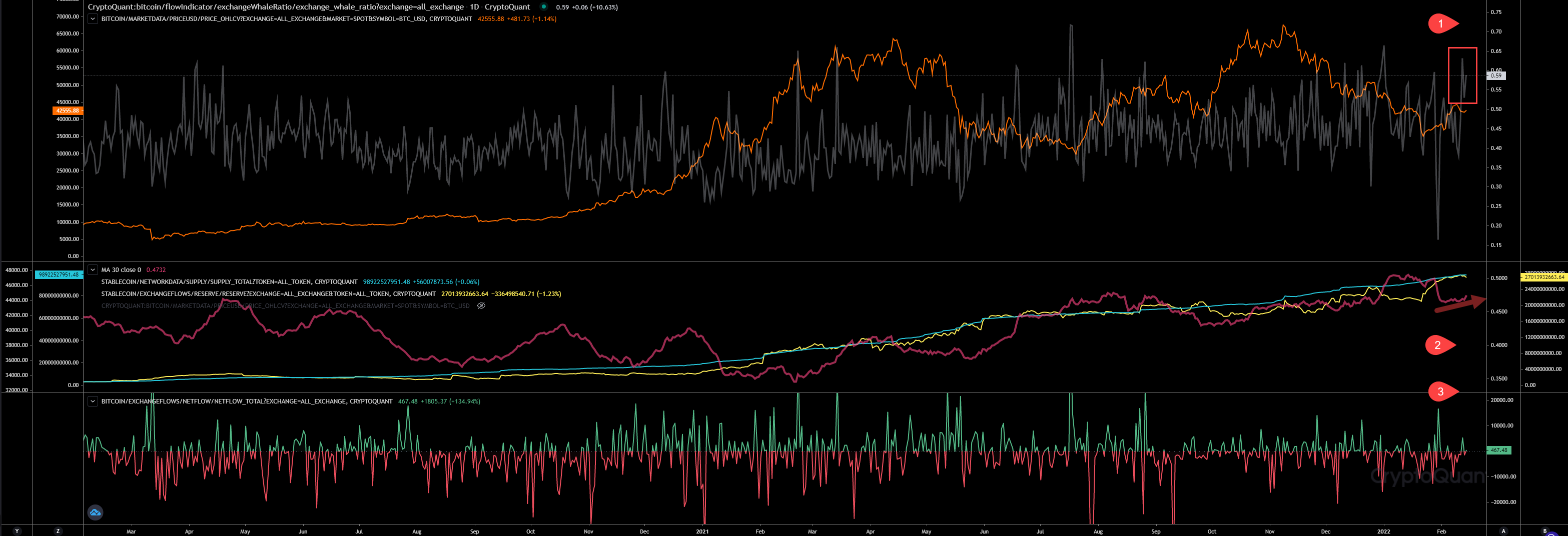

Whales Ratio - Hourly View

Chart Analysis:

Whales ratio (1) has declined and the price followed by lifting up in consequence. Now the whales ratio maintains a level of 0.91 and the sell pressure has started to rise.

Also confirmed by Whales Ratio 30h Average (2) indicating that sell pressure should rise more. Stablecoin reserves on exchanges declining indicating more stablecoin outflows than inflows.

Total exchange Netflows (3) is indicating more inflows than outflows detected today. Matches to the whales ratio.

Inspos Conclusion: The chart is showing a similar pattern like 07Feb22 close before we dumped afterwards to 42k.

