Whales Ratio - Hourly View

Chart Analysis:

Whales ratio (1) is declining now but it is in general lifting up, maintaing a level between 0.80 - 0.90 indicating whales are sending tokens to exchanges and rising the sell pressure. As consequence the price is declining again.

Also confirmed by Whales Ratio 30h Average (2) indicating that sell pressure should rise more. Since february is the whales ratio 30h average maintaining a high level. Stablecoin reserves on exchanges has declined by $750 million 12Feb22 indicating cash outs.

Total exchange Netflows (3) maintains a low level today.

Inspos Conclusion: The whales ratio in hourly view is rising and thats bearish. At least it could generate sell resistance and a rising volume in case they try to pump the price up.

URL to chart: https://cryptoquant.com/prochart/vYNO3z1cx9LcSvg

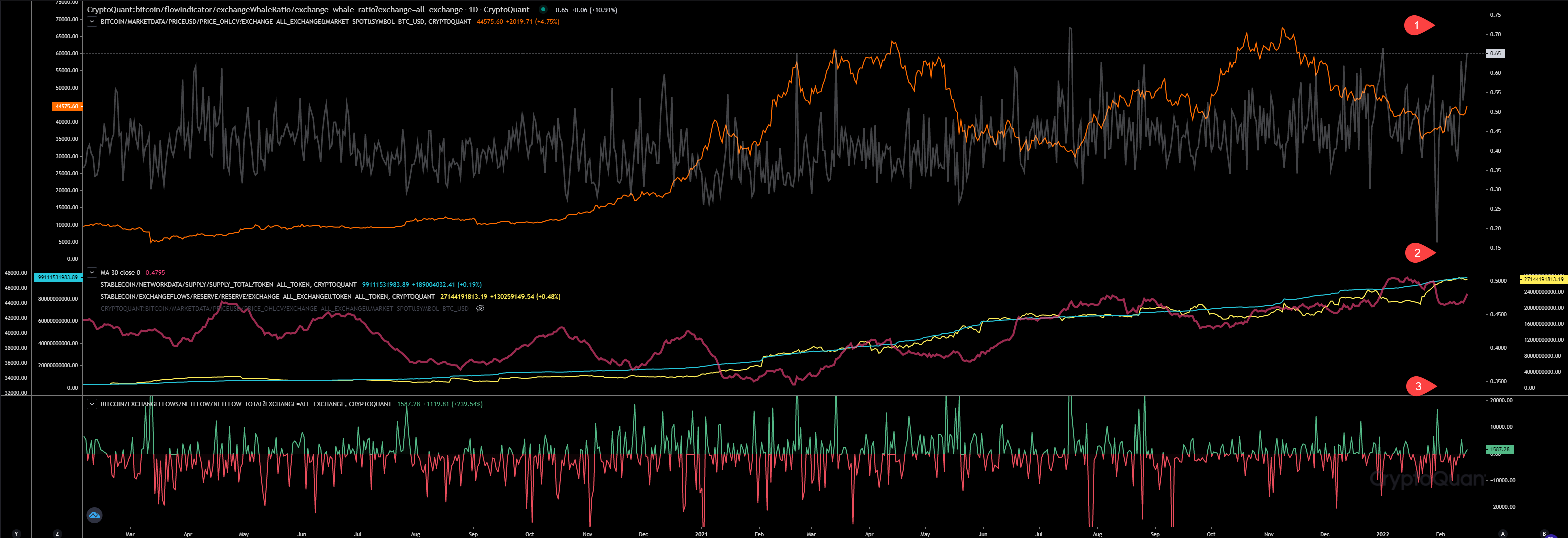

Whales Ratio - Daily View

Chart Analysis:

Whales ratio (1) has rised even more yesterday something I wasn’t expecting. It has reached a very high level.

Whales Ratio 30d Average (2) is rising more. That’s concerning me right now. I was expecting a falling whales ratio and as described a final dump to retest 33k, but it’s rising again. My interpretation here, they are preparing another dump phase.

Total exchange Netflows (3) is positive indicating more inflows than outflows yesterday.

Inspos Conclusion: The current chart looks ultra bearish again. Something that is really surprising me.

