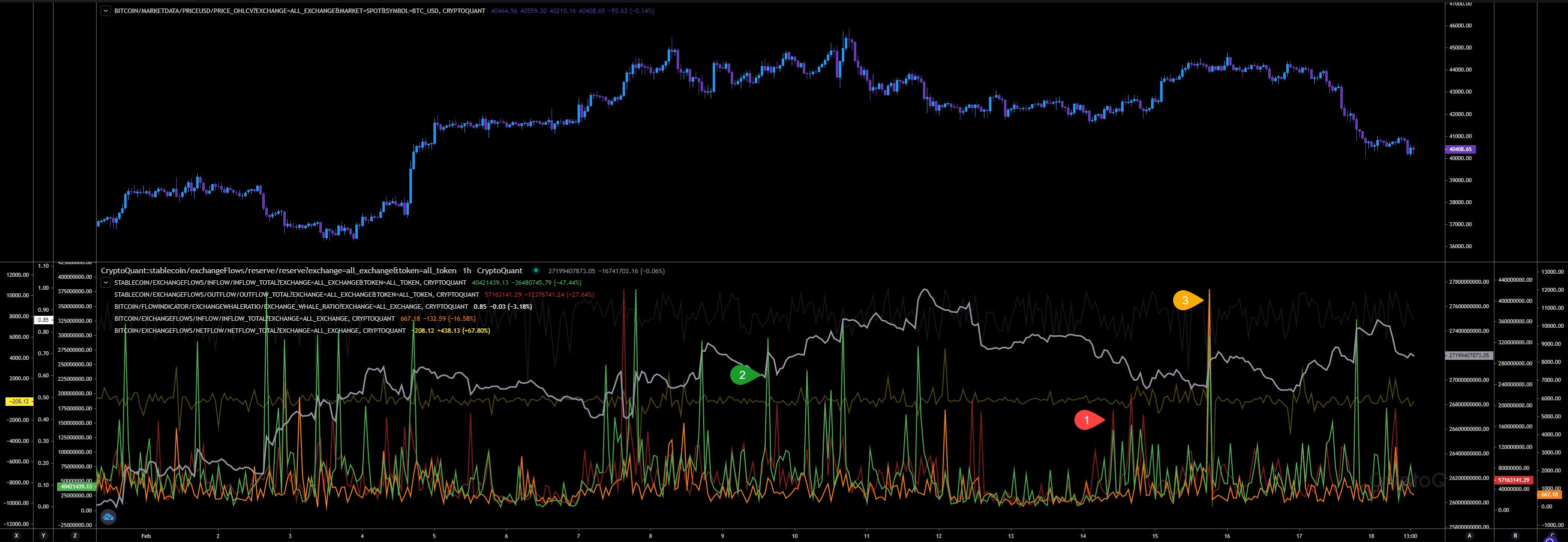

Whales Ratio - Daily View

Chart Analysis:

Whales ratio (1) has declined lifted up again yesterday and showing its impact to the price action.

Whales Ratio 30d Average (2) is lifting up indicating a rising sell pressure by whales. Stablecoin reserves lifting up instead.

Total exchange Netflows (3) is almost neutral.

Inspos Conclusion: No big news here. Just maintaining a sell pressure. But with the pump in Whales Ration of the recent days I’m expecting much more sell pressure soon.

