FREE VERSION

Block View

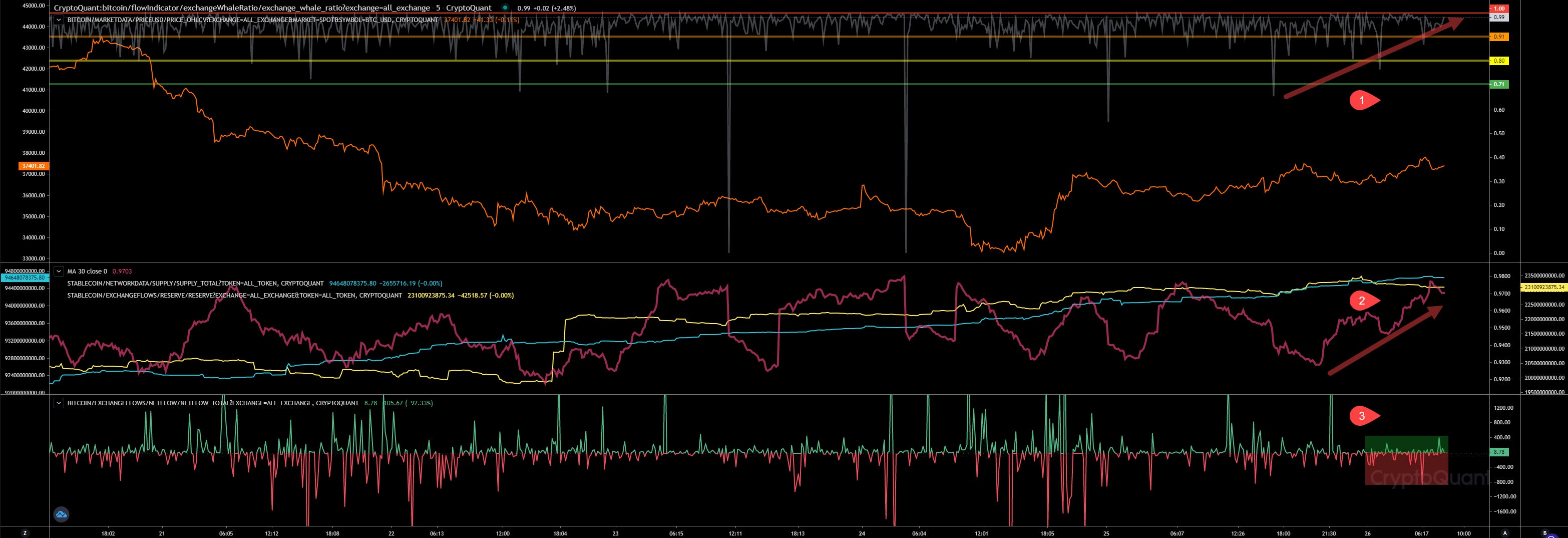

Since yesterday evening is our whales ratio (1) rising again. As usual indicating more inflows to exchanges related by whales. The sell pressure has declined, only as soon we lift up more we notice certain sell pressure. But only because the buy pressure isn’t big yet. The whales ratio development of the last few days matches to my expectations. They have accumulated enough BTC on the exchanges and are waiting now. But for what? To sell the way up? Bad news related to our FOMC? I’m not sure yet. However, it also match to my whales ratio 30D average analysis I did related to my “BTC Market - Special Report”. I have tweeted that report yesterday and it’s available on twitter for free, otherwise here for paid subs.

Our whales ratio 30block average (2) is confirming the observations we did above. However, since yesterday they have stopped to send more tokens to exchanges. Our netflow for all listed exchanges on crypto quant are showing more outflows than inflows. But even the negative netflows (3) are not big, while we had big inflows yesterday. In my opinion we have still a big volume of BTC remaining on exchanges. We have to be very careful today and max our risk management.

