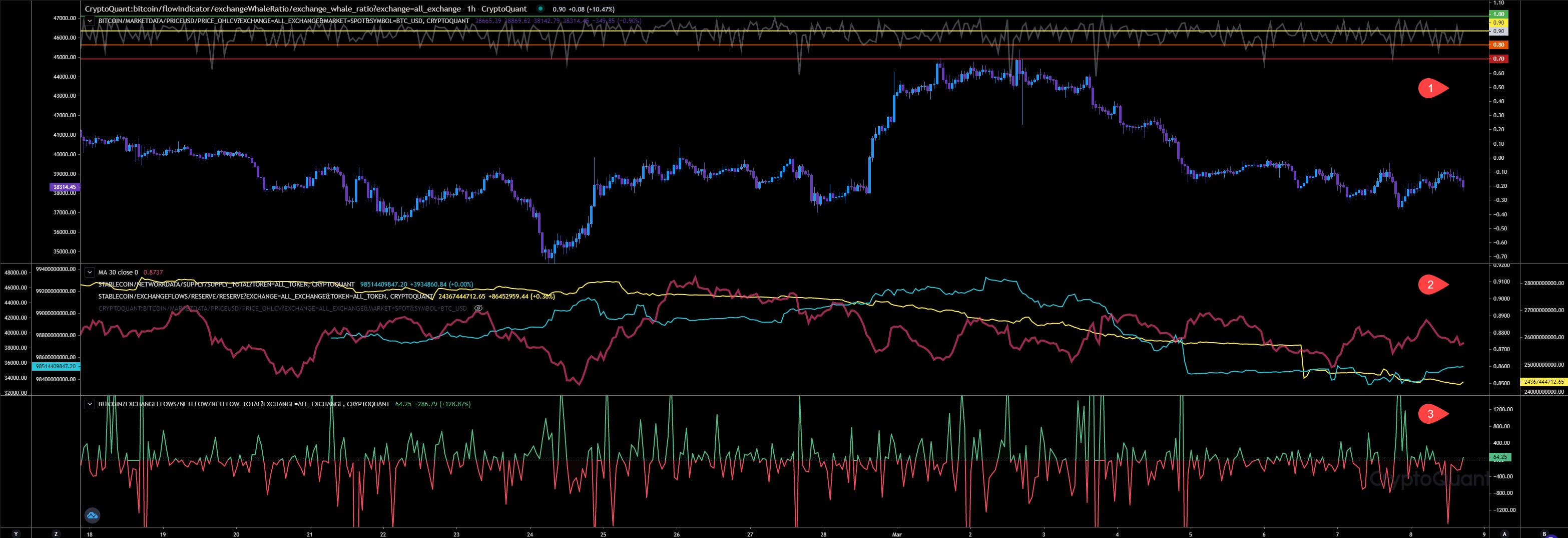

Whales Ratio - Hourly View

Chart Analysis:

Whales ratio (1) looks stable. Maintains its high level indicating a constant sell pressure by whales.

Whales Ratio 30h Average (2) has declined a bit and now maintaining its level. Stablecoin reserves on exchanges has started to lift up again but not big and stablecoin supply doing the same.

Total exchange Netflows (3) showing more outflows than inflows today.Looks like they have started to withdraw their purchases from yesterday.

Inspos Conclusion: Even if the price action looks bullish, the whales ratio is indicating more distribution. No sign of an incoming bull run in my opinion.

