Bitcoin Market Update [20Jan22]

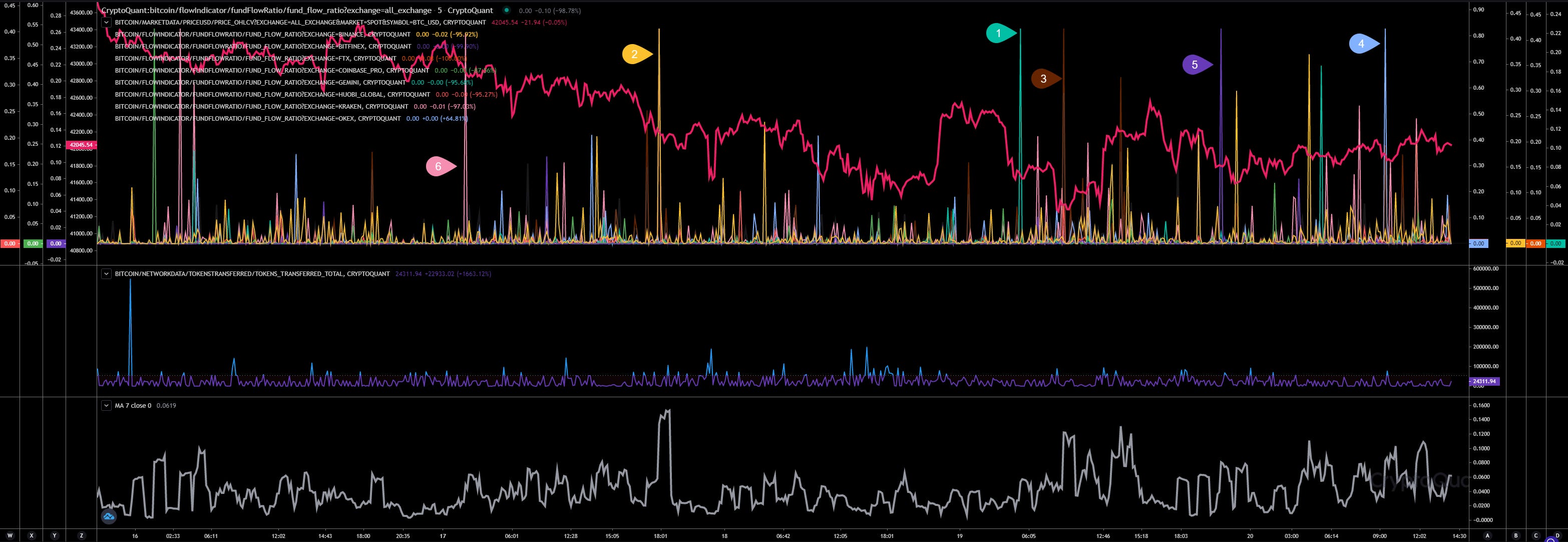

Hourly View

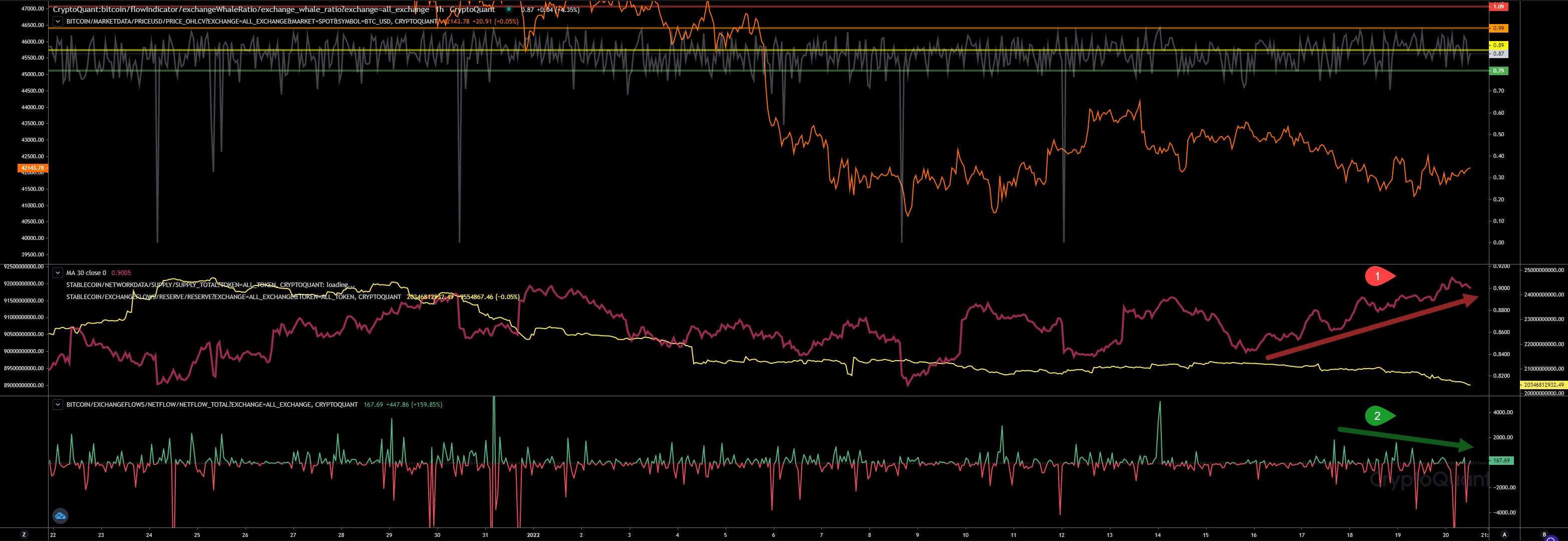

Since yesterday no big news. Our whales ratio 30h average (1) still lifting up indicating more incoming tokens by whales, but our netflow chart (2) isn’t indicating big incoming inflows, at least no big positive netflows. But we can see big negative netflows indicating big outflows instead. Anyway, we don’t know when they bought those tokens. So, interesting and useful to detect a trend. We will check our new inflows chart if we can find any big exchange inflows. However, the positive netflows are decreasing since our last big positive netflow 14Jan22 indicating less inflow volume to exchanges. Matches to our price action since few days.

URL to chart: https://cryptoquant.com/prochart/vYNO3z1cx9LcSvg

Block View

Once again is our whales ratio 30block average (1) showing the incoming price action (2). As soon as the indicator starts to rise, the BTC price starts to decline due incoming sell pressure and the opposite. Our highest positive netflow today way almost 120 BTC (3). That’s compared to the last weeks nothing, while negative netflows (more outflows than inflows are rising). That’s of course bullish, BUT always have in mind, inflow doesn’t mean that they are going to sell immediately afterwards. In some cases it would make sense to accumulate inflows on exchanges to dump hard once as strategic sell op, like to generate fear and shake out retailers. We need to keep observing the market if we can detect certain big market activities.

