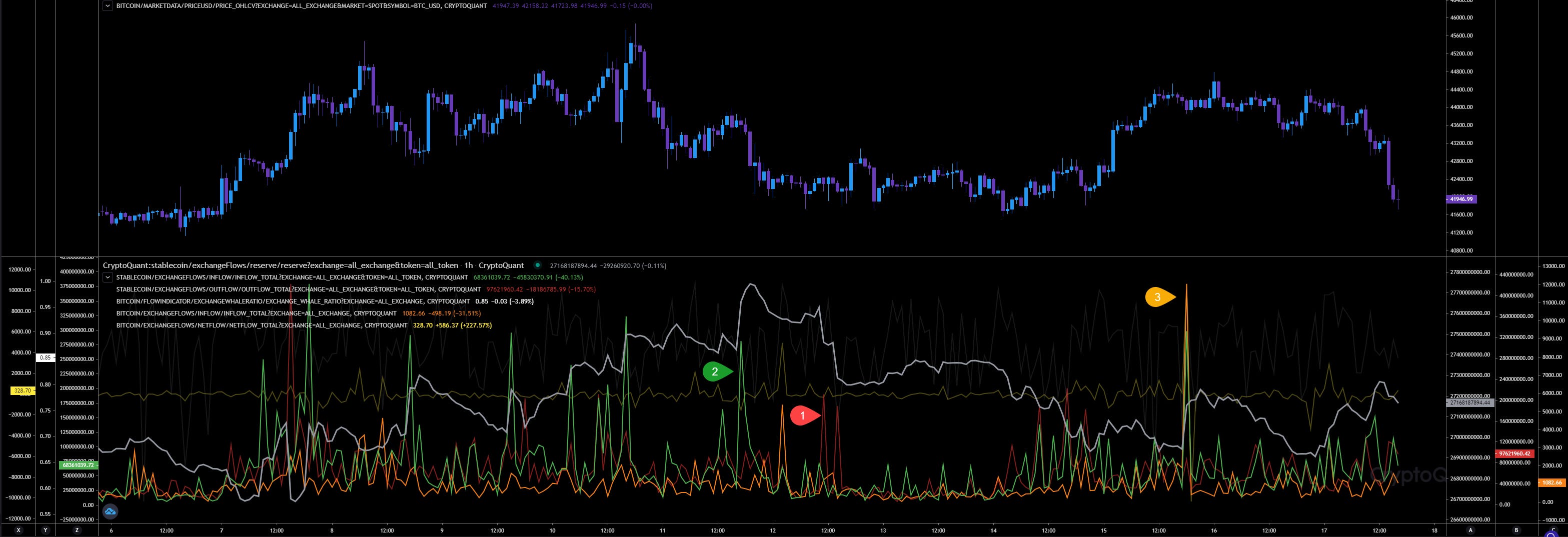

Whales Ratio - Daily View

Chart Analysis:

Whales ratio (1) has declined yesterday but with a higher low indicating the sell pressure will maintain. At least not indicating any dump coming soon.

Whales Ratio 30d Average (2) is now declining again. Stablecoin reserves declining too.

Total exchange Netflows (3) is negative indicating more outflows than inflows yesterday. Netflows could also show internal exchange flows.

Inspos Conclusion: The whales ratio warned us of an incoming dump phase and in my opinion, we will have intiated the dump phase today.

