Whales Ratio - Daily View

Chart Analysis:

Whales ratio (1) confirming what we have seens in hourly. Whales ratio daily declined, but maintains an upper level indicating whales want to maintain sell pressure. That indicates distribution. It seems they are selling in our current price level.

Whales Ratio 30d Average (2) is lifting up indicating a rising sell pressure by whales. Stablecoin reserves in daily declining. Even the circulating supply in stablecoins keeps declining indicating more stablecoin outflows from exchanges. Circulating supply not rising in daily it seems.

Total exchange Netflows (3) very negative showing big outflows yesterday. We had much more outflows than inflows.

Inspos Conclusion: The daily whales ratio still looks to bearish to me. Even the stablecoin outflows are not bullish at all. Only netflows don’t match with that, something that’s really strange.

URL to chart: https://cryptoquant.com/prochart/vYNO3z1cx9LcSvg

Market Flow Analysis

Chart Analysis:

We have received a lot of stablecoin inflows (2) today and just few outflows (1) compared to the days before! However spot BTC inflows (3) have rised today. Coinbase received 4,000 BTC. I’ve checked the transaction manually and looks valid.

Inspos Conclusion: We have received a lot of stablecoin inflows but we are not pumping like in the past. It seems they need more stablecoins to lift up the price up. Something that would match with my whales ratio analysis indicating the sell pressure is still very active.

URL to chart: https://cryptoquant.com/prochart/czejQkfJy5OBF69

Miners Flow Analysis

Chart Analysis:

Miners outflows showing almost the same volume like yesterday. Their reserves also are maintaining its level since 2 days.

Inspos Conclusion: Miners are not in sell-off mode. The declining reserves are not concerning me yet. We need to observe their reserves more in the coming days.