URL to chart: https://cryptoquant.com/prochart/vYNO3z1cx9LcSvg

Option Trading

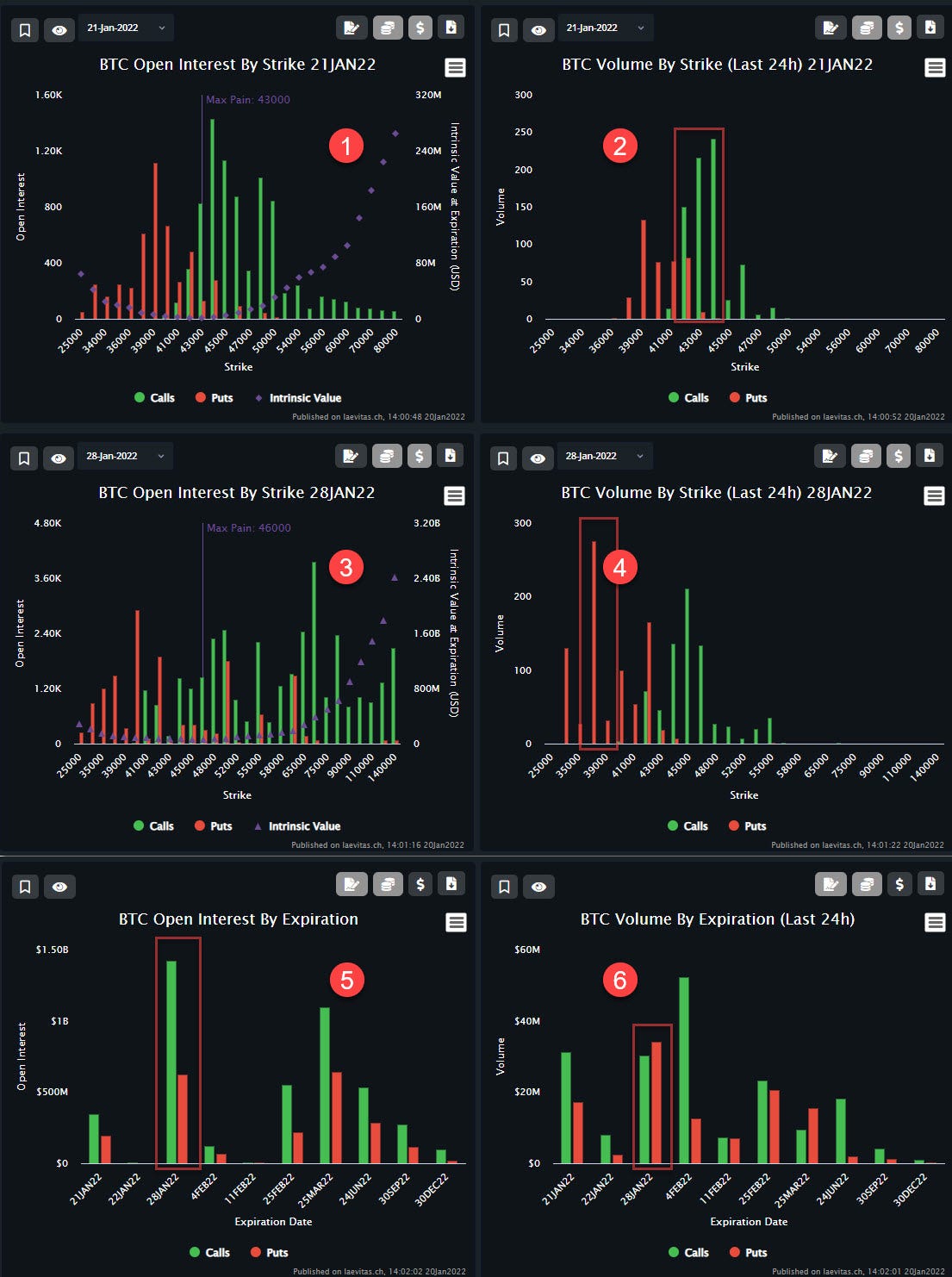

Expiry 21JAN22

Also no big news here. Volume relatively low compared to our last days and weeks. Our max pain here is still 43k (1). The last Volume by Strike (Last 24h) (2) showing more Call trades at a range between 43k - 44k, indicating here an expected price level above 44k until next friday. Keep in mind, that our next expiry has not a big volume. We have almost $540 million and $340 million are calls in a range between 43k - 50k. So, not that useful and I don’t think that our max pain here is going to be an accurate indicator.

More important is what will happen in US stock markets. We are here expecting an expiry with a total volume of $125 billion for the 21Jan22! That’s epic and could have a big impact to crypto too, as BTC is following $SPX in a very accurate way. We should expect here a big volatility!

https://spotgamma.com/the-deep-january-opex/

Expiry 28JAN22

Our max pain (3) for this expiry keeps at 46k since yesterday. More Puts volume detected since yesterday. The biggest volume was almost $10 million in Puts at 38k. Also not really big. But Puts trade in the range between 30k - 42k (4) has rised since yesterday, indicating a correction in sentiment by option traders. However, our Open Interest for that expiry shows $1.42 billion in Calls and only $625 million (5) in Puts! Even if more Puts (6) are arriving, it looks still bullish to me.

