On-Chain Analysis

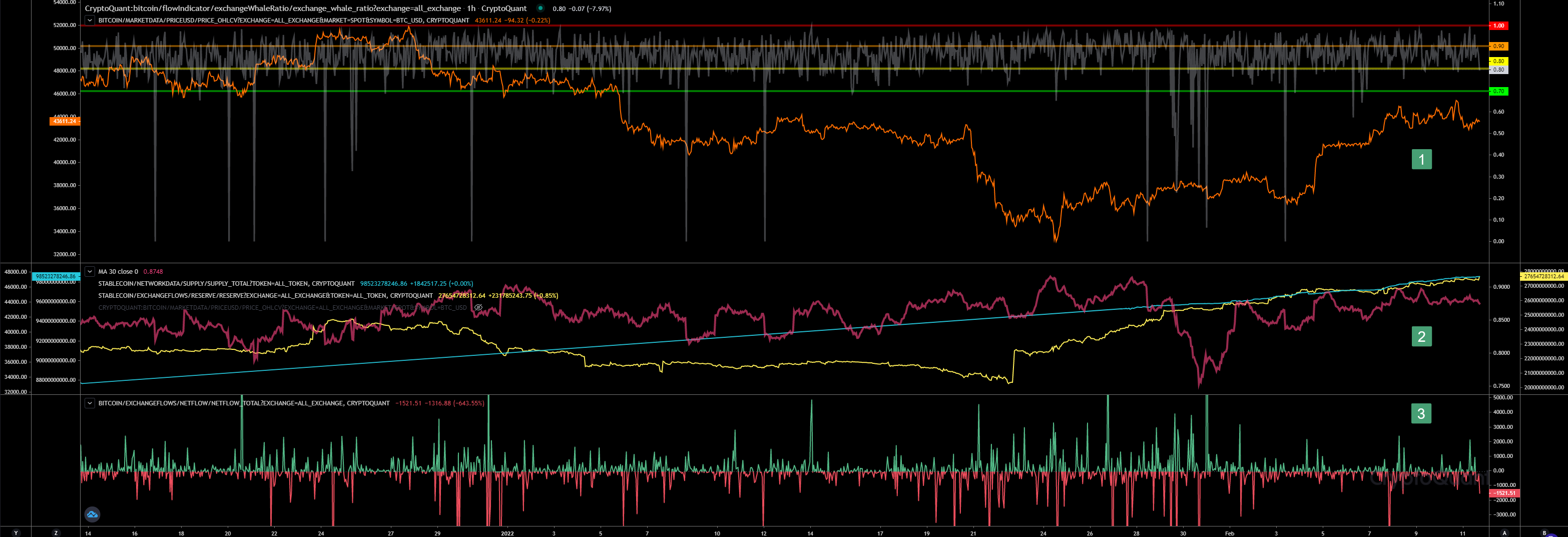

Whales Ratio Daily View

(1) Whales Ratio declining - bullish

(2) Whales Ration 30 days average declining - bullish

(2) Stablecoin Reserves on Exchanges rising - bullish

(3) Total Netflow negative but rising - neutral

Whales Ratio Hourly View

(1) Whales Ratio declining - neutral

(2) Whales Ration 30 hours average declining - neutral

(2) Stablecoin Reserves on Exchanges rising - bullish

