#Bitcoin Market Analysis: Navigating Bearish Sentiment Amid Key Economic Events and Resistance Challenges

1. Options Data Analysis

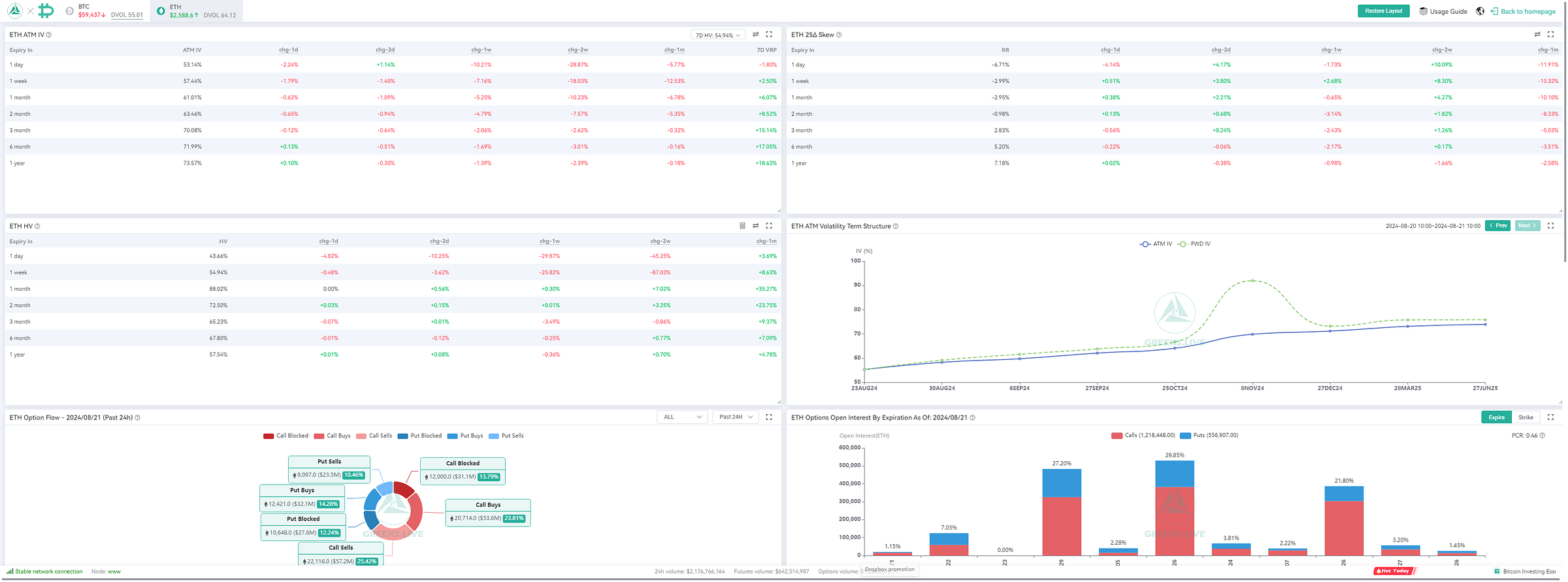

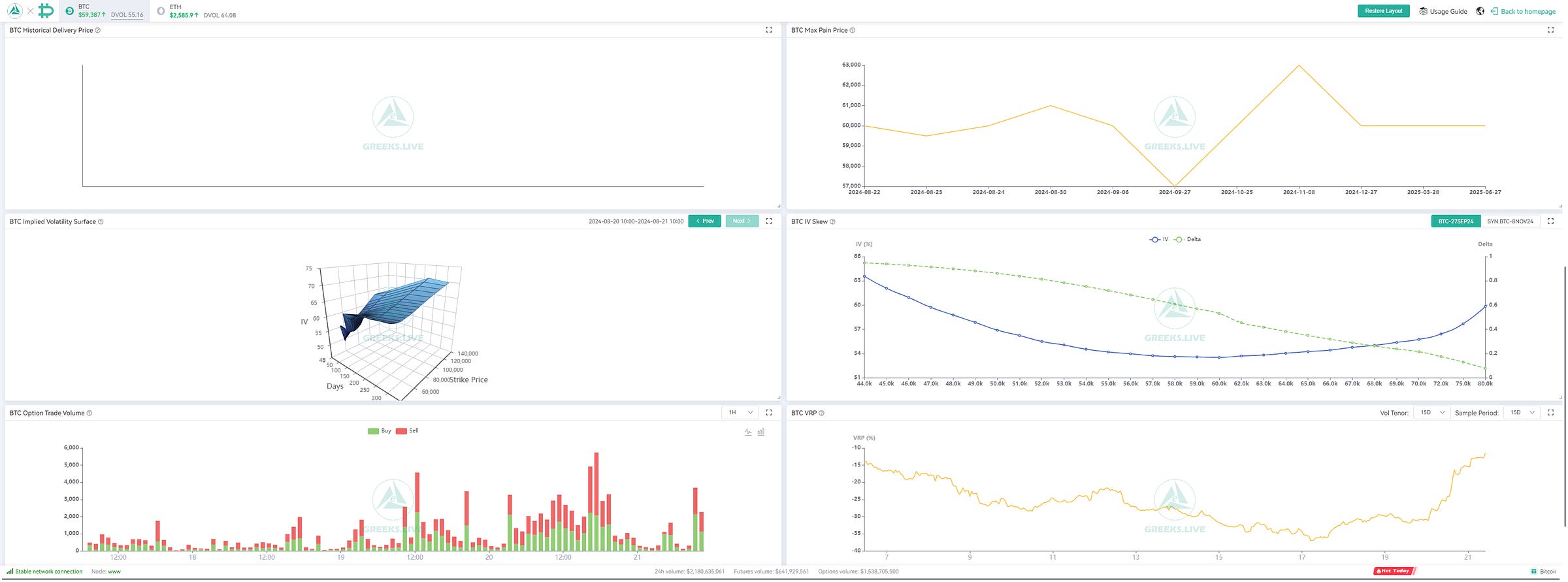

Implied Volatility (IV): The ATM IV indicates that the market is expecting significant price movement in the near term. The term structure shows an upward curve, with notable spikes around key expiration dates, particularly in September and November.

