FREE VERSION

Block View

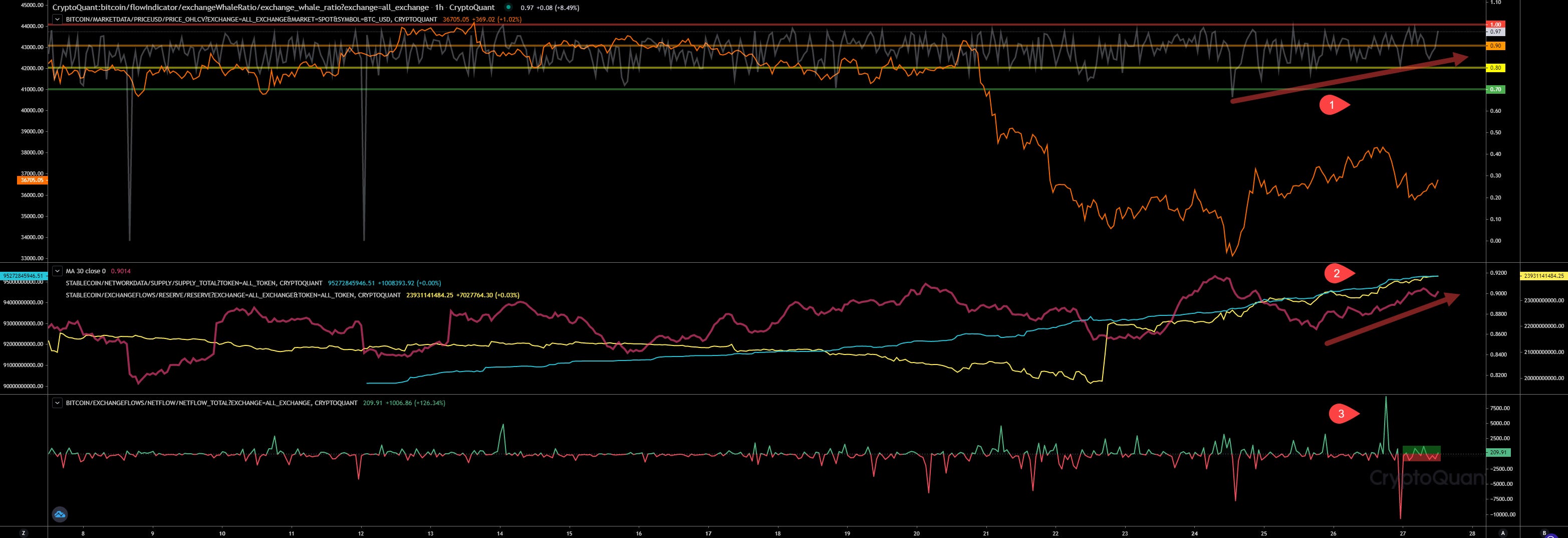

Yesterday was a very interesting day. With FOMC and Powells announce and confirmation of the Status Quo. However, we received a rising volatility and at the end the BTC declined from its local top at 39k to our local bottom at 35.5k. Since then the price is lifting up slowly and with low volume. Our whales ratio (1) keeps rising slowly, now heading again our top mark at 1.0. Our whales ratio 30 block average (2) is also rising indicating more whales tokens arriving on exchanges. But until now the netflow (3) shows less in- and outflows compared to yesterday.