(3) Total Netflow flipped to negative - neutral

Whales Ratio Block View

(1) Whales Ratio now declining - bullish

(2) Whales Ration 30 block average declining - bullish

(2) Stablecoin Reserves on Exchanges rising - bullish

(3) Total Netflow flipped to positive - bearish/neutral

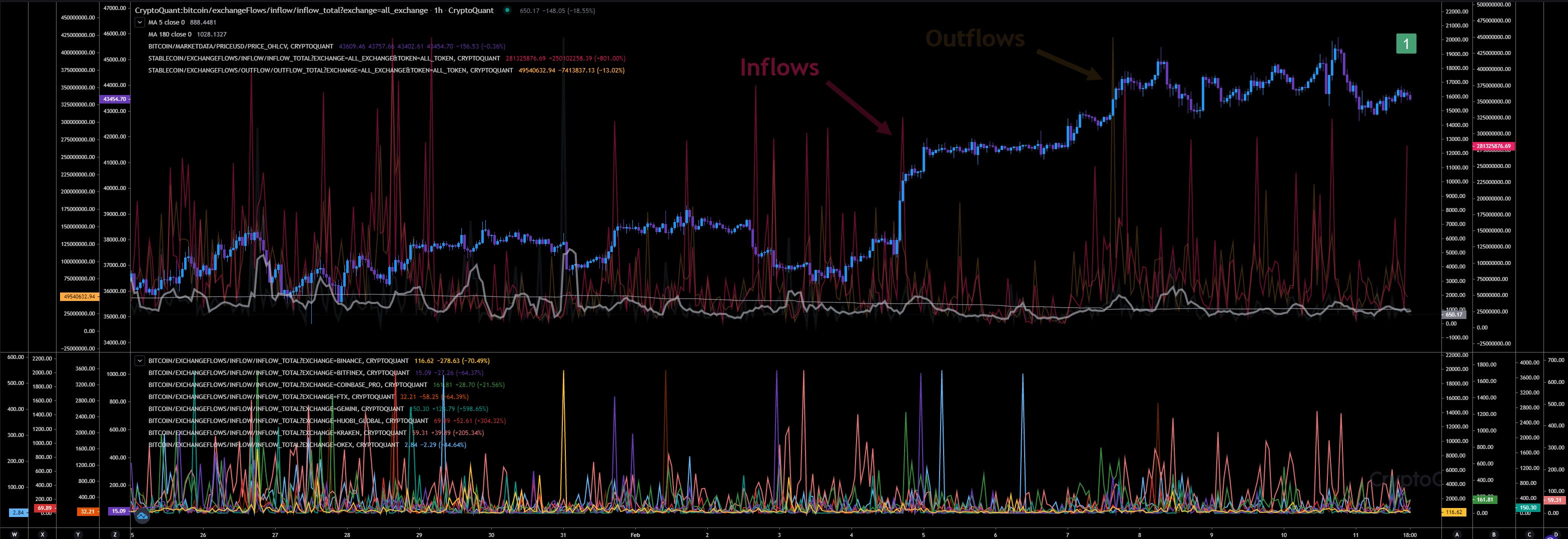

Stablecoin Flows Hourly View

(1) Stablecoin Flows MA5 stabilized - neutral

