FREE VERSION

Block View

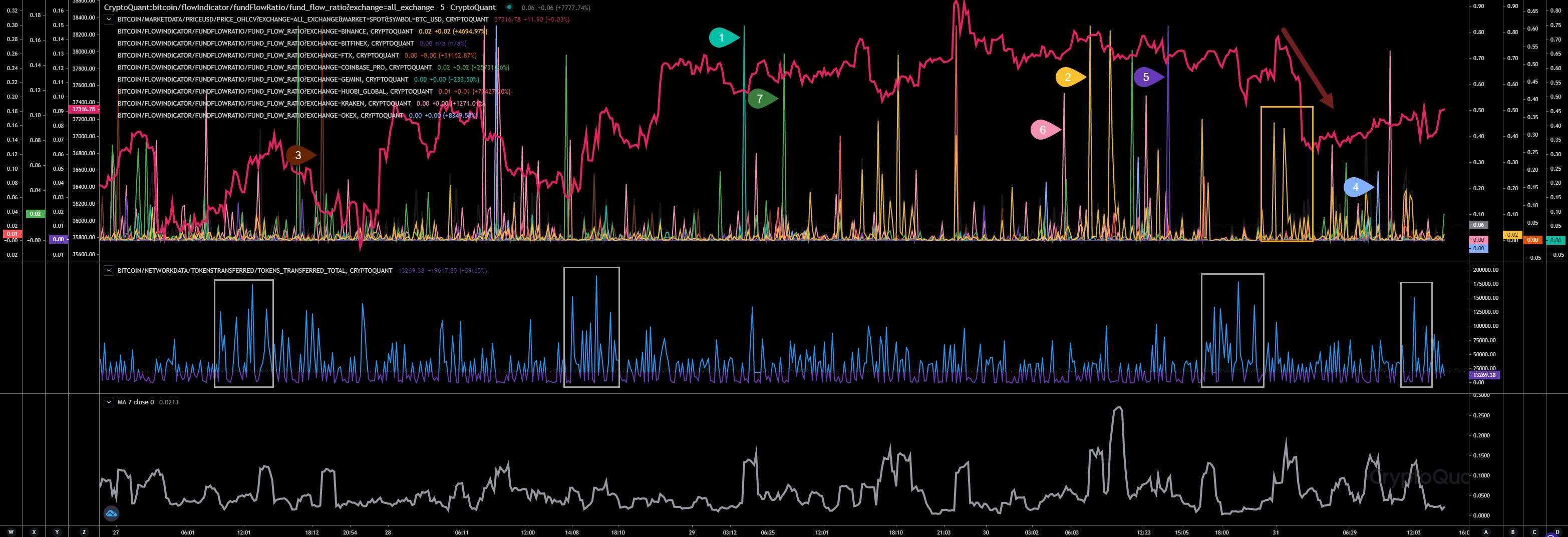

The block view of the whales ratio (1) is showing less inflows coming related to whales. In my opinion that looks like their preparations are done as mentioned in former analyses, only because the whales ratio is high and we notice big inflows it does mean, we will dump directly afterwards. Anyway, our whales ratio 30block average (2) is showing a declining trend indicating less whales inflows (at least the count of inflows not the volume) arriving on exchanges.

The total netflow (3) is not showing any big in- or outflows, except the huge one at midnight indicating a positive netflow of almost 18,000 BTC.

URL to chart: https://cryptoquant.com/prochart/vYNO3z1cx9LcSvg

Market Activity

Block View

#1 - Gemini

#2 - Binance

#3 - FTX

#4 - Okex

#5 - Bitfinex

#6 - Kraken

#7 - Coinbase

URL to chart: https://cryptoquant.com/prochart/MIV7FeYFXsE62DT

Interesting developement. The network data is showing big activity when the price lifts up or on the top before a declining price action. While CEX (centralized exchanges) are divided. The bottom chart shows the total CEX activity. The biggest CEX activity happenend at 38k after the failed retest of 38.5k as predicted. We can see the main driver of the recent dump from 38.2k to 36.8k last night. That was where we noticed that big inflows. Binance showing here the biggest activity indicating it was the dump driver.

