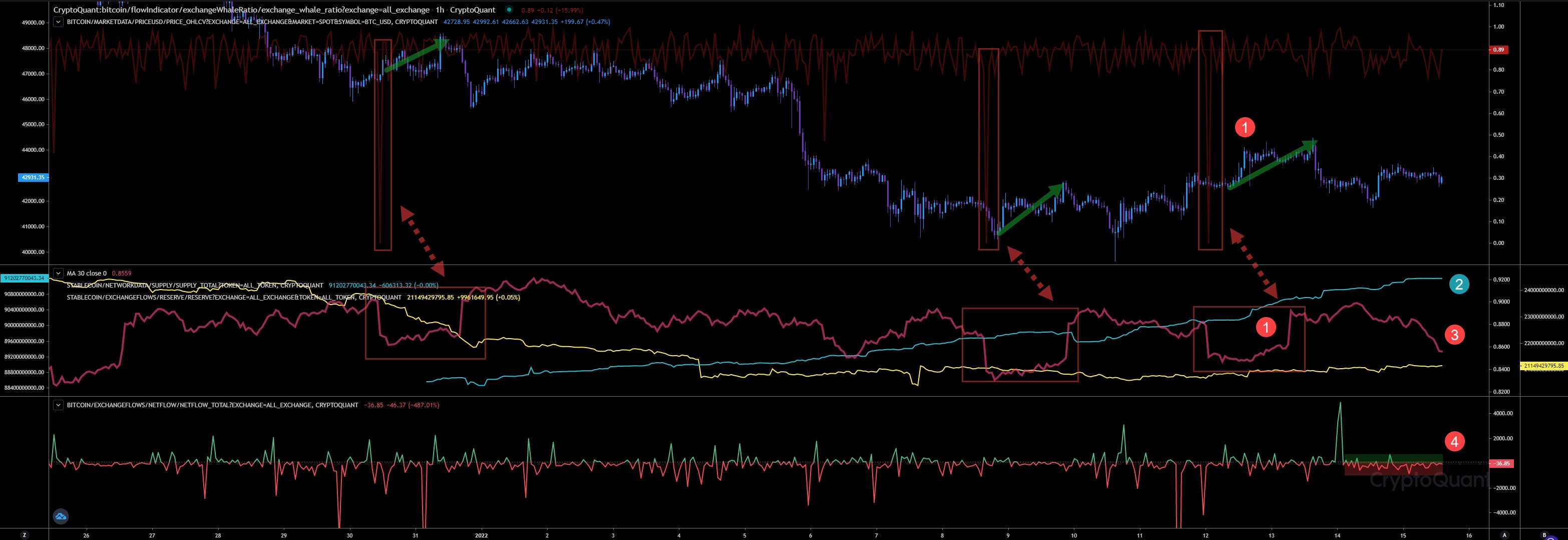

Hourly View

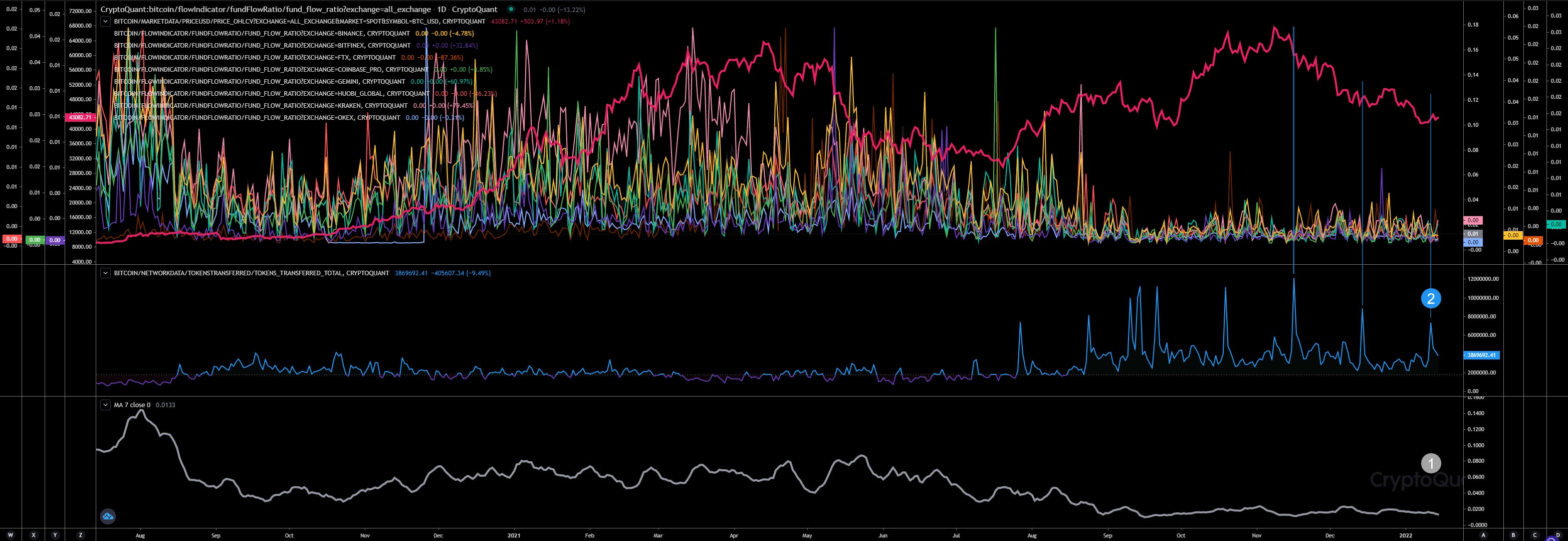

Once again we received a bullish signal by our hourly whales ratio (1) indicating a pump preparation. Few hours later the price has started to lift up again. Immediately after the whales ratio dumps, they start to send tokens to the exchanges to distribute the way up. That confirms also our whales ratio 30D average indicator. After it dumped it rised afterwards. We can see the result very well. The price lifted up and it has started to retrace (3) afterwards.

The stablecoin supply (circulating stablecoin supply) (2) keeps rising indicating a bigger demand in stablecoins. Since EoY we have added a volume of $2.76 billion stablecoins to the market, while the stablecoin reserves on exchanges maintains a level of $21 billions. Since thursday I have detect a total withdraw of $680 million in tether from Binance. The total netflows doesn’t show any big moves here in the last almost 48 hours.