(1) Stablecoin Flows rising- bullish

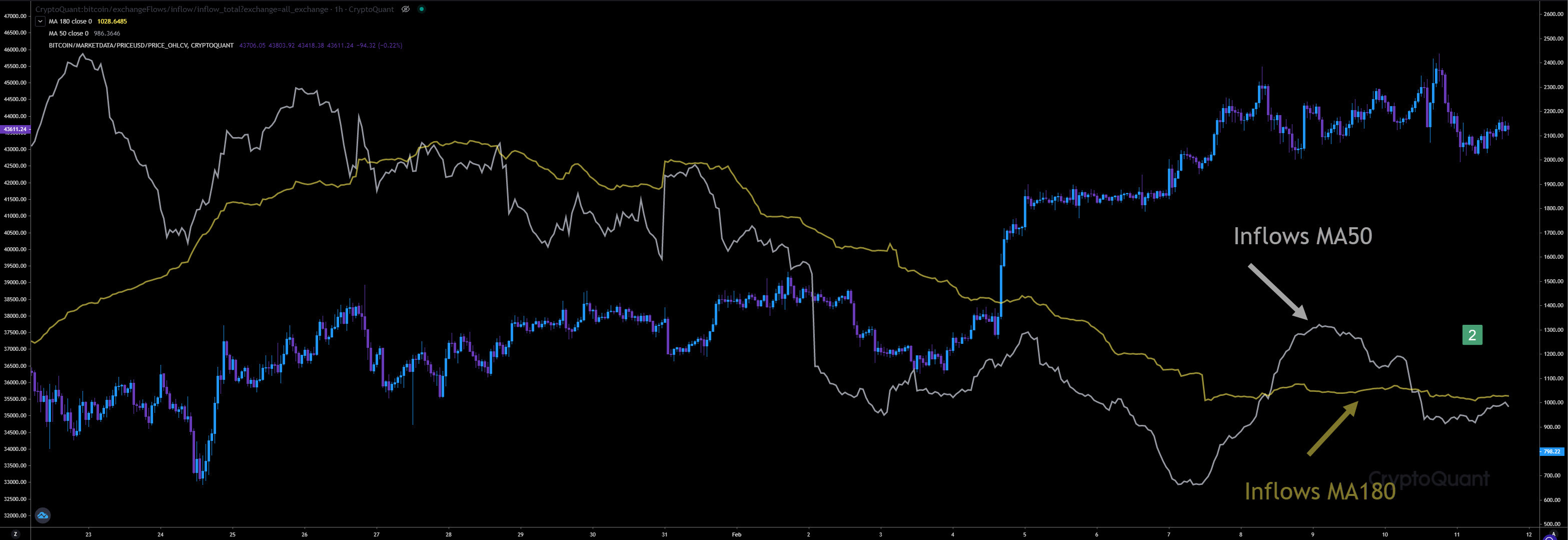

BTC Inflows Hourly View

(2) BTC Inflows MA50 lifting up - bearish

(2) BTC Inflows MA180 lifting up - bearish

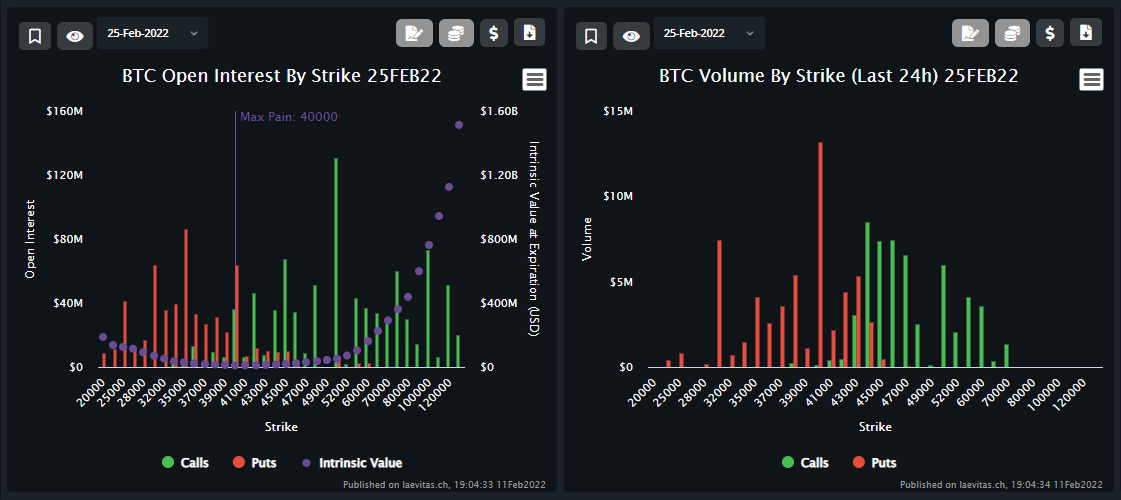

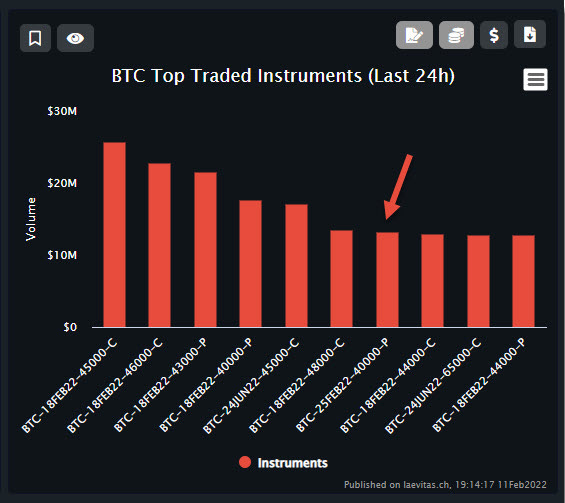

Option Trading Analysis

Expiry 25Feb22

Max Pain 40k - bearish

Biggest Volume by Strike Puts at 40k - bearish

25Feb22 Expiry

Puts at 40k - bearish

18Feb22 Expiry (leading)