URL to chart: https://cryptoquant.com/prochart/vYNO3z1cx9LcSvg

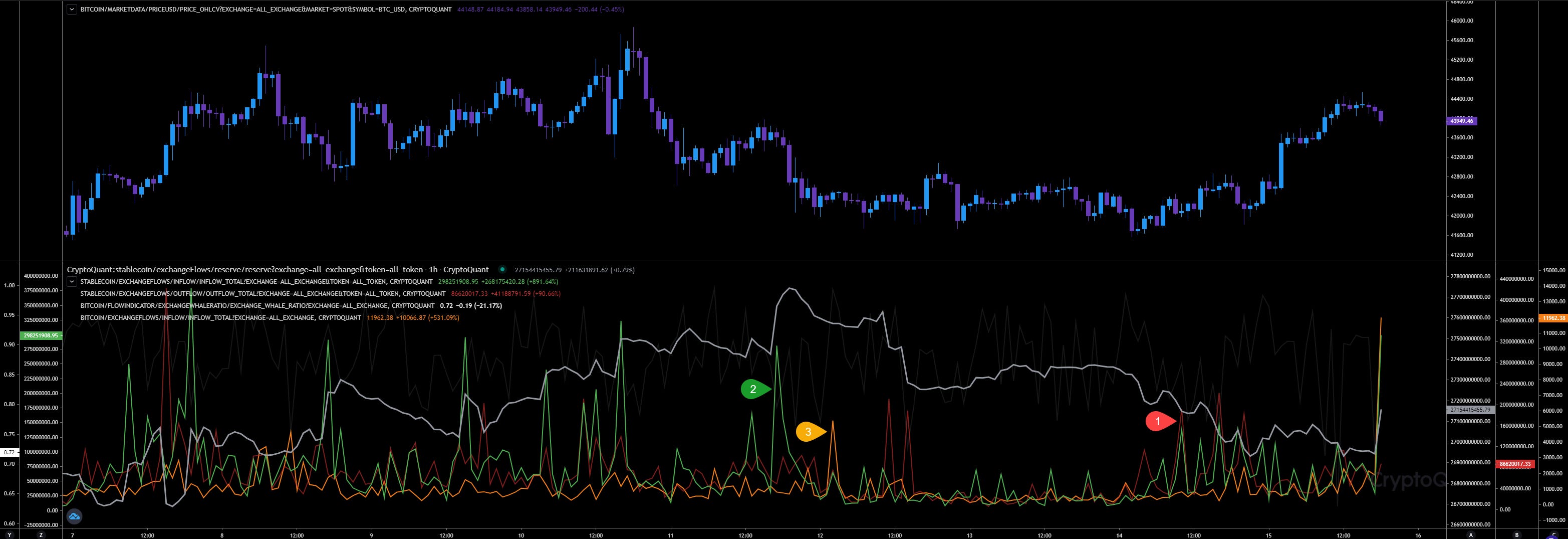

Whales Ratio - Daily View

Chart Analysis:

Whales ratio (1) maintains a high level. A level of 0.59 is high for the daily time frame. That indicates more sell pressure will follow.

Whales Ratio 30d Average (2) is lifting up again. Something I wasn’t expecting. The sell pressure is rising indicating that whales are distributing again.

Total exchange Netflows (3) is almost neutral from yesterday.

Inspos Conclusion: Looks bearish to me. Our whales ratio dump from 30Jan22 played out few days later pumping to 44.5k. Now we have a constant high whales ratio since 11Feb22. That looks like dump preparation to me.

