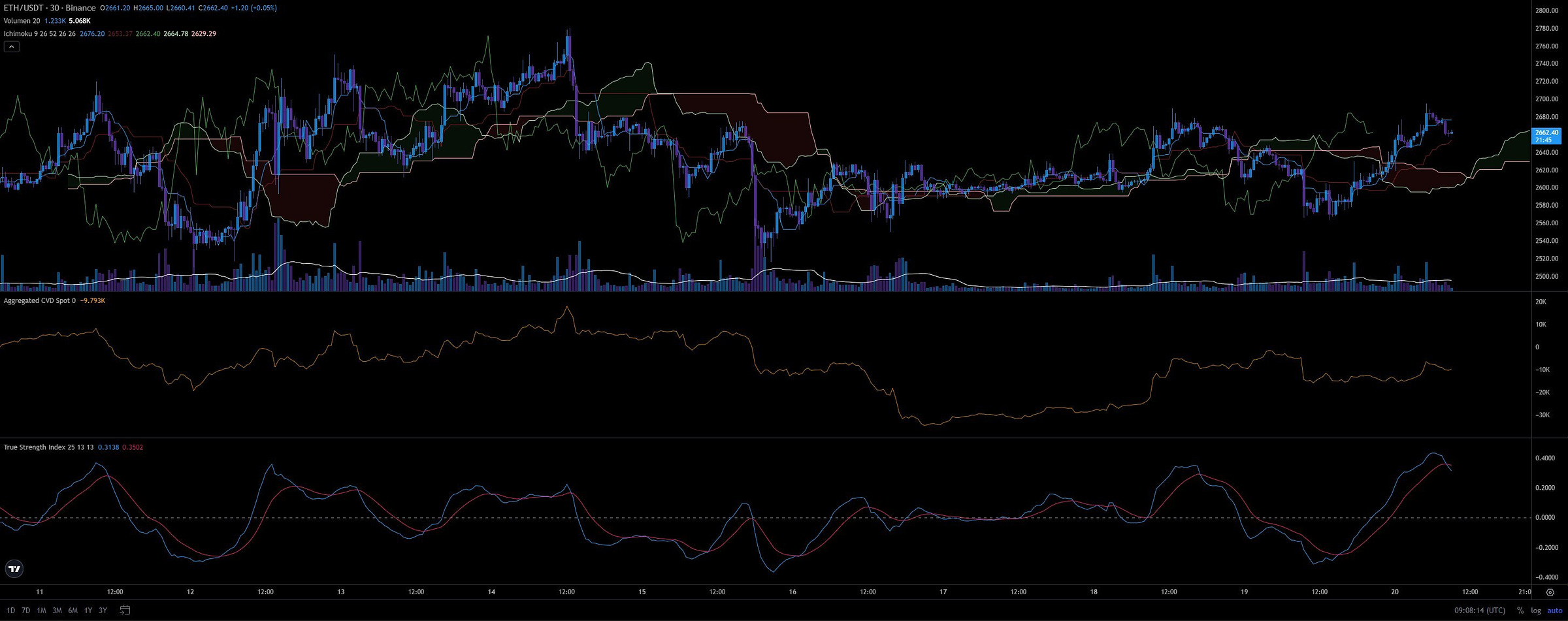

Ichimoku Cloud: The price is currently above the Ichimoku Cloud, indicating a potential uptrend. However, the cloud ahead is relatively thin, suggesting that the bullish momentum may not be very strong, and the price could easily slip back into a neutral or bearish trend if it encounters significant resistance.

Relative Strength Index (RSI): The RSI is currently around 64.33, indicating that ETH is nearing overbought territory. This suggests that while there is bullish momentum, the asset could face resistance soon and may require a pullback before continuing higher.

Support and Resistance Levels: Key support is identified around $2,640, with significant resistance at $2,700 and $2,750. A break above $2,700 could open the door for a run towards $2,800, while a failure to hold $2,640 could lead to a retest of $2,600 and potentially lower.

4. Trading Ideas

4.1 Opportunities

Bullish Scenario: If ETH can break and hold above the $2,700 resistance, there is potential for a strong upward move towards $2,750 and $2,800. Traders might consider long positions above this level with tight stop losses just below $2,650 to manage risk.

Short Squeeze Potential: Given the significant short liquidations, if ETH experiences a quick upward spike, it could trigger a short squeeze, pushing the price higher rapidly. This would be an opportunity for traders to capitalize on quick momentum trades.

4.2 Risks

Overbought Conditions: The RSI indicates that ETH is approaching overbought levels. Traders should be cautious of a potential pullback, especially if the price struggles to maintain above $2,700. This could lead to a short-term correction back to support levels around $2,640 or lower.

Volatility Risks: With increased implied volatility and significant options activity, the market could experience sharp price swings. Traders should be prepared for rapid changes in market conditions, particularly as the week progresses and options approach expiry.

Bearish Break Below Support: A break below $2,640 could lead to a retest of lower support levels around $2,600 or even $2,550. This would invalidate the bullish scenario and could trigger further downside, particularly if accompanied by increased selling volume and a negative shift in the funding rate.

This analysis outlines the current state of the ETH market with potential trading opportunities and risks for the next 24 hours and the upcoming week. Traders should remain vigilant and adapt their strategies based on the evolving market conditions.