URL to chart: https://cryptoquant.com/prochart/vYNO3z1cx9LcSvg

Market Activity

Block View

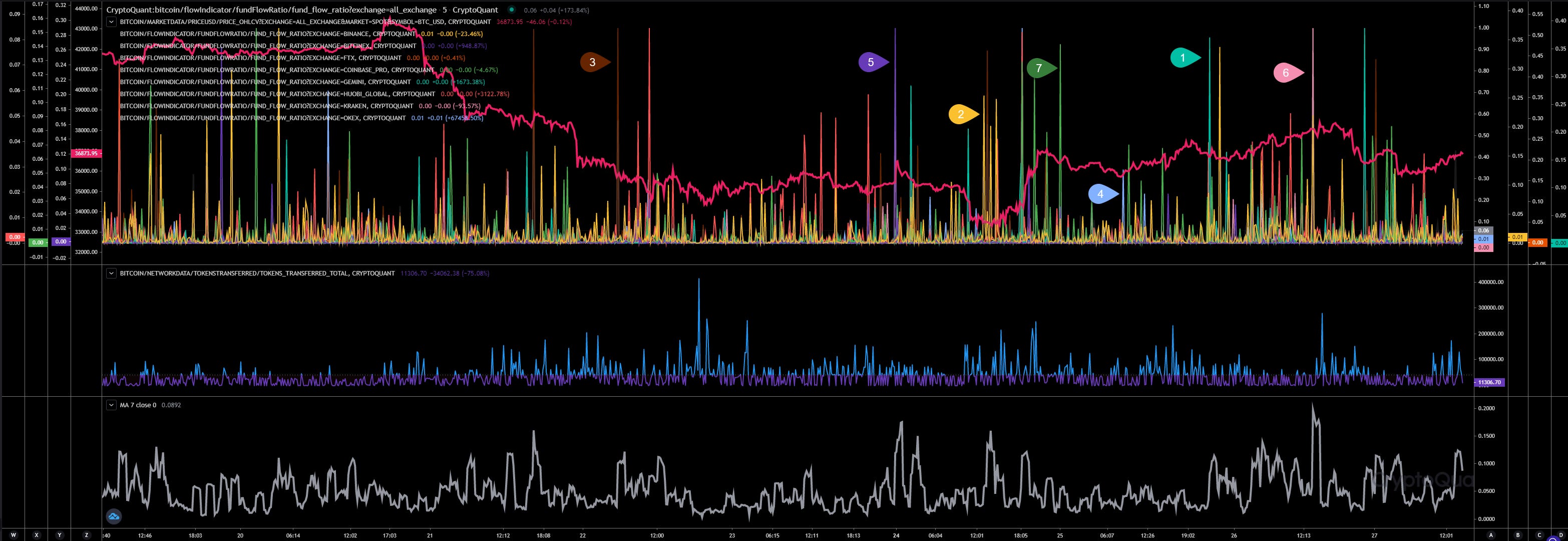

#1 - Gemini

#2 - Binance

#3 - FTX

#4 - Okex

#5 - Bitfinex

#6 - Kraken

#7 - Coinbase

URL to chart: https://cryptoquant.com/prochart/MIV7FeYFXsE62DT

The CEX (centralized exchange) activity matches to the inflows detected indicating they are more linked to sells, while the activity outside of CEX is more linked to the buy pressure. If so, that means that OTC and 3rd party is buying the dip.

I will observe the activities of each more, in particular the activity outside of CEX.