URL to chart: https://cryptoquant.com/prochart/vYNO3z1cx9LcSvg

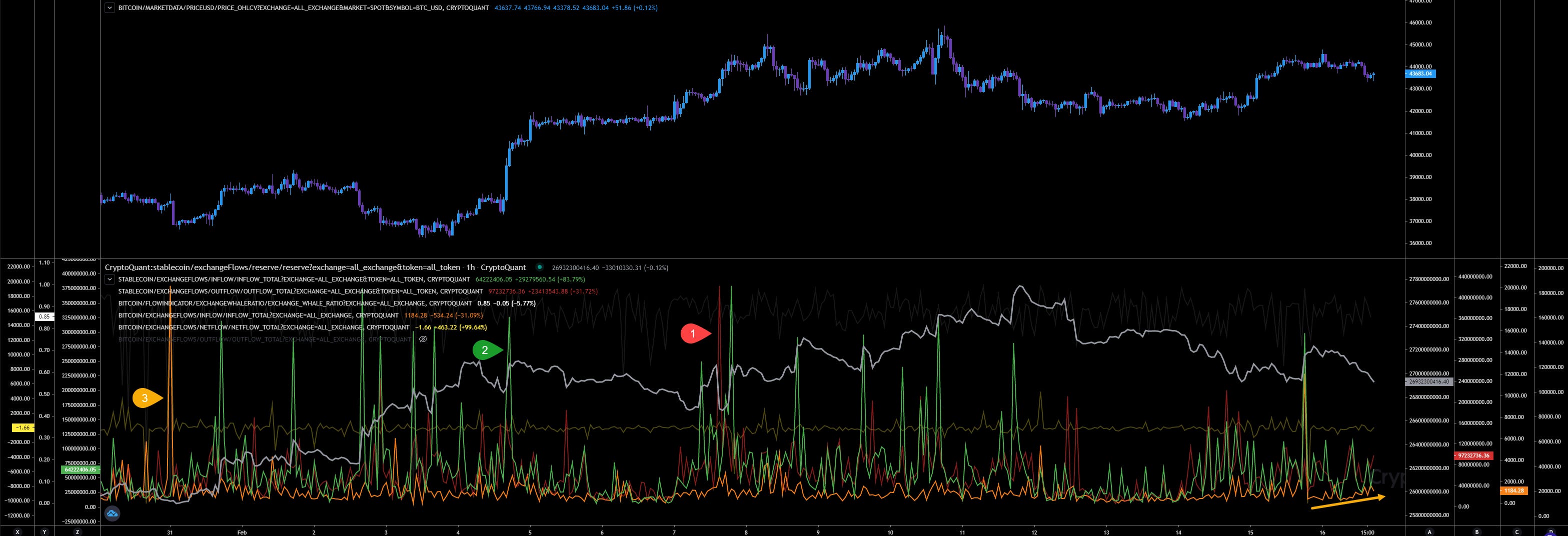

Market Flow Analysis

Chart Analysis:

The market keeps bearish since yesterday. Less stablecoin outflows (1) detected than inflows (2). The BTC inflows on exchanges (3) is showing a positive trend indicating more inflows coming in on exchanges.

Inspos Conclusion: No news here.

