From today on I will provide two different versions of my analysis, a free and paid sub version. In the paid sub version provides more time frames and market aspects. I will provide more adhoc data changes for sub paid too.

FREE VERSION

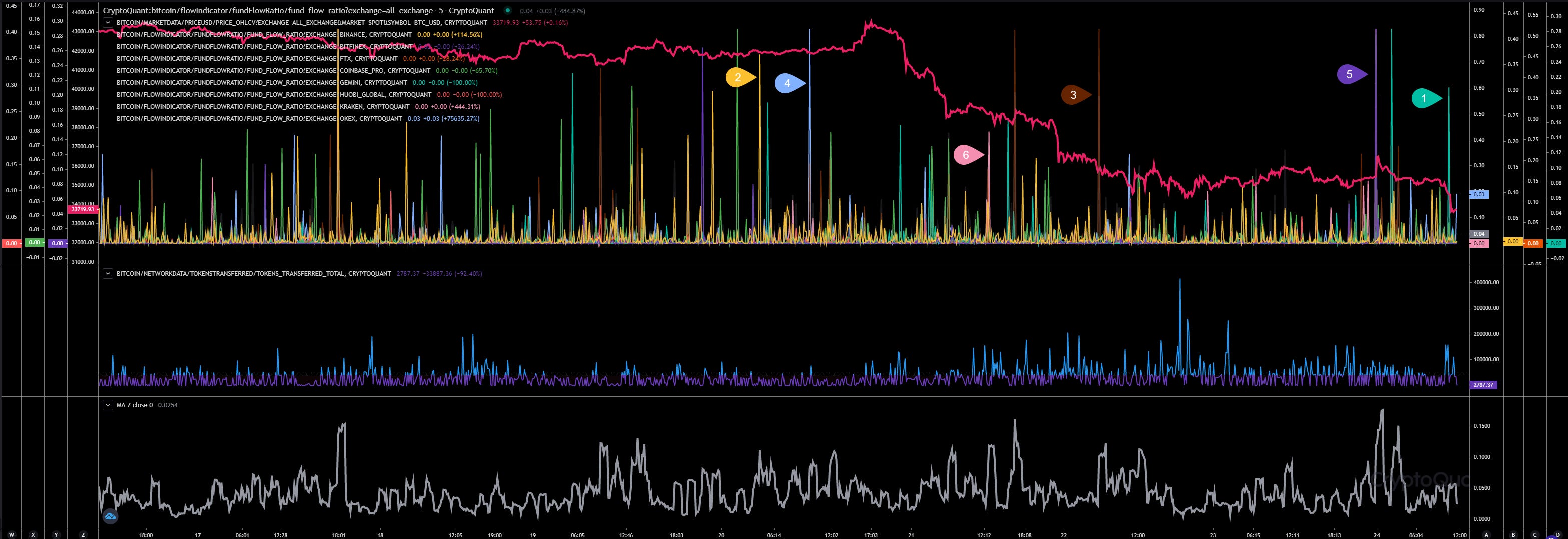

Block View

It’s shows very well the fake rally preparation (1). The whales ratio dumped before we declined in price heading 34.7k to pump hard afterwards forming a bull trap or fake rally. It seems whales were preparing another pump and it failed as we received more inflows as reported on twitter.

In general is our whales ratio 30block average (2) lifting up indicating that more sell pressure will follow, while the price action is showing its results.

In the whole morning we could detect several big inflows by FTX and Gemini (3) and Whale Alerts showing inflows also coming from Coinbase.

URL to chart: https://cryptoquant.com/prochart/vYNO3z1cx9LcSvg

Market Activity

Block View

#1 - Gemini

#2 - Binance

#3 - FTX

#4 - Okex

#5 - Bitfinex

#6 - Kraken

URL to chart: https://cryptoquant.com/prochart/MIV7FeYFXsE62DT

Interesting finding. While Bitfinex was the driver of our recent pump, Gemini and FTX generated sell pressure and started to sell the local top. No Binance involved here, at least not with such volume as we have detected in the past.

We can also detect more network activity at 33.6k. It looks like, someone outside of CEX (centralized exchanges) is buying the dip.

Future Trading

Hourly View

I’m happy to see the leverage ratio declining (1). That’s at least a good sign and could reduce the volatility. However, it maintains very high compared to months ago and and the funding rate (2) is declining due the price action. Even the funding rate is negative now, indicating a bigger demand in shorts, its not that negative as expected, also indicating many are longing expecting the bottom is in.

Interesting also are the liquidation charts. We have liquidated more shorts (3) than longs (4) within the weekend. But it seems the dump in leverage ratio was related to high leverage longs more than with high leverage shorts.

URL to chart: https://cryptoquant.com/prochart/h5G7kAg6yAM9hRC

Inspos Conclusion and personal trade strategy

Jesus! What an analysis! That’s in my opinion worst case. Taking into accunt all data from today, I don’t see anything bullish at the moment. Even if we pump, it will end in a fake rally it seems.

The price action reacted as expected. We dumped to 33k to bounce there rising the volatility. We are not done ladies and gentlemen and in some cases we can even expect more blood bath in the next days/weeks, at least what our whales ratio 30d average is showing!

My trade strategy for this week.

I have shorted from 34.5k to 33k. Closed there my short, have placed a new one at 34k (with tiny SL) when we bounced. As predicted we should maintain that level a bit. I would expect more inflows and the sell pressure should continue. As you can see in the whales ratio 30d average, we had a fake rally always before we nuked hard. That could happen again. So, Inspo is extremely bearish now. Even if we pump back to 38k! Only a solid change in data will flip me again.

PAID SUB VERSION

Keep reading with a 7-day free trial

Subscribe to InspoCrypto’s Daily Crypto Newsletter to keep reading this post and get 7 days of free access to the full post archives.