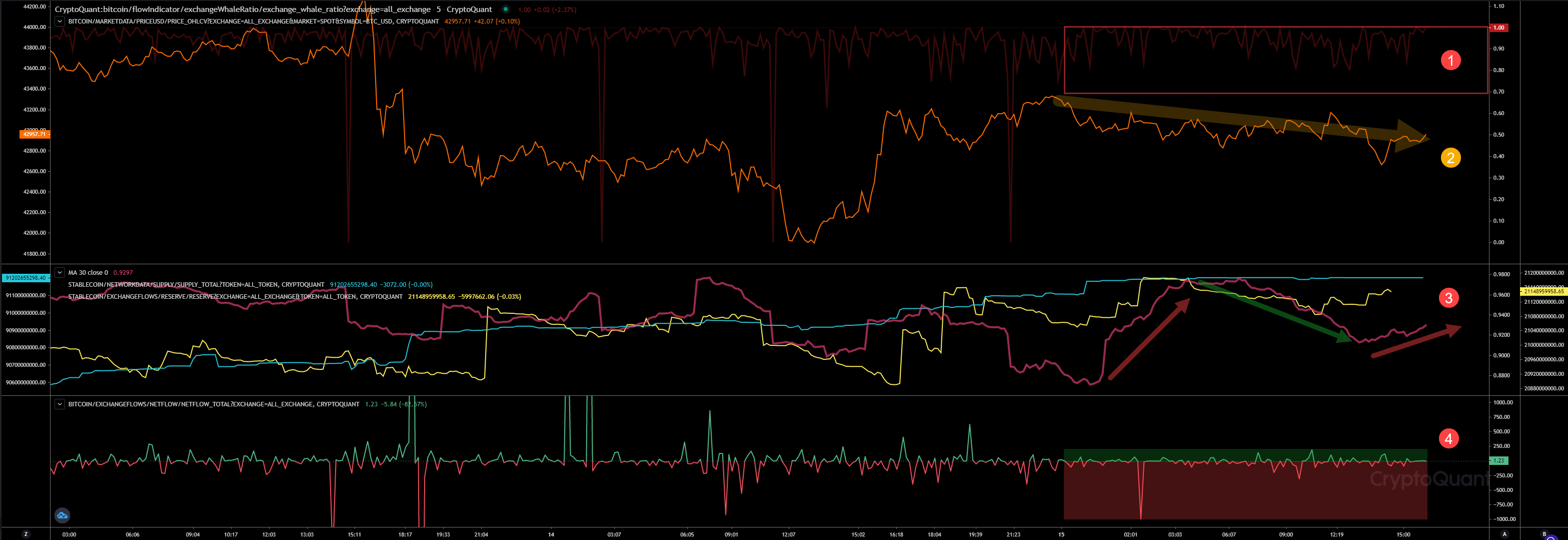

Block View

Our block view shows us what happenend since midnight. The whales ratio (1) has started to lift up again since yesterday, indicating more incoming sell pressure. We can see, the price action reacted afterwards with a falling price (2).

The whales ratio 30D (3) average indicator has started to decrease afterwards indicating the distribution and is starting to lift up again indicating that they are sending more tokens to the exchanges now. In consequence of that, we should see more increasing sell pressure.

Also the block view is showing less activity in the exchange netflows (4). Tonight we have detected one big negative netflow indicating a bigger outflow from exchanges, but in general the netflow looks very flat at the moment.

