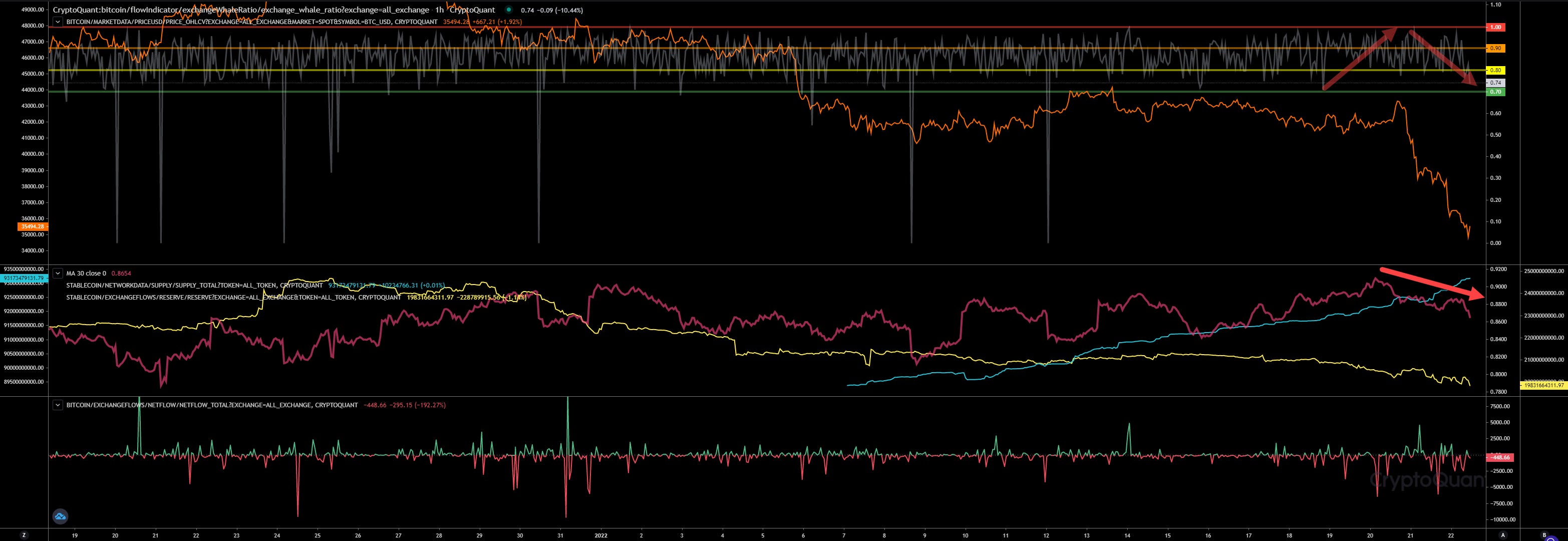

Hourly View

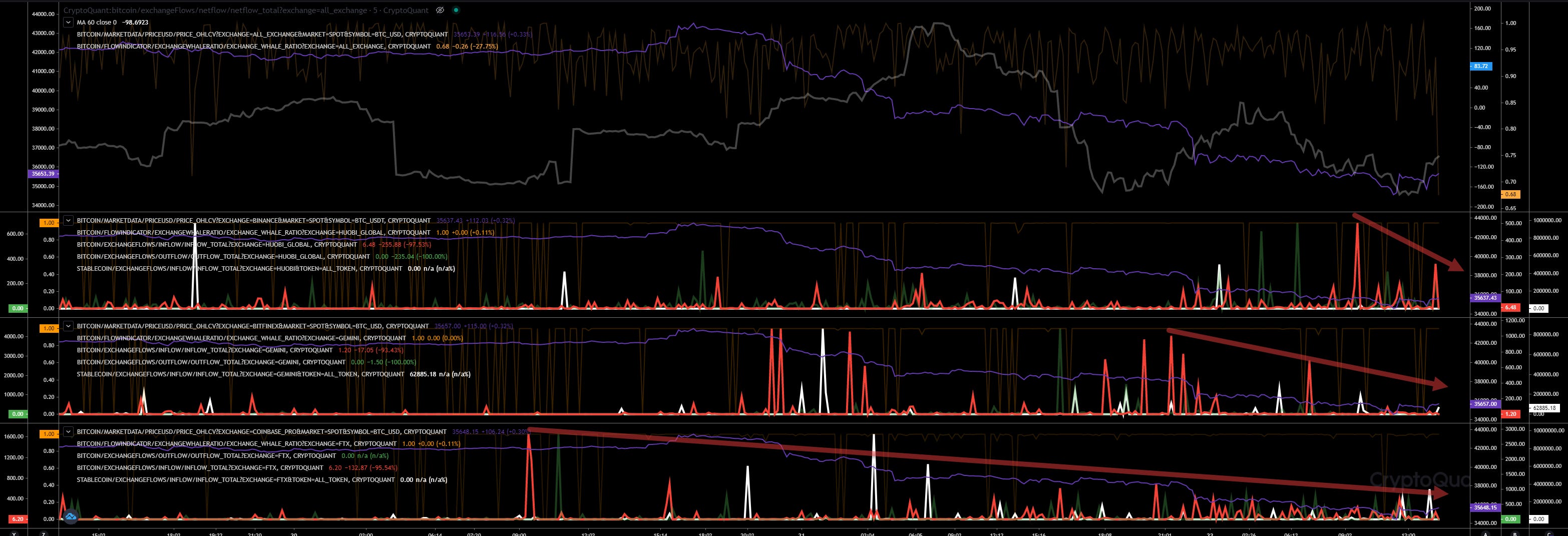

Our hourly looks good at the moment. Whales ratio is declining, price action rising. Netflows showing bigger outflows. Yesterday we had a lot of inflows and a big sell pressure. We need to see what happens next and if the whales ratio keeps falling. Then I would expect 38k first. If the inflows keeps declining too, I would expect a retrace back to 38k first.