Exchange Walls

#1 - Bitfinex | Walls: Upper at 37.8k, Lower at 22.2k

Future Trading

Hourly View

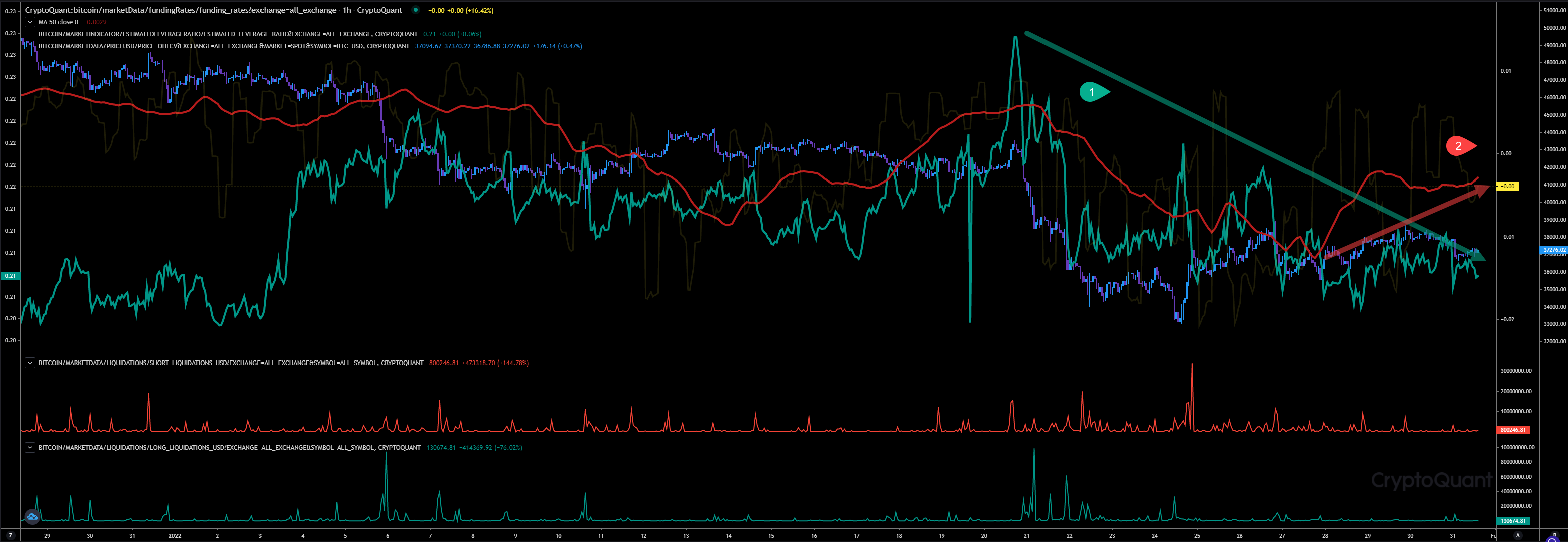

I’m happy to see (1) that the leverage ratio is declining indicating less high risks positions are open. Also something that could help to reduce some volatility in case if we start to pump or to dump. Funding rates (2) are rising indicating a rising demand for longs. Something that isn’t surprising me due the price action of the last few days.

URL to chart: https://cryptoquant.com/prochart/h5G7kAg6yAM9hRC

Inspos Conclusion and personal trade strategy

This weekend was not one of the most exciting actually. Less volume related to option traders, future traders playing less risky, whales ratio dumping indicating a lift up, but as mentioned not indicating, in my opiion, that we are done and the bottom is in as many thing already. Instead, as predicted 24Jan22 they are forming a big fake rally that will end in a big dump. As said, that’s my opinion and conclusion based on the data and the analyses I did.

It’s absolutely clear to me, that with a rising price action people will start to blame others. That’s how it works. The CT will always react as it did. That’s emotional and just guided by price action.

As mentioned the days before, I will short the way up, because I still stick to my plan and I’m still convinced that’s a trap. Bullish data looks different. Even the chart doesn’t show any schematic that would let me think we have accumulated and we will moon next.

In my saturday quick update I have mentioned that I would expect a lift up in price action heading 38.5k - 39k. Even 40k could be possible in my opinion to form a bull trap. As I still think we are in re-distribution phase, it’s usual that we retest our resistance and fail to retest our support again.

So, even it looks risky due the current price action, I will short the whole way up to 39k. As I have a bag of spots bought when we reached 33k, I can’t really make any loss.

So, make your own conclusions, create your trade strategy or stick to it and max your risk management!

PAID SUB VERSION

Keep reading with a 7-day free trial

Subscribe to InspoCrypto’s Daily Crypto Newsletter to keep reading this post and get 7 days of free access to the full post archives.