URL to chart: https://cryptoquant.com/prochart/vYNO3z1cx9LcSvg

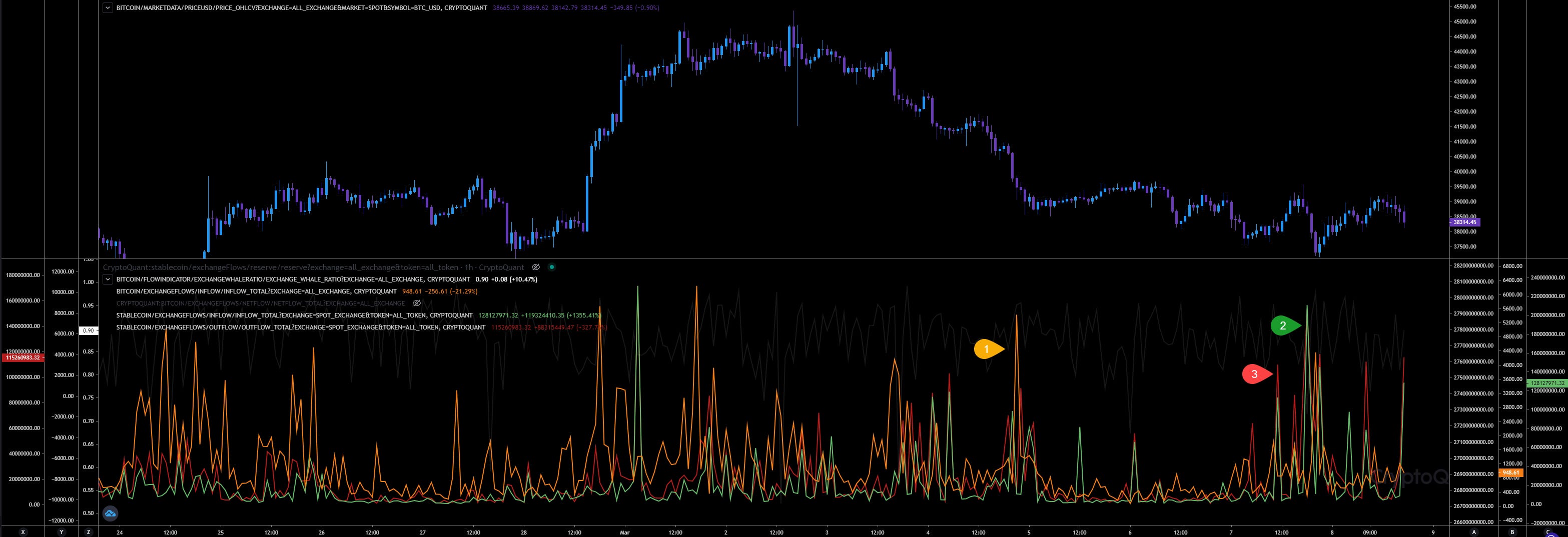

Market Flow Analysis

Chart Analysis:

BTC (1) inflows rising even if less than compared to yesterdays volume, the biggest BTC detected related to spot market was 1,600 BTC today.

Stablecoin inflows (2) compared to yesterday declined in volume, like also outflows (3)did. No big difference between stablecoin inflows and outflows.

Inspos Conclusion: In the last hour we have received almost 950 BTC, $128 million stablecoin inflows and $115 million outflows.