Block View

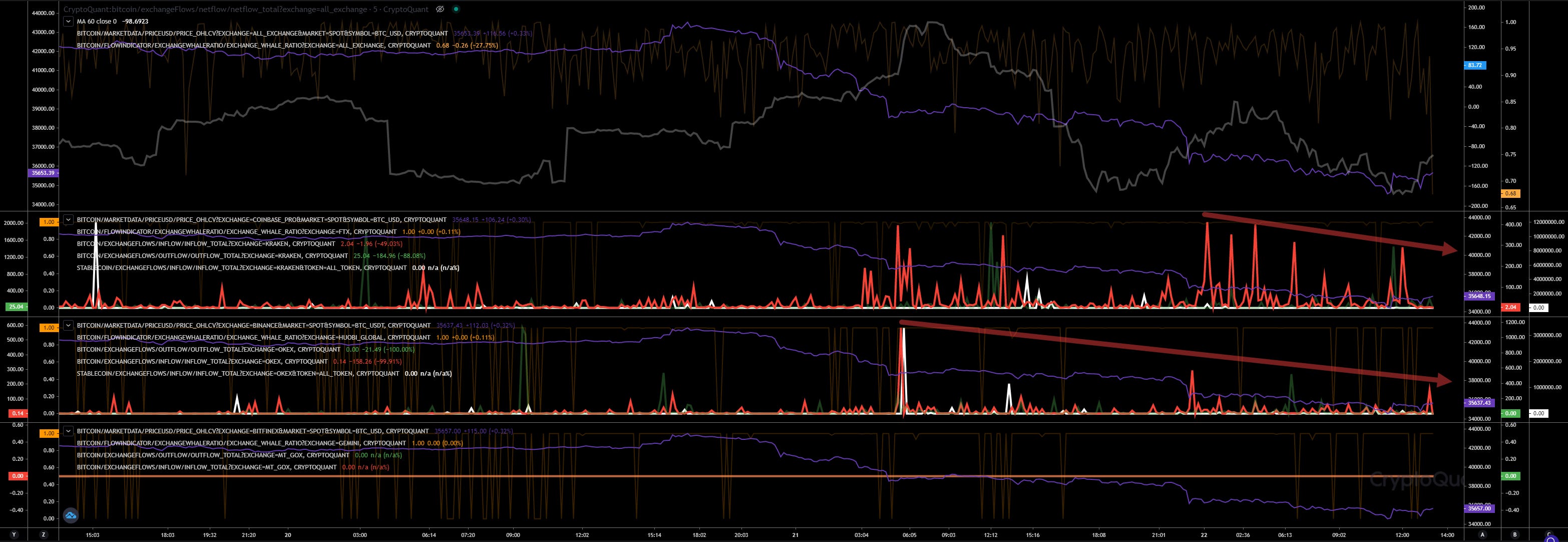

Our block view also indicating more a bullish trend now. That’s a short-term view. That can flip quick, but at the moment it looks good to me, to see 38k soon. Of course it depends also on the buy pressure. If they want to accumulate at 35k, we will maintain this price level a while. However, at the moment it doesn’t look that bearish. But we need to check all data before we can create a trade strategy.

