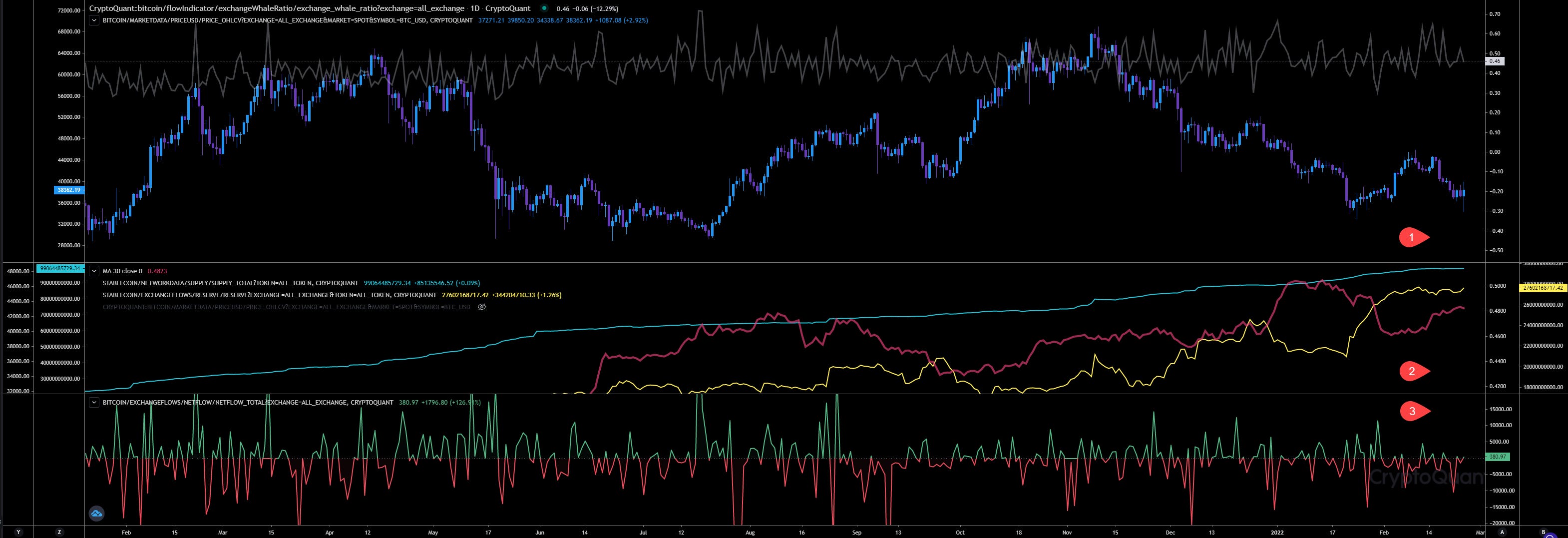

Whales Ratio - Daily View

Chart Analysis:

Whales ratio (1) has declined yesterday but again, maintains a high level. It seems the current price level is key and some whales don’t want to let the price lift up more.

Whales Ratio 30d Average (2) has started to decline since yesterday while the stablecoin reserves on exchange have started to lift up at the same time.

Total exchange Netflows (3) almost flat related to yesterday.

Inspos Conclusion: The daily whales ratio 30d average not showing any sign of a possible next bull run. Maintains high indicating the sell pressure keeps intact.