Exchange Walls

#1 - Bitfinex | Walls: Upper at 42.5k, Lower at 22.2k

Future Trading

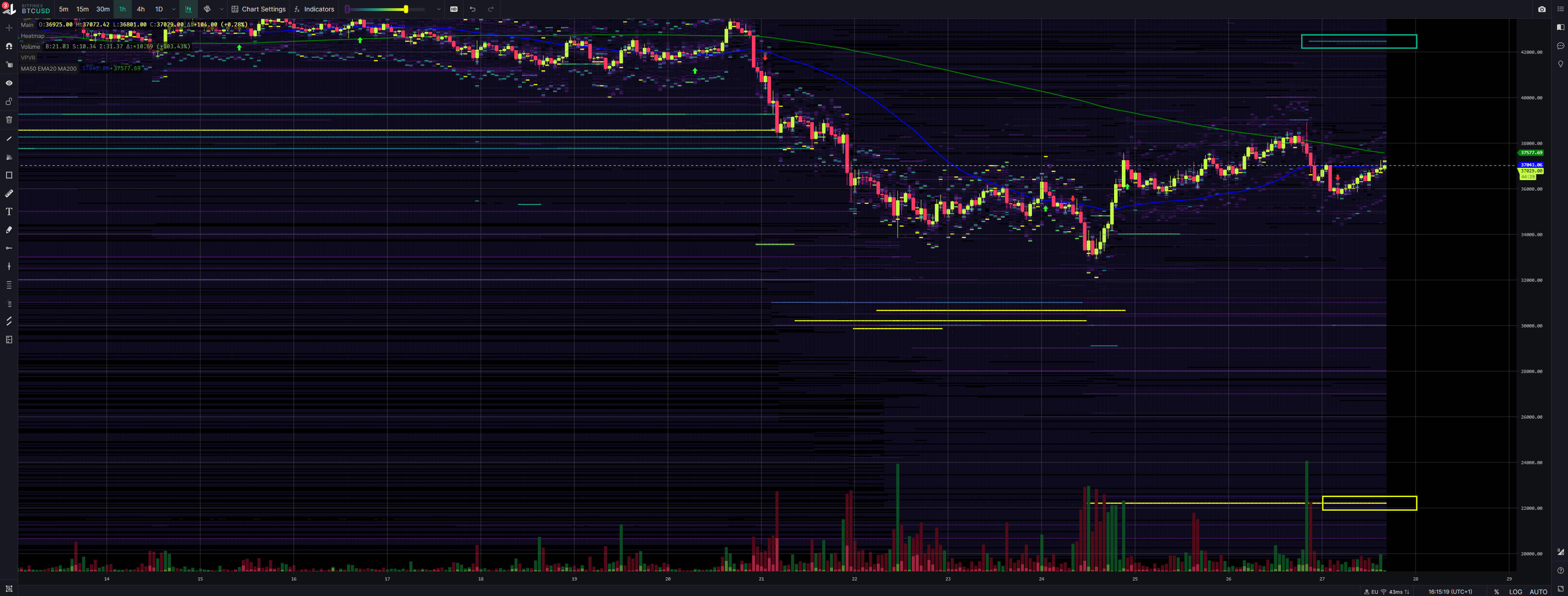

Hourly View

Our trend in leverage ratio (1) is clearly in a downward trend. Thats good. But we are still close to our ATH indicating, we have still many future traders places risky positions. Our funding rate (2) has declined a bit more, but no big changes here.

URL to chart: https://cryptoquant.com/prochart/h5G7kAg6yAM9hRC

Inspos Conclusion and personal trade strategy

Let us see. Future traders expecting a rising price, option traders not expecting a big pump at least in the next hours until 28Jan22 expiry, exchanges walls limiting the way up and reinforcing the lower walls in lower 30k ranges, and in my opinion more still remaining dump ammo on exchanges and the big Binance inflow we have detected just few hours ago. That looks very bearish to me, at least short-term. As you know and mentioning that since days, I’m still expecting a big move downwards to retest our 33k, before I would expect a rising price range heading 40k.

Unfortunately no big news, but a confirmation that we are on track. Depends how big the dump will be and if they can cross the big walls in lower 30k ranges, I would start to long and add more funds to my position the way down with low leverage, as I did (adding more funds the way up) yesterday with my short. I’m not going to liquiddate my spot bags, because I’m still convinced we will see some big green candles soon. I will accumulate even more. Only, if I see that DXY keeps pumping I would start to re-think my trade strategy. Because then, the sell pressure in stocks and crypto will rise anyway. But taking into account that we have enough time until rate hikes, and even then it takes some weeks and even months to show its impact to the markets, I cant imagine that we will just go down and shift in a bear market now. It will happen in 2022, but not yet.

PAID SUB VERSION

Keep reading with a 7-day free trial

Subscribe to InspoCrypto’s Daily Crypto Newsletter to keep reading this post and get 7 days of free access to the full post archives.