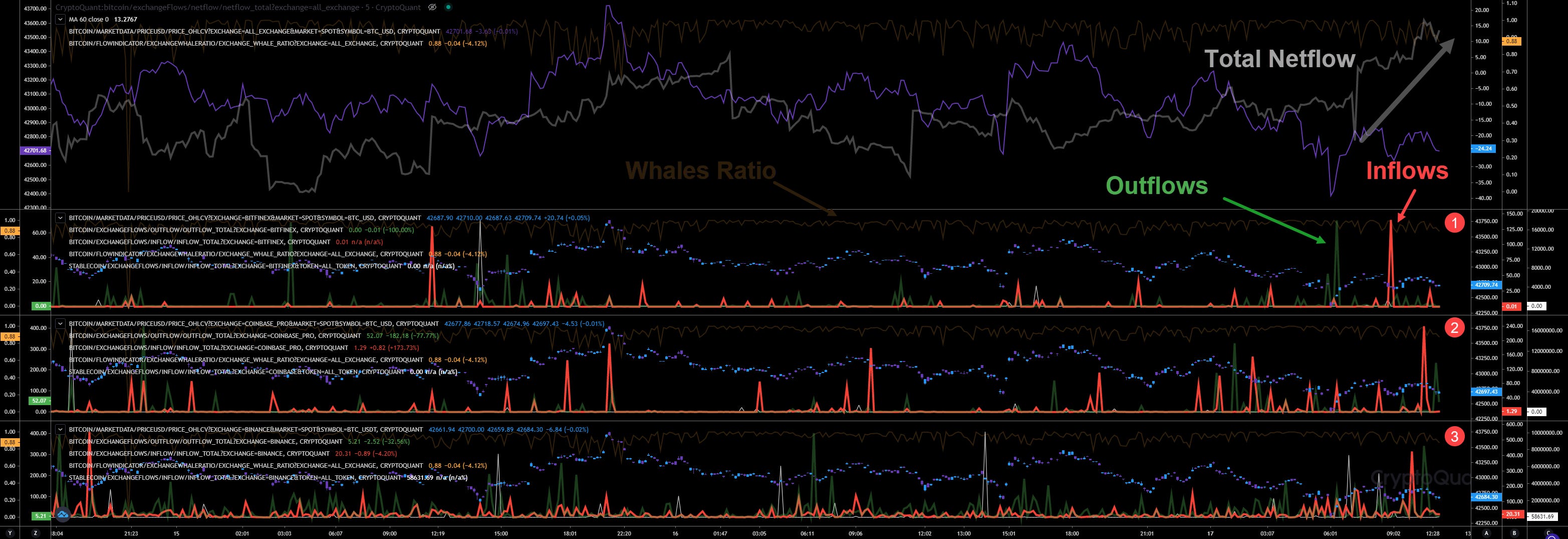

Hourly View

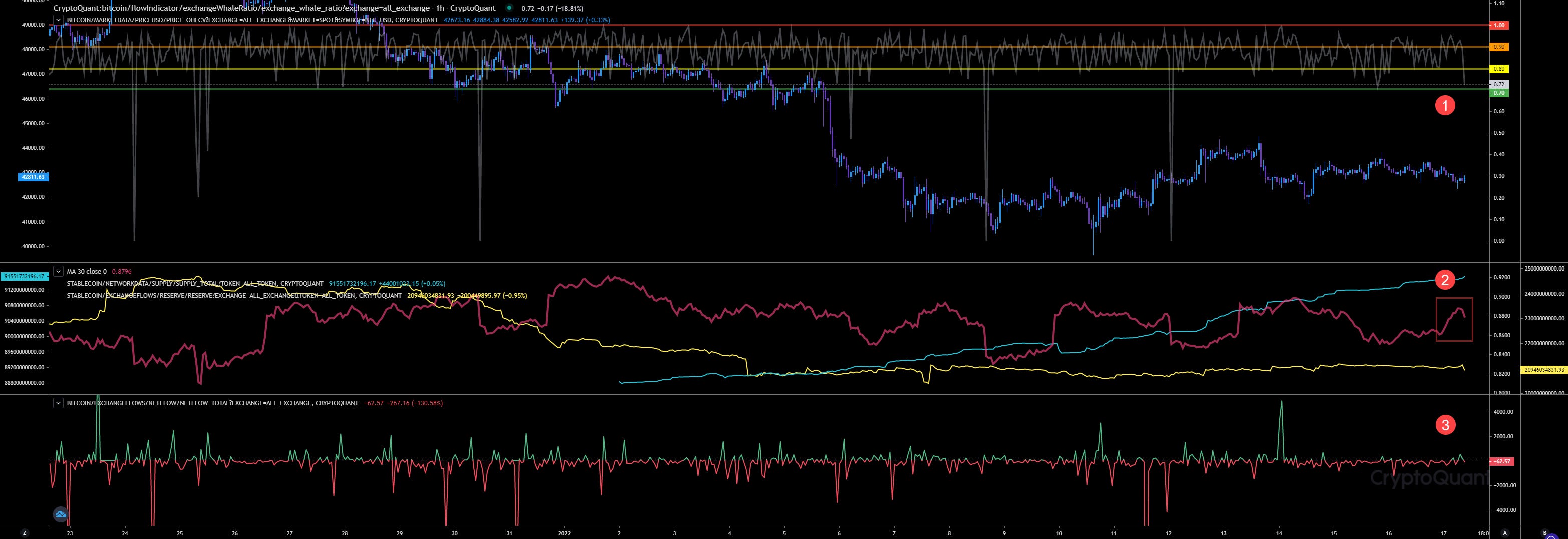

Since last night the whales ratio (1) has started to rise again indicating an incoming sell pressure by whales. As we can also see at our whales ratio 30D average (2), it liefted up since yesterday and is declining right now. That would indicate less sell pressure and the opportunity to lift up again a bit. The netflow (3) on hourly view doesn’t show any big movement yet. Only a netflow of almost 500 BTC few hours ago, indicating more inflows than outflows. Interesting here, this netflow wasn’t purely generated by whales, indicating that retailers are selling too now.

Block View

Our block view shows us what happenend since midnight. The whales ratio (1) has started to lift up again and maintained its top level between 0.9 - 1.0 indicating incoming tokens on exchanges by whales. Since almost 5 hours the whales ratio 30D (2) average has started to decline indicating less whales tokens arriving exchanges. While stablecoin reserves has declined by almost $260 million (3) in the last couple hours, indicating more stablecoin outflow from exchanges. I think its related with Binance again. I have received 2 whale alerts showing almost $150 million in tether were withdrawed from Binance in the last few hours. Also the netflow in block view shows bigger moves. Almost 4 hours ago we have detected a positive netflow (4) (more inflow than outflow) of 1,400 BTC. Just few minutes ago we have detected another 350 BTC indicating that the sell pressure should rise soon. At the moment we are noticing more inflows arriving the exchanges. That could be a sign of an incoming dump or at least a constant high sell pressure.