URL to chart: https://cryptoquant.com/prochart/vYNO3z1cx9LcSvg

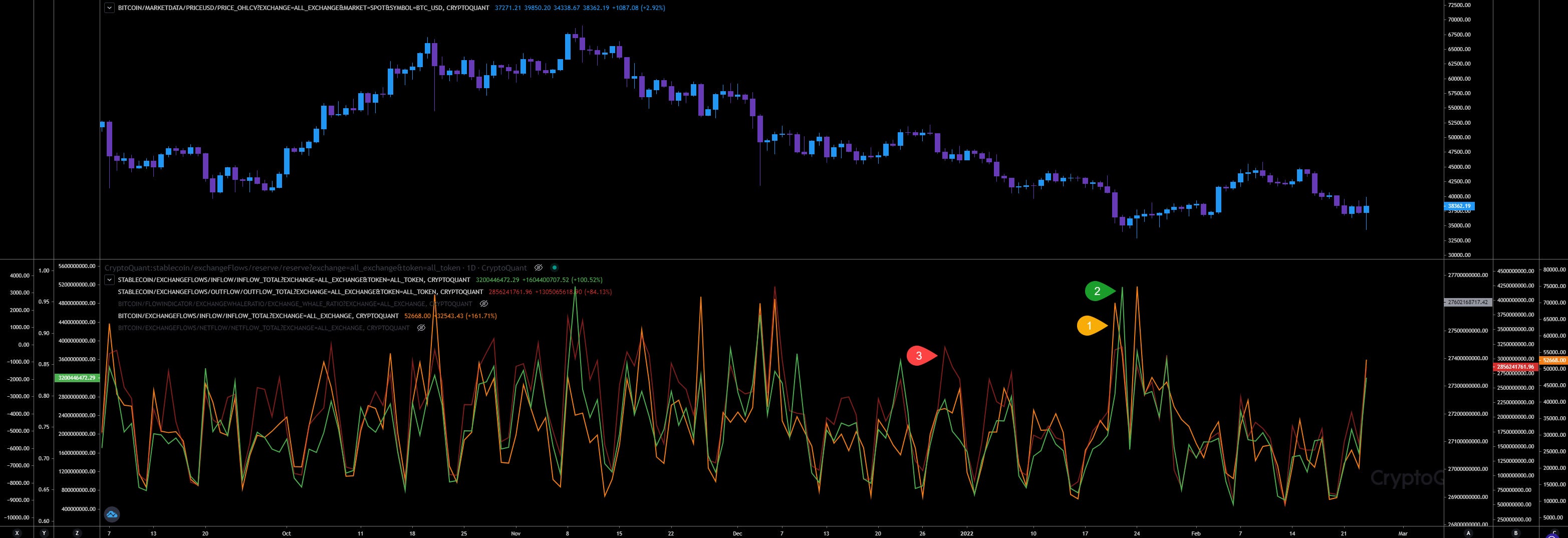

Market Flow Analysis

Chart Analysis:

Today we are receiving less flows. BTC (1) inflows today has declined compared to yesterday. We have received 52,600 BTC yesterday! Not reaching Jan level, but close. Also stablecoin inflows (2) are declining today while outflows (3) are rising at the same time. Yesterday we had $3.2 billion in stablecoin inflows and $2.8 billion in stablecoin outflows!

Inspos Conclusion: Yesterday we had a big whale fight again. Huge amount of capital was involved here. However, it seems we are not done with such fights as the flows maintains on a high level.

URL to chart: https://cryptoquant.com/prochart/czejQkfJy5OBF69

Miners Flow Analysis

Chart Analysis:

Miners outflows showing almost the same volume like yesterday. Their reserves also are maintaining its level since 2 days.

Inspos Conclusion: Miners are not in sell-off mode. The declining reserves are not concerning me yet. We need to observe their reserves more in the coming days.