URL to chart: https://cryptoquant.com/prochart/vYNO3z1cx9LcSvg

Market Activity

Block View

#1 - Gemini

#2 - Binance

#3 - FTX

#4 - Okex

#5 - Bitfinex

#6 - Kraken

#7 - Coinbase

URL to chart: https://cryptoquant.com/prochart/MIV7FeYFXsE62DT

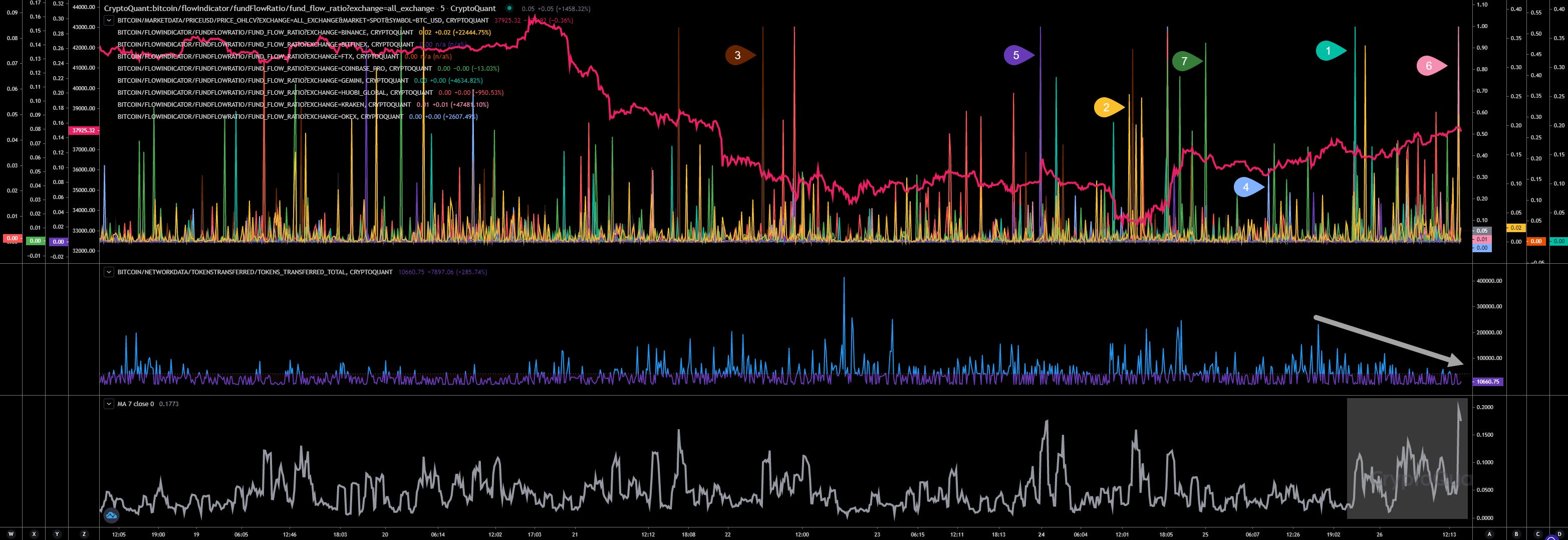

Interesting in todays chart is the reaction of Coinbase when have started to pump. You can see the huge fund flow activity. If we check at the same time inflow chart and compare, we can see that Coinbase whales used the opportunity to sell big here, and we know that Coinbase is the exchange of some really big whales. We should observe the development related to Coinbase.

However, the buy pressure that triggered the pump didn’t come from CEX (centralized exchanges) it seems. Only Bitfinex is showing sometimes some bullish activity. My theory here is, certain institutionals are trying to push the price up maybe due the max pain related to option trading. As mentioned several times, the max pain for the 28Jan22 expiry is big.