URL to chart: https://cryptoquant.com/prochart/vYNO3z1cx9LcSvg

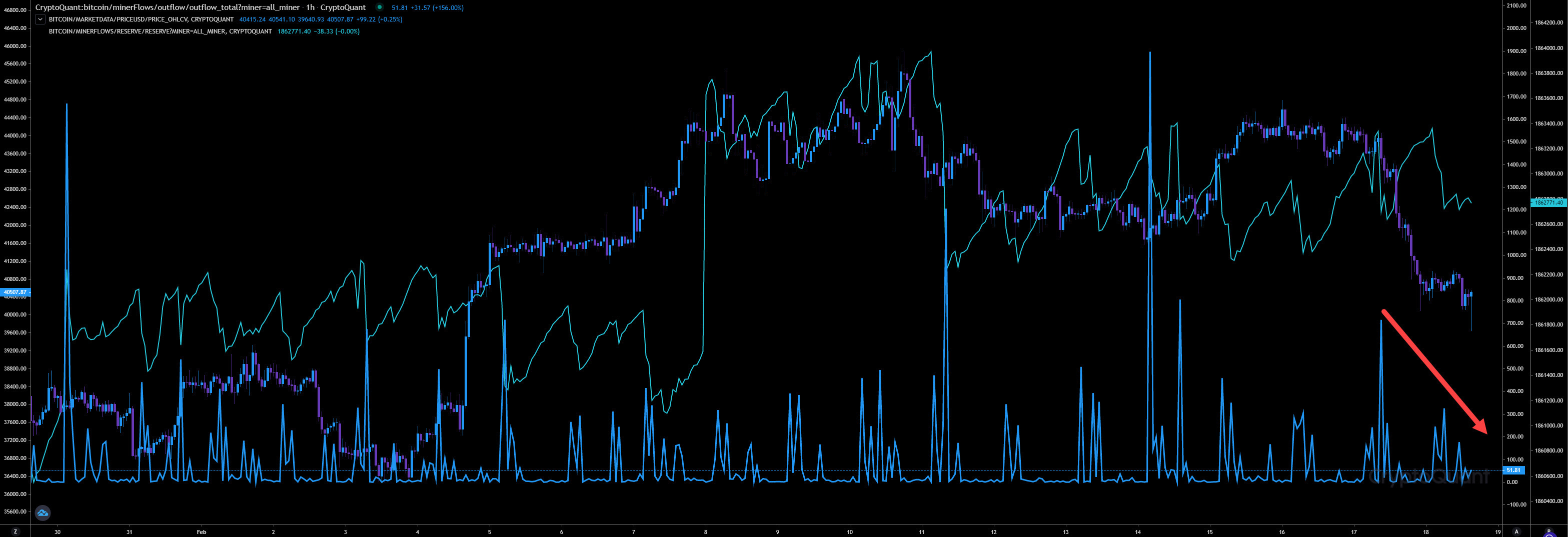

Market Flow Analysis

Chart Analysis:

Today we have a nice volume in outflows (1) related to stablecoins but still more inflows (2). However we have also received much more BTC (3) on exchanges than yesterday.

Inspos Conclusion: Except those BTC inflows also here no big news since yesterday.

URL to chart: https://cryptoquant.com/prochart/czejQkfJy5OBF69

Miners Flow Analysis

Chart Analysis:

Miners outflows declined today. Nothing that would have an impact to price action.

Inspos Conclusion: Miners are not in sell-off mode. Everything looks fine here.

