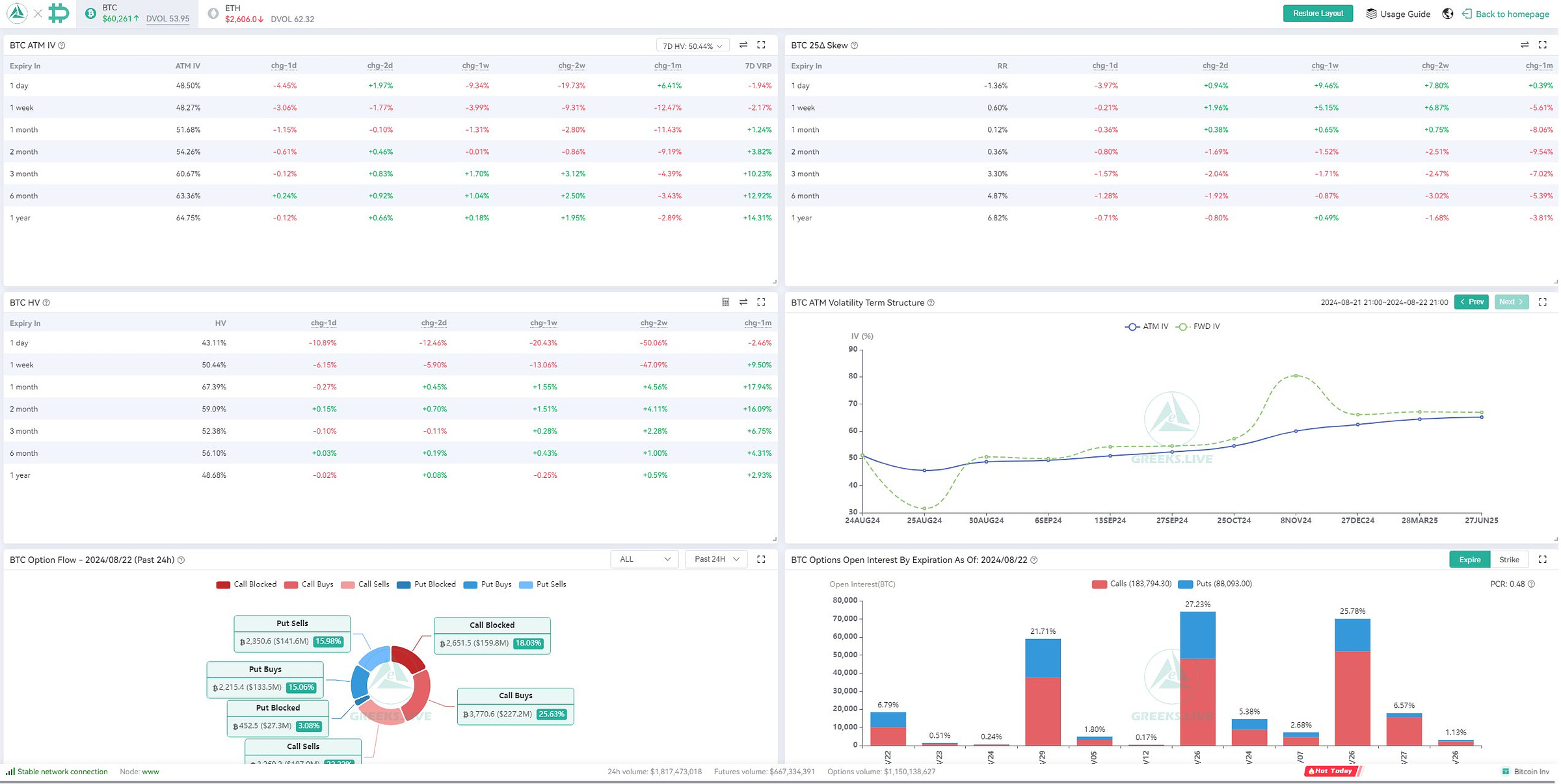

Implied Volatility (IV):

There's a slight decrease in IV, indicating reduced expected market volatility. This suggests traders are less concerned about drastic price movements in the near term.

Skew:

The skew remains relatively stable, with no significant shift. This indicates a balanced outlook with no strong bias towards calls or puts.

