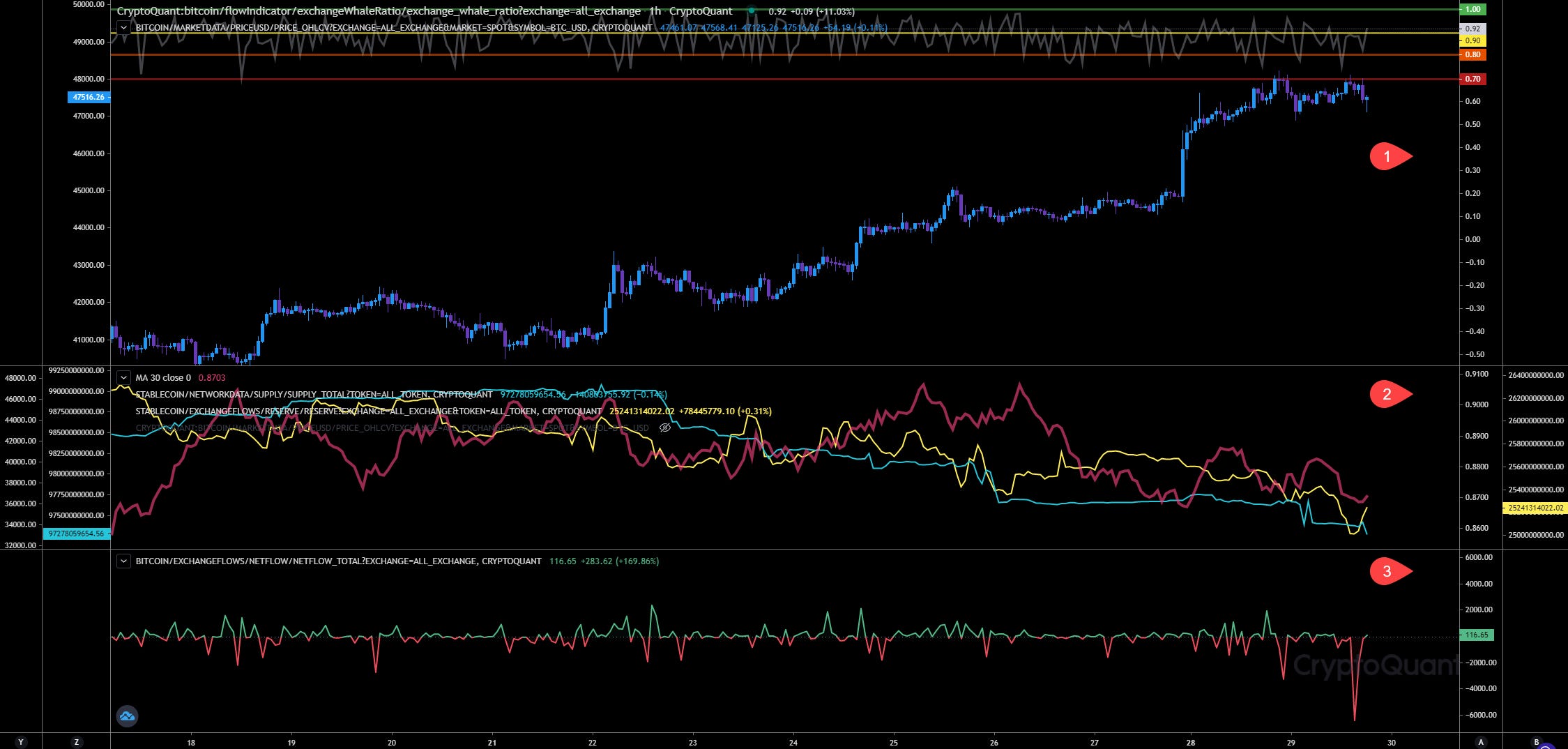

Whales Ratio - Hourly View

Chart Analysis:

Whales ratio (1) has started to decline again indicating less sell pressure by whales.

Whales Ratio 30d Average (2) confirming the observations above and also showing that stablecoin supply and reserves on exchanges keeps declining.

Total exchange Netflows (3) shows a big and negative netflow indicating more outflows than inflows.

(4) BTC inflows very flat today. The biggest inflow today was 600 BTC, while we can detect more stablecoin activity. I have added also the netflow (5) indicator to the stablecoin flows related to the spot exchanges. We had today a bit more stablecoin inflows than outflows. However, spot exchanges also offer altcoins. The flows related to stablecoins doesn’t have to be related to Bitcoin only.

