Whales Ratio - Daily View

Chart Analysis:

Whales ratio (1) has declined again, but keeps maintaining a good upper level.

Whales Ratio 30d Average (2) is lifting up indicating a rising sell pressure by whales. Stablecoin reserves in daily lifting up instead.

Total exchange Netflows (3) is almost neutral. At least no big moves. We will see tomorrow the 5,000 BTC from today.

Inspos Conclusion: No big news here. Just maintaining a sell pressure. You know my theory of what should happen in the next days. More sell pressure and I expect more dump coming.

URL to chart: https://cryptoquant.com/prochart/vYNO3z1cx9LcSvg

Market Flow Analysis

Chart Analysis:

Today we have a nice volume in outflows (1) related to stablecoins and much less inflows (2). However we have also received a nice volume in BTC (3) on exchanges.

Inspos Conclusion: Except those stablecoin outflows no big news I need to highlight here.

URL to chart: https://cryptoquant.com/prochart/czejQkfJy5OBF69

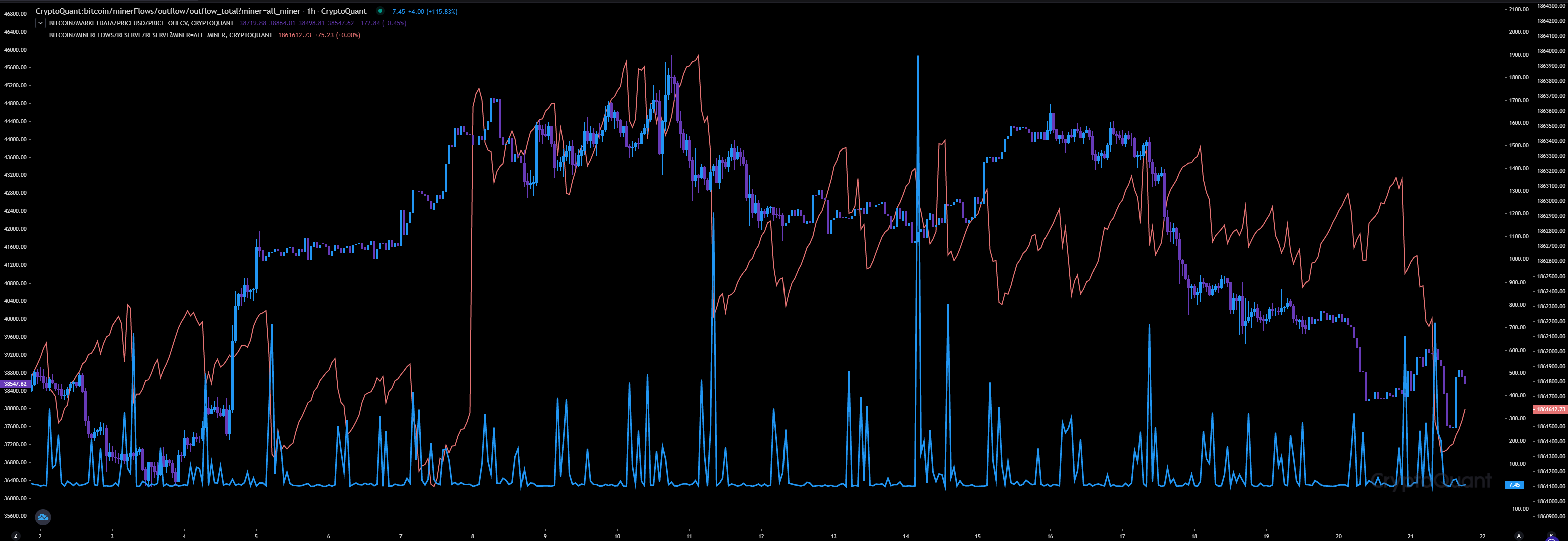

Miners Flow Analysis

Chart Analysis:

Miners outflows rised today. Their reserves has declined by 1,700 BTC since 18Feb22. Since 10Feb22 their reserves are in a downward trend.

Inspos Conclusion: Miners are not in sell-off mode. The declining reserves are not concerning me yet. We need to observe their reserves more in the coming days.