URL to App: https://app.laevitas.ch/dashboard/btc/deribit/options/activity/overview

Future Trading

Daily View

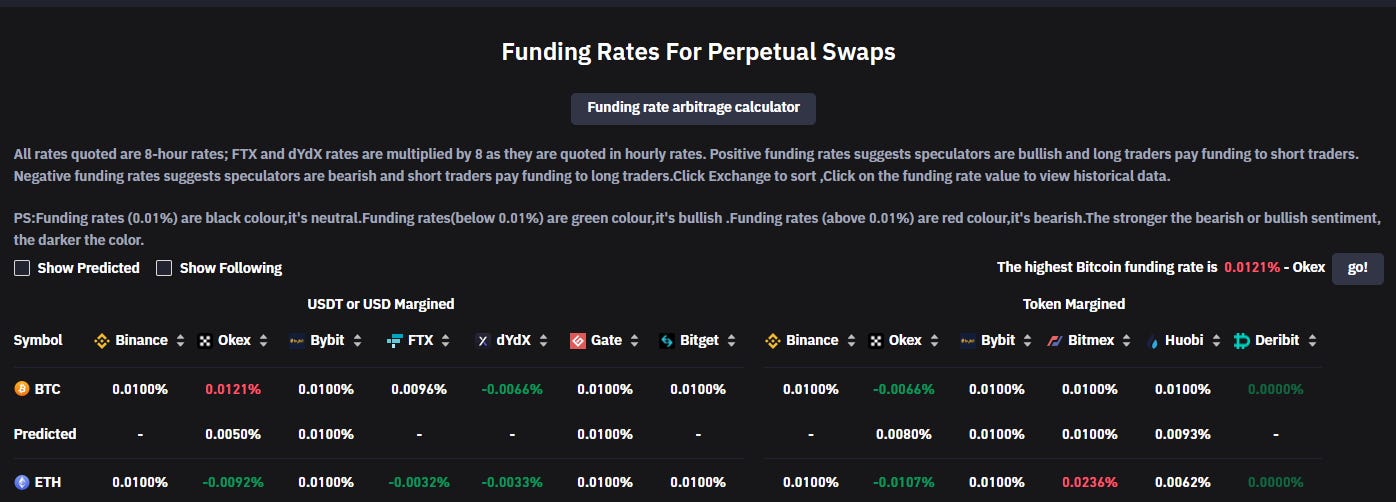

Future trading daily view is not showing any big changes again. The Leverage Ratio (1) keeps rising and is heading our ATH indicating more incoming high leverage positions. The Funding Rate maintains almost the level of yesterday. It’s showing more positive than negative right now.

URL to chart: https://cryptoquant.com/prochart/h5G7kAg6yAM9hRC

Daily View

Future trading is not showing any big changes again. The Leverage Ratio (2) keeps rising and the Funding rate is also showing more longs demand than shorts, showing a rising Funding Rate (1). Interesting here is, it seems someone has closed some positions with high leverage last night. I say close, because I can’t see any liquidations related to this move. With a rising volatility in stocks, it will be a Rodeo tomorrow at crpyto too, with all that high leverage positions. A good opportunity to clean the market from all that toxic positions.

URL to chart: https://cryptoquant.com/prochart/h5G7kAg6yAM9hRC

Also Coinglass confirms the observation described above. Funding rates of the last 8h are almost all neutral, except Okex showing a positive Funding Rate and dYdX a negative one. But also here, nothing big.