URL to chart: https://cryptoquant.com/prochart/W1qyCruejyfhoEh

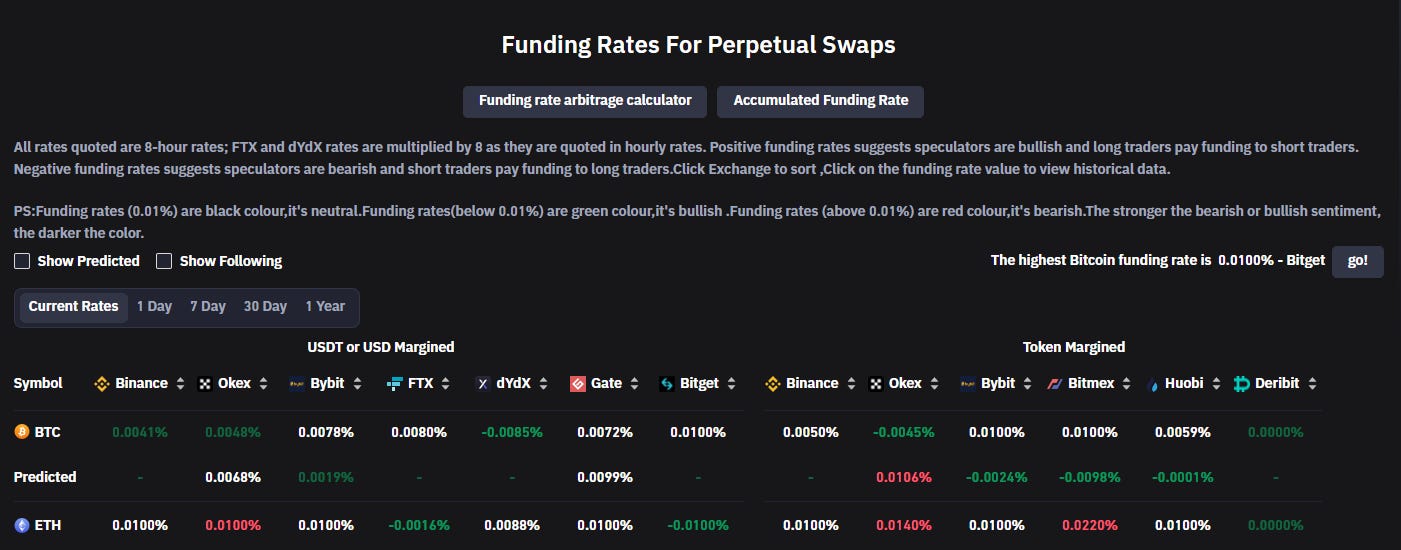

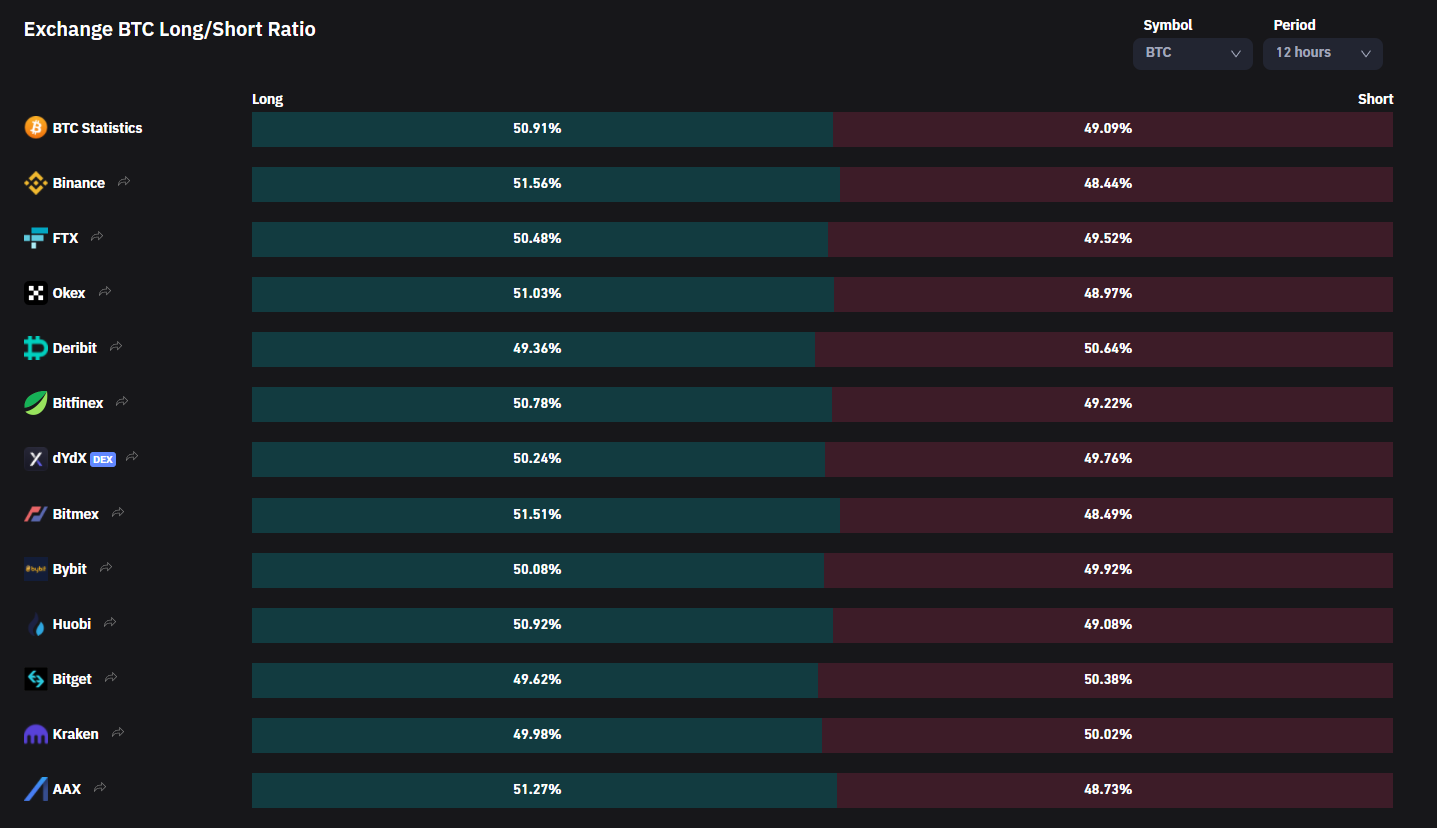

Future Trading Analysis

Data Analysis:

Funding rates neither bullish nor bearish. Future traders switched from bearish to neutral/bullih since yesterday.

Also confirmed by the Long/Short ratio that shows a tiny difference between both within the last 12 hours.

Inspos Conclusion: Not useful this time. We can’t detect a solid trend here again. Bitfinex future traders flipping to bullish. They liquidated late shorts yesterday and I expect they will do the same with longs afterwards.

URL to chart: https://www.coinglass.com/FundingRate

Exchange Order Walls

Analysis:

Bitfinex limiting the way down at 34.3k and a lot of mini BTC buy orders (max 50 BTC) below the current price level.

Inspos Conclusion: They are limiting upwards at 40k indicating our local top and limiting downwards at 35k - 33k. Interesting, because they still expect a rising sell pressure it seems and they don’t want to push up further it seems.

URL to chart: https://www.tradinglite.com/

Inspos Conclusion and personal trade strategy

Based on the on-chain data, the recent option trades and the exchange walls, it would make sense to see 36.5k again soon.

Market makers has reduced their balances between 23FEB22 and 24FEB22 by almost 40,000 BTC. The consequence, we dumped from 39.2k to 34.3k within 2 days. It seems they were very interested to push the price further down. We don’t know if their trade behavior was related to some option trades. But it would match to my theory.

As the demand in the market is weak they use their bags to manipulate the price action to their favor to reach certain price levels related to option trading.

However, if they start to sell again with such volume, we will dump again heading 34k.

Anyway, DXY looks very weak again and is pushing SPX up and BTC is following. If that continues, we will at least maintain the current price level today.

I’m not going to trade today. Too risky and not worth in my opinion. I would short again at 36.5k if we have our breakout there again. But if not, I will sit on my hands.