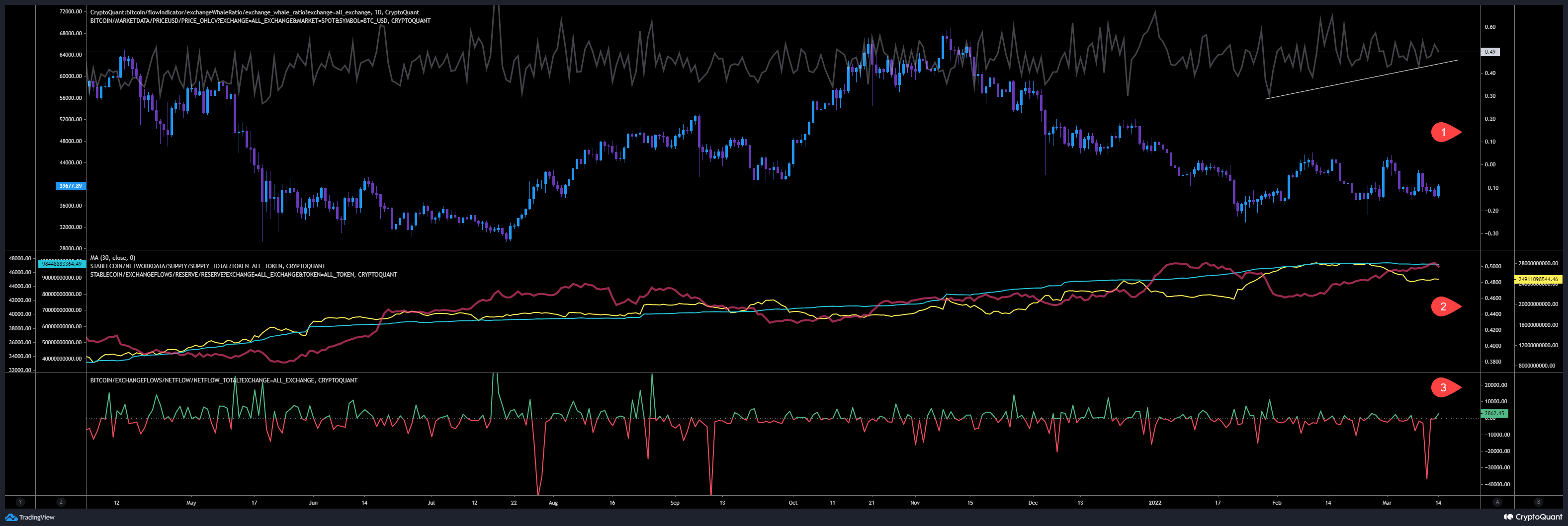

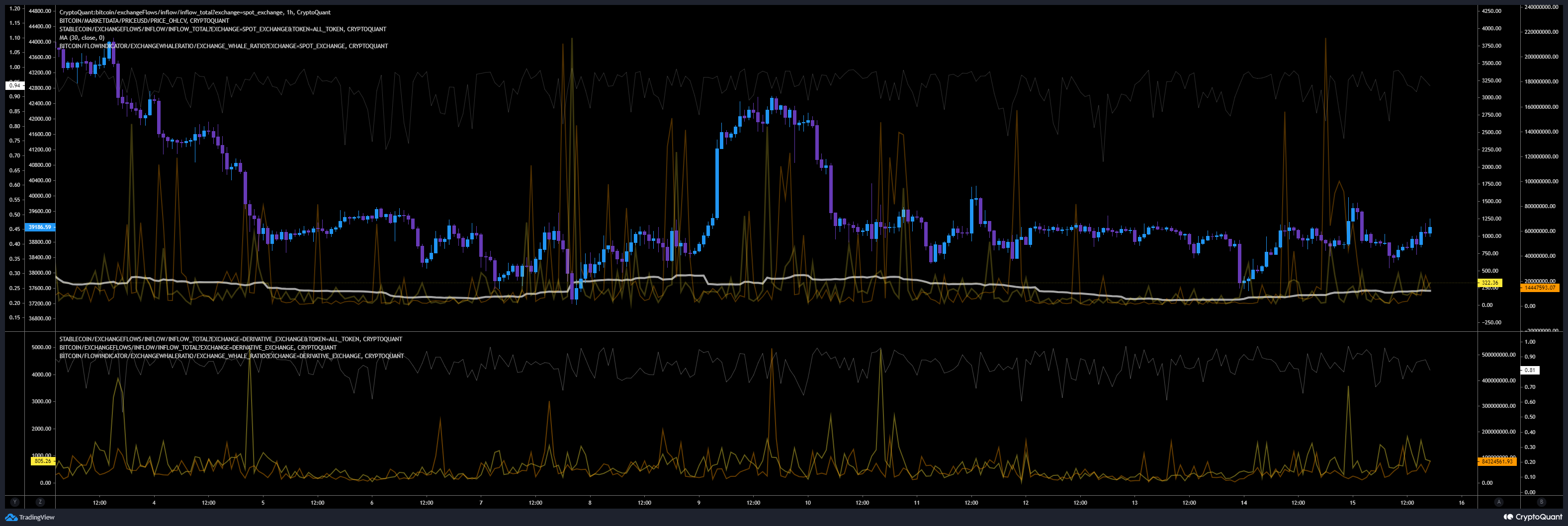

Whales Ratio - Daily View

Chart Analysis:

Whales ratio (1) keeps forming higher lows indicating that it maintains a relatively high sell pressure. Since february we are rising in sell pressure. Same like in the time between december and january. Then we had a dump in whales ratio and the price followed with a pump.

Whales Ratio 30d Average (2) reached its top it seems and is declining now. While stablecoins reserves didn’t change and the whole supply is declining, but just a bit.

Total exchange Netflows (3) of yesterday showing more inflows than outflows, indicating a positive netflow of almost 2,800 BTC.

Inspos Conclusion: Whales ratio 30d has reached its top. Usually from now on we should expect a dump soon.

