FREE VERSION

Block View

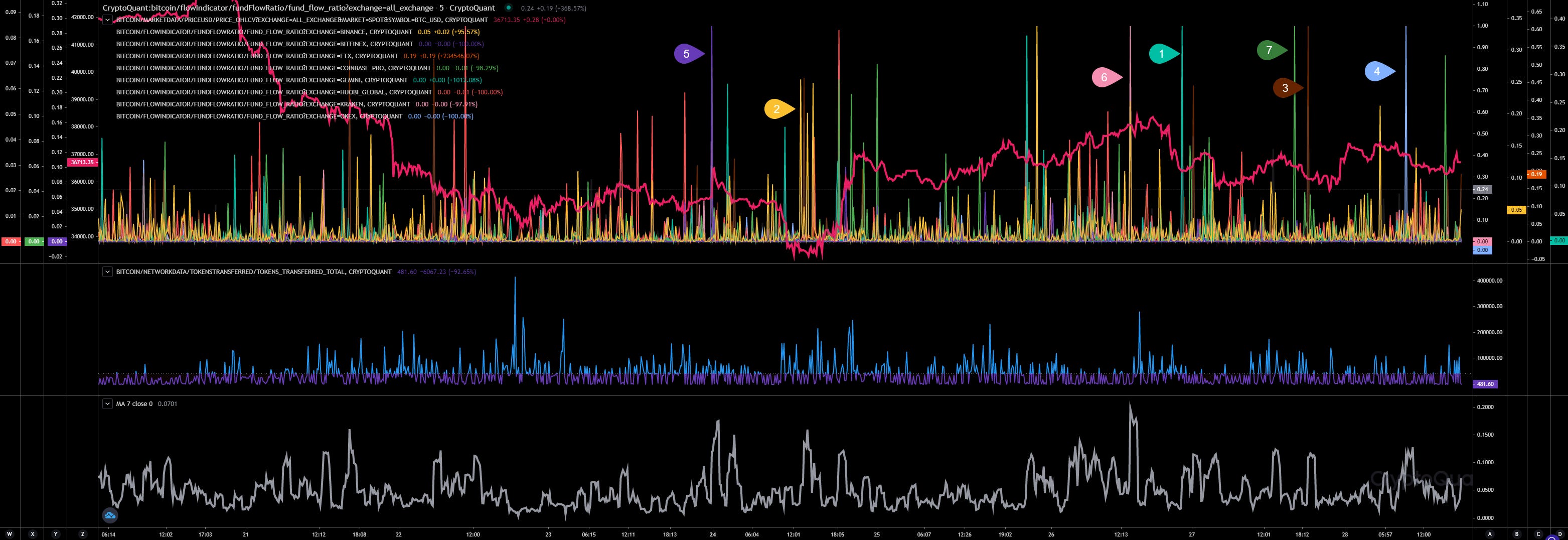

Since this morning is our whales ratio (1) declining showing that less inflows are arriving related to whales. Also our whales ratio 30block average (2) shows the same trend. In the same time our stablecoin reserves on exchanges (yellow curve) has started to rise and is falling now indicating more stablecoins are leaving exchanges. I have noticed almost $150 million in Tether that were withdrawed on Binance today. Anyway, our total netflow (3) chart is showing big in- and outflow activities. Maybe a bit more positive netflows (more inflows than outflows), but no big difference.