Option Trading

Expiry 21JAN22

This expiry has a total Open Interest of $502 million, $336 million of these are Calls and $166 million Puts. I have detect a reduction of Open Interest of $10 million for this expo

We still hold our max pain (1) of 43k. Our biggest Open Interest here is at 44k showing a total volume of $59 million ($4m more than last saturday) in Calls indicating that option traders expect a higher price than 44k until expiry.

Our most traded option within the last 24 hours (2) was a Call at 48k showing a trade volume of $9 million indicating that option traders here expect a higher price than 48k until expiry. Interesting here are also the Puts volume $8.4 million at 40k and $8.2 million at 42k indicating that some option traders expect a price below of 40k and 42k. We also have some Call volume for options at 44k ($7.5m), 45k ($7m) and 46k ($7.5m) indicating more a bullish trend than a bearish one also for the next expiry. However, the volume of this expiry is compared to the 28Jan22 expiry not that big.

Expiry 28JAN22

For this expiry we have a total Open Interest (6) of $1.96 billion, while $1.36 billion are Calls and $600 million Puts.

We also hold here our former max pain (3) of 48k. Our range with the biggest Open Interest here in Calls is between 65k - 80k. The biggest Open Interest related to Puts is here at 40k.

Our most traded option within the last 24 hours (5) was a Call at 45k showing a trade volume of $20 million for the 25Feb22 expiry indicating that option traders expects a price higher than 45k until 25Feb22.

No big changes happenend related to options since our saturday update.