URL to chart: https://cryptoquant.com/prochart/vYNO3z1cx9LcSvg

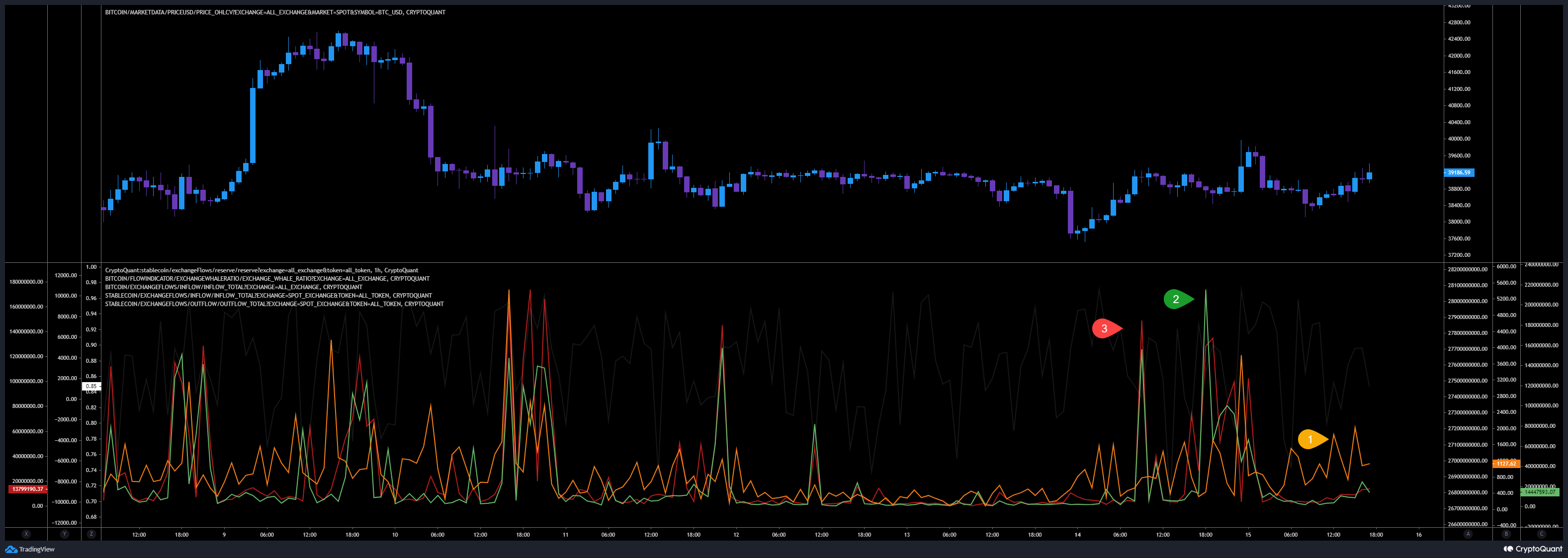

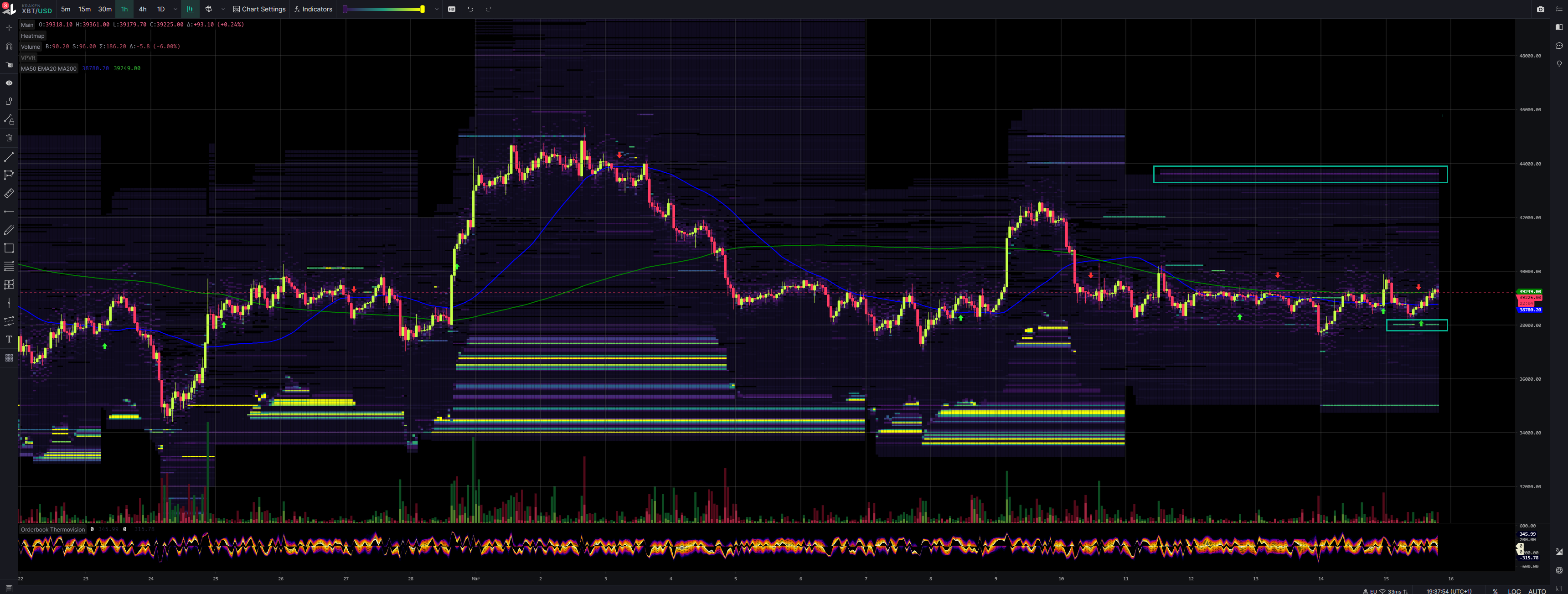

Market Flow Analysis

Chart Analysis:

BTC (1) inflows rising more and more. We had almost 23,500 BTC inflows yesterday and I would say, we are getting even more BTC inflows today.