Exchange Walls

#1 - Bitfinex | Walls: Upper at 40k, Lower at 22.2k

Future Trading

Hourly View

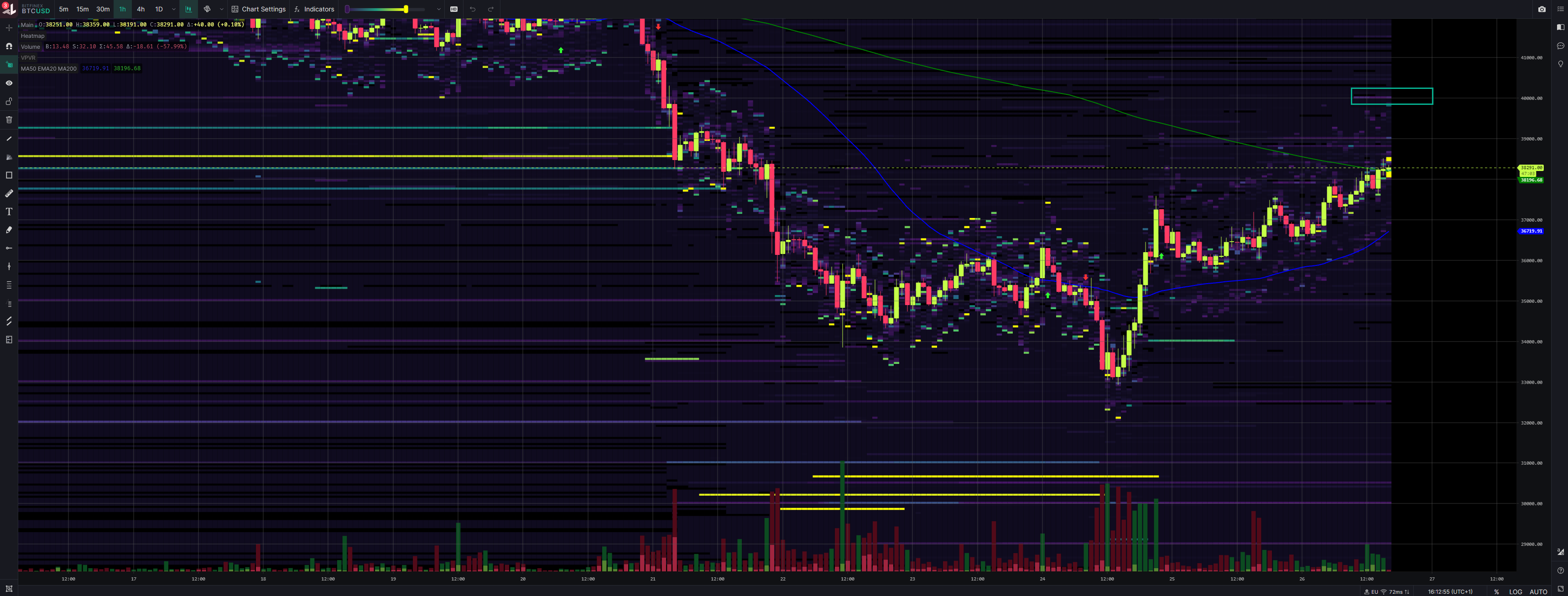

No big changes here. We can see, after the pump high leverage (1) longs rised up and since then the demand for shorts are rising showing a declining funding rate (2). This combination is bullish. A negative funding rate combined with high leverage indicates, we have risky late shorts, risky because they use high leverage but they entry price is close to the current market price. In other words, as soon we rise in volatility all these shorts will be liquidated in seconds. BUT, that is just a short-term view. If you check the chart, you can see a rising funding rate before indicating a bigger demand for longs also combined with a high leverage. If we check the liquidation chart for longs (4) we can see the curve is almost flat, no liquidations happenend here yet. The opposite happenend with late shorts. We can see here (3), they have liquidated in the last few days a lot of them. So, with a rising volatility we will even rise more in volatility because of this high leverage positions. As mentioned before. It’s time to max your risk management.

URL to chart: https://cryptoquant.com/prochart/h5G7kAg6yAM9hRC

Exchange Walls

#1 - Bitfinex | Walls: Upper at 46.6k, Lower at 22.2k

No news here either. All the upper and lower walls disappeared or are showing less volume. In Bitfinex language that means, we are not expecting any surprises at the moment. We are in control and don’t need any “crash barriers” anymore. That can change of course quick.