Future Trading

Daily View

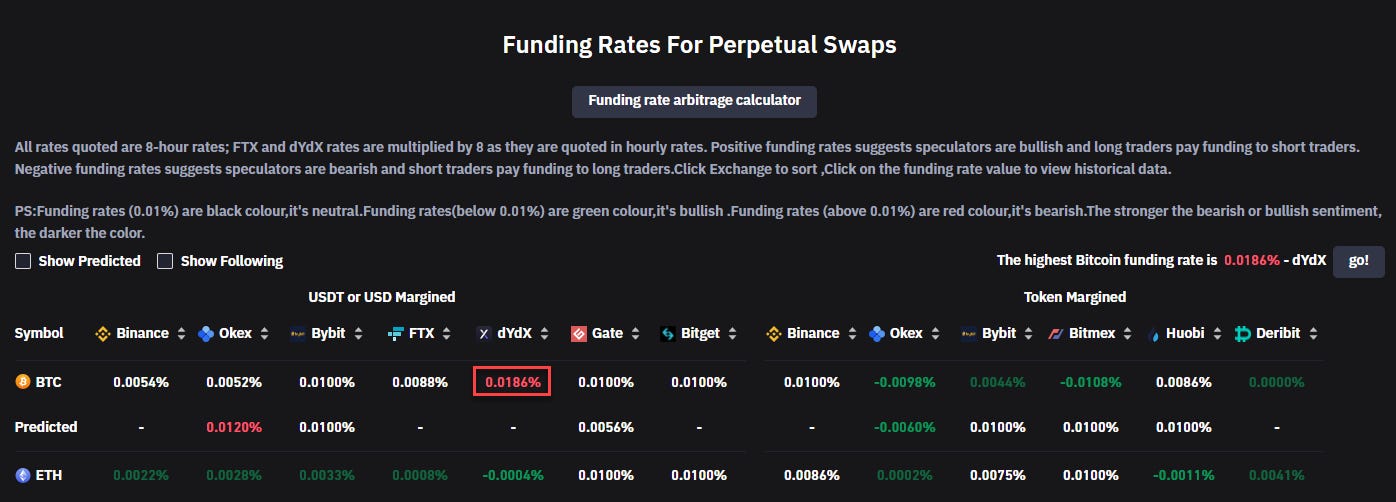

Our leverage ratio (1) is stalling since saturday indicating no more traders are placing high leverage positions. Anyway, the leverage ratio is still close to its ATH. Our funding rate keeps showing here a falling trend indicating that traders are placing more shorts than longs.

However, since our last update saturday also the Coinglass Funding Rates sheet is showing that traders are switching to longs again. We have 1 positive funding rate indicating more demand for longs than shorts and the remaining are neutral. If that continue we should see a rising funding rate in our chart again soon. Our volatility is very low at the moment, so no big liquidations happenend since saturday either.