URL to chart: https://cryptoquant.com/prochart/W1qyCruejyfhoEh

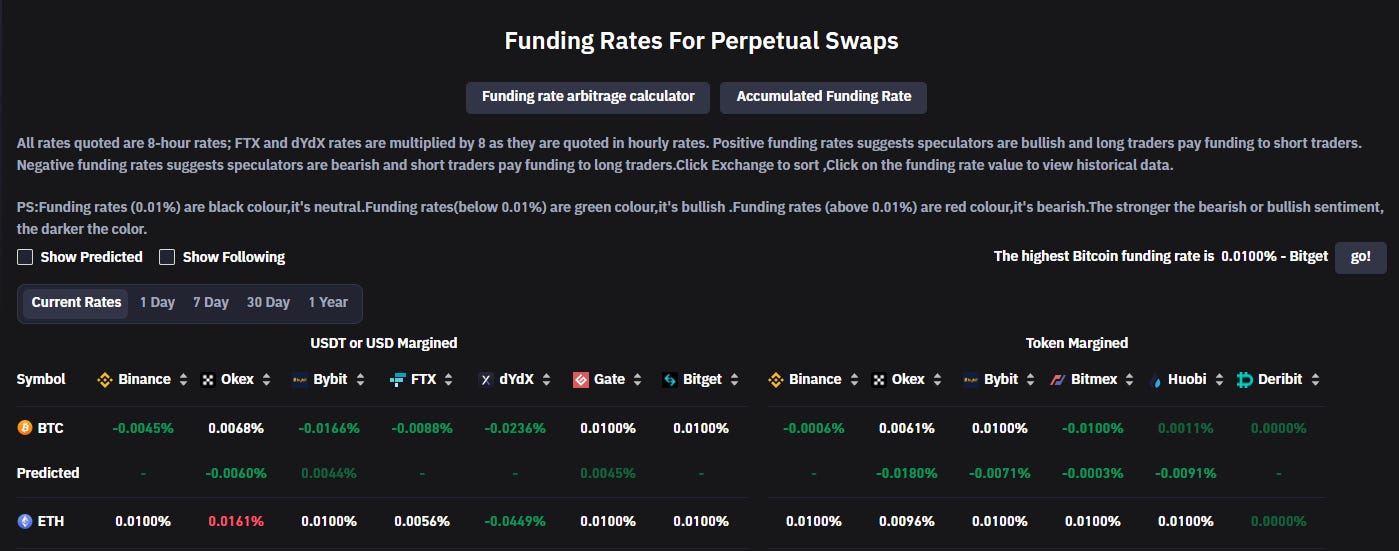

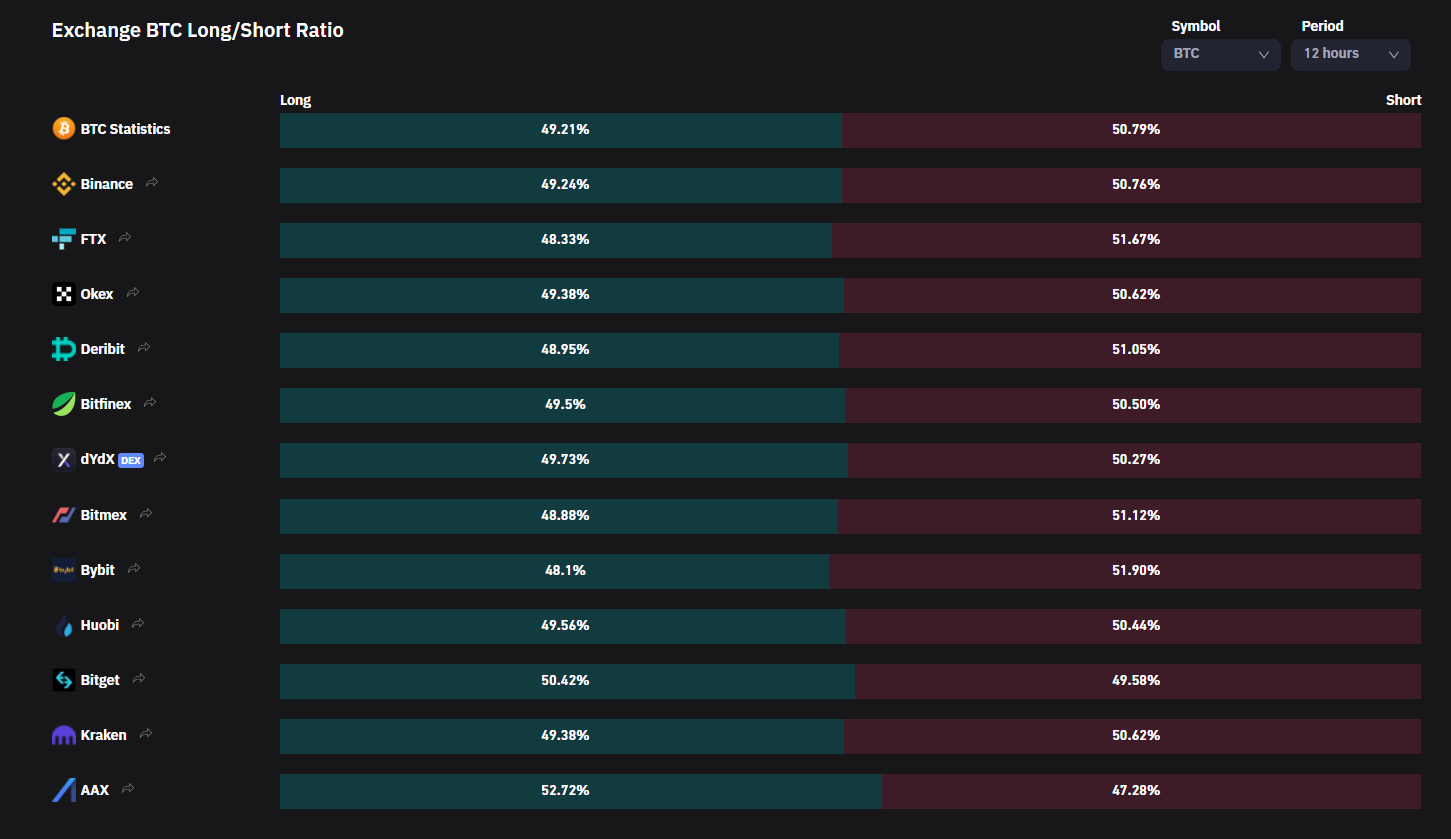

Future Trading Analysis

Data Analysis:

Funding rates showing that traders have flipped slowly to bearish, even if not enough in my opinion taking into account the last price actions. Leverage ratio keeps ultra high and that generates even more volatility. Open interest in the last 24 hours has declined again by 2.25%.

Inspos Conclusion: We have still too many high leverage positions open and more are arriving. However, we have based on Bitfinex a lot of longs with an entry at 40k. If they keeps dumping they will trigger a long cascade.

URL to chart: https://www.coinglass.com/FundingRate

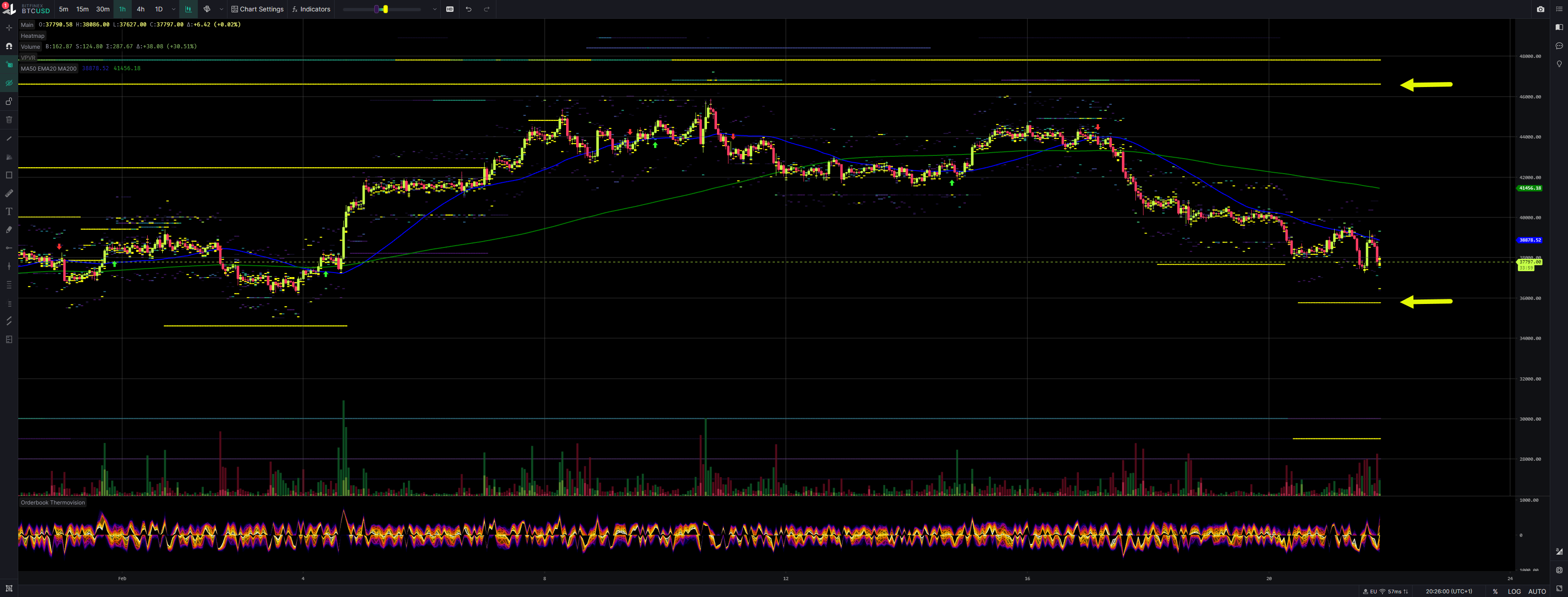

Exchange Order Walls

Analysis:

Bitfinex limiting the way up at 46.6k and the way down at 35.8k and low volume at 30k and 28.5k.

Inspos Conclusion: The at 45k are still there but they have started to place new walls in lower ranges now.

URL to chart: https://www.tradinglite.com/

Inspos Conclusion and personal trade strategy

Today its everything but not boring at all. We have started to the day with a big dump, followed by a big pump and afterwards another dump happenend. Big money is fighting here it seems. Whales ratio indicating a constant high sell pressure by whales, option trades looking bearish, future traders sentiment flipped back to bearish, but not bearish enough at the moment, exchanges showing order walls in lower ranges now. Market makers selling since few days and they have big bags that would allow they to keep the market down if they want.

I really don’t know what is happening behind the curtains, but it’s huge. Maybe also related to Bidens Executive Order.

https://techstory.in/joe-biden-will-issue-a-crypto-executive-order-this-week/

Always work with SL and TP!