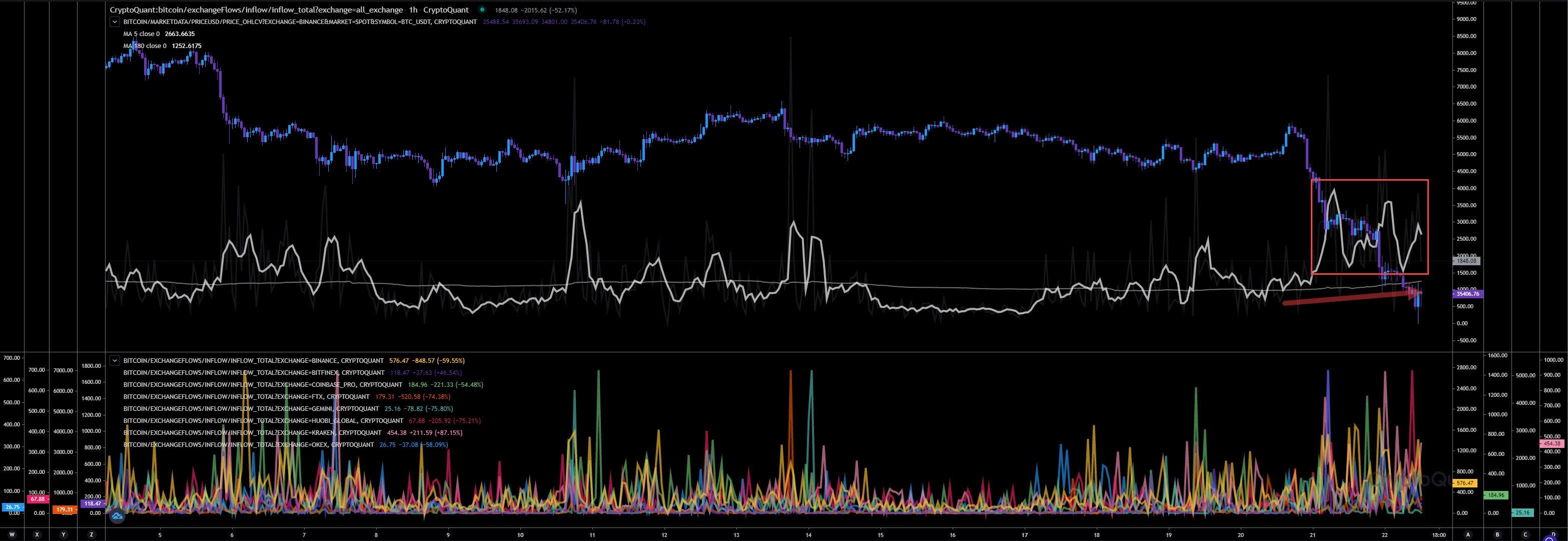

Exchange Inflows

Our hourly view indicating a rising inflow showing more than 1,600 BTC reaching exchanges in the last hour. That should generate more incoming sell pressure. That’s not really bullish. Only if whales are ready to absorb all these tokens. But if keep rising in inflows, we will see 33k next for sure.