URL to chart: https://cryptoquant.com/prochart/vYNO3z1cx9LcSvg

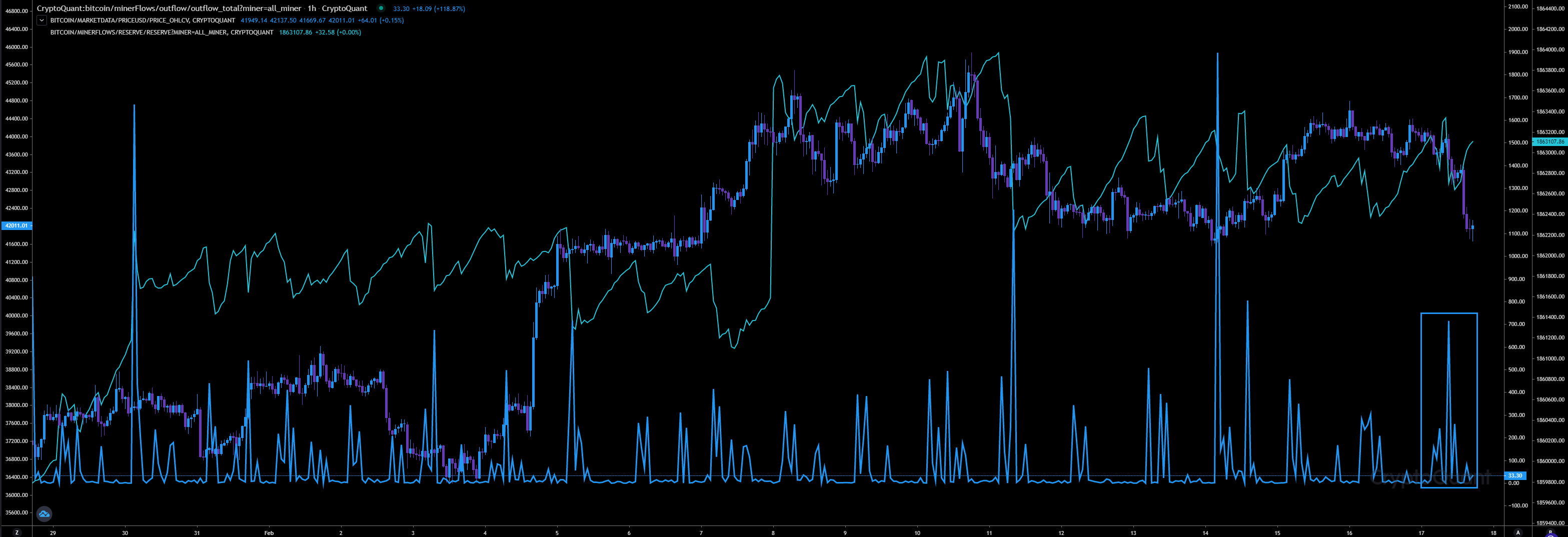

Market Flow Analysis

Chart Analysis:

Today we can detect almost the same volume in stablecoin outflows (1) like inflows (2). 8 hours ago, when we reached the last time 44k before we have initiated the dump phase, we have detected almost $720 million in stablecoins outflow and inflows at the same time. The BTC inflows on exchanges (3) is showing a positive trend indicating more inflows coming in on exchanges, but still not that big, at least compared to former weeks. As mentioned in my Special Report from 24Jan22 they have accumulated enough BTC on exchanges, so it shouldn’t surprise us if we miss big inflows now. I would even expect more outflows from now on.

Inspos Conclusion: Since yesterday no big news.