URL to chart: https://cryptoquant.com/prochart/vYNO3z1cx9LcSvg

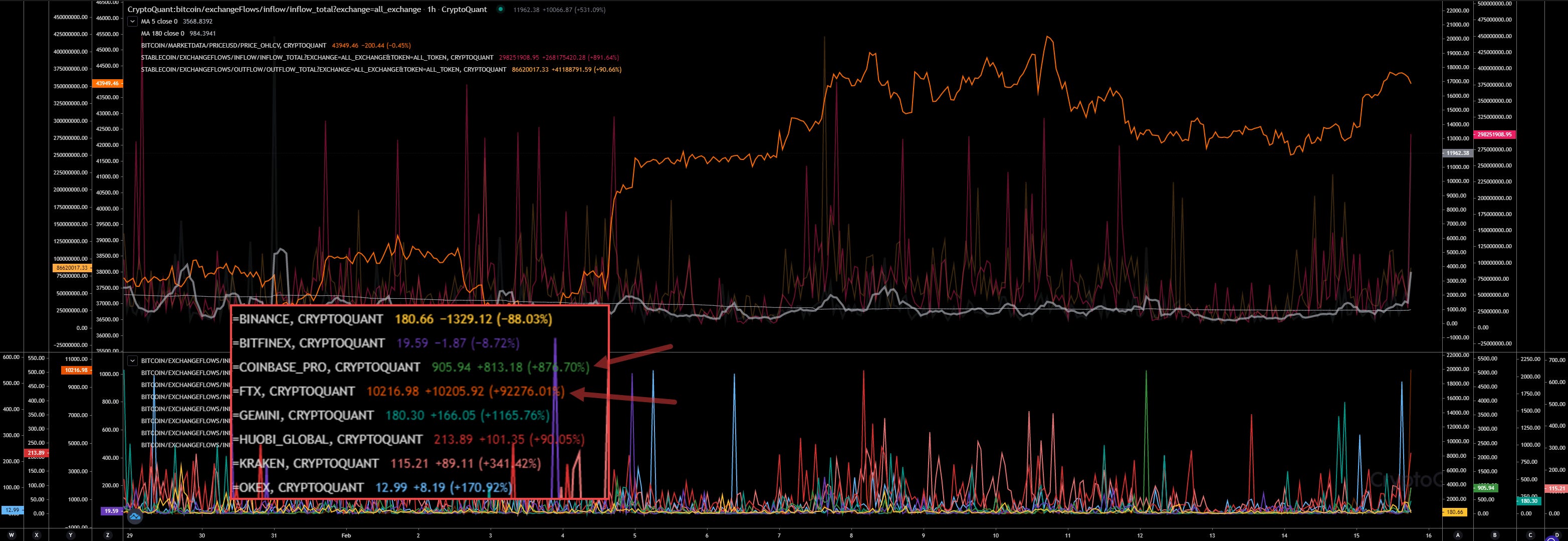

Market Flow Analysis

Chart Analysis:

The market flipped today to bearish. Less stablecoin outflows (1) detected than inflows (2). The BTC inflows on exchanges (3) was lifting up the whole day and I have detected almost 12,000 BTC flowing an hour ago.

Inspos Conclusion: Looks like dump preparation. FTX with 10,000 BTC and Coinbase with 900 BTC leading the inflows here.

URL to chart: https://cryptoquant.com/prochart/czejQkfJy5OBF69

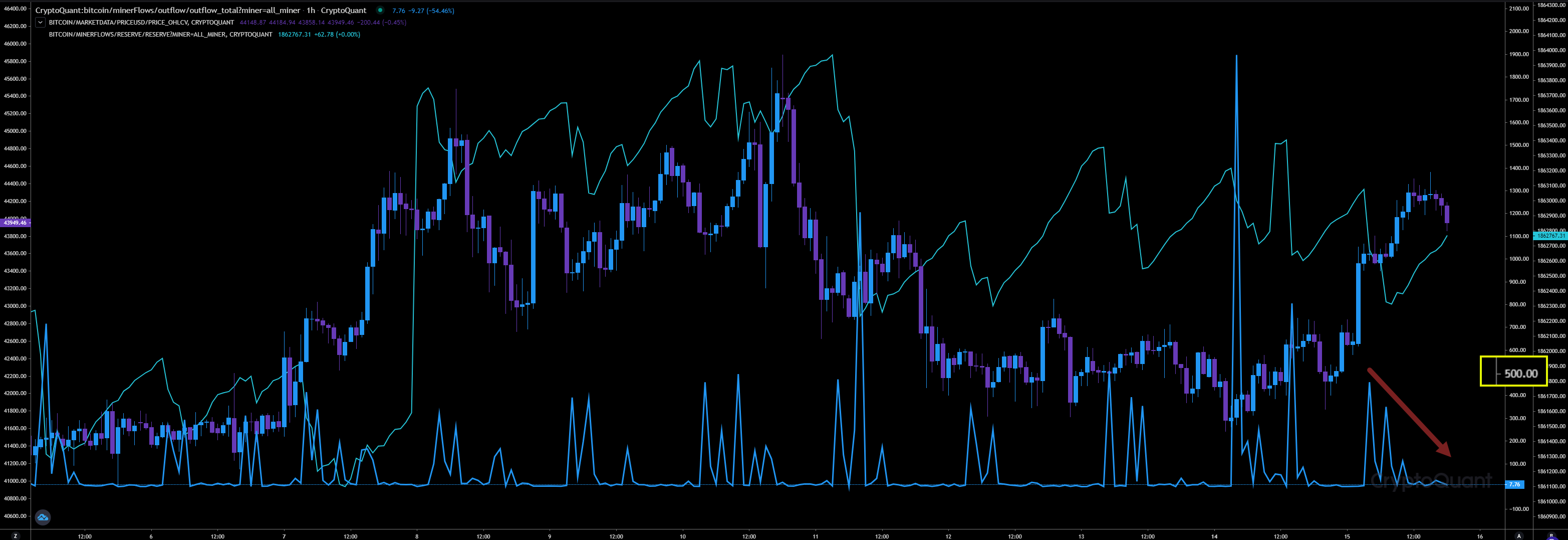

Miners Flow Analysis

Chart Analysis:

Today less outflows by miners indicating less sells. Yesterday the opposite.