The block view brings a better picture. We had our peak in inflows yesterday in the morning. However the preparation have started 20Jan22 showing a big inflow by FTX and Gemini followed. Since then the inflows in volume are declining indicating less tokens are arriving on exchanges. Also showing some bullish signals. That could allow us to lift up at least a bit as mentioned above, back to 38k.

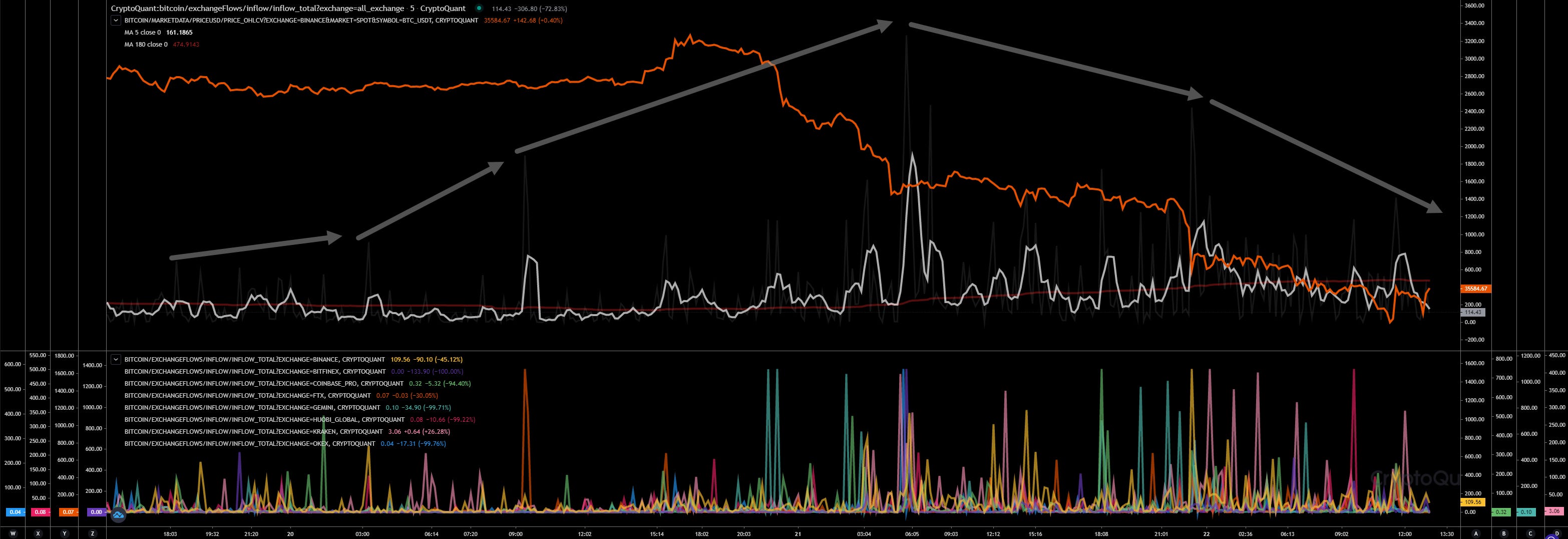

If we check each exchange we will also here notice a bullish trend. Inflow volume declining, more stablecoin inflows detected. That’s also bullish. Binance still showing inflows, but less than 400 BTC each.

Huobi relatively active related to inflows, but with low volume. Gemini last big infow happenend this morning with a total volume of 600 BTC, since then also almost no activity here. FTX the same, last inflow with 400 BTC happenend an hour again, but as usual, stablecoin arrived immediately afterwards and those 400 BTC disappeared afterwards.