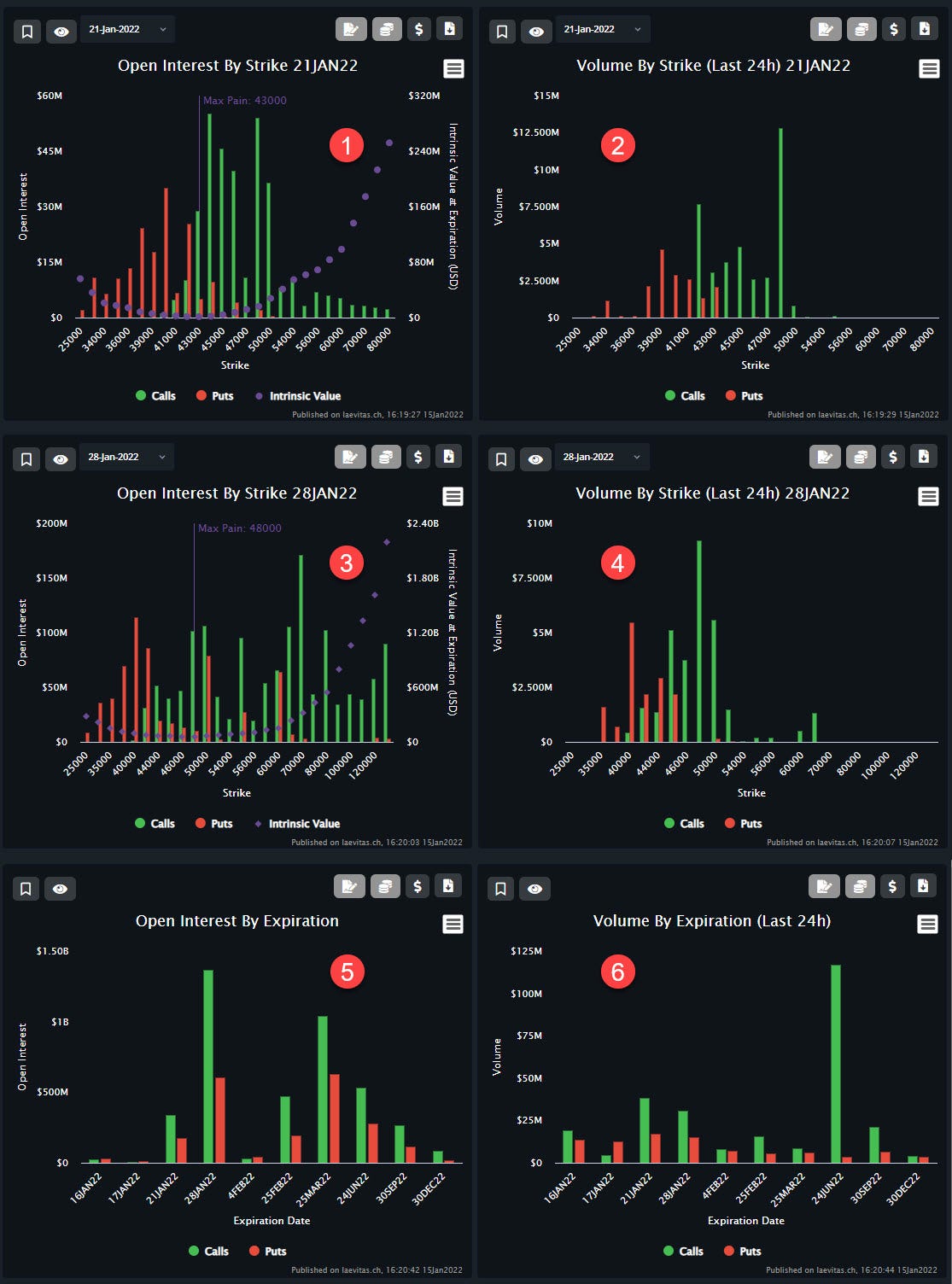

Option Trading

Expiry 21JAN22

This expiry has a total Open Interest of $512 million, $338 million of these are Calls and $174 million Puts.

We still hold our max pain (1) of 43k. Our biggest Open Interest here is at 44k showing a total volume of $55 million in Calls indicating that option traders expect a higher price than 44k until expiry.

Our most traded option within the last 24 hours (2) was a Call at 48k showing a trade volume of $12.8 million indicating that option traders here expect a higher price than 48k until expiry.

Expiry 28JAN22

For this expiry we have a total Open Interest (5) of $1.96 billion, while $1.36 billion are Calls and $600 million Puts.

We also hold here our former max pain (3) of 48k. Our range with the biggest Open Interest here in Calls is between 65k - 80k. The biggest Open Interest related to Puts is here at 40k.

Our most traded option within the last 24 hours (4) was a Call at 48k showing a trade volume of $9 million indicating that option traders here expect a higher price than 48k until expiry.

General Information

The Open Interest for our Expiry 28Jan22 is at the moment the biggest of all. So, if we maintain the max pain of 48k, this price level should be very accurate and I would expect that we reach that level until 28Jan22.