URL to App: https://www.coinglass.com/FundingRate

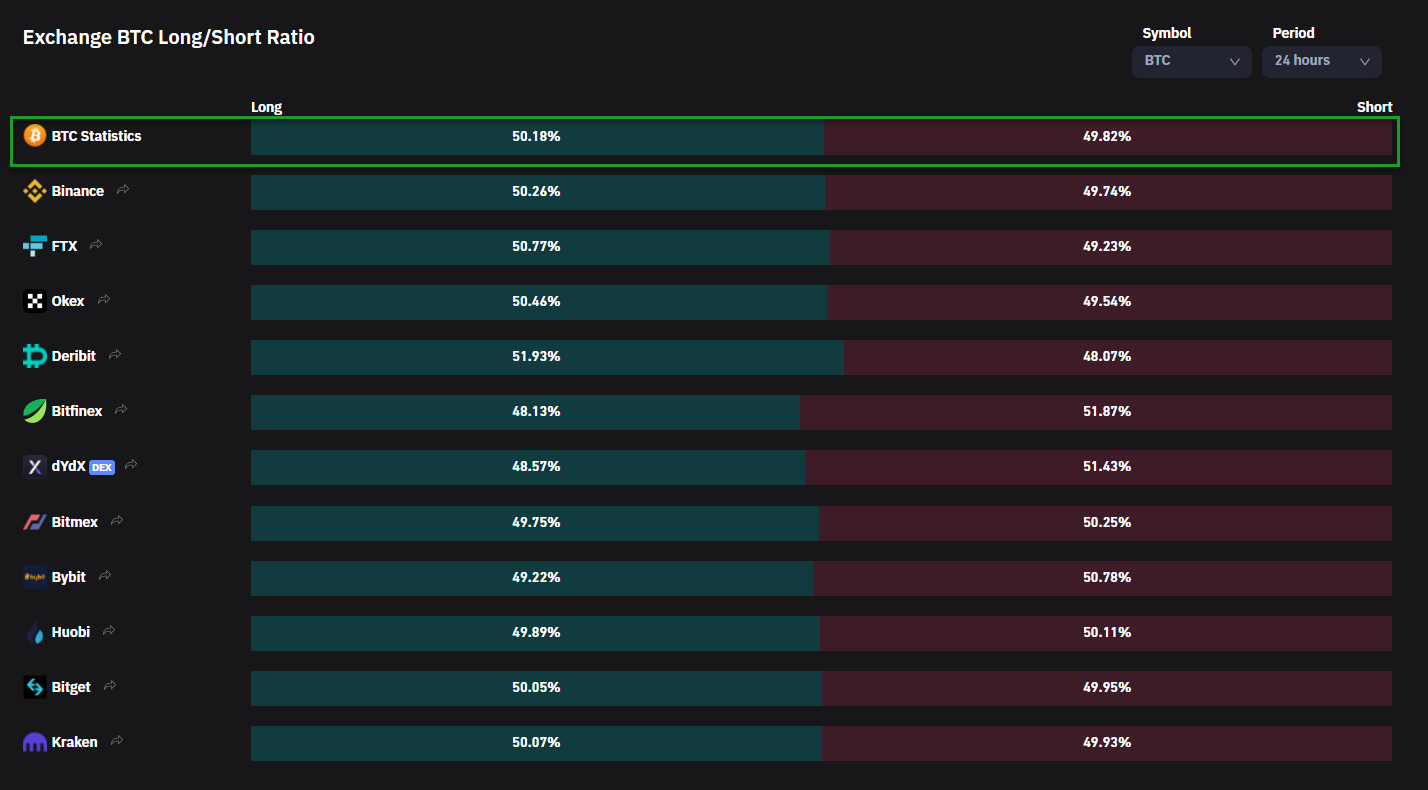

Also the Long/Short Ration of the last 24h confirms that more and more traders are placing longs now. That combined with high leverage is not bullish at all!

URL to App: https://www.coinglass.com/LongShortRatio

Market Activity

Block View

#1 - Gemini

#2 - Binance

#3 - FTX

#4 - Okex

#5 - Bitfinex

#6 - Kraken

We can see here again what is happening since weeks. Binance always linked to falling price action, while the remaining exchanges almost to rising prices. FTX and Bitfinex looks very bullish to me.