URL to chart: https://cryptoquant.com/prochart/W1qyCruejyfhoEh

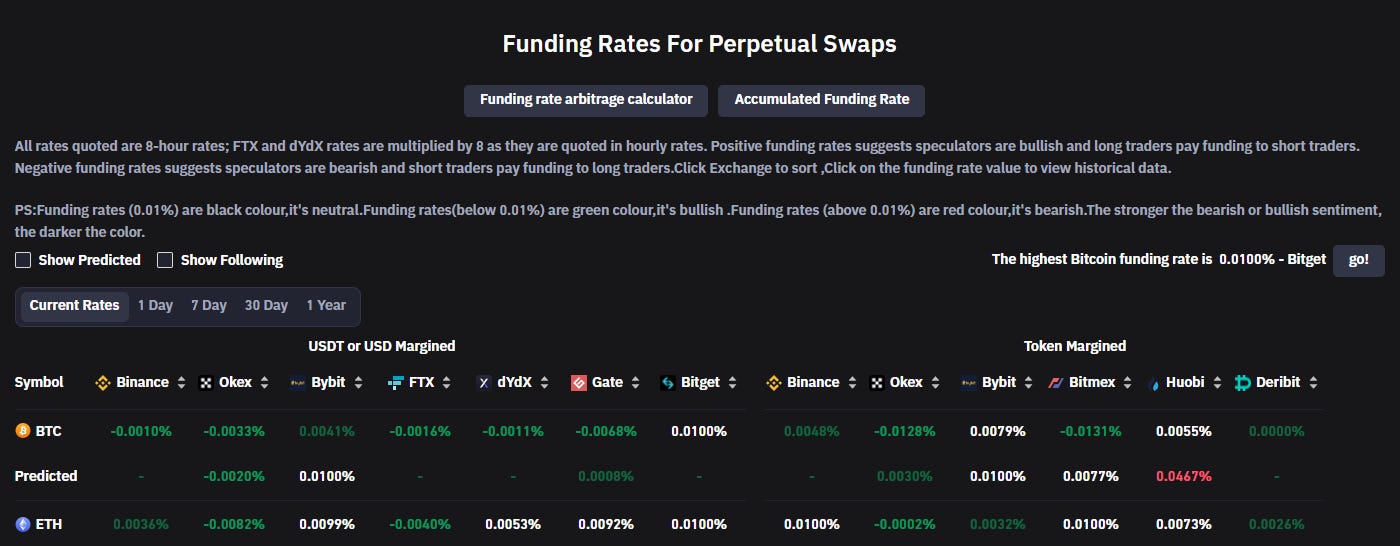

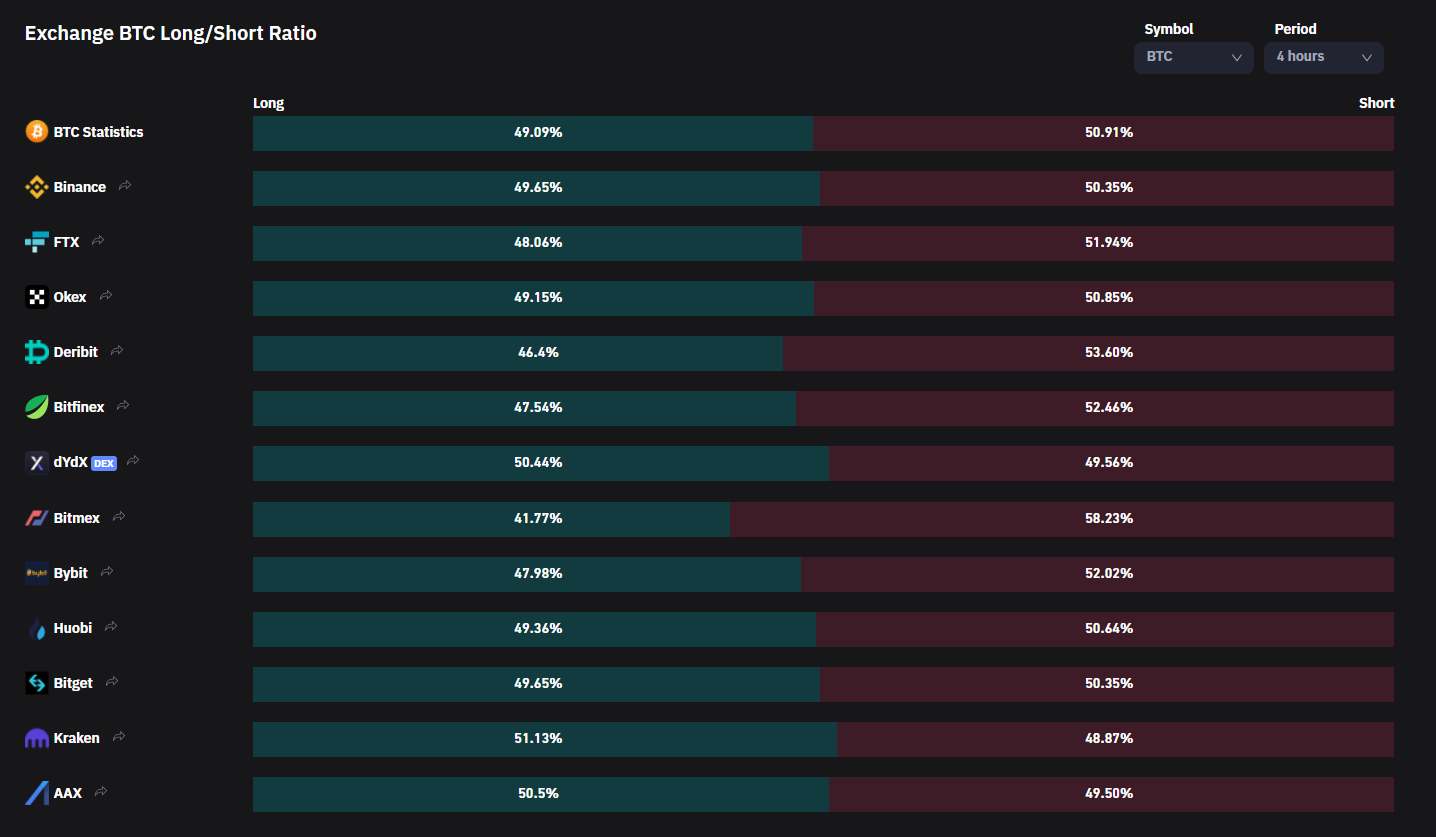

Future Trading Analysis

Data Analysis:

Funding rates have declined again showing more demand for shorts than for longs. However, leverage ratio keeps on ATH level. Long/Short ratio on exchanges confirming the Funding Rate. Anyway, the Open Interest has declined the second day in a row by 4.71%. That’s really big indicating more people are staying away here too.

Inspos Conclusion: We have still too many high leverage positions open and more are arriving. I really don’t get that.

URL to chart: https://www.coinglass.com/FundingRate

Exchange Order Walls

Analysis:

Bitfinex limiting the way up at 46.6k and the way down at 37.7k.

Inspos Conclusion: They keep walls at 45k but have adjusted the lower walls and placing those at 35k now!

URL to chart:

https://www.tradinglite.com/

Inspos Conclusion and personal trade strategy

Like yesterday almost nothing here is bullish, except the stablecoin inflows. Our trading range is widing now to 35k. Option trades bearish, whales ratio bearish, future tradings maybe more bullish just because we are placing more shorts right now, but I guess that will just rise volatility.

In my opinion different parties with different interests but huge budgets are driving the market. That would also explain the risk management preparations related to option trading of the last few days. Something similar we are noticing related to SPX, SPY option tradings. They are expecting something big coming.

Those labeled by me as market makers have started to sell again. Almost 30,000 BTC within 3 days. If they have started to sell those BTC bought in lower ranges, we will have a bearish February for sure. They have accumulated 150,000 BTC in lower price ranges.

However, my short maintains open. 40k is still our key zone. Only if we see a solid dump that brings the price below 40k and we maintain there, I would add more funds to my short. Otherwise I wouldn’t trade there. Too risky in my opinion. As soon as we dump and maintain below 40k we will rise in pace and we will head the 35k.