URL to chart: https://cryptoquant.com/prochart/vYNO3z1cx9LcSvg

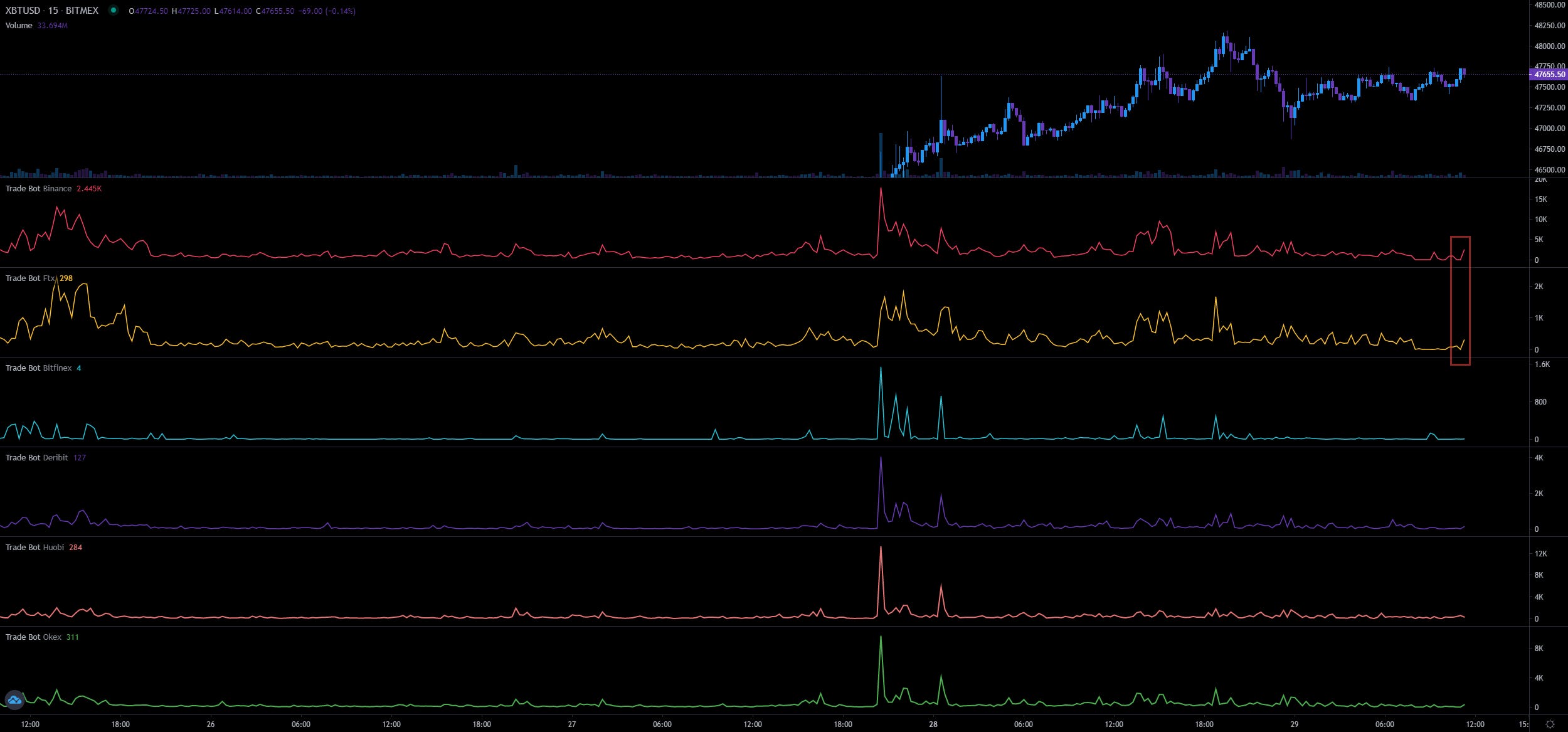

Market Driver Analysis

Chart Analysis:

It seems FTX and Bitfinex are still driving the market with trading bots. While big exchanges like Binance and Coinbase has started to distribute their purchased BTC from last pump, FTX and Bitfinex are still showing, based on their CVD, very bullish.

Here a comparison between Coinbase and Bitfinex spot CVD

Here a comparison between Binance and FTX spot CVD

You can see, that FTX and Bitfinex are trading the opposite of the big exchanges and using those with their trading bots as showed in the past days.

URL to chart:

https://coinalyze.net/bitcoin/usdt/binance/price-chart-live/

https://alphaapp.hyblockcapital.com/chart

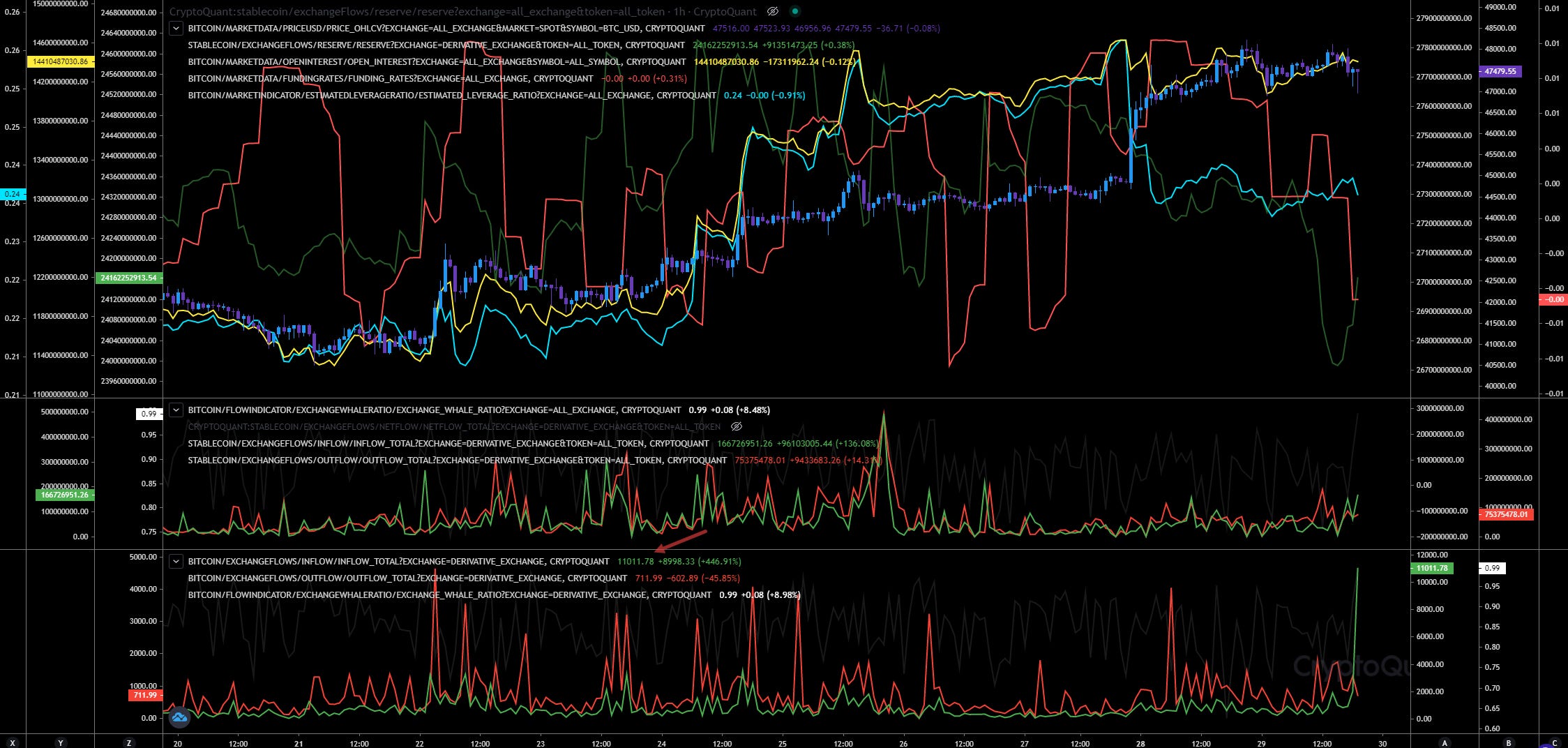

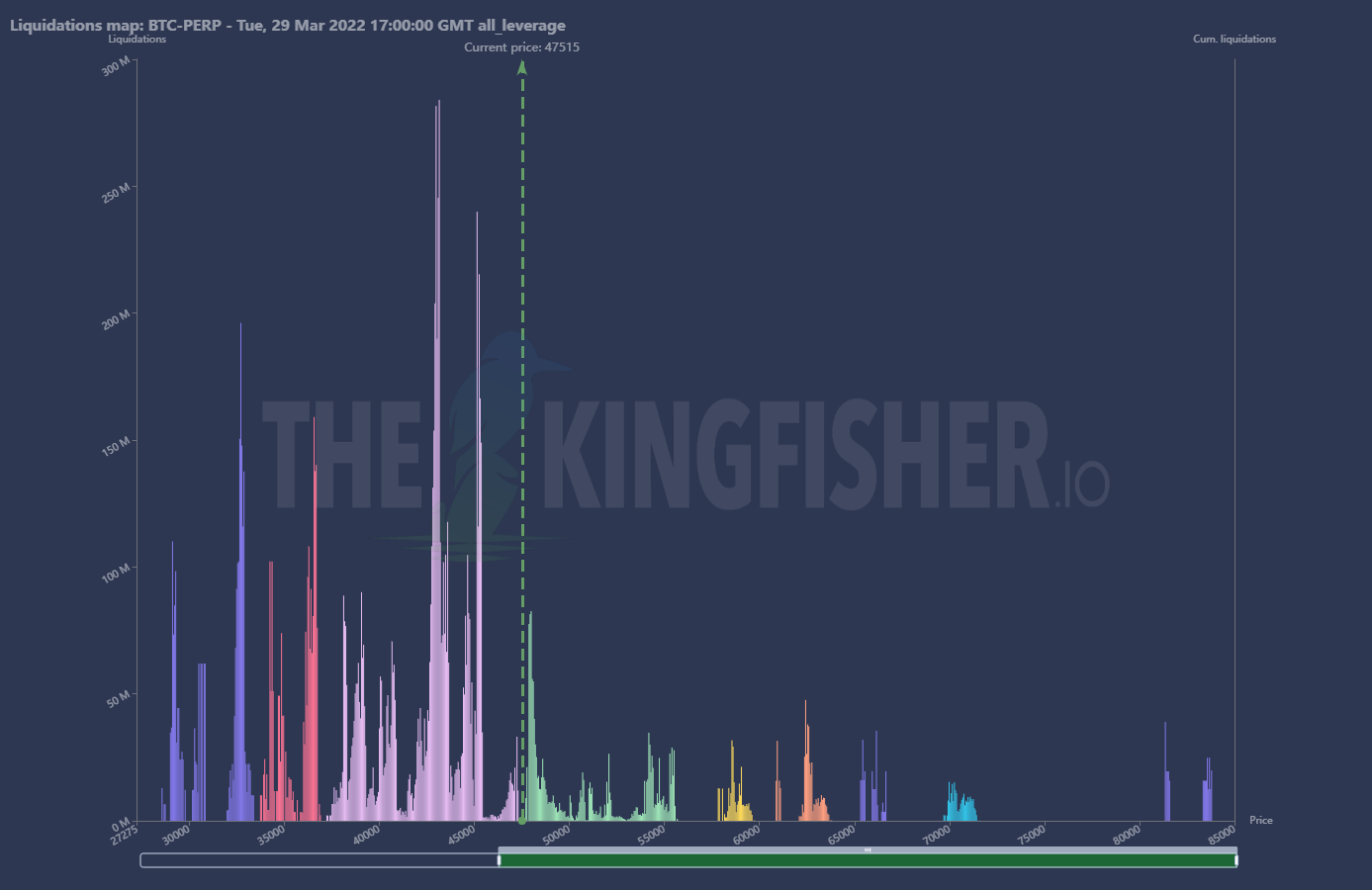

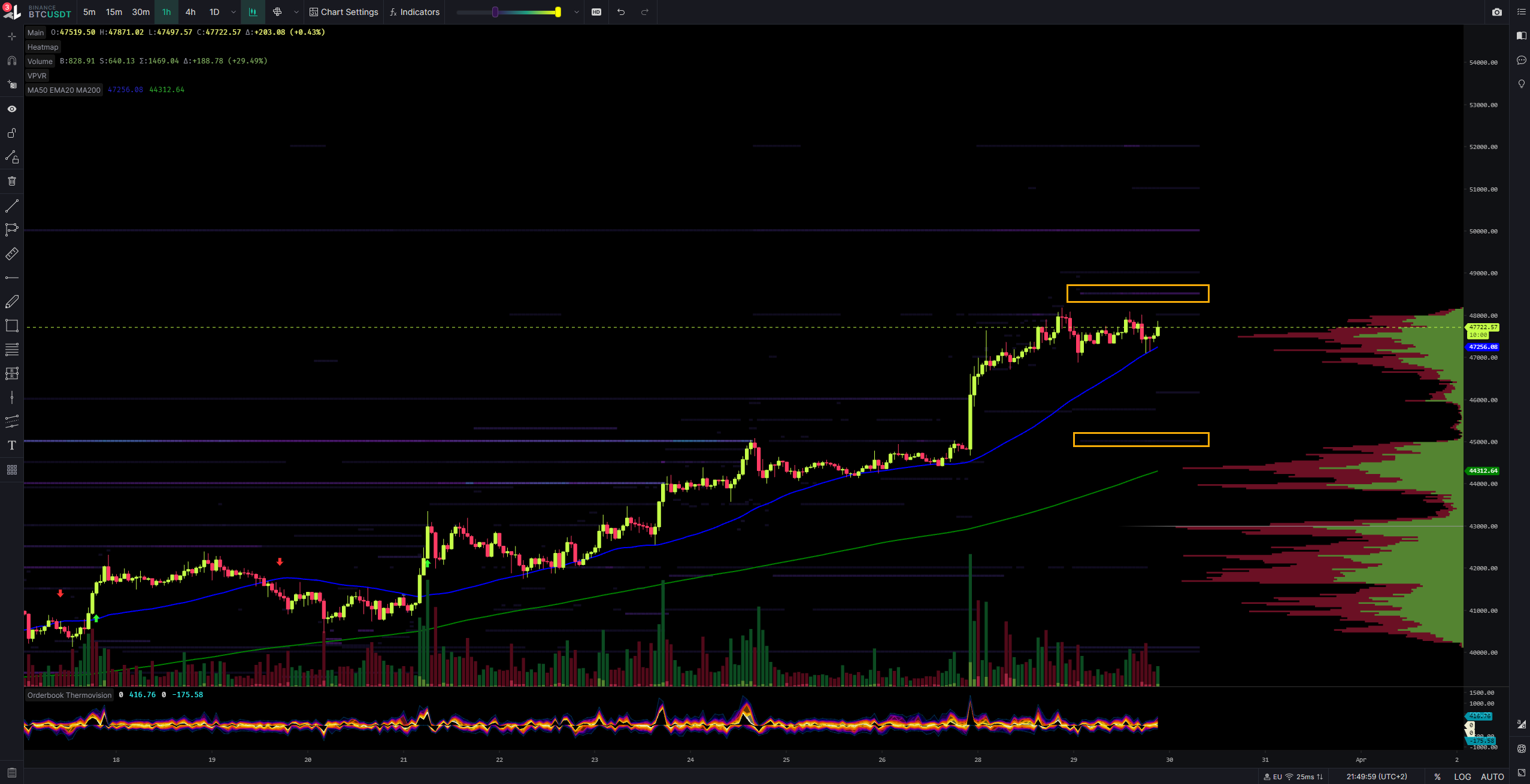

Future Trading Analysis