URL to chart: https://cryptoquant.com/prochart/czejQkfJy5OBF69

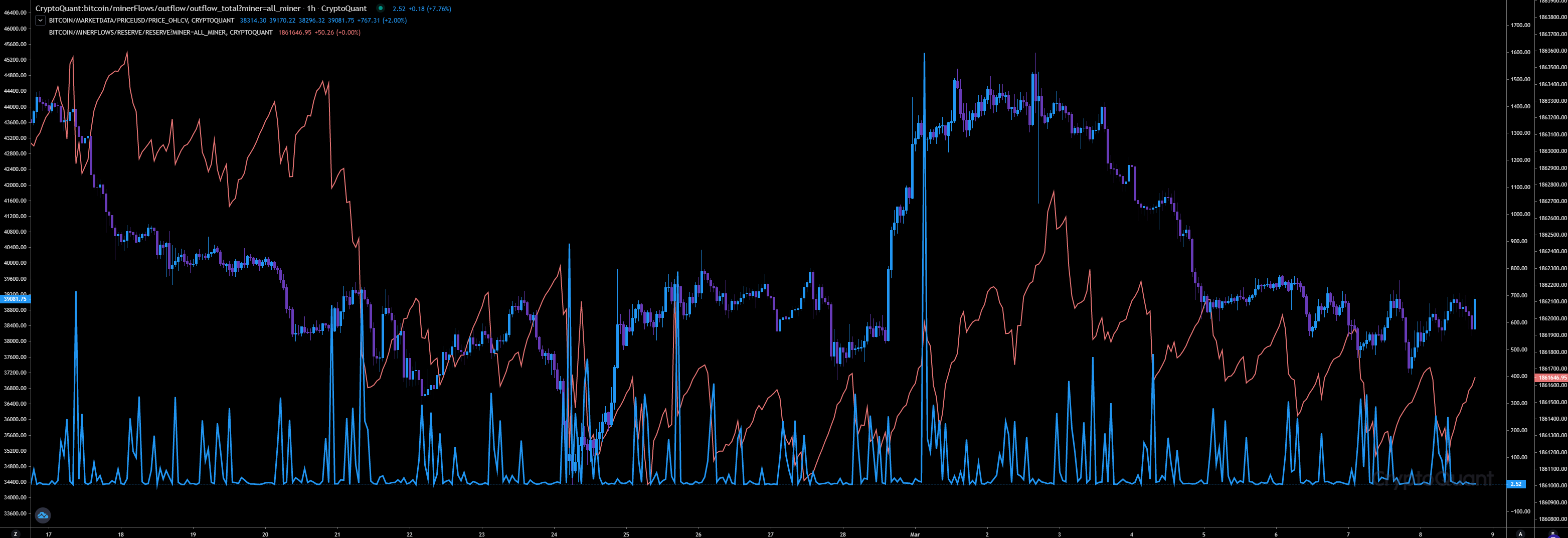

Miners Flow Analysis

Chart Analysis:

Miners outflows declined compared to yesterday and their reserves has lifted up again.

Inspos Conclusion: Miners reserves are declining, but still maintains its level above of 1.86 million BTC.