Kraken was/is very active and is showing almost 2,000 BTC inflow since this morning. Okex is low volume and not in my scope at the moment.

Option Trading

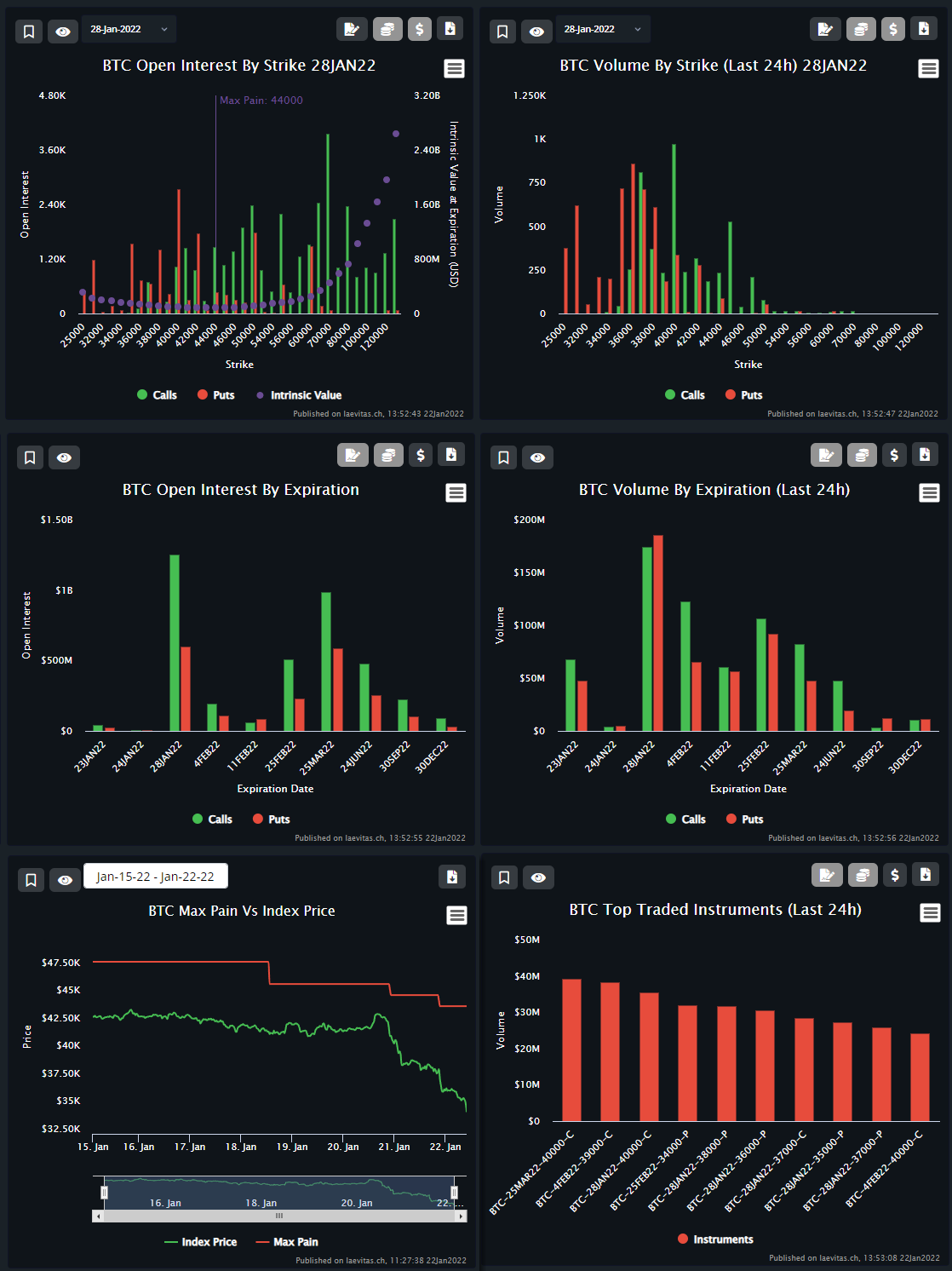

Expiry 28JAN22

Our max pain has declined once more to 44k. More Calls were traded in the last 24h in lower ranges at 40k and 37k. They traded more Puts than Calls in the last 24h. Indicating that option traders are adjusting their option positions. We have now less Open Interest related to this expiry. We have $1.25 billion in Calls and almost $600 million in Puts. We had a bit more just few days ago, indicating that some option traders are shifting to other expiries like the 25Mar22 one. As you can see the top traded instruments are Calls and Puts in lower ranges. Thats not bullish at all, at least for the next big coming expiry 28Jan22.

Future Trading

Hourly View

The last two days were christmas for exchanges. We can see big longs and shorts liquidations. Interesting here, the leverage ratio is declining and the funding rate too, indicating more demand in shorts at the moment. It seems no many are expecting here the bottom. However, the leverage ratio maintains very high and the funding rate is declining, but still showing that the demand for shorts isn’t huge. That doesn’t look like capitulation at the moment.