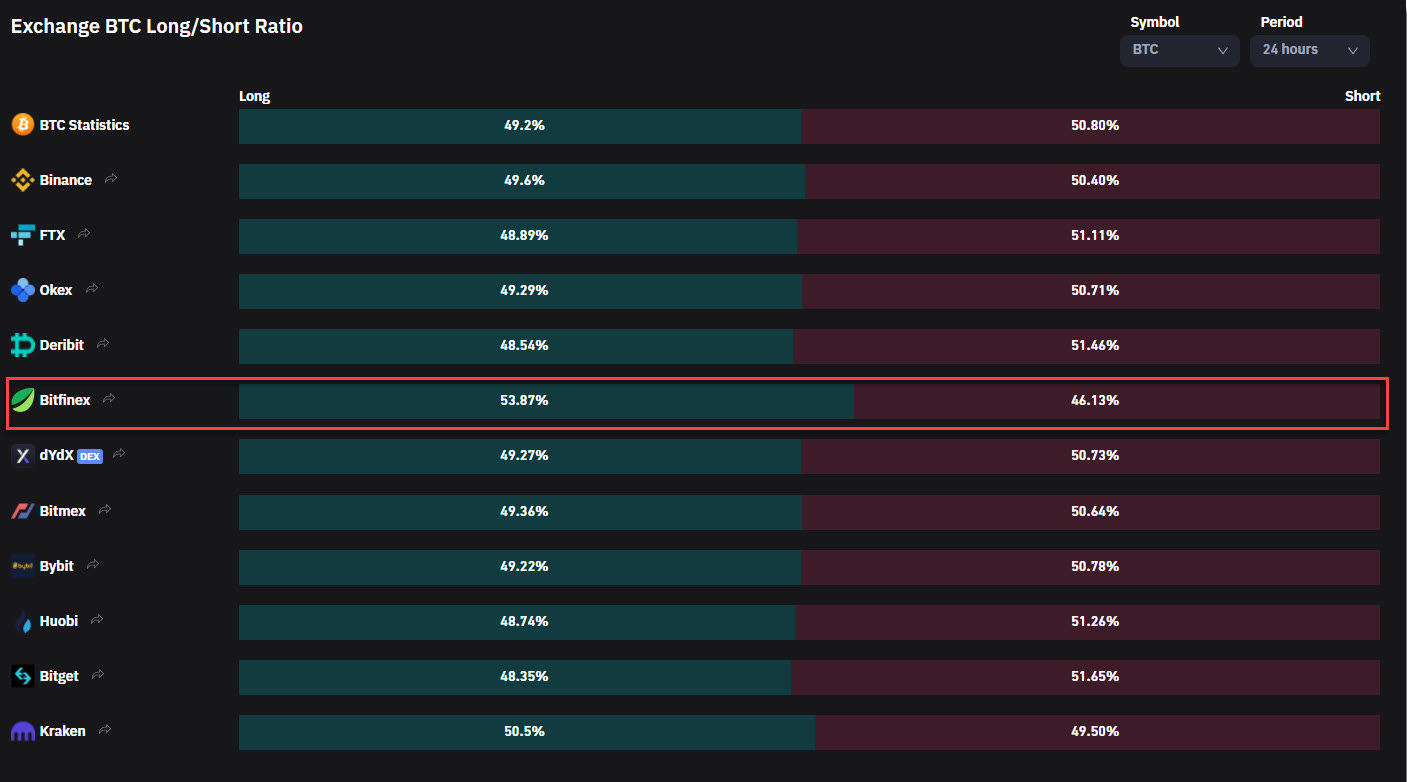

If we check the LS Ratio on Coinglass we can see what I have mentioned above. Longs are coming now while we notice a reduction of shorts. Indicating a shift in sentiment by future traders from bearish to bullish. Bitfinex traders are very bullish it seems.

Hourly View

Our hourly view is showing a rising funding rate (2) indicating that traders are demanding more longs in the recent hours. Matches also to our observations described above. Nevertheless nothing big. It seems those new longs are using also a higher leverage (1) again, while the funging rates are flipping to positive. But compared to saturday we can detect a change in sentiment by traders, but that’s it. No big changes detected here related to leverage ratio at least.