URL to chart: https://cryptoquant.com/prochart/W1qyCruejyfhoEh

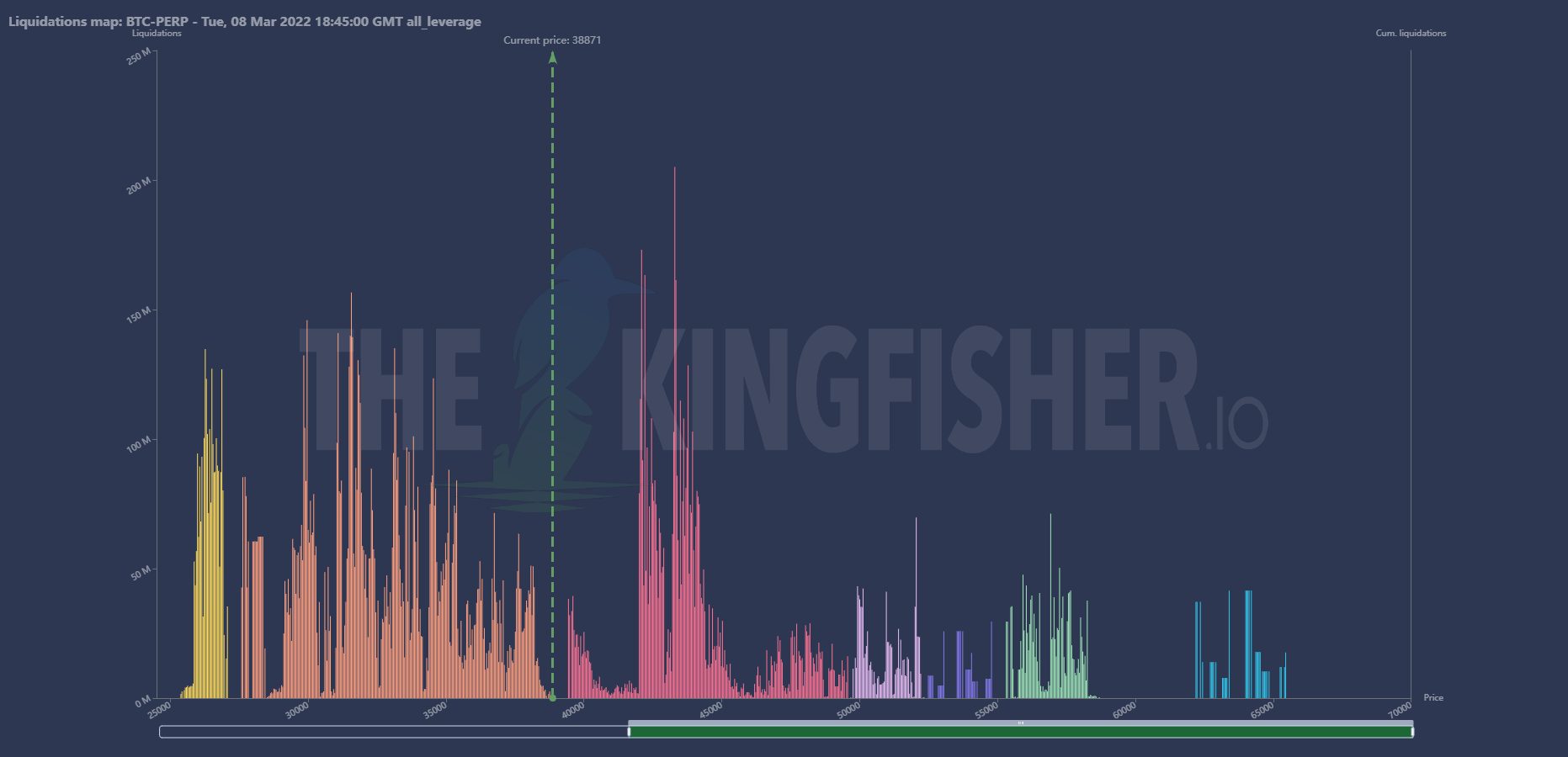

Future Trading Analysis

Data Analysis:

Funding rate has rised again with a rising leverage ratio and open interest indicating more longs coming in. The future market is more driven by stablecoins today and less by coin-margin. In the last few hours we have received almost $420 million stablecoins on derivative exchanges. Spots to derivative exchanges maintains relatively low since few days.

We have some liquidation clusters for longs (bigger volume btw) at 34.5k and for shorts at 42k!

Inspos Conclusion: Future traders are flipping to bullish now and it seems trading higher leverage. That would explain the accumulated volume related to the long liquidation cluster.

URL to chart: https://www.coinglass.com/FundingRate

Exchange Order Walls

Analysis:

Bitfinex limiting the way up at 45.5k (low volume cluster) and limiting the way down at 34.4k (low volume cluster).

Inspos Conclusion: 35k looks interesting as possible next local bottom. A possible local top should be between 40k - 42k based on BitMex and Bitfinex Derivatives.

URL to chart:

https://www.tradinglite.com/

Inspos Conclusion and personal trade strategy

No big news since yesterday. Whales ratio indicating distribution, less flows related to spot market but more to derivatives, option traders expecting a rising volatility and forming walls at 40k/42k - 34k, future traders forming big volume liquidation clusters in ranges below 34.5k while the short clusters have declined in volume a bit, exchange walls matches to option traders expectations.

At the moment is BTC folowing 1:1 SPX again and SPX doing the opposite of the DXY. DXY has declined to day as it was in hourly overbought and is rising again, generating sell pressure at SPX and BTC. We need to see what happens after stock markets will close. Based on the data I have analysed here I can’t see any pump preparations. However, if we lift up I think 40k would be the max, if we decline more 37k as a retest level.

Joe Bidens Executive Order could be relaesed this week, could explain option traders strategy! If so, I think the market will react bearish due its sensitive condition. In such case, 34k and lower could be possible!