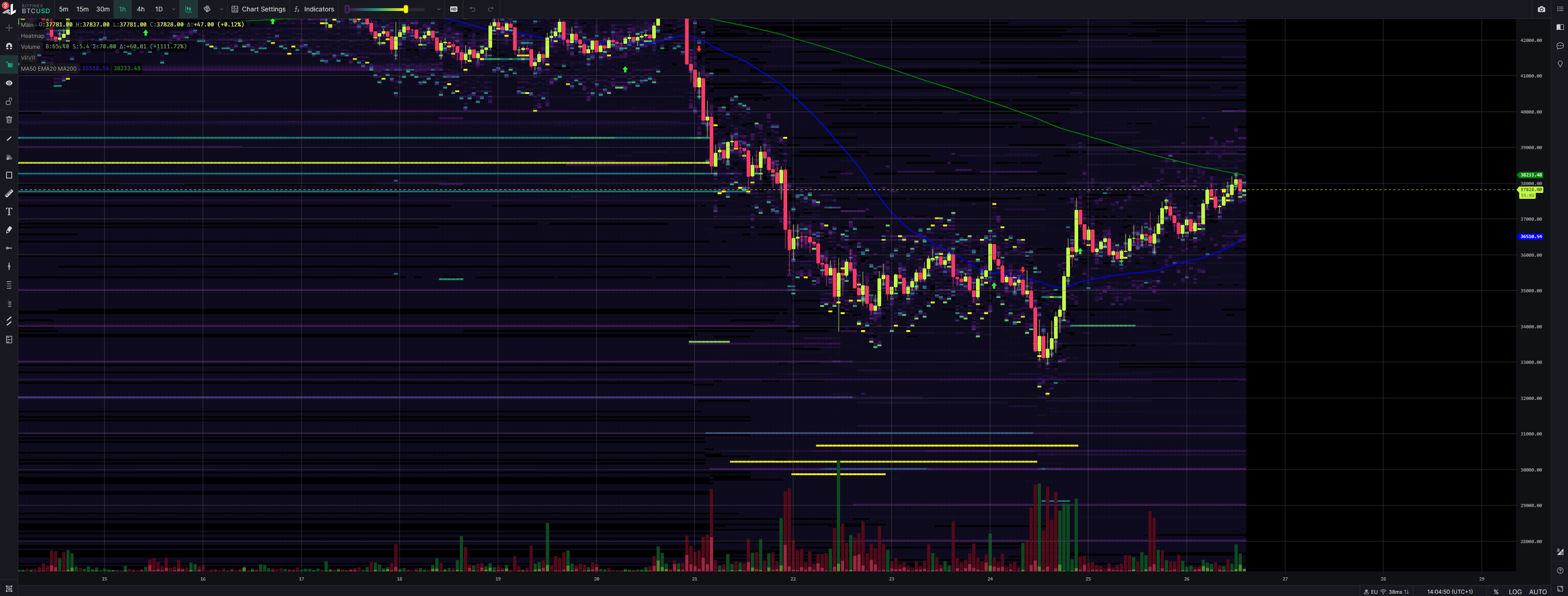

Inspos Conclusion and personal trade strategy

We are on track. The current data shows the opportunity to lift up to a range between 39k - 41k next. We have many walls between 39k - 41k indicating the expectation of many traders/exchanges. The walls matches also with the current max pain of 42k. No big inflows detected today, but we had a big “inflows-day” yesterday and I’m sure we have a lot of tokens remaining there yet. Also interesting the stablecoin reserve development. We should keep that in mind. They expect a bigger demand in stablecoins on exchanges. That happenend before our dump phase too. Also that would match to my expectations.

I will still accumulate low leverage shorts the way up. My strategy is simple. While we are lifting up, my spot bags are rising too, my short position is in red of course. As I think we will flip soon to dump afterwards I don’t care if my short position is in red now. As soon we reach our locol top I add a bigger amount to my shorts with a big leverage to let the leverage rise and I would start to sell some of my spot bags. In case they surprise me and we pump above 42k I would close my short position with low loss (10% - 20% max) and my spots would generate a nice gain as I bought them in the lowe ranges.

However, that’s my personal opinion and my personal trade strategy! Don’t follow my opinion or/and trade strategy! Use the data provided here and make your own conclusions! Due the FOMC today, we need to be careful with volatility anyway! So please, don’t rush to risky trades and max your risk management!

PAID SUB VERSION

Keep reading with a 7-day free trial

Subscribe to InspoCrypto’s Daily Crypto Newsletter to keep reading this post and get 7 days of free access to the full post archives.