Inspos Conclusion: Miners are not in sell-off mode. Everything looks fine here.

URL to chart: https://cryptoquant.com/prochart/W1qyCruejyfhoEh

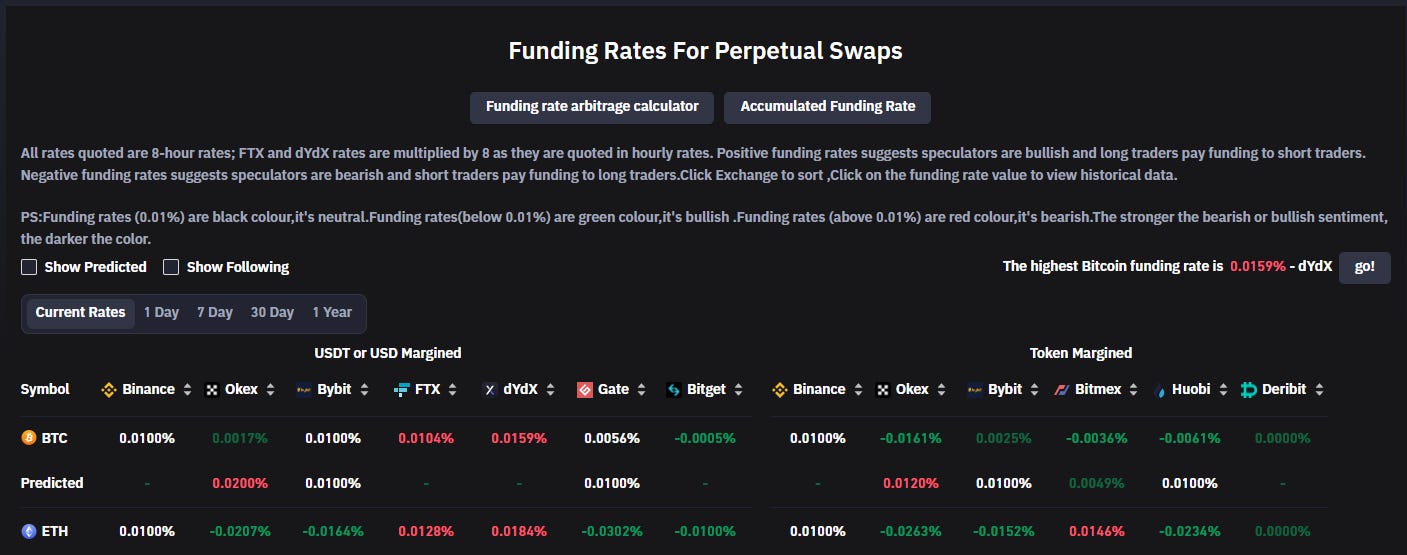

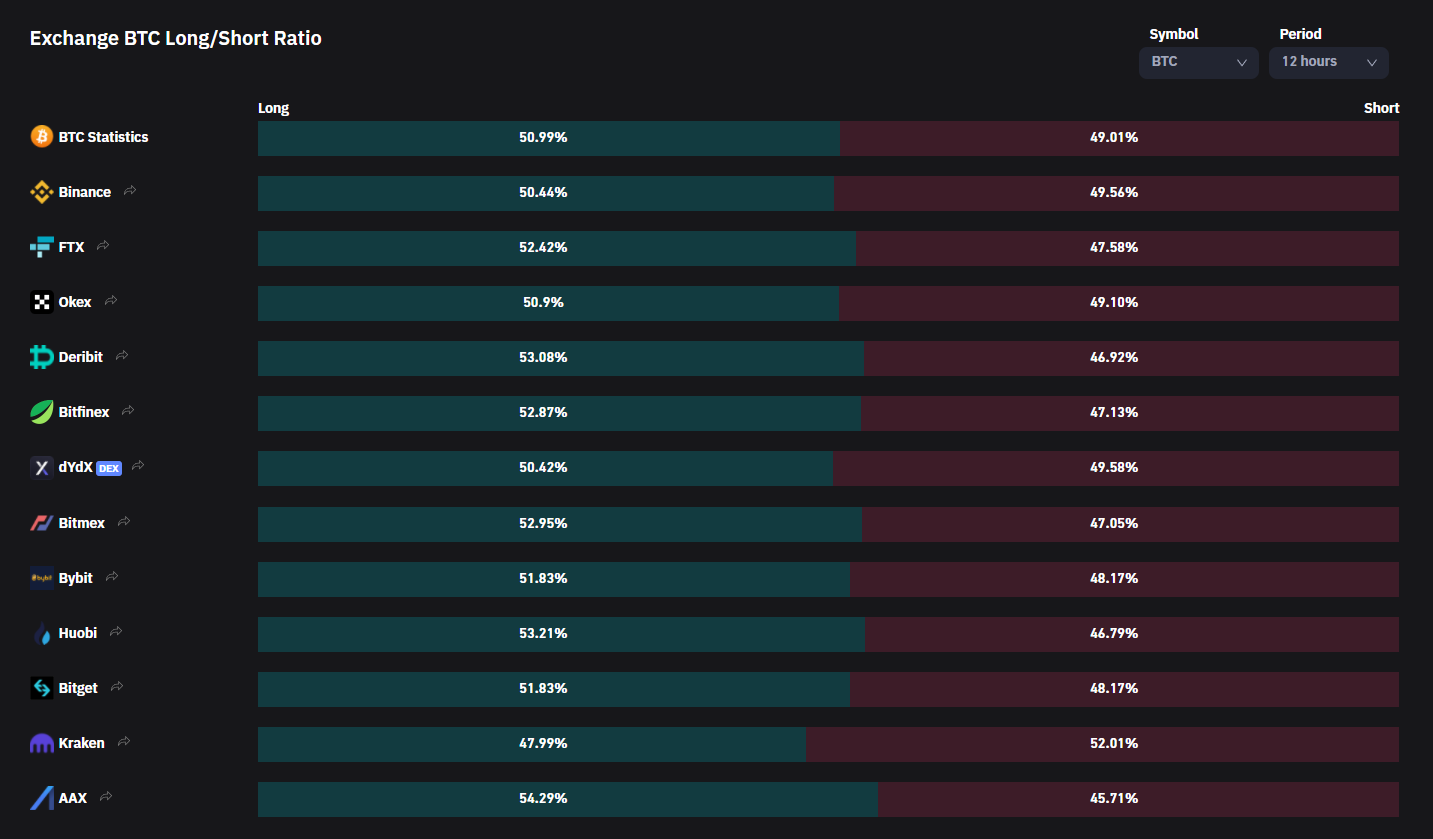

Future Trading Analysis

Data Analysis:

Funding rates are positive, leverage ratio is heading ATH, Long/Shorts ratio showing more longs than shorts and Open Interest increased by 4% since yesterday.

Inspos Conclusion: If they use those 12,000 BTC to dump the price they will liquidate a lot of late high leverage longs.

URL to chart: https://www.coinglass.com/FundingRate

Exchange Order Walls

Analysis:

Bitfinex limiting the way up at 46.6k.

Inspos Conclusion and personal trade strategy

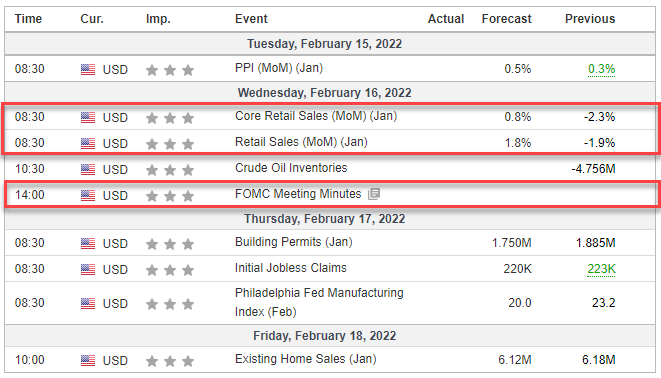

Today the market flipped to bearish based on the data. Whales ratio indicating a bearish price action, option traders expecting until next friday a price below of 40k - 41k, future traders longing with high leverage and we can detect on exchanges walls in upper levels, but in lower levels some of them disappeared.

Keep in mind that tomorrow could be an important day! FED had its meeting in “secret” and will release they new steps. I’m sure it will have an impact to the price action. Volatility should rise again.

I still see here a trade range between 41k -45k. Bitfinex wall even at 46.6k. However, we are reaching our local top imo. Taking into account the data mentioned above we will see a bearish price action that could bring us to 41k first. I’m shorting since our local top but in case they pump hard with stablecoins as they did in the past, I will set a SL at 45k. Risky trade. If you want to trade then max your risk management always!