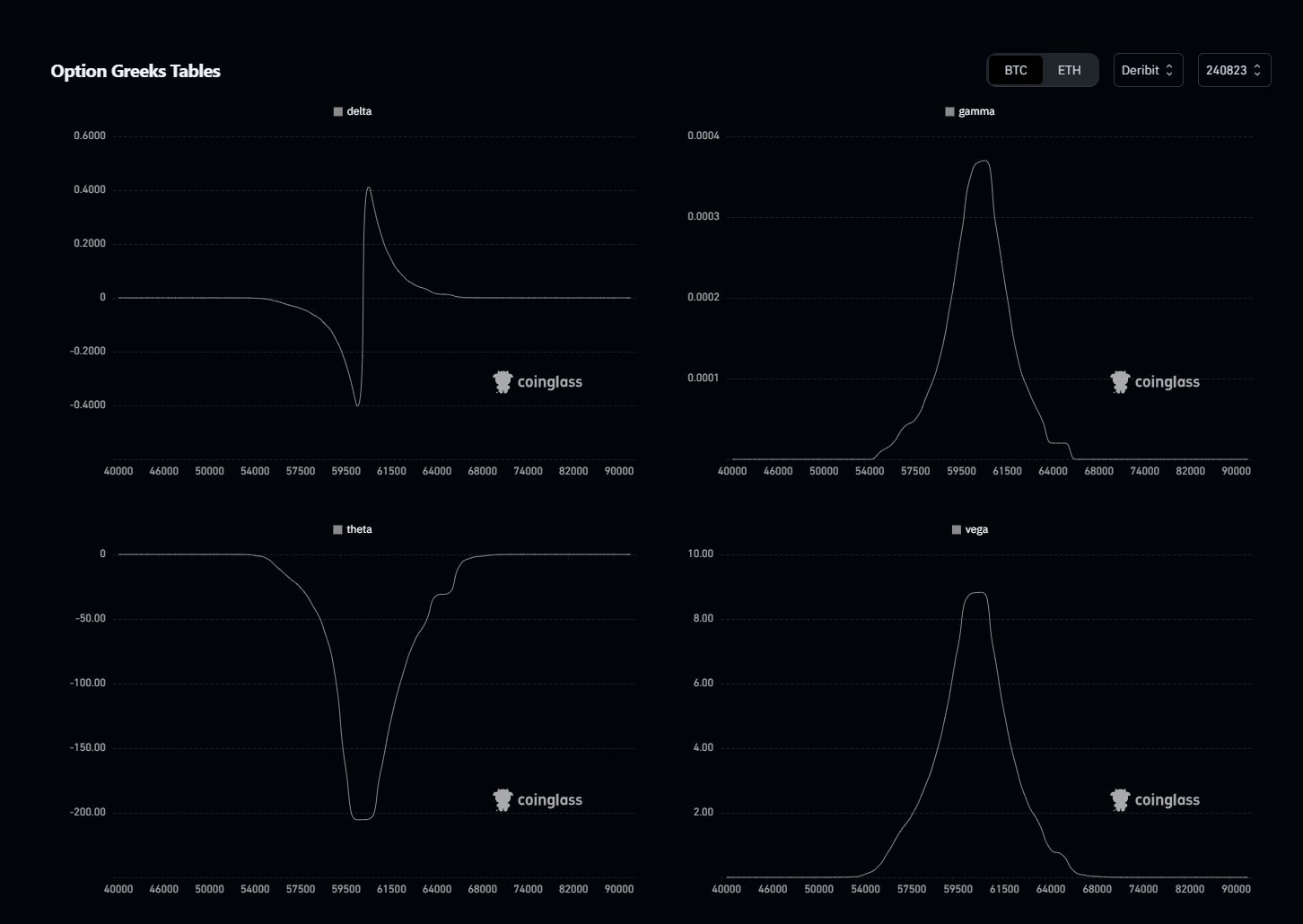

Greeks:

The Greek metrics, particularly delta and gamma, show a slight leaning towards neutral positions, with no significant changes observed throughout the day.

Conclusion:

There hasn't been a substantial change in trader expectations since this morning. The overall market sentiment remains cautiously neutral with a slight bullish bias. In the short term, expect relatively stable prices with low volatility, unless external factors come into play.

It seems like it will be a quiet night. At least, options traders aren't expecting significant price volatility. We'll likely stay between $61,500 and $59,500, with price dynamics mainly revolving around $60,000.

Good night, everyone.