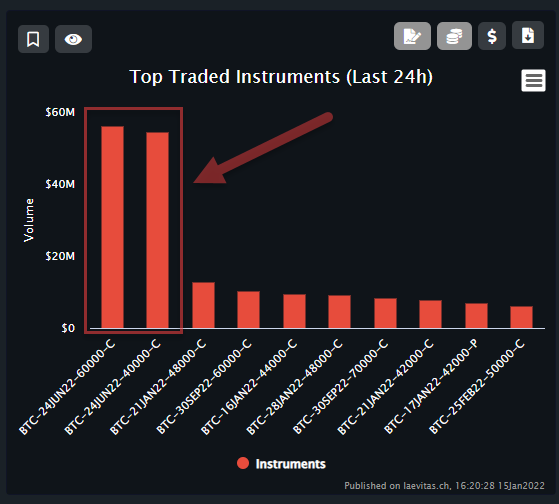

However, in the last 24 hours traders has bought more option related to the 24Jan22 expity, a total volume of $117 million, $56 million in Calls at 60k and another $54 million in Calls at 40k.

Future Trading

Daily View

Our leverage ratio is stalling at the moment indicating no more traders are placing high leverage positions. Anyway, the leverage ratio is still close to its ATH. Our funding rate is showing here a falling trend indicating that traders placed more shorts than longs.

Hourly View

Our hourly view is showing a rising funding rate (1) indicating more longs have been placed since yesterday. Usual, when traders expect a rising price afterwards. Interesting here after our recent pump from 41.8k to 43.3k they have started to flip (2) to short instead, but without a rising leverage ratio (3) at the same time.

Coinglass Funding Rate sheet is confirming the observations mentioned above showing a negative funding rate in almost every exchange for the last 8 hours. That’s bullish. Trading with low volume as we are trading currently it’s easy to liquidate those shorts and lift up quick.