URL to chart: https://cryptoquant.com/prochart/vYNO3z1cx9LcSvg

Market Activity

Block View

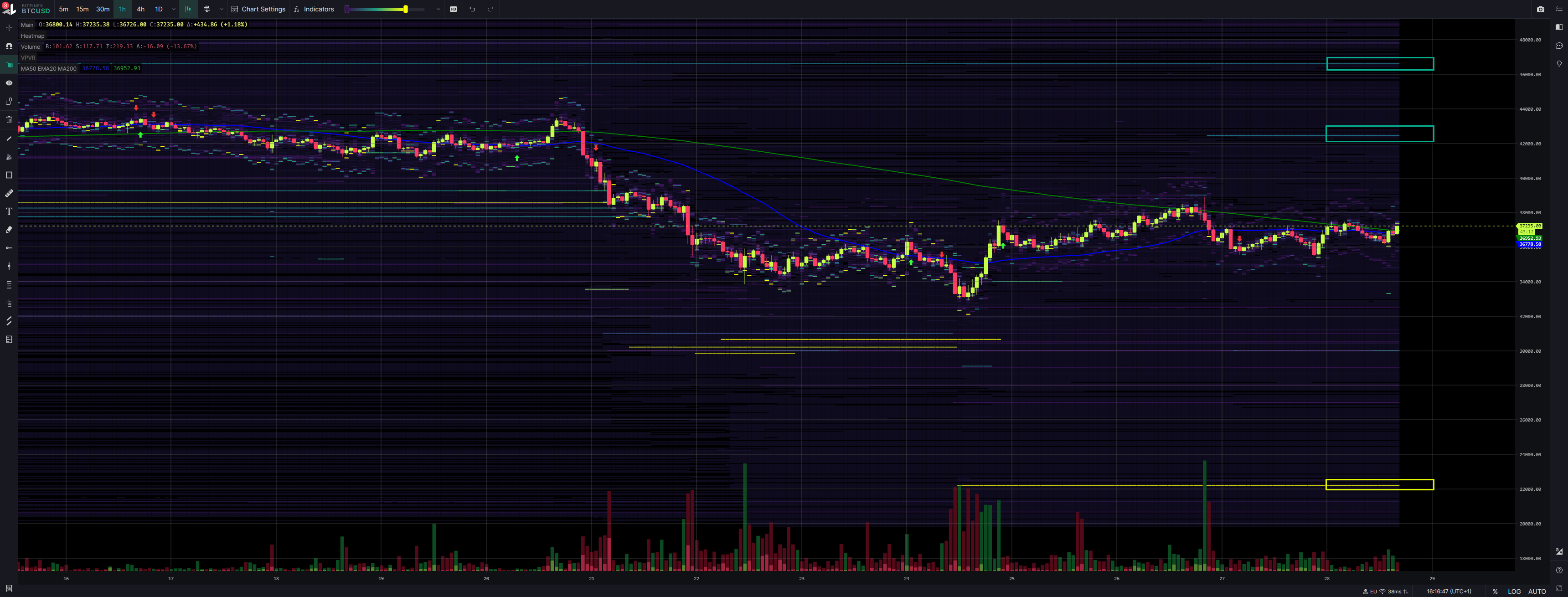

#1 - Gemini

#2 - Binance

#3 - FTX

#4 - Okex

#5 - Bitfinex

#6 - Kraken

#7 - Coinbase

URL to chart: https://cryptoquant.com/prochart/MIV7FeYFXsE62DT

The fund flow related to CEX (centralized exchanges) are more linked to falling price action and the activity (total transferred tokens on network) outside of CEX keeps being linked more to rising price action. So, no changes detected here. I still think, 3rd party is absoving the tokens dumped by CEX. But who and why?