Data Analysis:

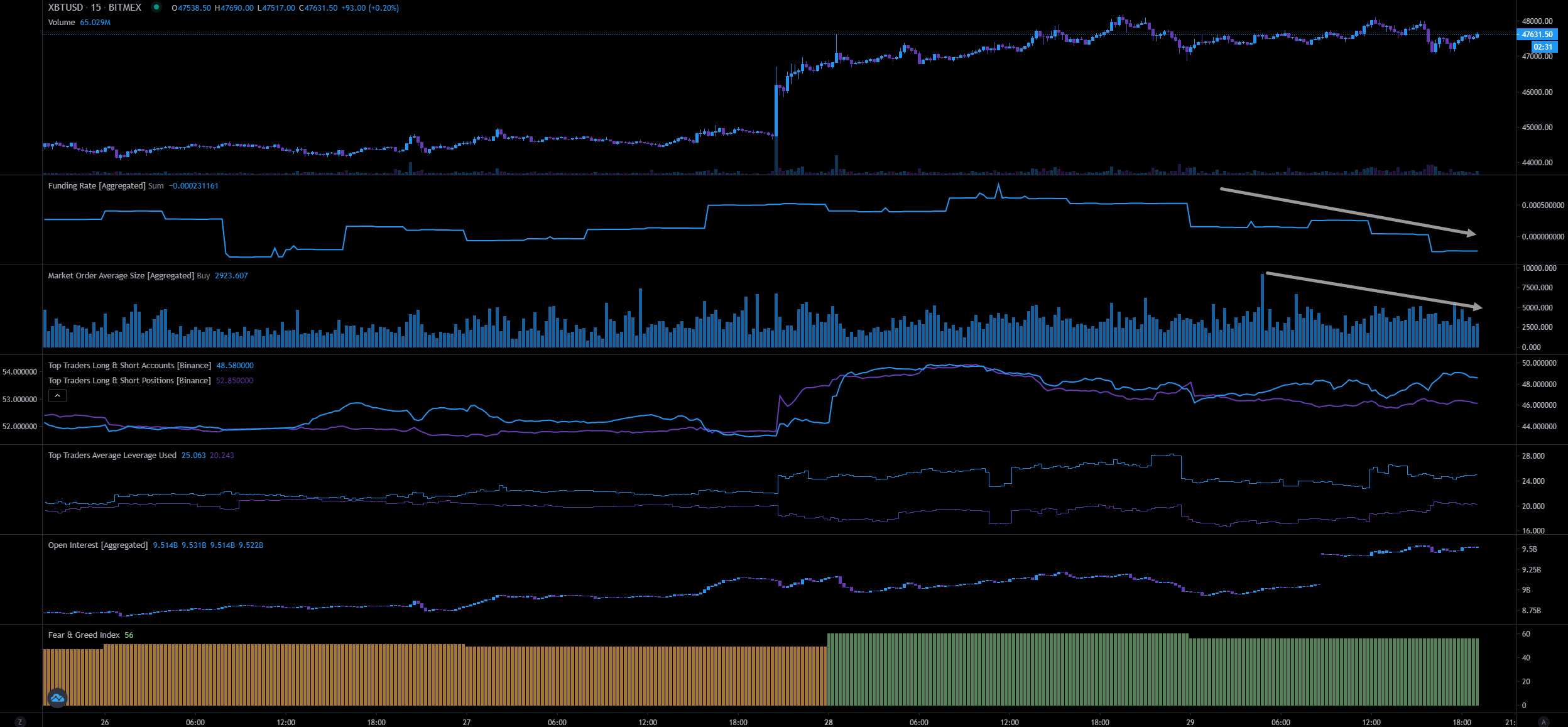

Funding rate declining, open interest lifting up and leverage ratio falling again.

Stablecoin inflows lifting up again and what is interesting here, we have detected almost 11,000 BTC inflows related to derivative exchanges. After checking all exchanges I have found that this transaction is linked to FTX. Almost 10,000 BTC arrived there.

The aggregated funding rate is declining with big market orders. The greed index showing a positive level at 56.