URL to chart: https://cryptoquant.com/prochart/czejQkfJy5OBF69

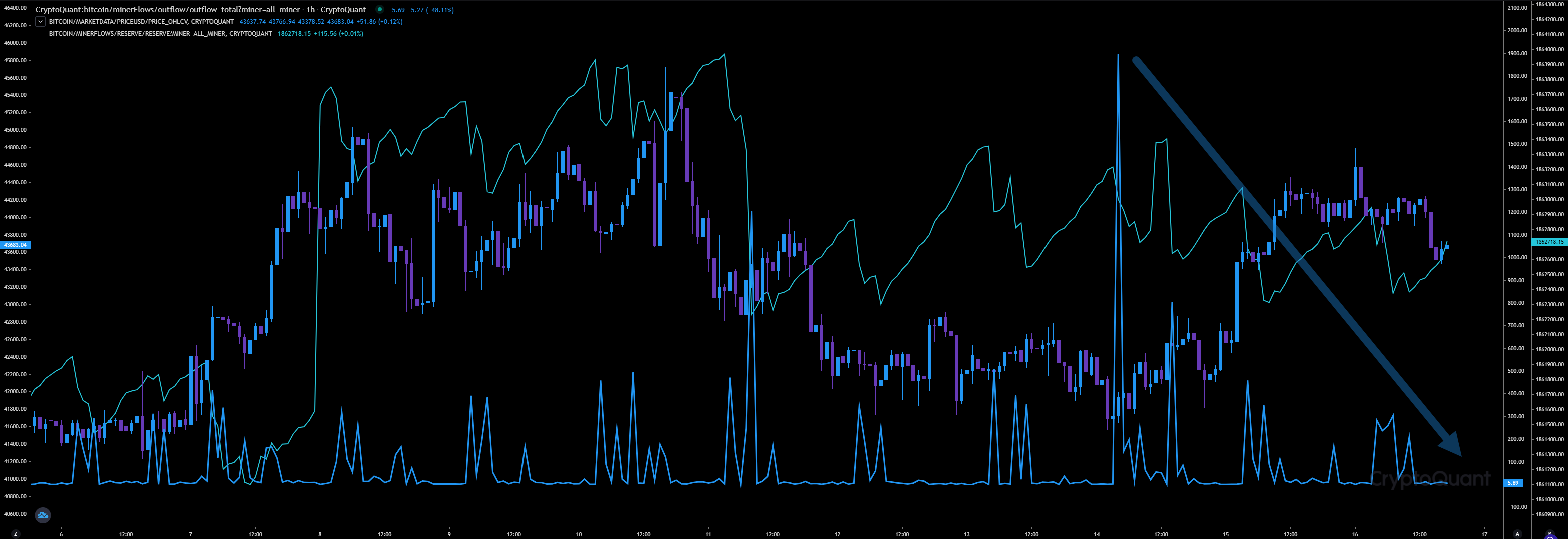

Miners Flow Analysis

Chart Analysis:

Miners outflows declining more today. Also here no news.

Inspos Conclusion: Miners are not in sell-off mode. Everything looks fine here.