Exchange Walls

#1 - Bitfinex | Walls: Upper at 42.5k, Lower at 22.2k

Future Trading

Hourly View

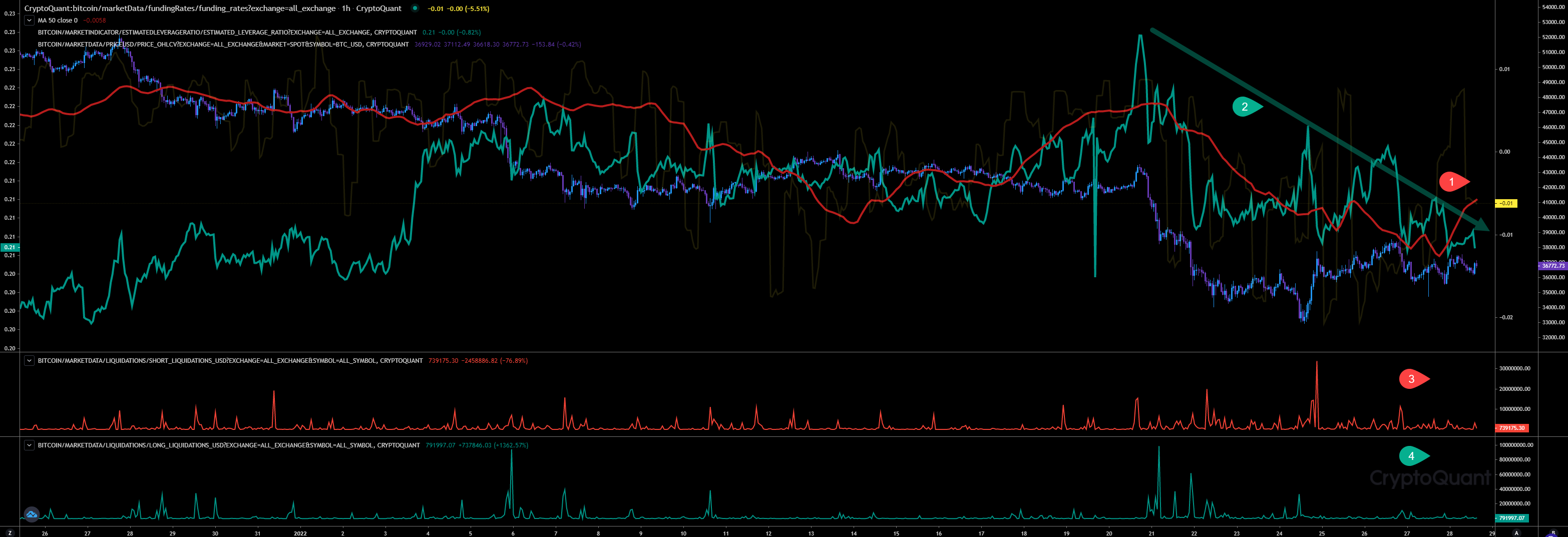

The leverage ratio (2) keeps declining while our funding rate (1) is rising since yesterday, indicating a bigger demand for longs than shorts at the moment.

Interesting here is, that we are liquidating shorts (3) all the time since 19Jan22 while the liquidation chart for longs (4) is almost flat since 25Jan22. With a rising volatiliy also these charts should more activity.

URL to chart: https://cryptoquant.com/prochart/h5G7kAg6yAM9hRC

Inspos Conclusion and personal trade strategy

No big changes since yesterday. At least nothing that would indicate we will moon soon. Only our whales ratio has dumped indicating a coming positive price action, at the same time we have received almost 6,000 BTC on different exchanges. Our 28Jan22 expiry didn’t have the expected impact. Even on ETH. However, the recent data is showing that volatility will rise again. These inflows with the whales ratio indicates a possible bull trap coming. Our future data shows less liquidations related to longs, even if the leverage ratio maintains high. If they pump and dump, in case they do, it could trigger a cascade as we have seen already. BTC keeps following SPX and SPX do the opposite of DXY. At the moment is DXY maintaing its level, after the rally of the last few days. SPX and NDY are lifting up again and BTC just following. In my opinion the price action in SPX will flip again soon at its resistance and BTC will follow and decline again.

My trade strategy would to check the inflows, whales ratio and trade the swing. In case we retest 38k - 38.5k again, I would short there with low leverage, expecting a quick retrace there.

PAID SUB VERSION

Keep reading with a 7-day free trial

Subscribe to InspoCrypto’s Daily Crypto Newsletter to keep reading this post and get 7 days of free access to the full post archives.