Stablecoin inflows (2) has declined today. Yesterday we reached almost the level of 28JAN21 with almost $980m!! Stablecoin Outflows (3) was also big yesterday with almost $950m a bit less than 7MAR22!! Today a lot less stablecoin movement detected.

Inspos Conclusion: Less stablecoin activity but more BTC activity detected. It’s not necessarly bearish as they can use those BTC also as coin-margin. We need to check the derivative markets as next.

URL to chart: https://cryptoquant.com/prochart/czejQkfJy5OBF69

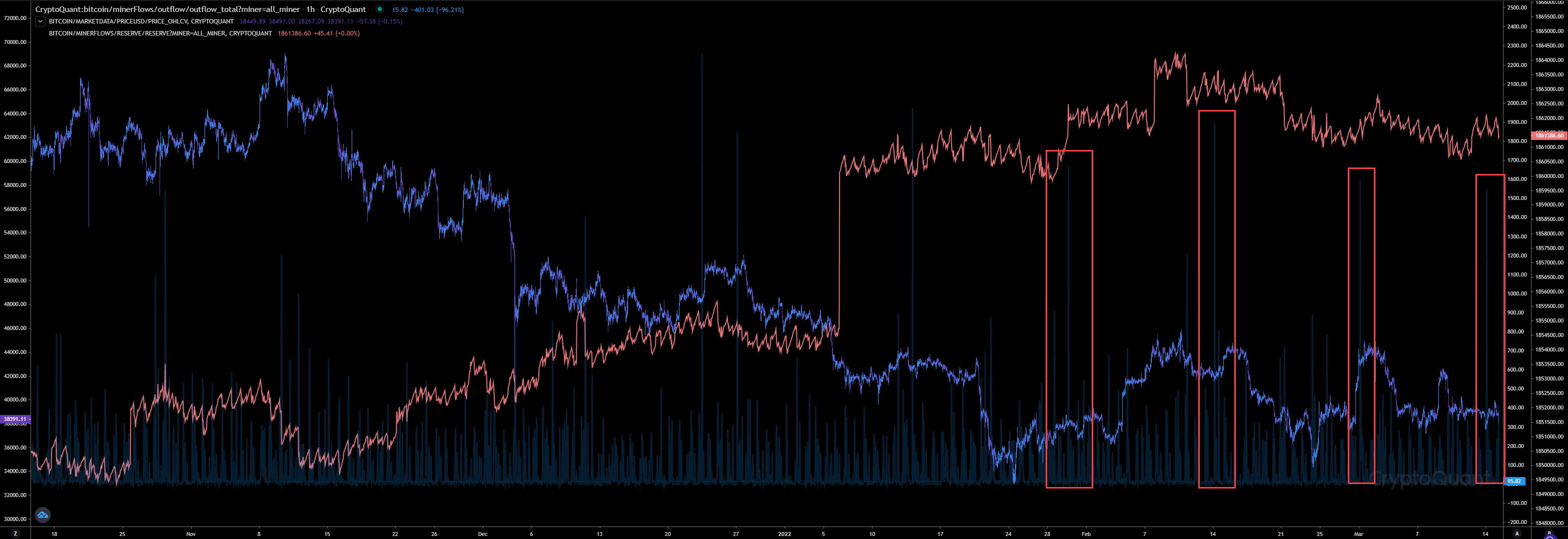

Miners Flow Analysis

Chart Analysis:

Yesterday miners have sold 2,867 BTC. As mentioned in former analysis that’s what they do every 2 weeks since this year it seems.

Inspos Conclusion: Miners reserves are declining, but still maintains its level above of 1.86 million BTC.