URL to chart: https://cryptoquant.com/prochart/W1qyCruejyfhoEh

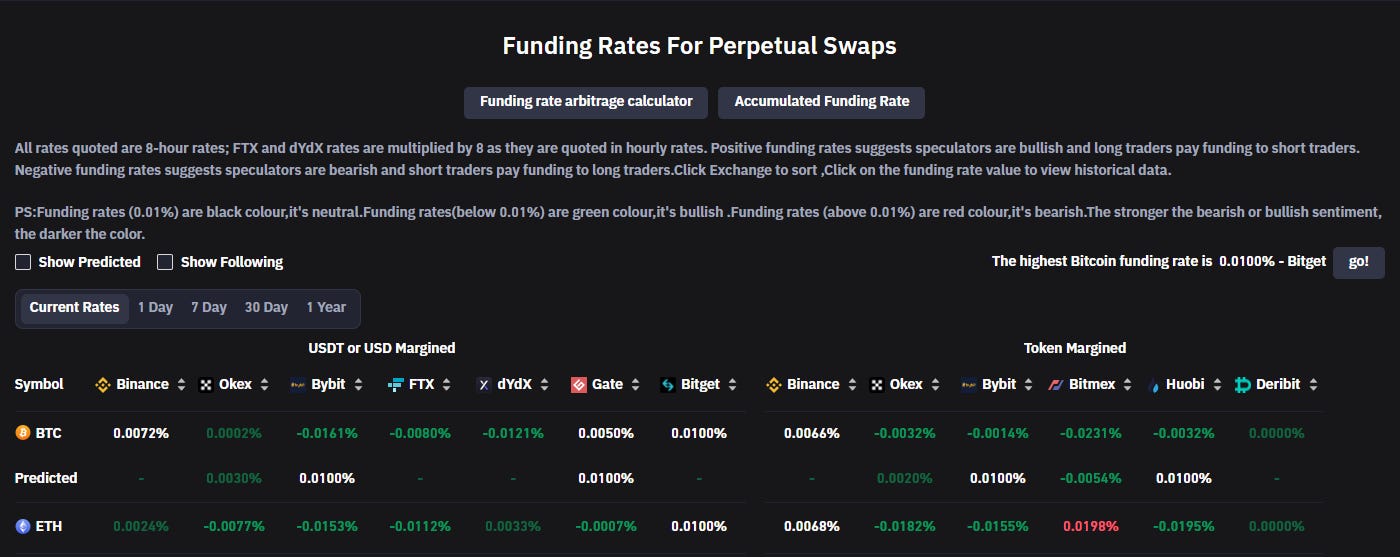

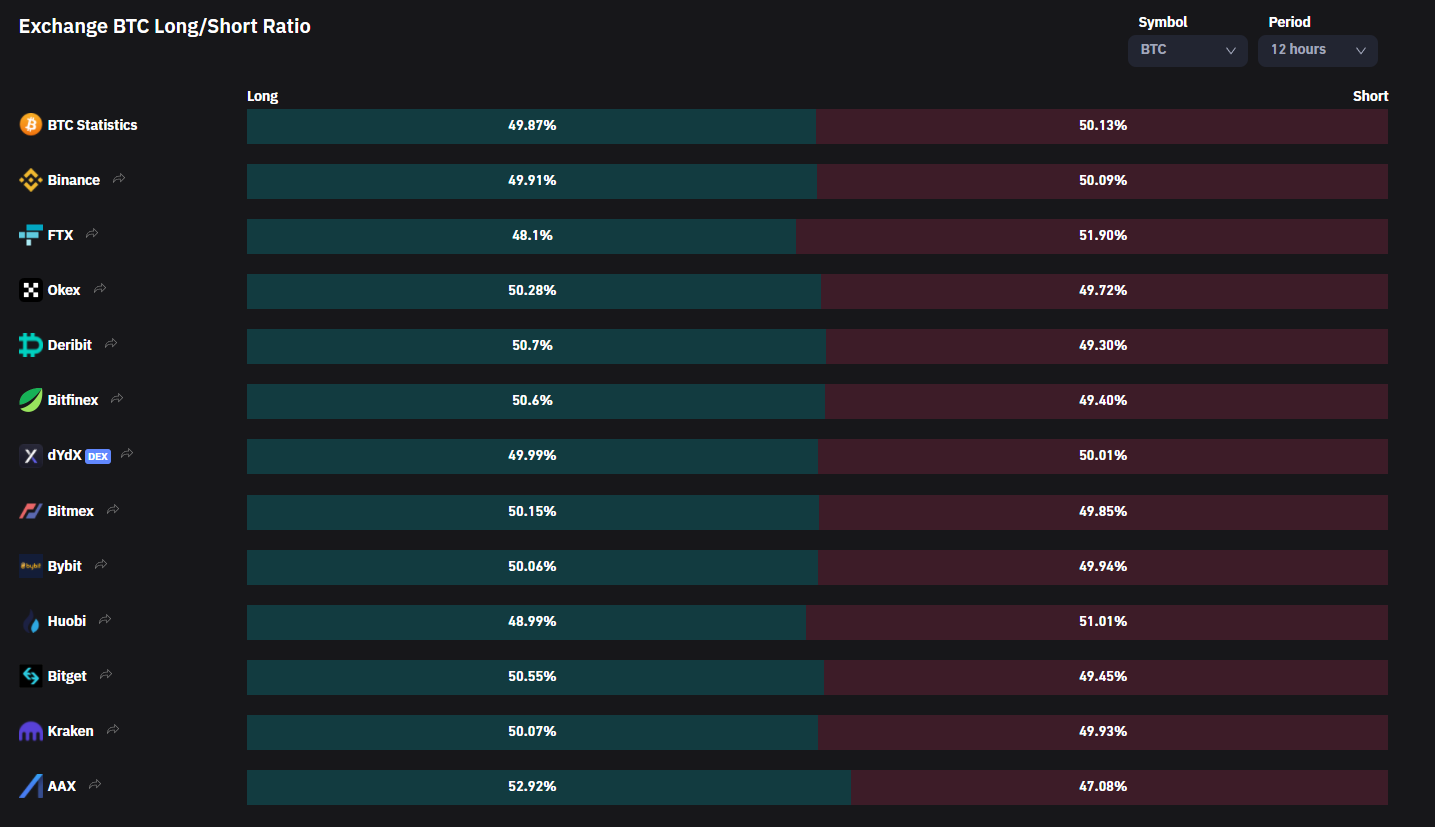

Future Trading Analysis

Data Analysis:

Funding rates showing a bigger demand for shorts than longs in the last 8 hours. But not a big gap it seems. The Long/Short ratio for the last 12 hours showing a bit more shorts. But also here, almost no difference. Open Interests lifting up a bit by 0.79% since yesterday.

Inspos Conclusion: Not useful this time. We can’t detect a solid trend here again. Bitfinex future traders flipping to bearish now. Shorts rising and late longs liquidated.

URL to chart: https://www.coinglass.com/FundingRate

Exchange Order Walls

Analysis:

Bitfinex limiting the way up at 47.8k and the way down at 35.8k and a lot of mini BTC buy orders (max 50 BTC) below the current price level.

Inspos Conclusion: The at 45k are still there but they have started to place new walls in lower ranges now. 36k is the limit at the moment and it matches to 36k puts related to the friday expiry! I guess that’s coincidence. ;-)

URL to chart:

https://www.tradinglite.com/

Also something I would like to show. Bitfinex and Binance Perp showing similar structure but it seems contrarian interests.

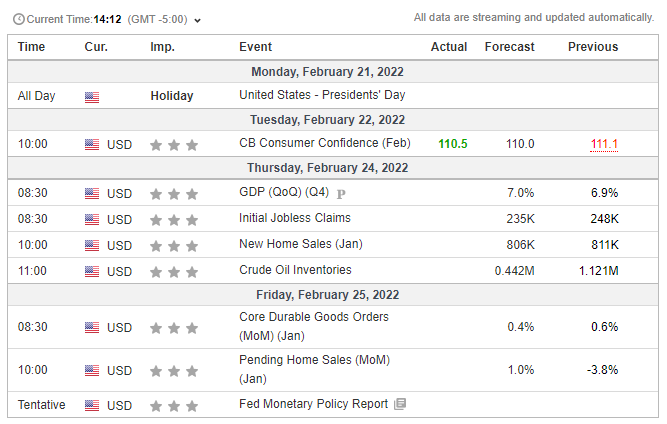

Inspos Conclusion and personal trade strategy

At the moment it’s not easy to detect solid trends to predict certain price levels. It looks bearish, no doubt. Option traders showing a trade range. They will fight to push the price to the level they need. We have still a lot of stablecoins that in my opinion will try to prevent a bigger dump. BTC inflows are not that big like in Dec. or Jan. anymore.

I’m shorting since 39k and my short maintains open. I expect a price below 38k due the puts positions there. We need to see what happens after tomorrows expiry, but in my opinion they will try to push the price further down heading 36k. Anyway, I expect a rising volatility again! Tomorrow some data could have an impact to the market and friday too. So, trade carefully.