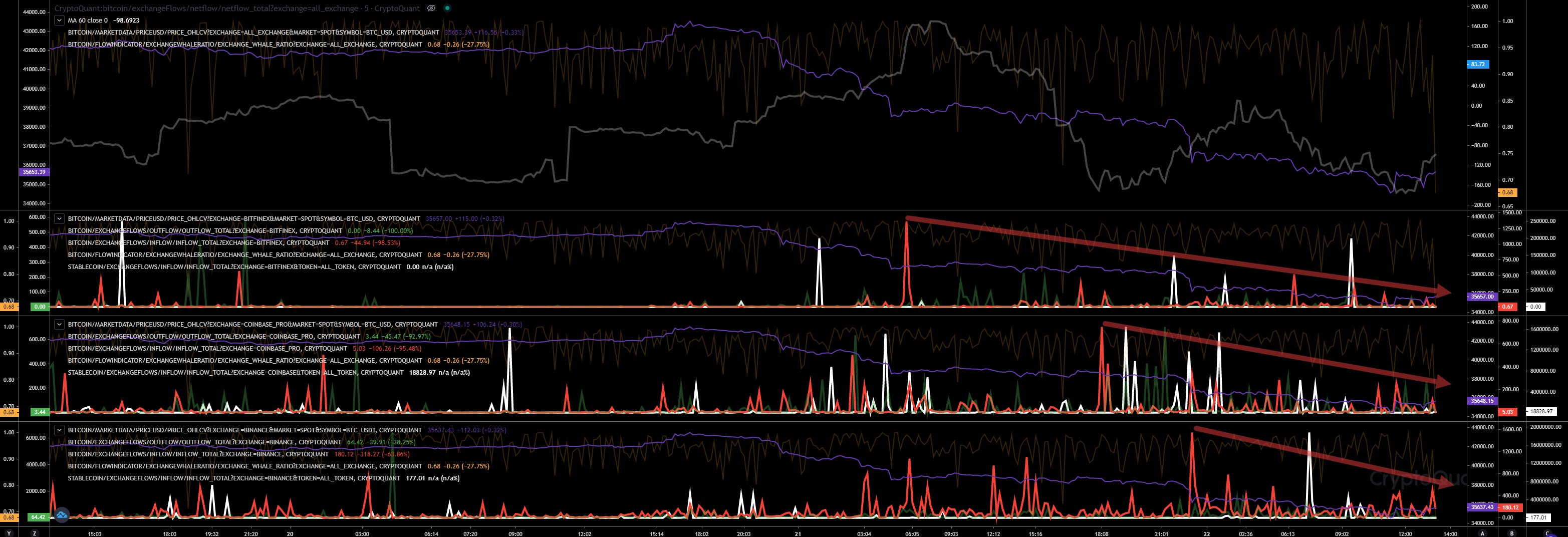

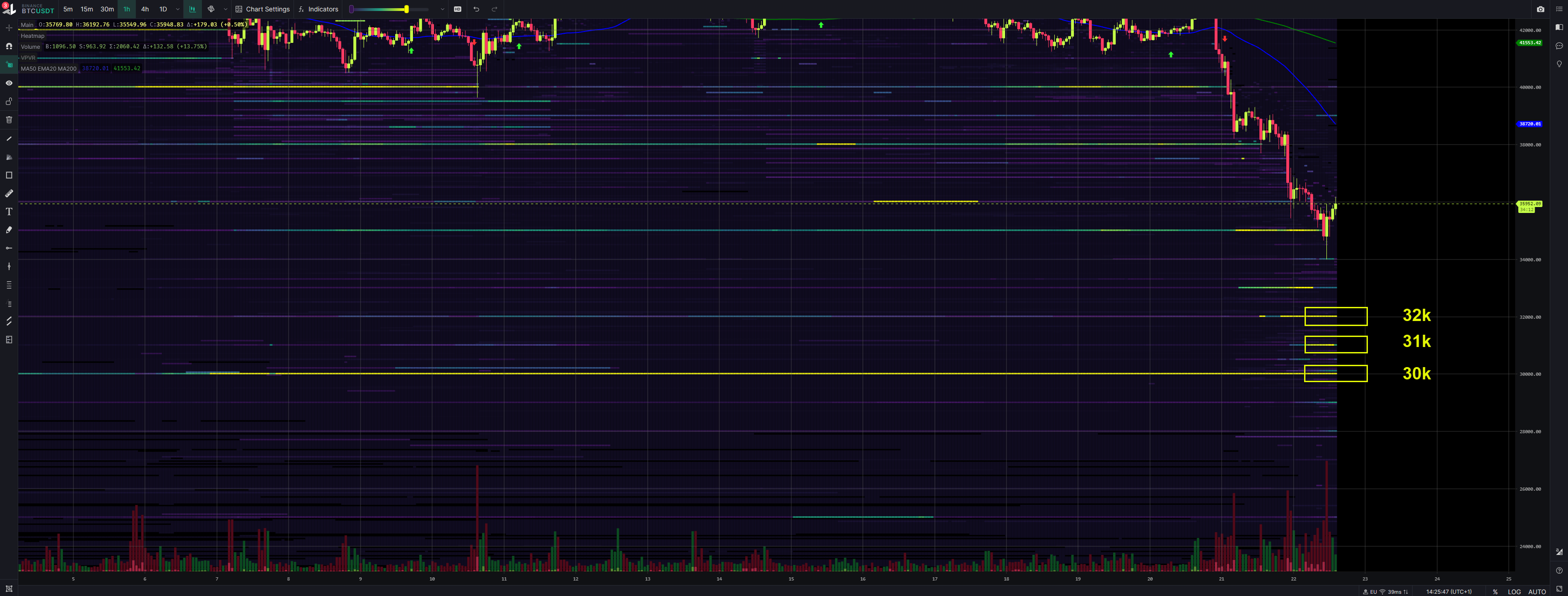

Exchange Walls

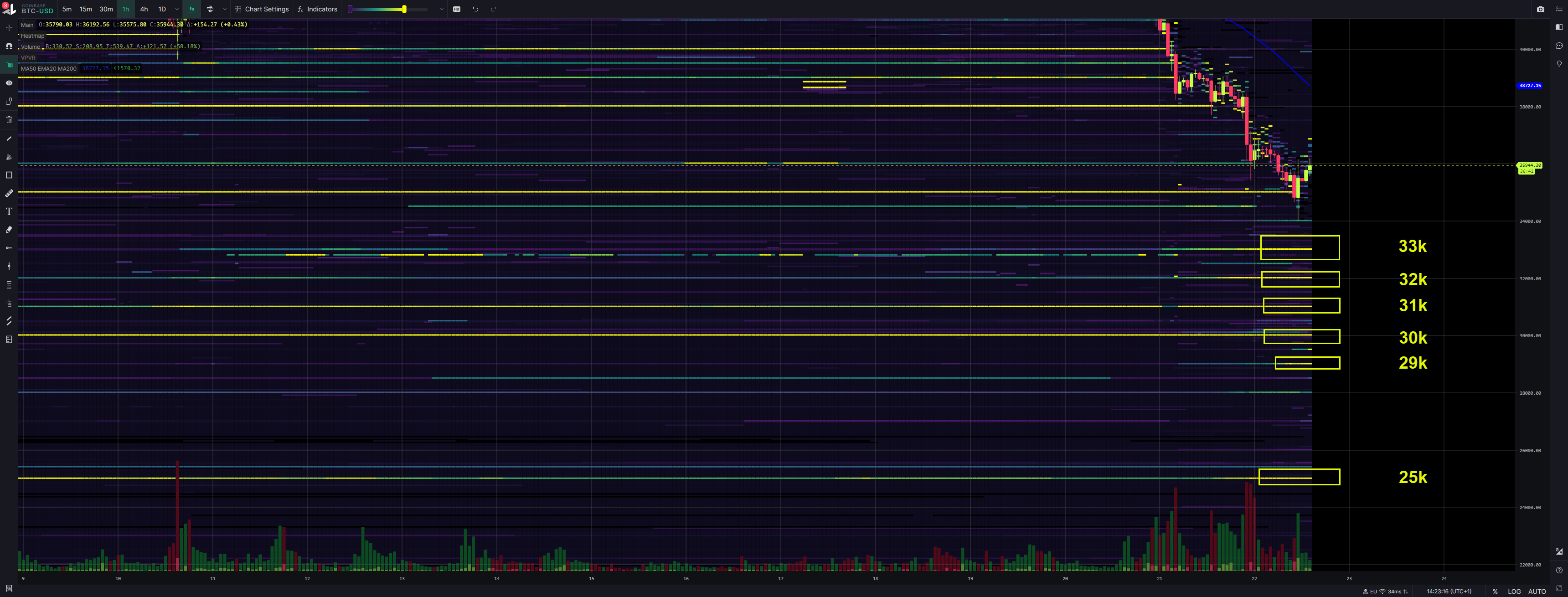

#1 - Bitfinex | Walls: Upper at 46.6k, Lower at 30.7k - 29.8k (NEW!)

#2 - Coinbase | Walls: Upper at 48k, Lower at 33k - 25k (NEW!)

#3 - Binance | Walls: Upper at 46k, Lower at 32k - 30k (NEW!)

#4 - FTX | Walls: Upper at 48.5k, Lower at 30k

#5 - Kraken | Walls: Upper at 44k (NEW!), Lower at 30k (NEW!)

Inspos Conclusion and personal trade strategy

At the moment we have less sell pressure and we are lifting up, but I’m missing the big buy pressure. the wallet count is rising indicating more retailers involved in the recent price action. Based on whales ratio we should maintain the current trade range. The volume is declining right now. If we maintain the current buy pressure it’s going to be a challenge even to lift up heading 37k. In my opinion and based also on the exchange walls, we will not make big steps until evening or tonight. Then we should notice more inflows again. If so, 33k should be our next level before we will see our old 30k level again. But for that, we need more inflows. Of course I don’t know how much coins they still have on exchanges waiting since our big inflows from yesterday. But the data is showing very bearish since yesterday. I have placed a short at 35.8k with a low leverage. Whales are not interested to pump the price up yet.

Use this chart to track the inflows. https://cryptoquant.com/prochart/O3opncepjPqfqIb

As always, thank you! It's reeally helpfull to know, what's going on. It feels like we are in the middle of the cryptowar theater 😗

Could you tell me when exactly will the expiry time in UTC?