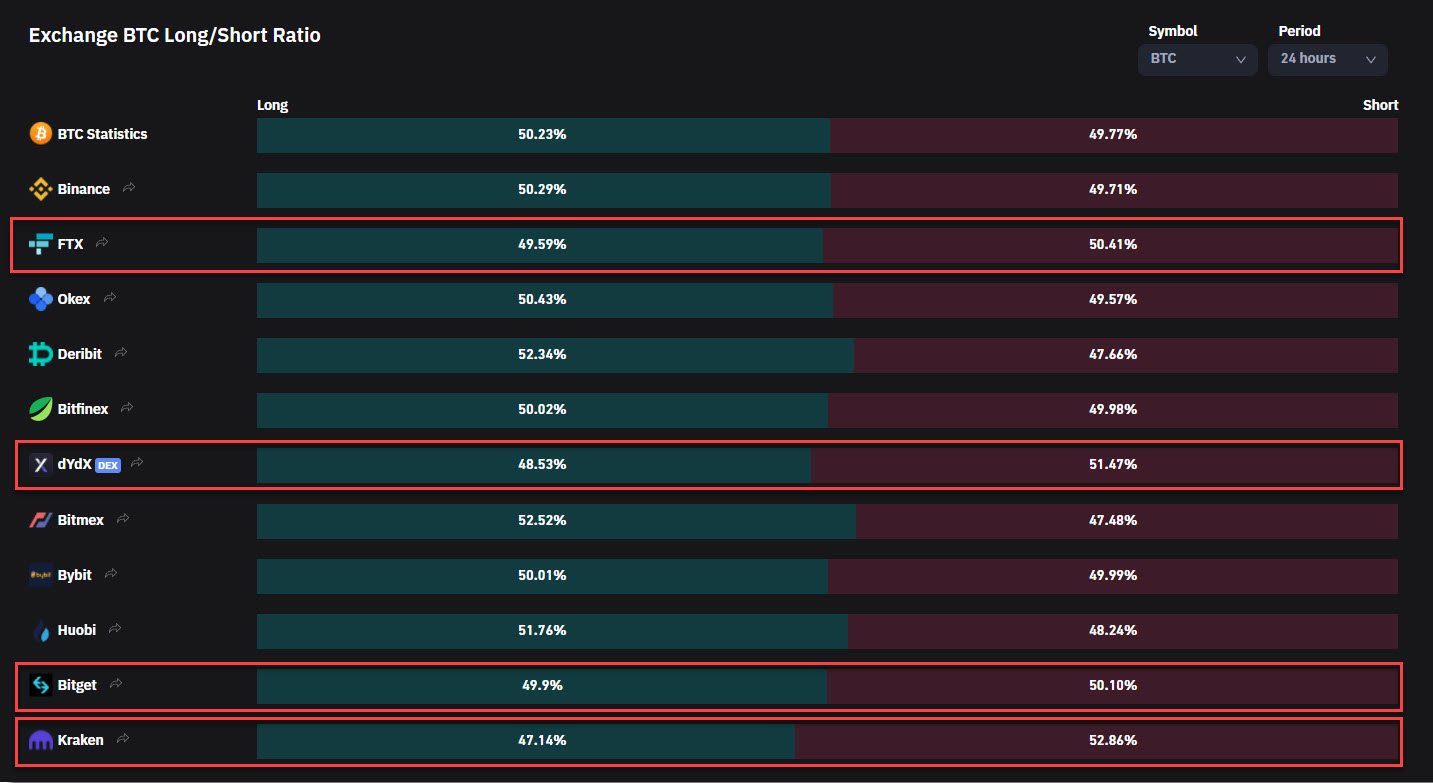

Long/Short Ratio

Coinglass ratio shows more shorts than longs too. However, interesting here is who is maintaing a bearish sentiment indicating more shorts than longs in the last 24 hours. FTX and Kraken are here in my interest due their buy walls.