URL to chart: https://cryptoquant.com/prochart/W1qyCruejyfhoEh

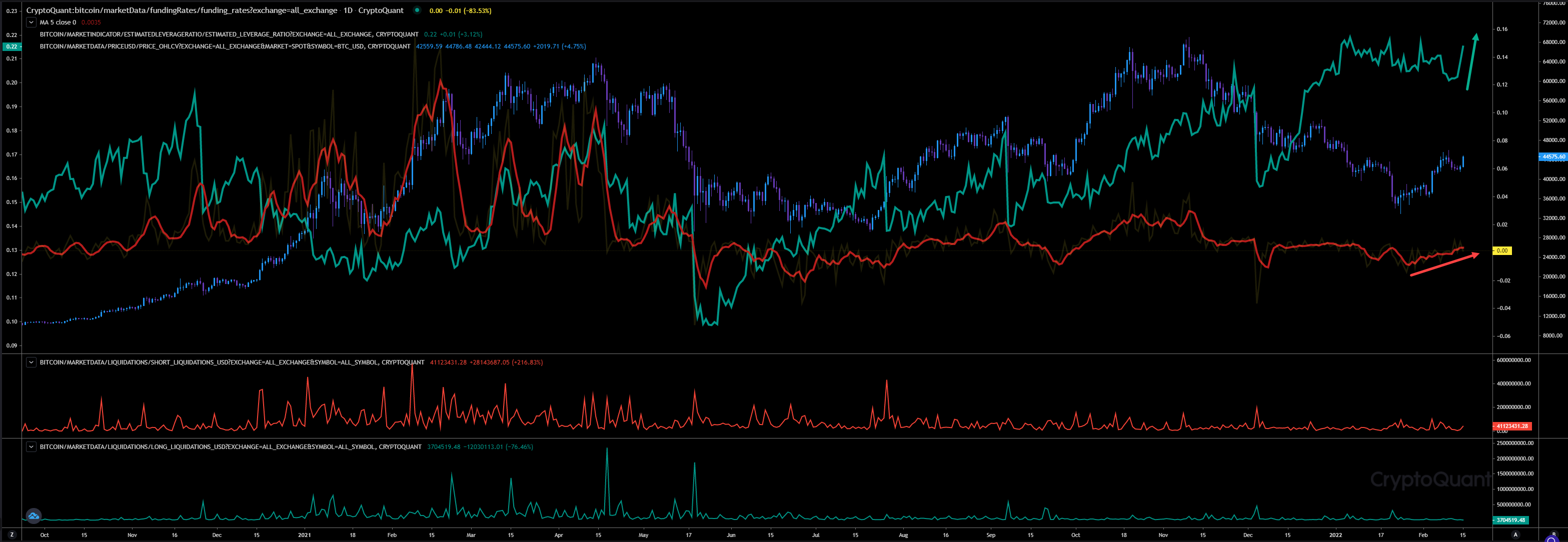

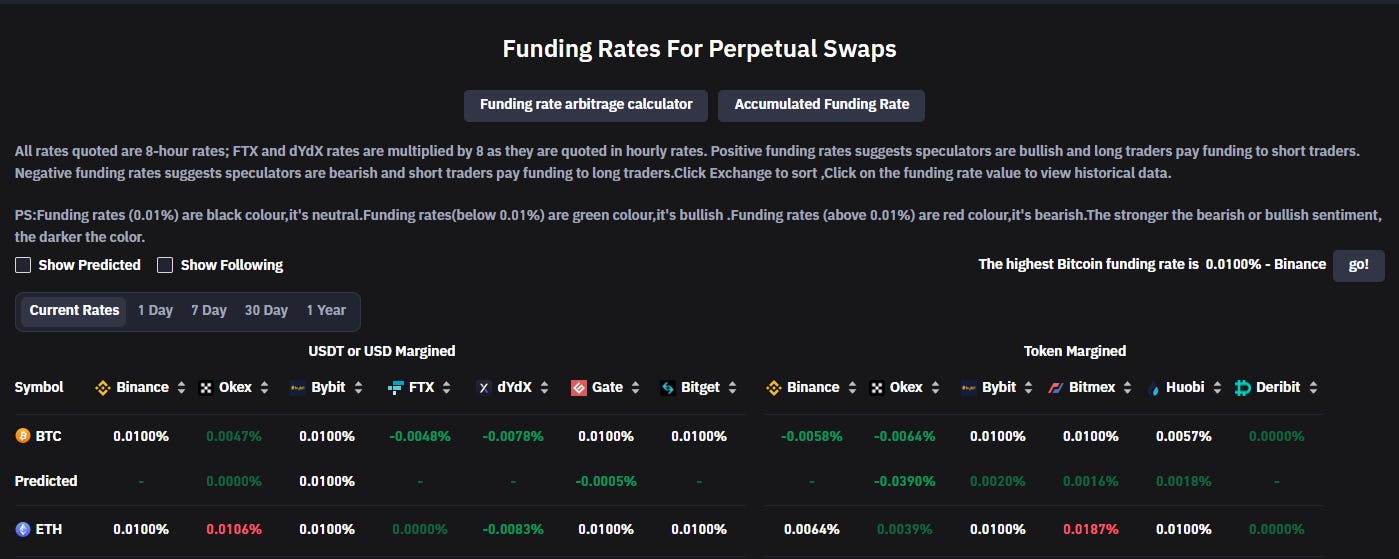

Future Trading Analysis

Data Analysis:

Funding rates are declining today again but the trend maintains positive, while the leverage ratio is heading a new ATH. Looks like we have high leverage longs and shorts ready. In the last 4 hours exchanges have received more shorts than longs and our Open Interest has declined since yesterday by - 2.22%.

Inspos Conclusion: We are accumulating enough ammo for a rising volatility. That would match to some option traders strategies and also with the whales ratio.

URL to chart: https://www.coinglass.com/FundingRate

Exchange Order Walls

Analysis:

Bitfinex limiting the way up at 45k.

Inspos Conclusion: Looks like, 41.3k - 41.9k is our local bottom and 44k - 45k our local top.

URL to chart: https://www.tradinglite.com/

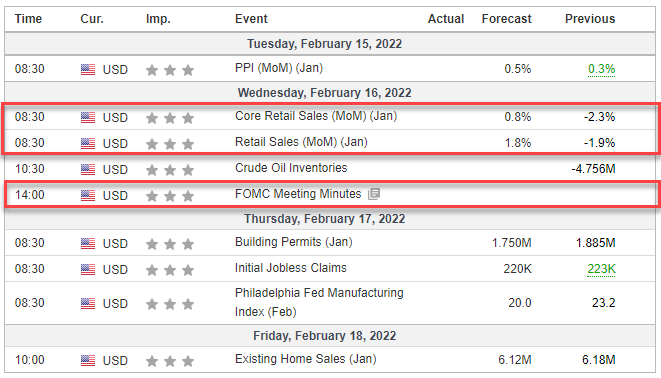

Inspos Conclusion and personal trade strategy

Except the whales ratio in daily view I can’t detect anything that would be helpful to create a trade strategy today. As mentioned just the whales ratio let me expect a dump soon. However, maybe just a preparation for todays FOMC. Be ready for a rising volatility today. Depends on what the FED will communicate the market will nuke. But to be honest, FED will try to maintain a bullish sentiment.

If they bring very bad news today they would trigger a chain reaction and make the situation even worse. FEDs goal to fight inflation but to stabilize the markets is almost impossible. In my opinion market actors are very nervous at the moment and react very sensitive to FED news. Coinbase and FTX are in my scope today. Both are generating sell pressure. FTX limiting the way up and showing enough space down to 40k. Looks very interesting. I will keep observing the market and only if I see a solid bullish or bearish signal I will trade. At the moment it looks very neutral.