URL to chart: https://cryptoquant.com/prochart/MIV7FeYFXsE62DT

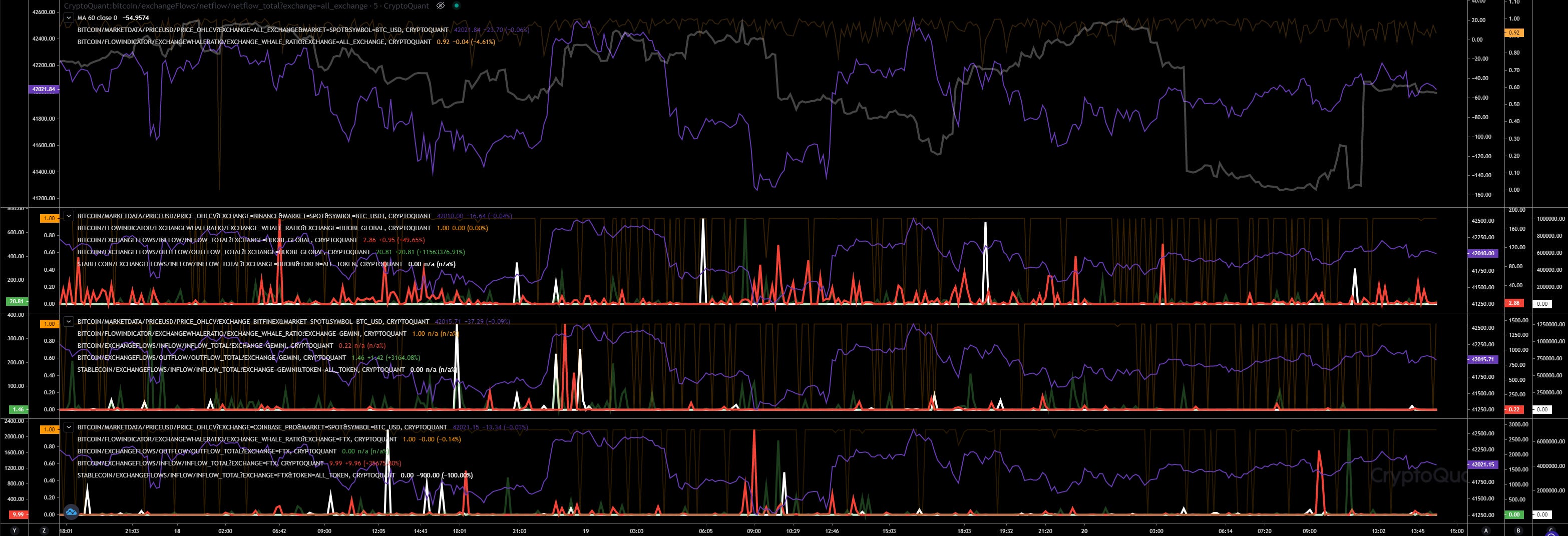

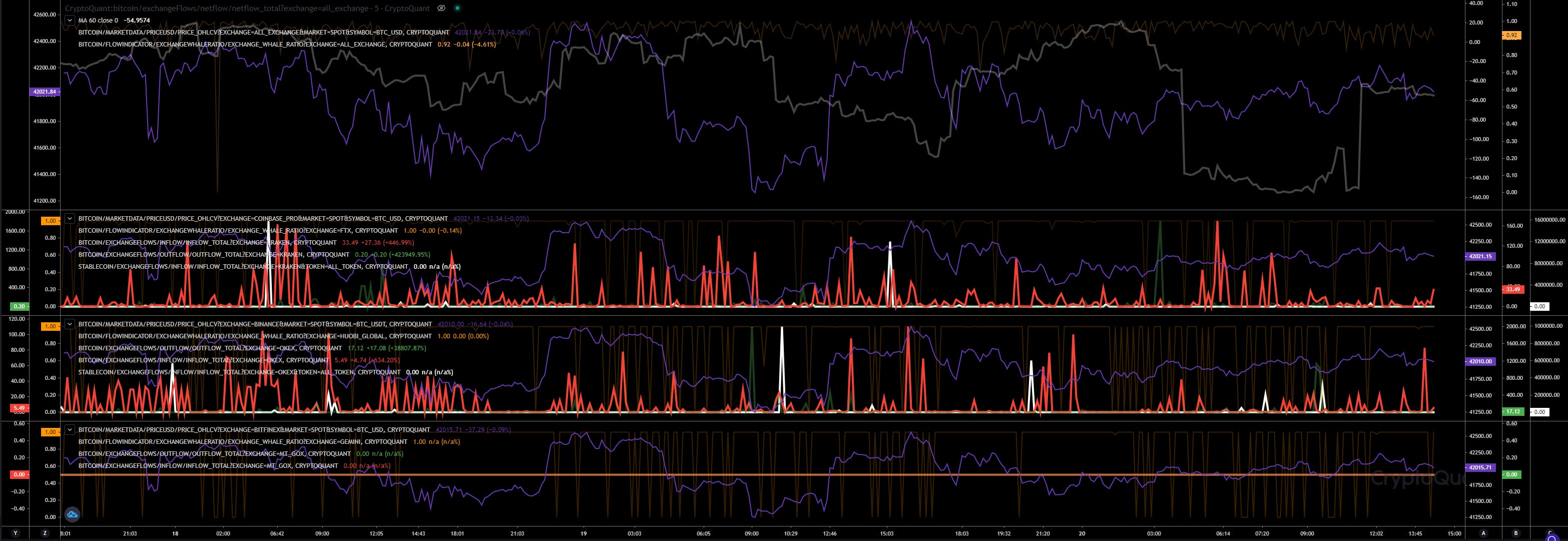

Exchange Activities

#1 - BTC Inflows

#2 - Stablecoin Inflows

#3 - BTC Price (USD)

#4 - Total Netflow

#5 - Total Whales Ratio

#6 - BTC Outflows

URL to chart: https://cryptoquant.com/prochart/5orKIwFerljHvhr

Again we can see here more red activity on Binance than on Bitfinex or Coinbase indicating where the sell pressure is coming from. Binance still leading the sell pressure receiving more inflows. As you also can see, the inflows are declining in volume here. Also interesting more incoming stablecoin inflows to Binance. Bitfinex not showing any big activity and Coinbase more stablecoin inflows, but less in- and outflows.

Huobi showing some inflows, but nothing bit. The biggest was 120 BTC tonight, the remaining inflows are low volume (40 - 60 BTC). Almost no outflows detected here. Gemini almost flat. Neither big inflows nor big outflows detected here. FTX had a big inflow today of almost 2,000 BTC but as usual here, those just had its outflow (almost 2,400 BTC) few hours later.

Here we see much more red activity. Kraken showing more small inflows (max 160 BTC) and almost no outflows. The same on Okex. We had just few hours ago a big inflow of almost 1,600 BTC and in general showing a nice inflow volume the whole day in a range of 400 - 600 BTC in different times since this morning.

Exchange Walls

#1 - Bitfinex | Walls: Upper at 46.6k, Lower at 39.3k

#2 - Coinbase | Walls: Upper at 48k, Lower at 40k

#3 - Binance | Walls: Upper at 46k, Lower at 40k

#4 - FTX | Walls: Upper at 48.5k, Lower at 37.5k (NEW!)