URL to chart: https://cryptoquant.com/prochart/czejQkfJy5OBF69

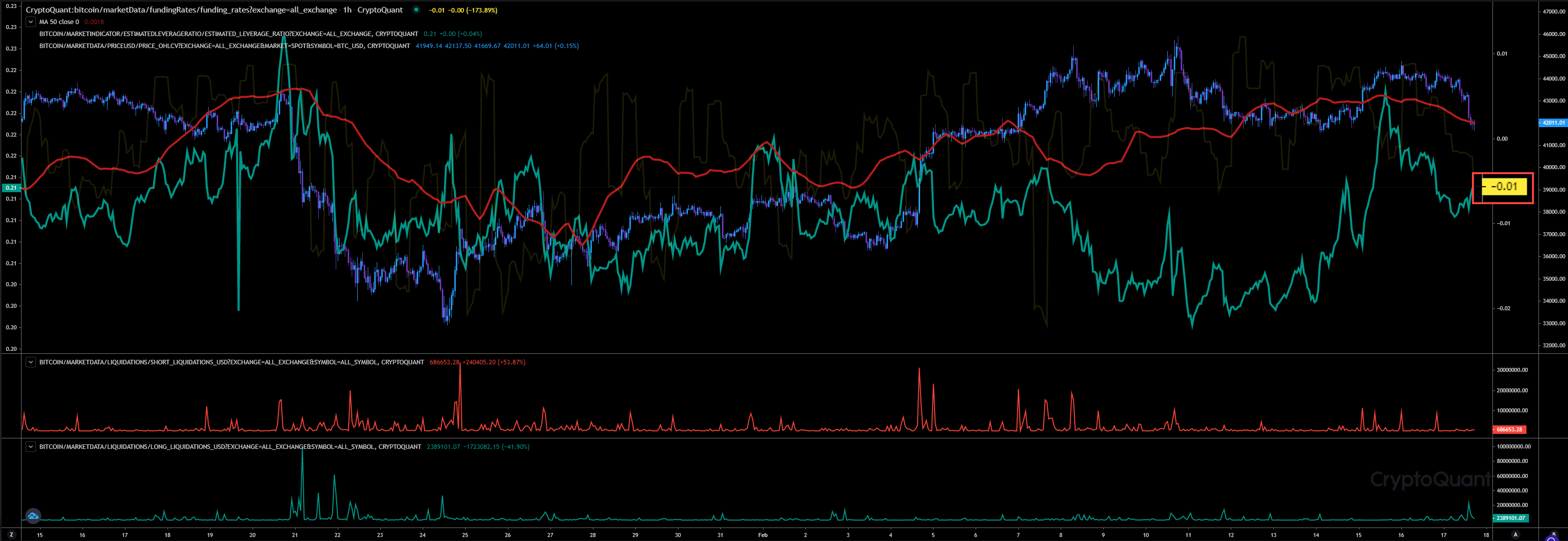

Miners Flow Analysis

Chart Analysis:

Miners outflows rised today. But the volume keeps relatively low. Almost 1,500 BTC.

Inspos Conclusion: Miners are not in sell-off mode. Everything looks fine here.