Market Activity

Daily View

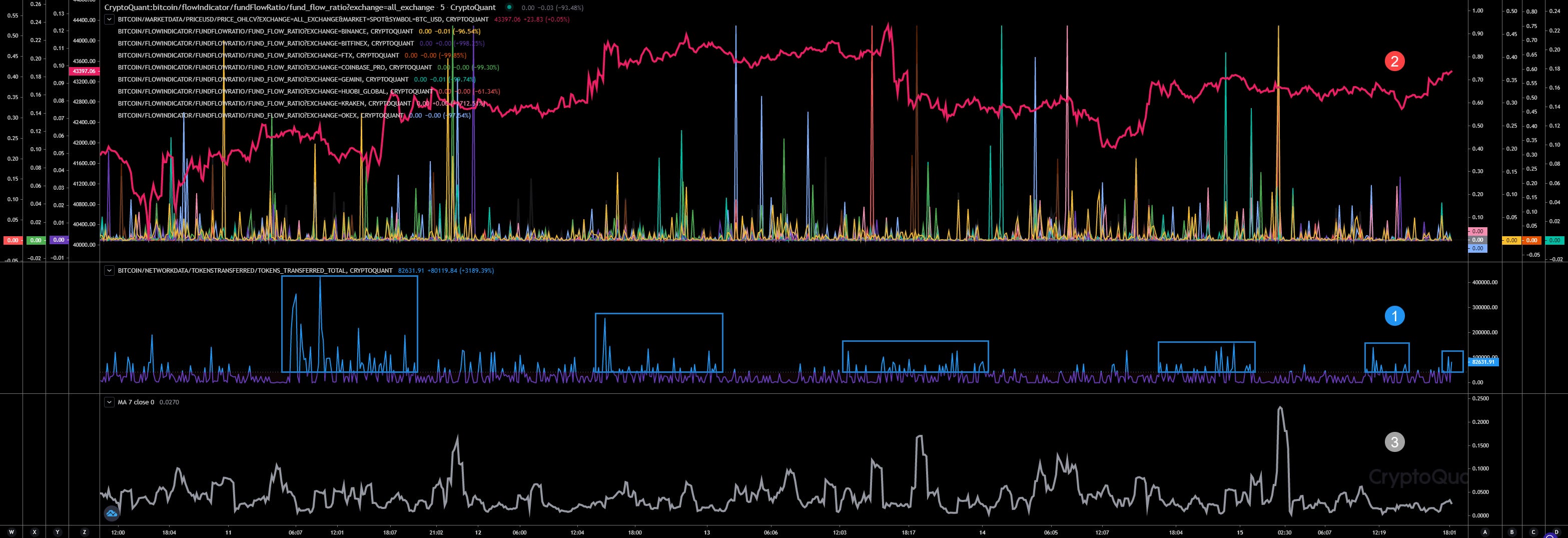

Our exchange activity (1) maintains low indicating less activity related to retailers. While we can detect big activity outside of exchanges. interesting here, everytime when we detect big activity related to total transferred BTC on the network (2), but the exchange activity is low, we lift up and dump afterwards. To be clear, that could be a sign that OTC desks are selling. Our last big activity here was detected 11Jan22. As I have mentioned different times already, that would match to Genesis (OTC Desk) last Q3 2021 report indicating less BTC demand by institutionals.

Block View

I don’t think it’s coincidence that the network activity rises (1) always close before we dump. Afterwards exchange activity rises (2) too. Also interesting here to see what exchanges shows the biggest sequential activities. It’s at the moment Okex, Binance, Gemini, Kraken and FTX. Coinbase and Bitfinex are not playing a big role in the price action of the last 2-3 days. Also interesting that I have reported many times in the last few weeks, that Binance, Gemini, Bitfinex and Okex has rising exchange reserves in BTC.

Exchange Walls

Binance

Upper wall at 70k - Lower Wall at 38k

Coinbase

Upper wall at 69k - Lower Wall at 40k

Bitfinex

Upper wall at 62.7k - Lower Wall at 38.5k

Kraken

Upper wall at 45.5k - Lower Wall at 40k

FTX Perp

Upper wall at 45.5k - Lower Wall at 41.4k

Inspos Conclusion and personal trade strategy

Taking into account the information above we are not done yet, even if I think the bottom is in based on what I see. So, at the moment I’m not expecting a dump heading upper 30s anymore, but I’m not expecting 48k next week either. I don’t think we will maintain 43k just because our max pain of the 21Jan22 expiry as the Open Interest isn’t really big. I think we will maintain a trading range between 45.5k - 40k until end of the next week. The week of the 28Jan22 expiry will let us lift up heading the max pain level of 48k.

I will maintain my short position with my 42.8k open, even if I think it’s possible that we lift up even more short term. I’m not shorting with high leverage, so even if we start lifting up heading 44k I have enough margin and time to close with little loss. Anyway, I expect a retest of 40k soon. We still have a lot of high leverage longs (we also have shorts here, but more longs remaining) and I think we need to clean those high leverage positions before we can lift up heading 50s. So, still expecting a rising volatility soon. At the moment the market looks guided by some assets like SPX, NDX and indirectly also by DXY. So, I would not expect a big pump or dump this weekend. However, I will max my risk management in case they surprise me.

Right now I’m 40% bullish and 60% bearish.

Just subscribed for a year. Happy to support such a good analyst.

You've been pretty bang on lately sir. Thanks a lot!