#5 - Kraken | Walls: Upper at 44k (NEW!), Lower at 40k

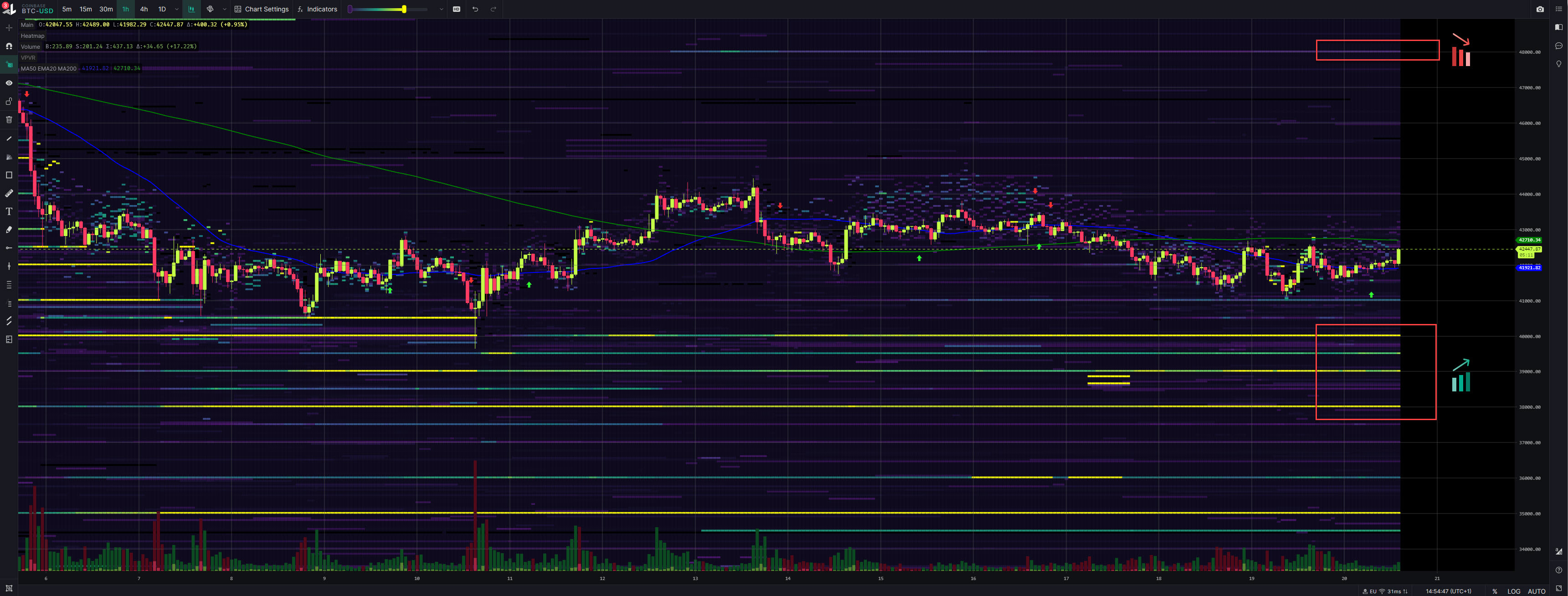

Inspos Conclusion and personal trade strategy

No big moves detected since yesterday. Some data changed a bit, but nothing that let me change my trade strategy yet. Low volume attracts big price actions in both directions. We have detected some bin inflows related to Okex, but even then, that could generate some sell pressure, but I’m missing some big inflows in other exchanges too.

Checking my $DXY, $SPX andd $NDX charts I see an incoming falling trend for $SPX and $NDX, while $DXY is holding its support level. If $DXY would have a breakout downwards I would expect a rising buy pressure also on crypto.

At the moment BTC is pumping with low volume. As expected, when we trade with low volume we can make big price actions very quick. We are heading our resistance level. We have failed twice already and we retraced afterwards. Bullish here is our LH trendline we have formed since yesterday. But did the demand changed since yesterday? I have my doubts. So, I’m expecting here another failed retest and retrace heading 41.4k. If we have the breakout, then we will lift up heading 43.2k. We know that level very well. We have spent few days there already before we dumped to 41k. So, I would then expect a retrace at 43.2k. In case they surprise me with a big low volume pump, 44k we have the first wall waiting. So, my trade strategy for today, and this time its a risky one, to short with low leverage (5 - 10) from now and in case we lift up more, to add more funds the way up. I will use a tiny SL in case they pump as mention with low volume. However, tomorrow and maybe the whole weekend can be very volatile. I’m not sure yet, if I will maintain my position open tomorrow. I will see how the market reacts today.