URL to chart: https://cryptoquant.com/prochart/W1qyCruejyfhoEh

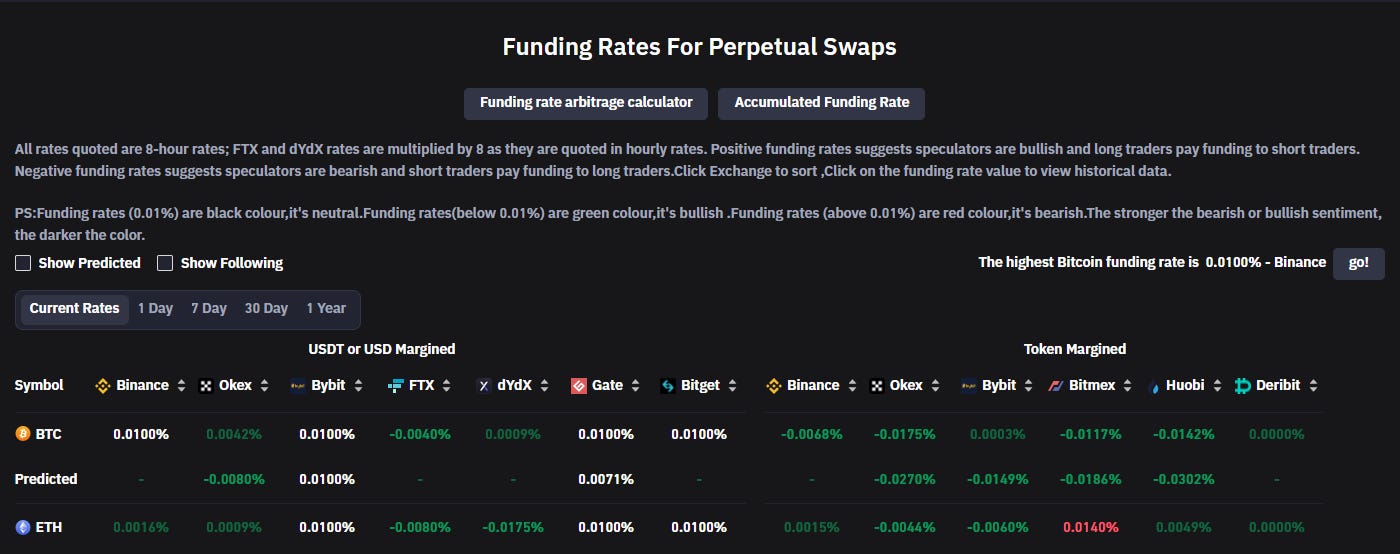

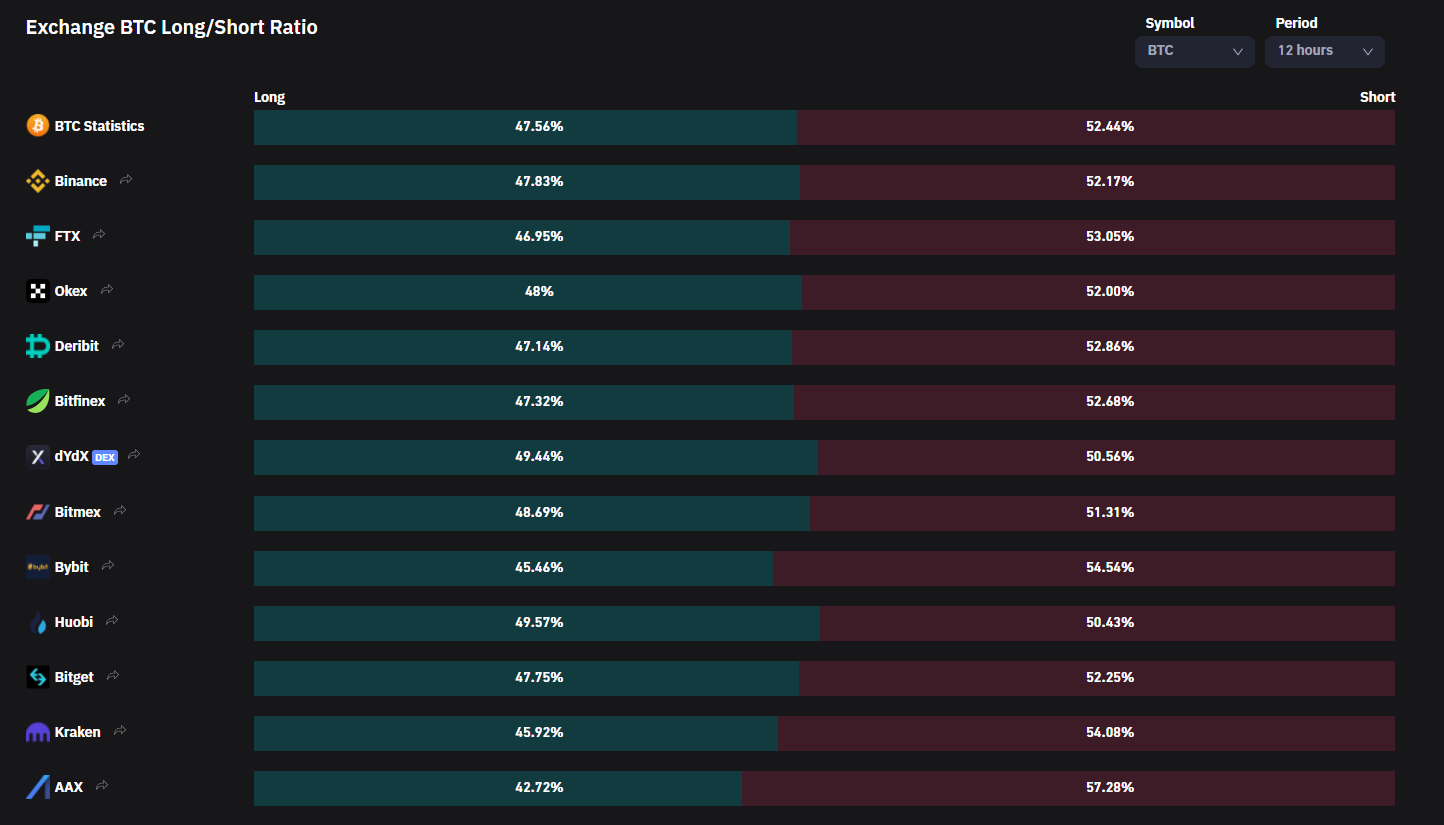

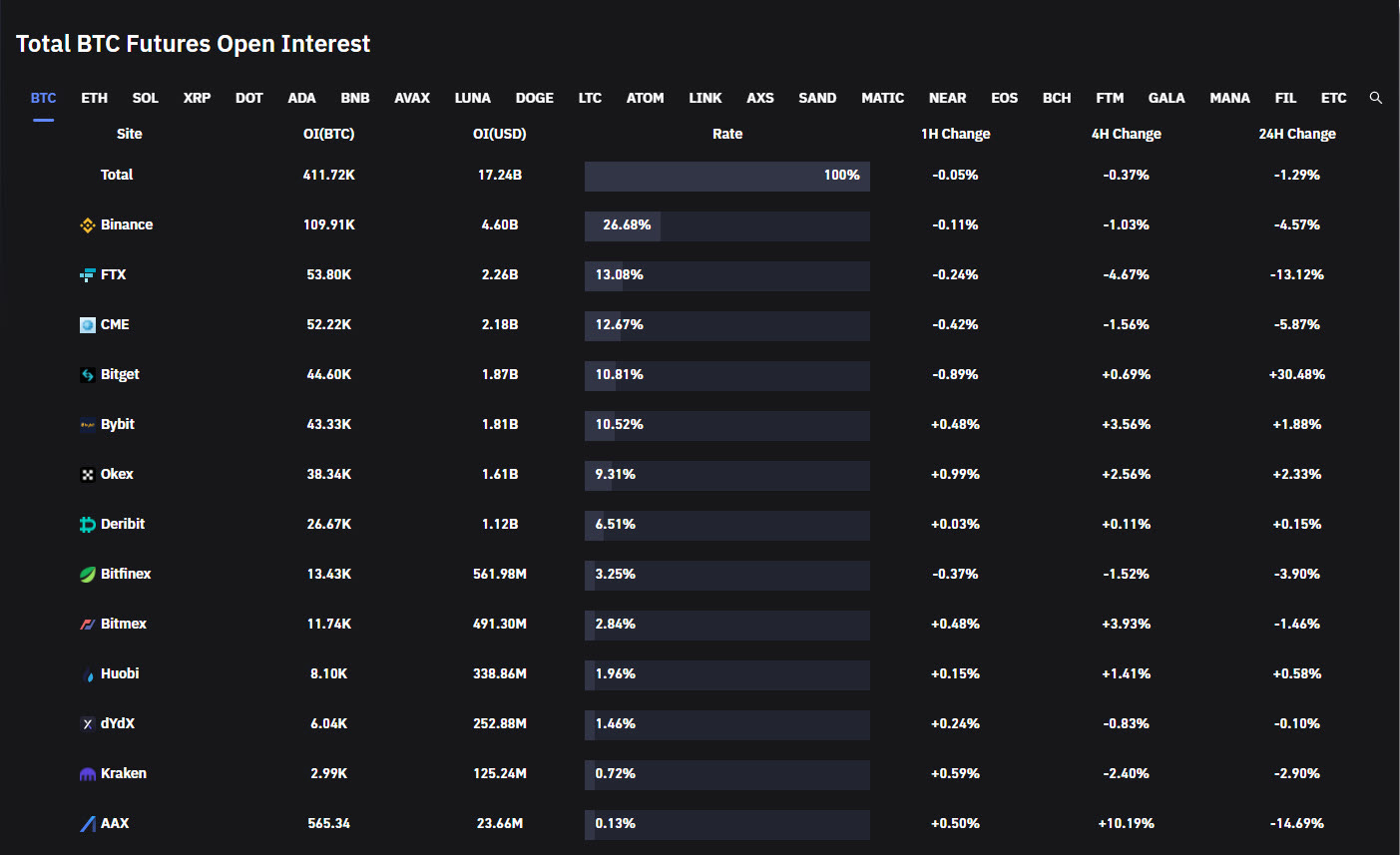

Future Trading Analysis

Data Analysis:

Funding rates have declined today showing a bigger demand for shorts than for longs in the last 8 hours. While the leverage ratio is rising again and we keep in an ATH range. That’s really concerning me. Long/Short ratio on exchanges confirming the Funding Rate. Anyway, the Open Interest has declined the second day in a row by 1.29%.