URL to chart: https://cryptoquant.com/prochart/W1qyCruejyfhoEh

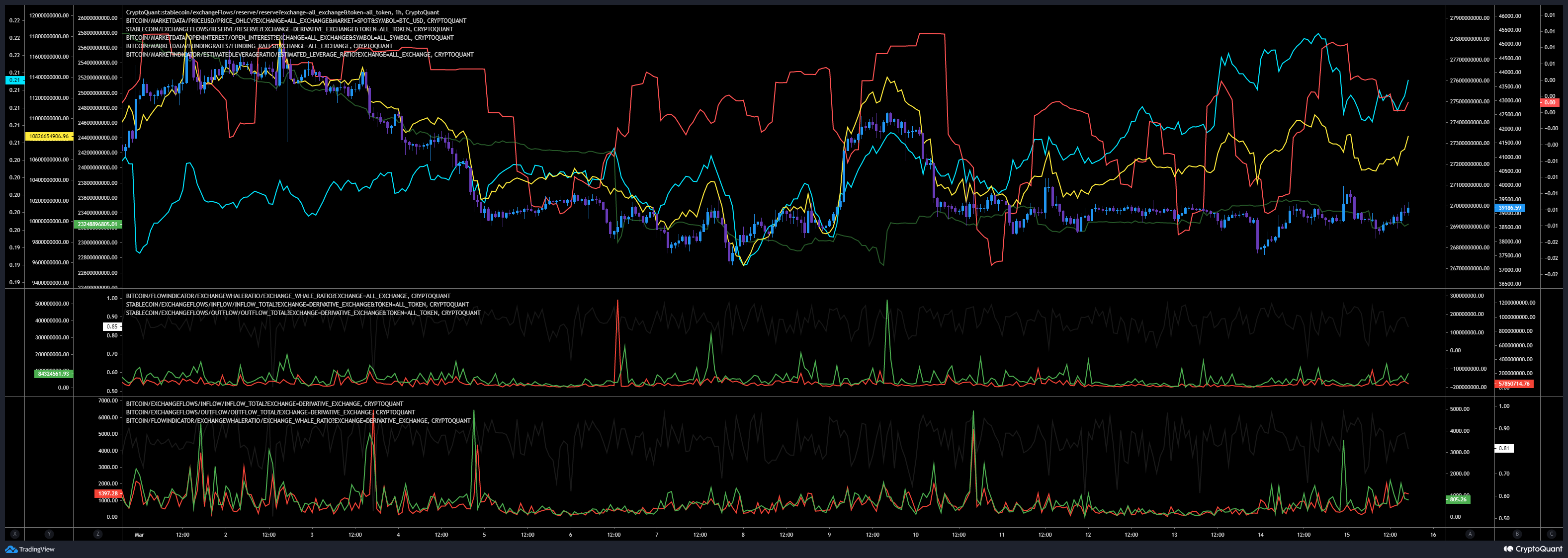

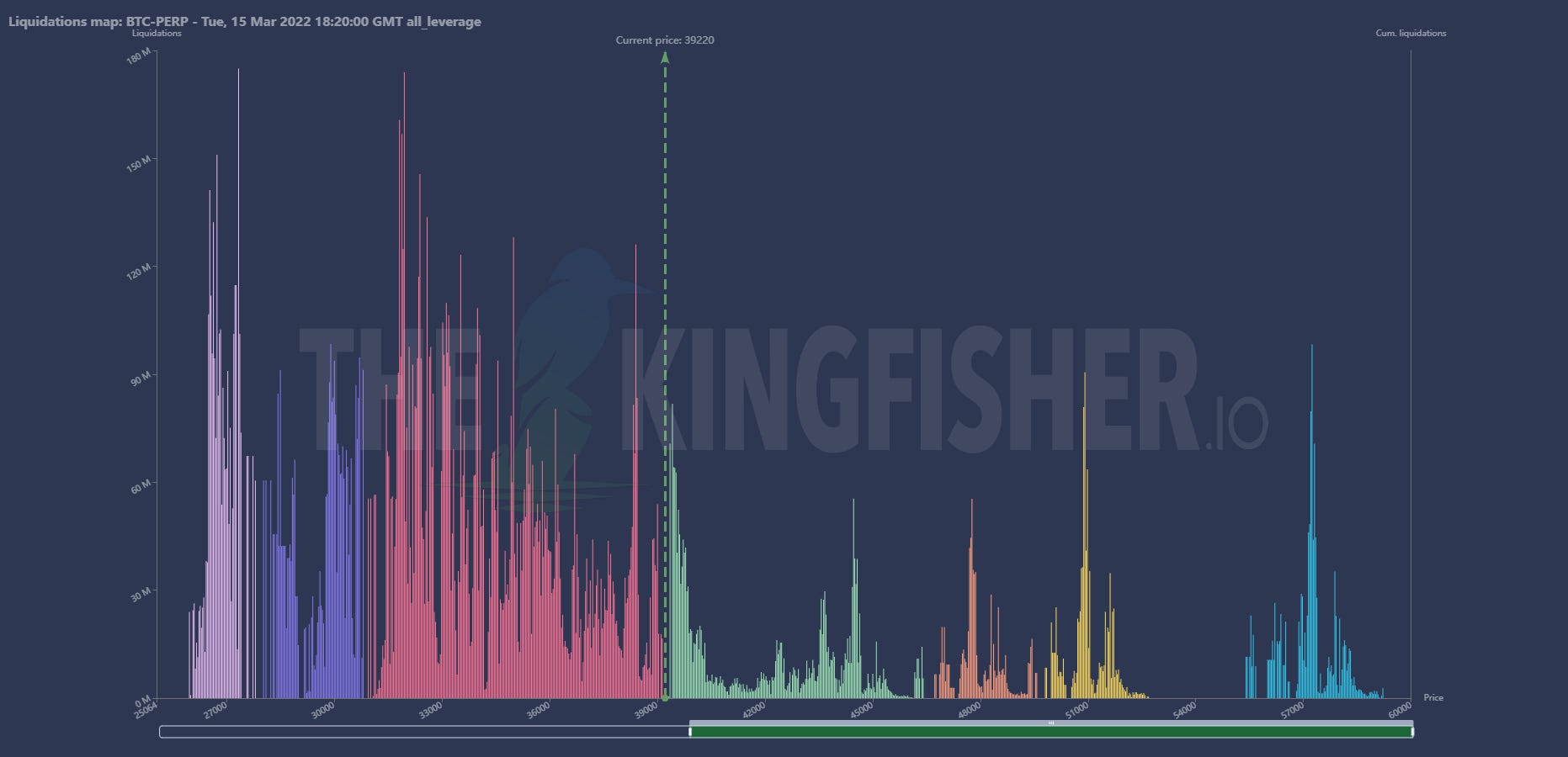

Future Trading Analysis

Data Analysis:

Funding rate has declined since yesterday, while the open interest is rising and the leverage ratio too!

Many of the BTC inflows are related to derivative exchanges! Interesting here, we can detect a big BTC outflow from derivative exchanges, maybe an indicator of profit taking. Almost 5,000 BTC has been withdrawn in the last 2 hours! Stablecoin activity maintains relatively low, the volume keeps below $100m.

We are accumulating more volume in long liquidations based on the liquidation map. Whales could push a bit higher to liquidate those high leverage shorts at 39.4k - 39.8k but the long liquidation volume should attract them much more. Everything below 38.4k looks very promising.

Inspos Conclusion: Even if funding rates have declined since yesterday, its almost neutral now and also liftung up again. With the open interest rising at the same time indicating more longs are arriving and bringing more volume to the liquidation map.