URL to chart: https://cryptoquant.com/prochart/zFcleLpk1mYReou

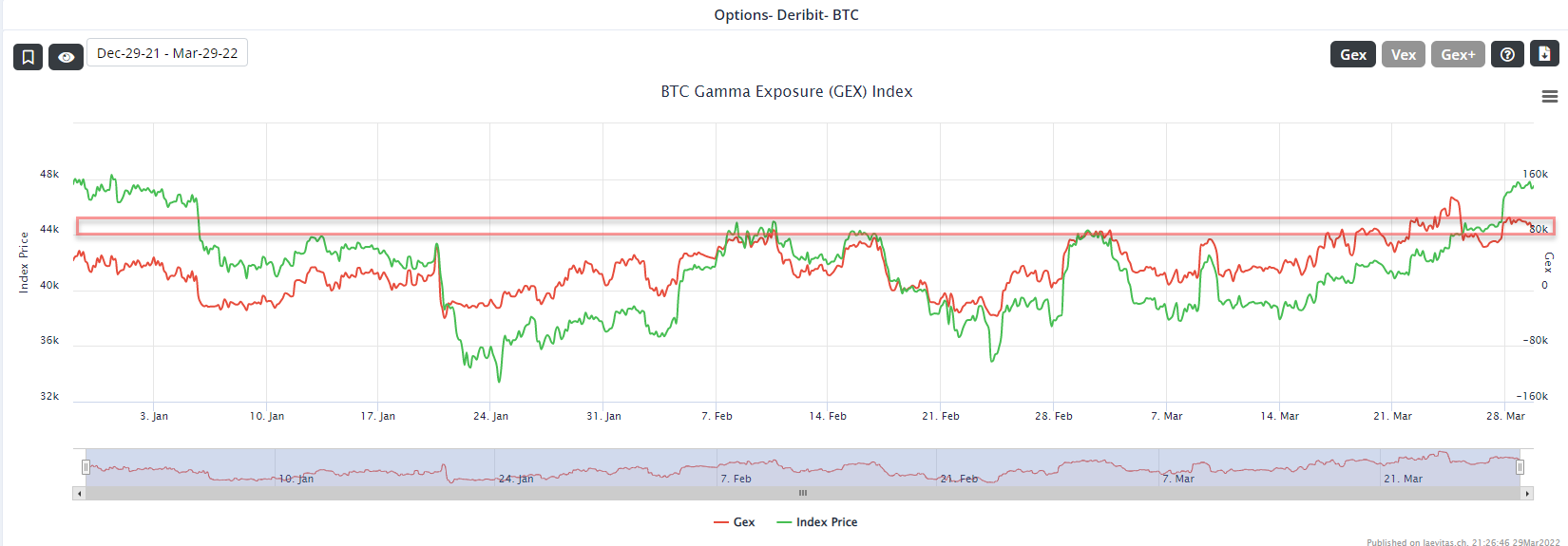

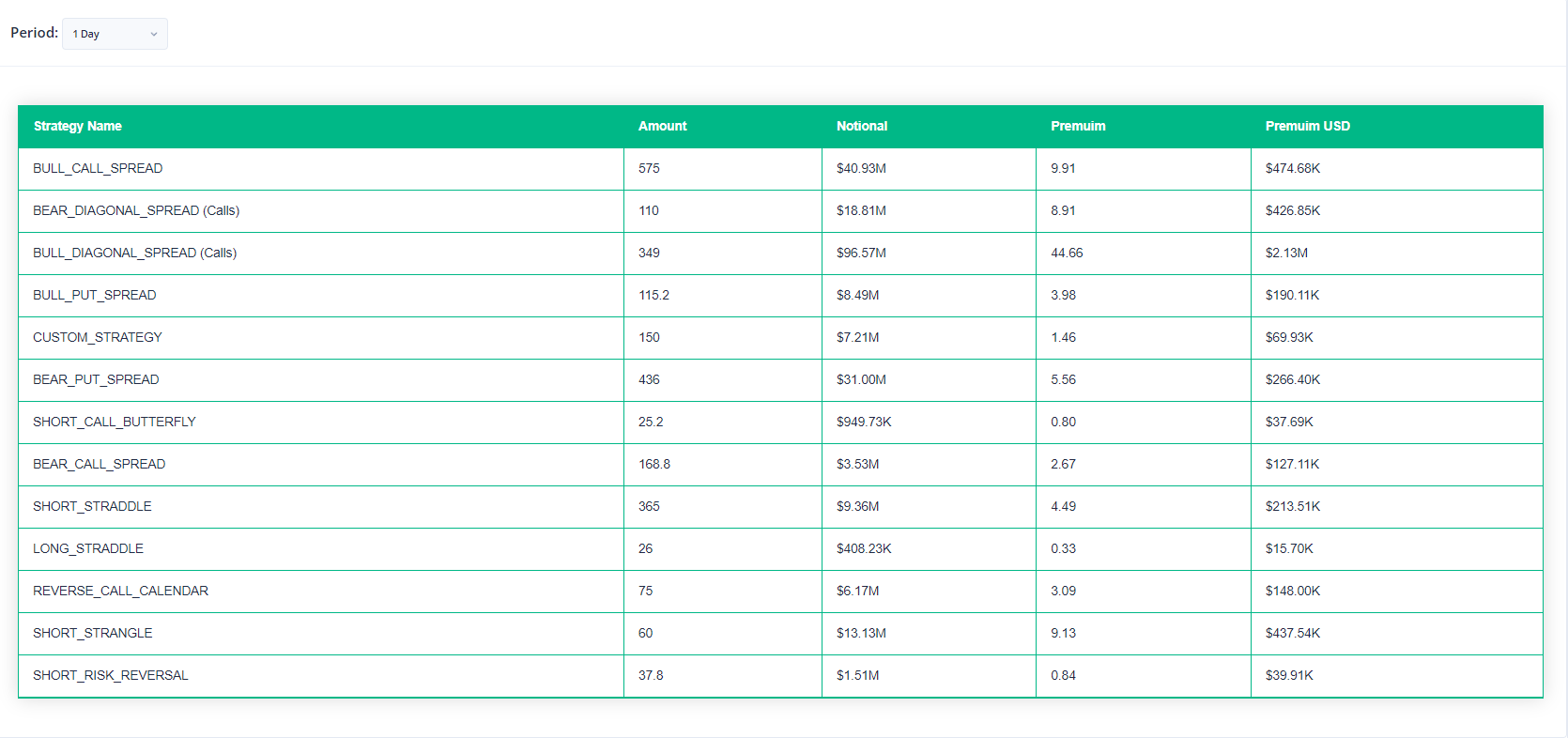

Option Trading Analysis

Data Analysis:

GEX is now declining a bit, but still maintains a very high level.

Also related to GEX we still have those wall at 50k and 47k.

I have checked all recent trades but didn’t find anything useful. No big volume trade related to the next coming days.

URL to Chart:

https://app.laevitas.ch/dashboard/btc/deribit/options/activity/overview

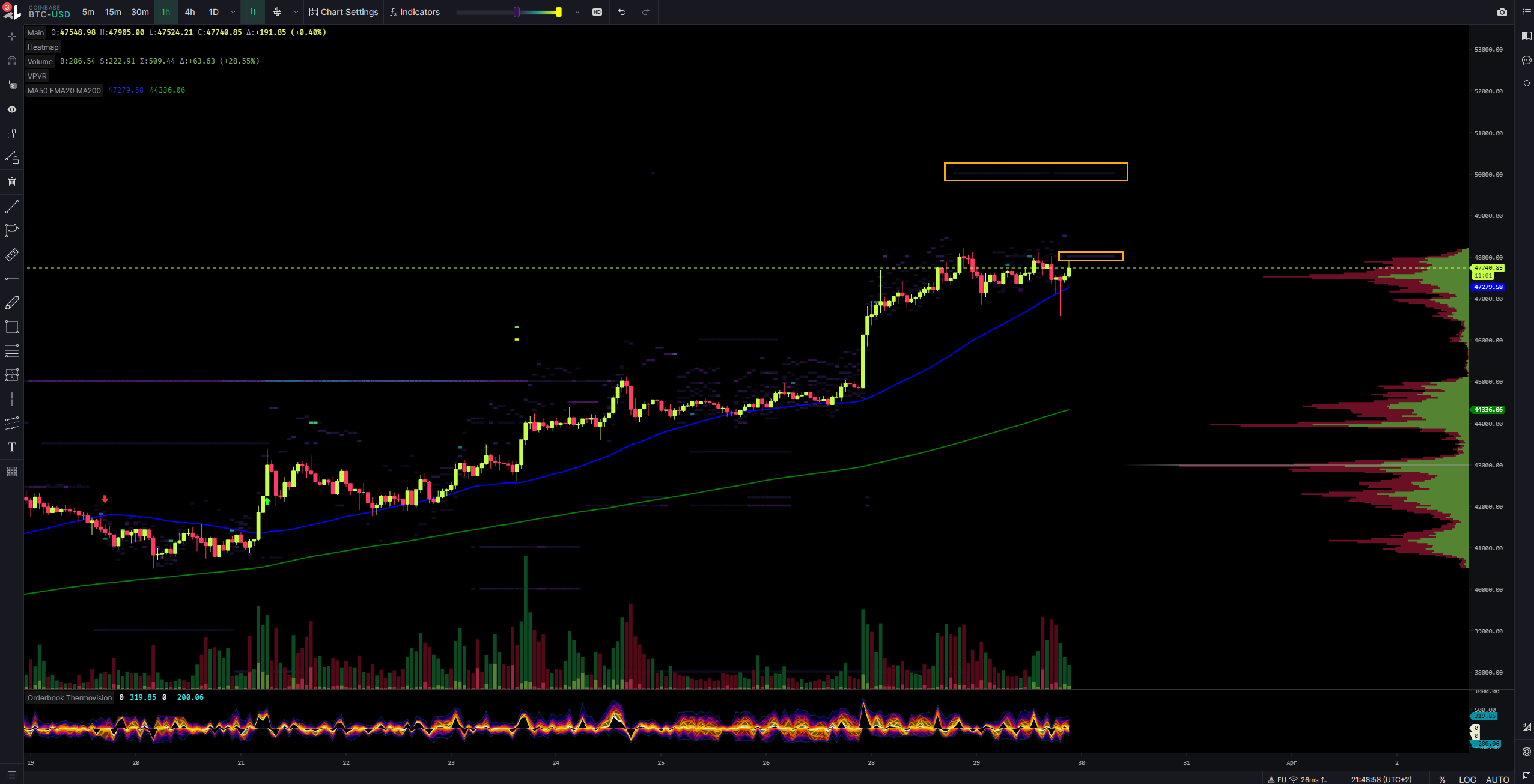

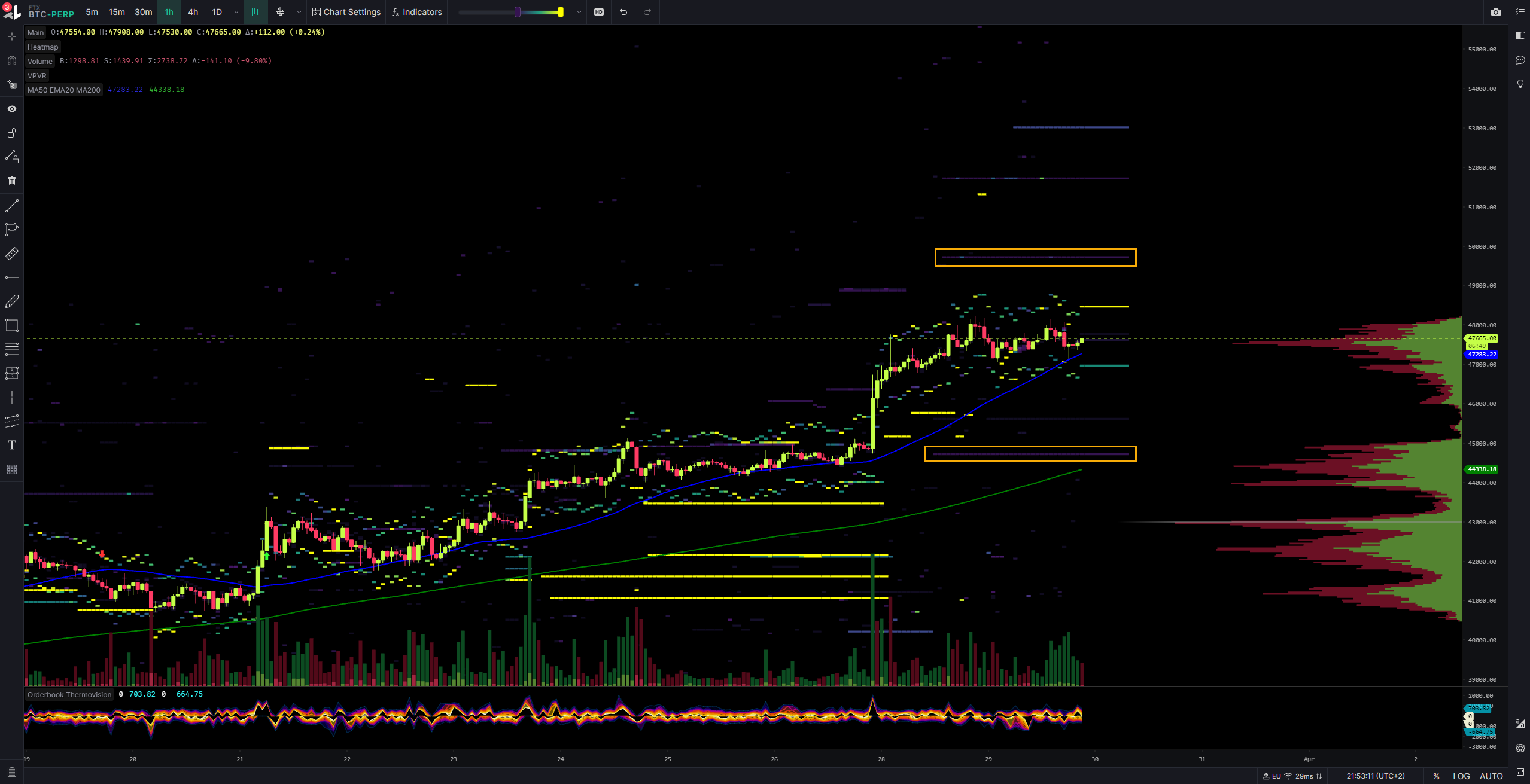

Exchange Order Walls

Analysis:

Coinbase limiting at 48k and 50k with mid-size volume.

Binance limiting the way up at 48.5k and the way down at 45k.

Bitfinex no limiting anymore.

FTX Perp limiting the way up at 52k, 50k and the way down at 45k.

URL to chart: https://www.tradinglite.com/