Market Activity

Daily View

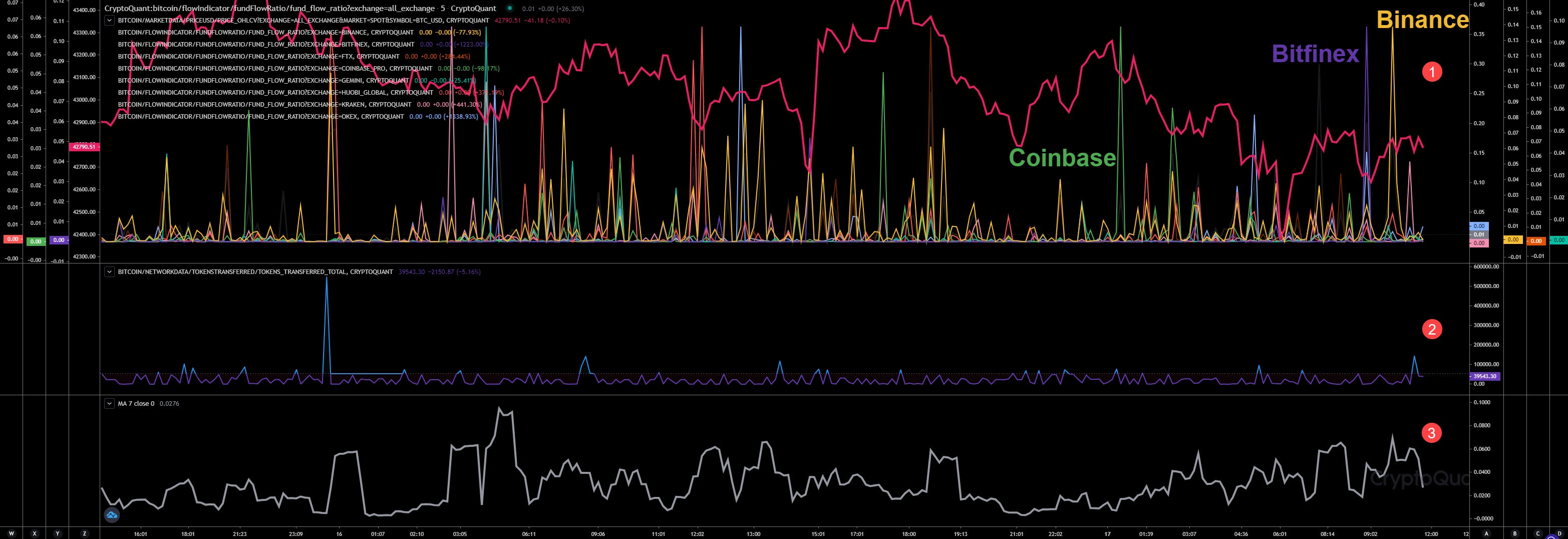

Our exchange activity (3) is declining now indicating less trade activity. If we check our top chart (1) we can see some interesting patterns. This chart shows the total activity of 8 exchanges. Since midnight Coinbase, Bitfinex and Binance are showing the biggest activity here. Bitfinex buying the dip, Binance showing big activity always before the sell pressure rises and Coinbase very active in local tops. I don’t think they are buying the local tops always. Looks like Coinbase is selling too. Anyway, our indicator “Total transferred BTC on network“ (2) maintains low. I use this indicator to detect activities outside of exchanges, what could indicate OTC Desk activities, at least when the exchange activity is very low at the same time.

Exchange Activities

From now on I will add a detailed exchage activity charts to detect certain exchange trends.

#1 Bitfinex - Showing a bit more outflows than inflows

#2 Coinbase - Showing more inflows than outflows

#3 Binance - Showing more outflows than inflows. Interesting. It seems, Binance has sent their tokens before EoY (China Mainlandd Ban) and are selling those since then. Would also match to these big tether outflows everyday.

#4 Huobi - Not showing a big difference between in- and outflows.

#5 Gemini - Also almost neutral. Bigger inflows detected (volume: 350 BTC) but also outflows.

#6 FTX -Interesting here, after every detected inflow an outflow follows. Like someone is waiting to buy the arriving tokens. That would also explain why FTX exchange reserves always maintain its level.

#7 Kraken - Showing in the last few days more outflows than inflows.

#8 Okex - More outflows detect than inflows.

#9 MT Gox - Flat. Only part of the chart to detect some outflows in the next months.

Exchange Walls

Only at FTX Perp I have detected a change in their walls. We have a small upper wall at 43.5k and the lower cluster between 41.35k -41.6k. Looks like, they will maintain the current trading range. Only a bigger dump in tokens could send us to 40k to retest. At the moment it doesn’t look that strong to let it happen.

Inspos Conclusion and personal trade strategy

Even if I think we will fall further heading 41.5k I’m not going to short. I prefer to long the local bottom as I still think we will reach 48k until end of the month. The price action doesn’t look very bullish at the moment. However, we can see that they let fall the price to buy those tokens in a lower price level and lift up a bit again. At the same time the demand in upper ranges looks very weak. We have retested our bottom line different times already and failed too. We have started to lift up again. I think we will see a breakout downwards soon. Anway, we have lower limitations in almost every exchange between 41k - 41.5k. So, if the sell pressure don’t rises much more, I would expect our local bottom there to pump afterwards. So, that would be my plan for todays trade. Wait to get an interesting entry in upper 40s to go long and take some quick gain. As US stock markets are closed today due the Martin Luther King Jr. holiday in the US I wouldnt expect any big action. Our volume maintains very low. That’s always very risky. If I go long in upper 40s, then with low leverage only.

General Information

In the next days and weeks I will prepare more material for you to show you how to read all these charts.

Nice thread just subscribed looking forward to more analysis.

Hey bud, which plan in Crypto Quant would you recommend to sign up? Plans that at least can read all the things you are providing. Advance/Professional/Premium?