URL to chart: https://www.coinglass.com/FundingRate

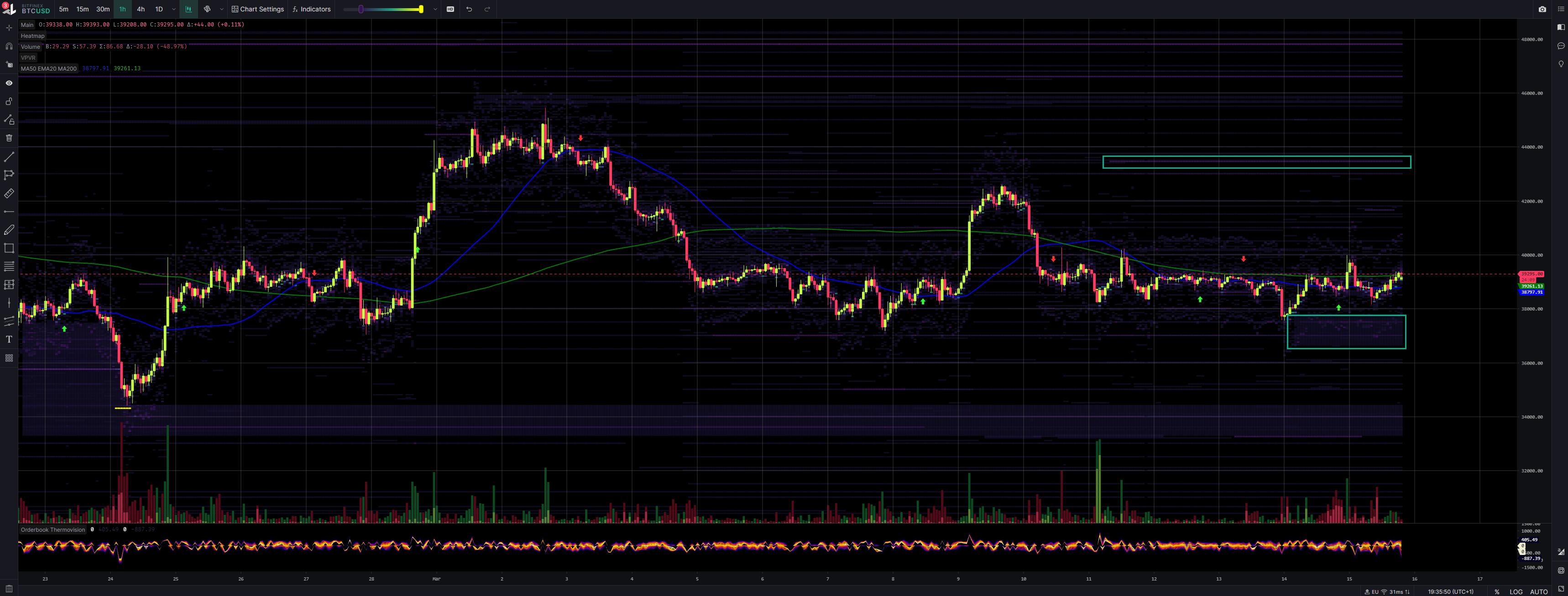

Exchange Order Walls

Analysis:

Coinbase limiting the way down at 35k.

Binance limiting the way up at 45k and limiting the way down at 36k.

Bitfinex limiting the way up at 43.4k (low volume) and limiting the way down at 37.8k (low volume cluster).

FTX Perp is limiting the way up at 41.9k and limiting the way down at 37k and 35.2k.

Kraken is limiting the way up at 43.6k and limiting the way down at 38k and 35k.

BitMex is limiting the way up at 43k and limiting the way down at 33.7k.

Inspos Conclusion: It seems 43k could be the next local top and 35k the next local bottom.

URL to chart:

https://www.tradinglite.com/

Inspos Conclusion and personal trade strategy

Whales ratio keeps high, more flows detected related to derivative exchanges, hoge volume related to option trading indicating more sideway run or a BTC price that should lift up, future traders expecting a pump, while they are generating a big volume liquidation cluster and the exchanges walls are maintaining their levels, except FTX perp. This one shifts down or up, depends of the price action, like controlling the price movements.

Almost every dump starts with a dump. Something I would expect here to. Yes, short-term bullish but I keep very bearish. The data is not convincing me yet. I think we will trap bulls first and dump hard afterwards. So, I will start to short the way up with a max of x12 leverage. I will start to short at 39.5k and I would expect a local top at 42k as max. But as usual, just use the data to make your own conclusions!