Inspos Conclusion: We are accumulating enough ammo for a rising volatility. That would match to some option traders strategies and also with the whales ratio.

URL to chart: https://www.coinglass.com/FundingRate

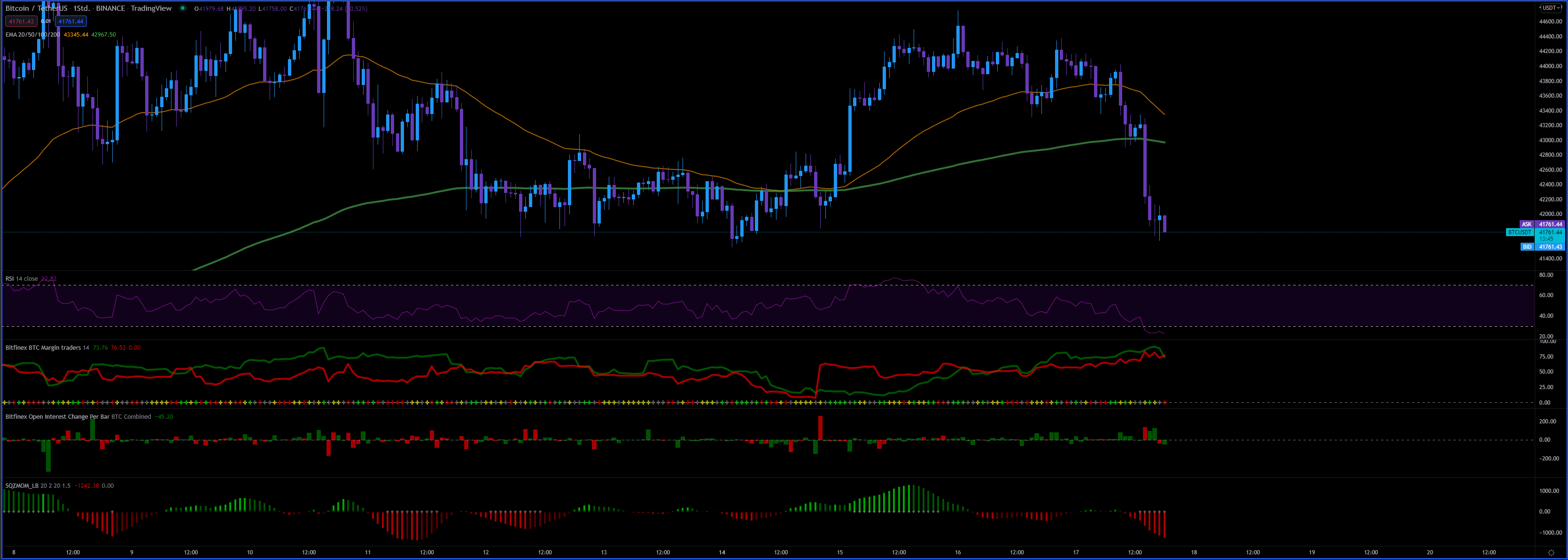

Exchange Order Walls

Analysis:

Bitfinex limiting the way up at 46.6k.

Inspos Conclusion: They want to prevent any dump further than 40k. For me a key range now related to a rising volatility.

URL to chart:

https://www.tradinglite.com/

Inspos Conclusion and personal trade strategy

The market looks weak again today.We are seeing a big sell pressure. Whales ratio daily declined but is still maintaining a high level, option traders flipped to bearish and placing Puts even in 30k ranges, indicating they are ready to see a bearish price action that will bring us back to 30s (30k - 39k).

Future traders feeding volatility with a high leverage ratio, it doesn’t matter if long or short. At the same time we can see some preparations related to order walls at 40k.

In my opinion 41k is key and they are right, if we fail to hold 41k the dump phase will rise and pace and start to be aggressive. In case it happens my prediction from 24Jan22 is confirmed and everything based on on-chain.

I have checked the market makers. We need to wait until tomorrow, but I guess they are selling even more.

Trade careful and try to avoid any risk trades. Keep in mind that 41k is a key level where we can find liquidity. But in case we fail 41k we will dump with a rising volatility due the walls at 40k!