Calls at 44k/45k/46k/48k

Puts at 40k/43K/44k

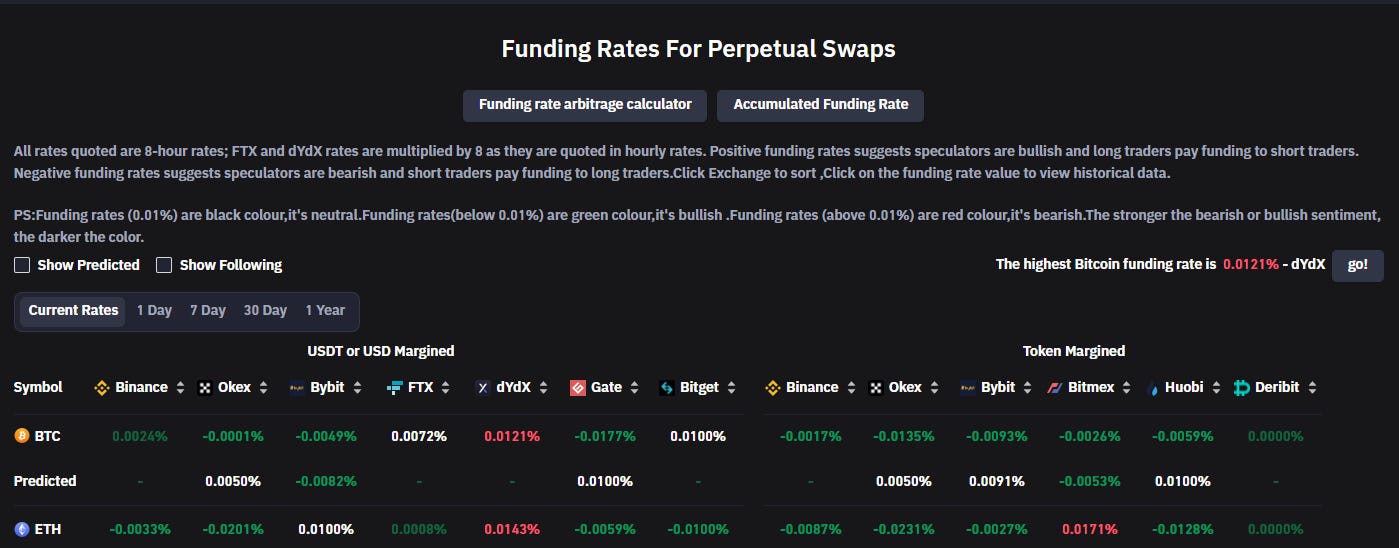

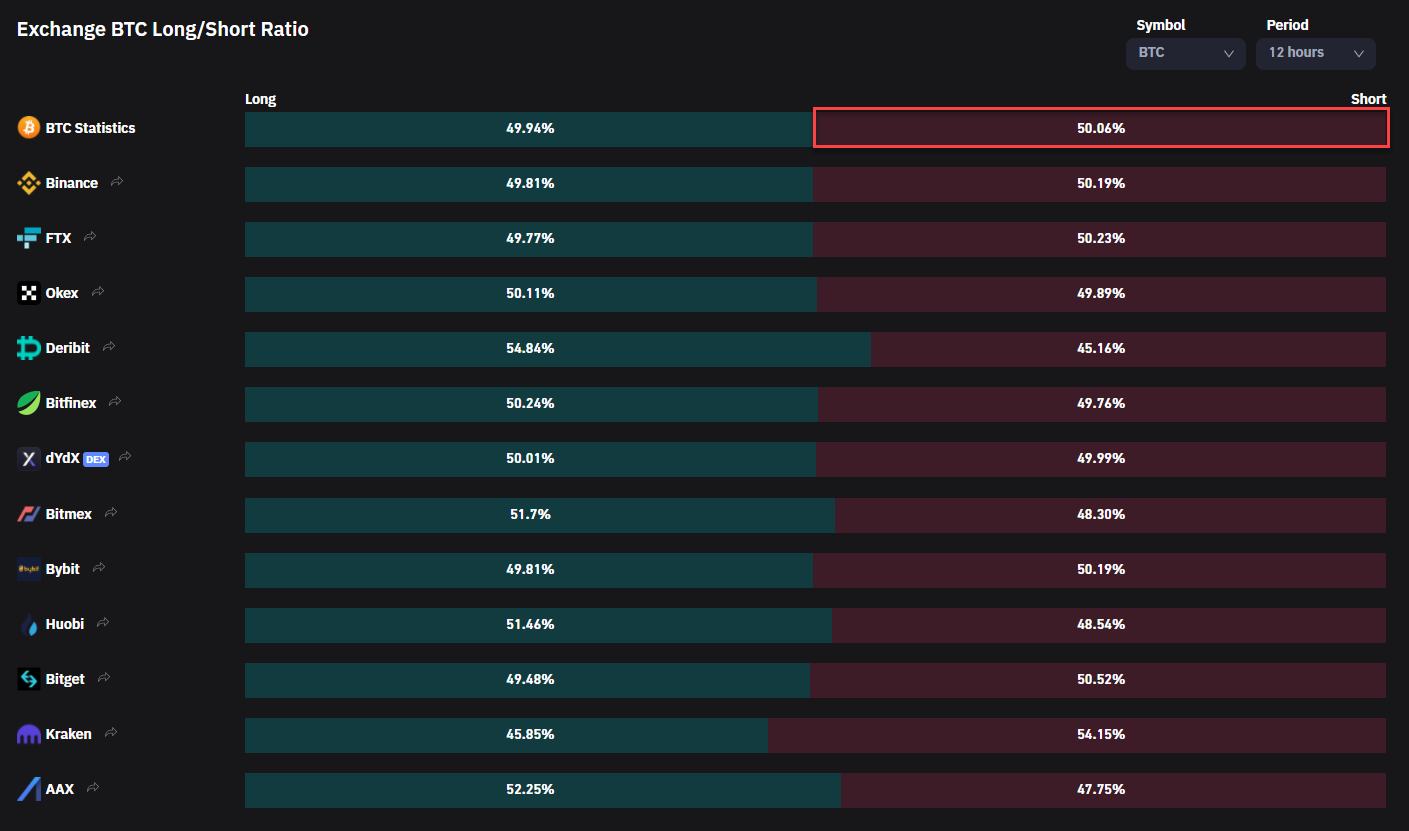

Future Trading Analysis

Funding Rates - 4 negative / 2 neutral / 1 positive

Bearish sentiment

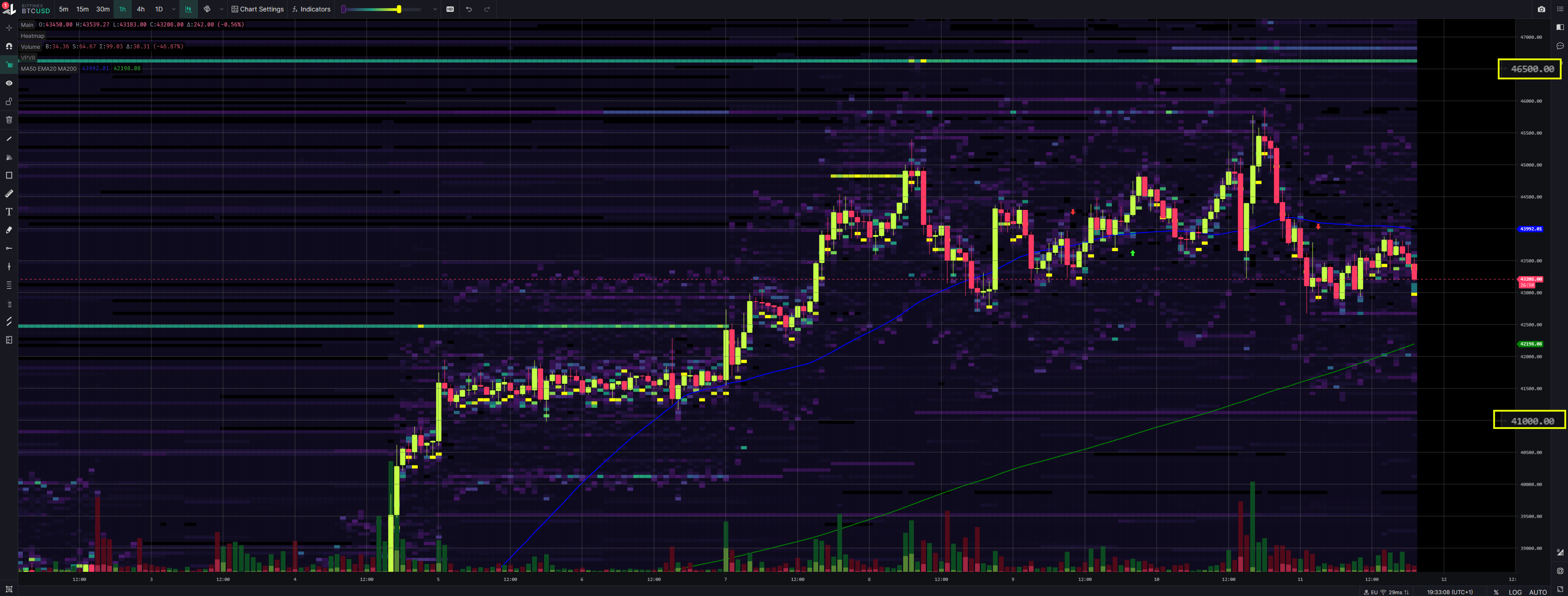

Exchange Order Walls

Binance

Coinbase

Bitfinex

FTX PERP

Personal Conclusion

Whales ratio declining while more BTC inflows have arrived, bigger ($300m) stablecoin inflows also detected, option traders showing bearish sentiment for next week friday and future traders showing a bigger demand for shorts than longs, even if not a big difference.

Exchange walls have changed a bit. Coinbase order activity showing sell pressure above our current level.

Price should fall heading 42.4k. Be careful, we can pump up from there afterwards.