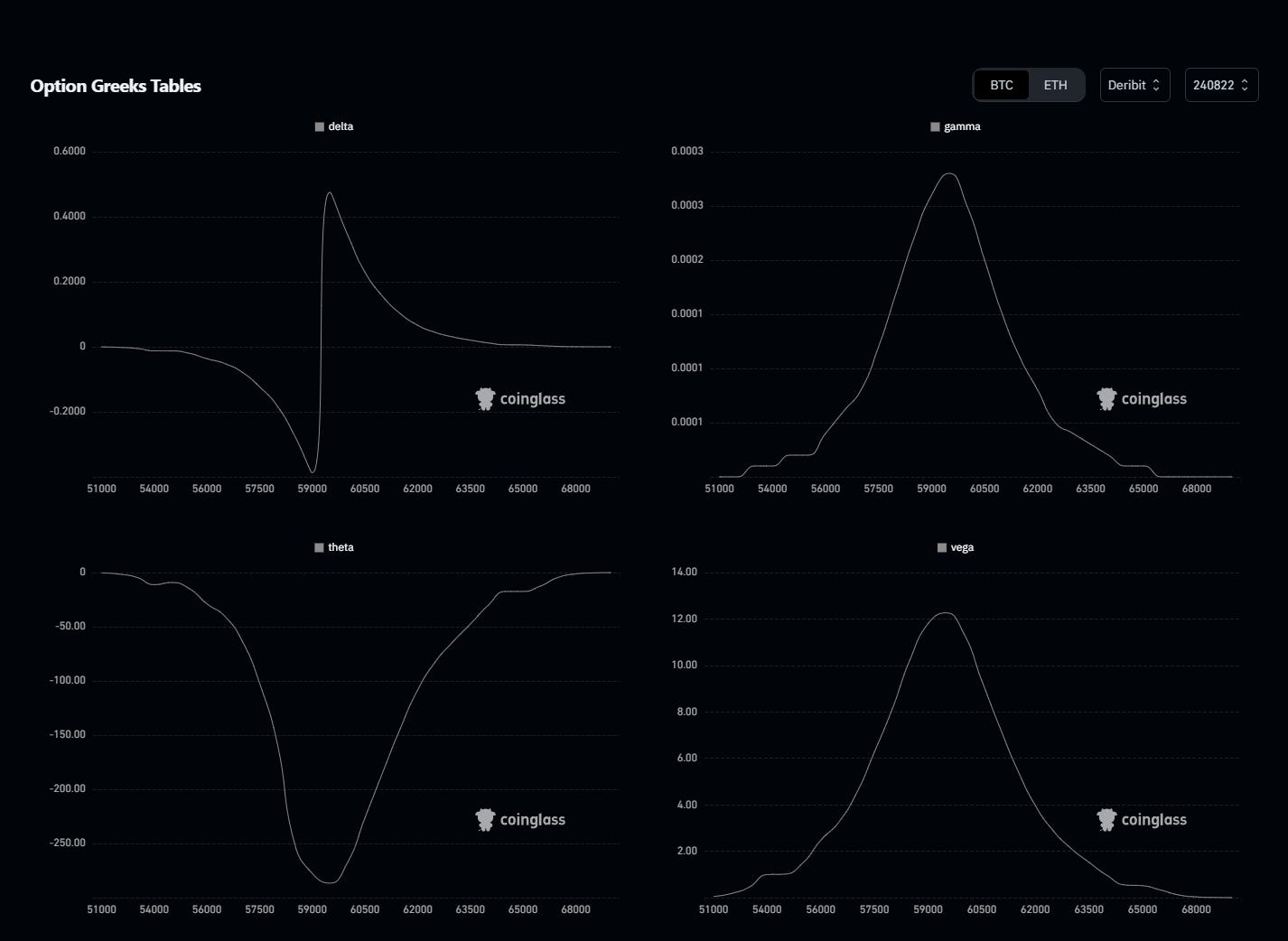

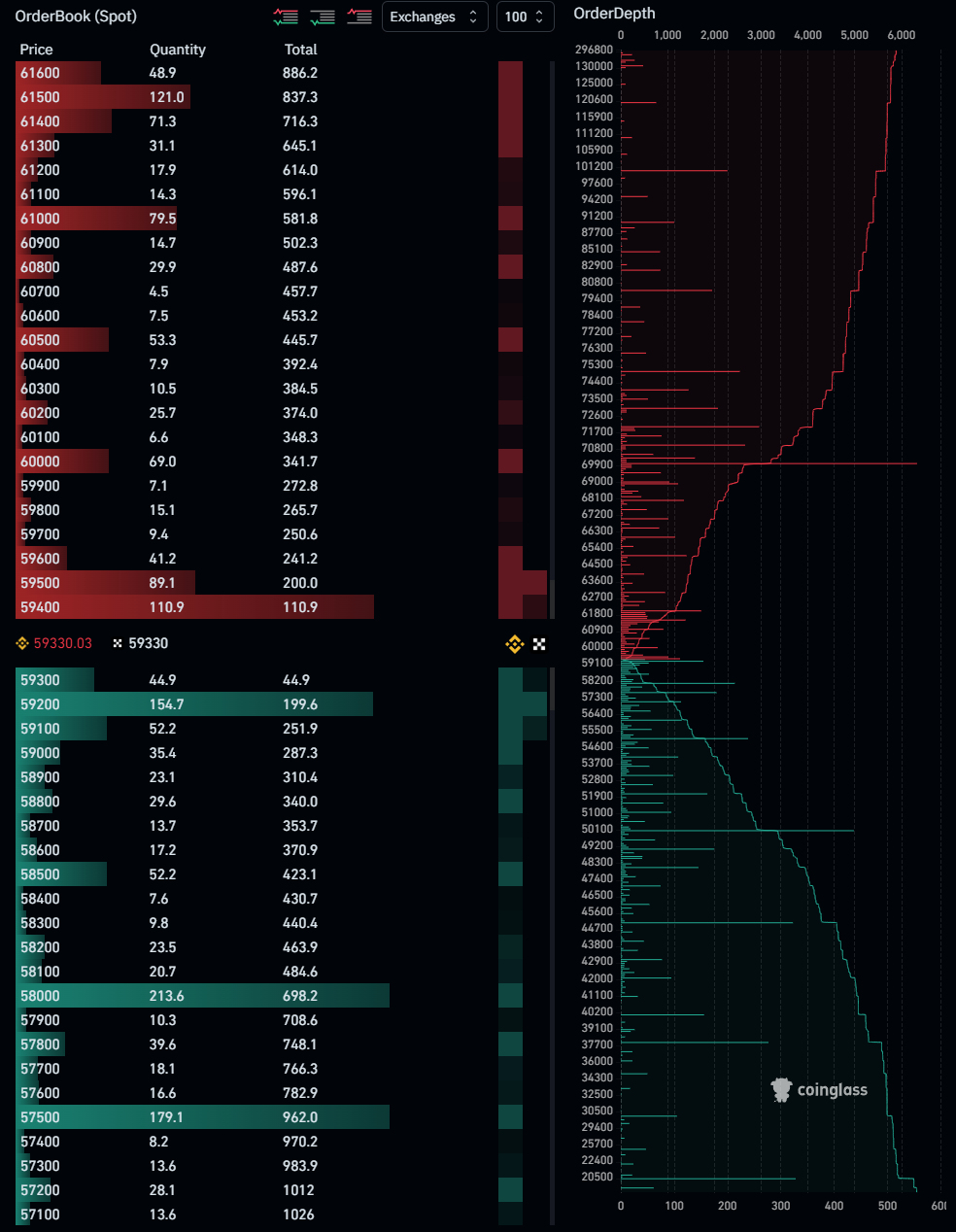

Open Interest (OI) and Skew: A large concentration of open interest at the $60,000 strike price suggests that this level is crucial. The skew is leaning bearish, indicating that traders are paying more for downside protection, which might suggest expectations of potential price declines.

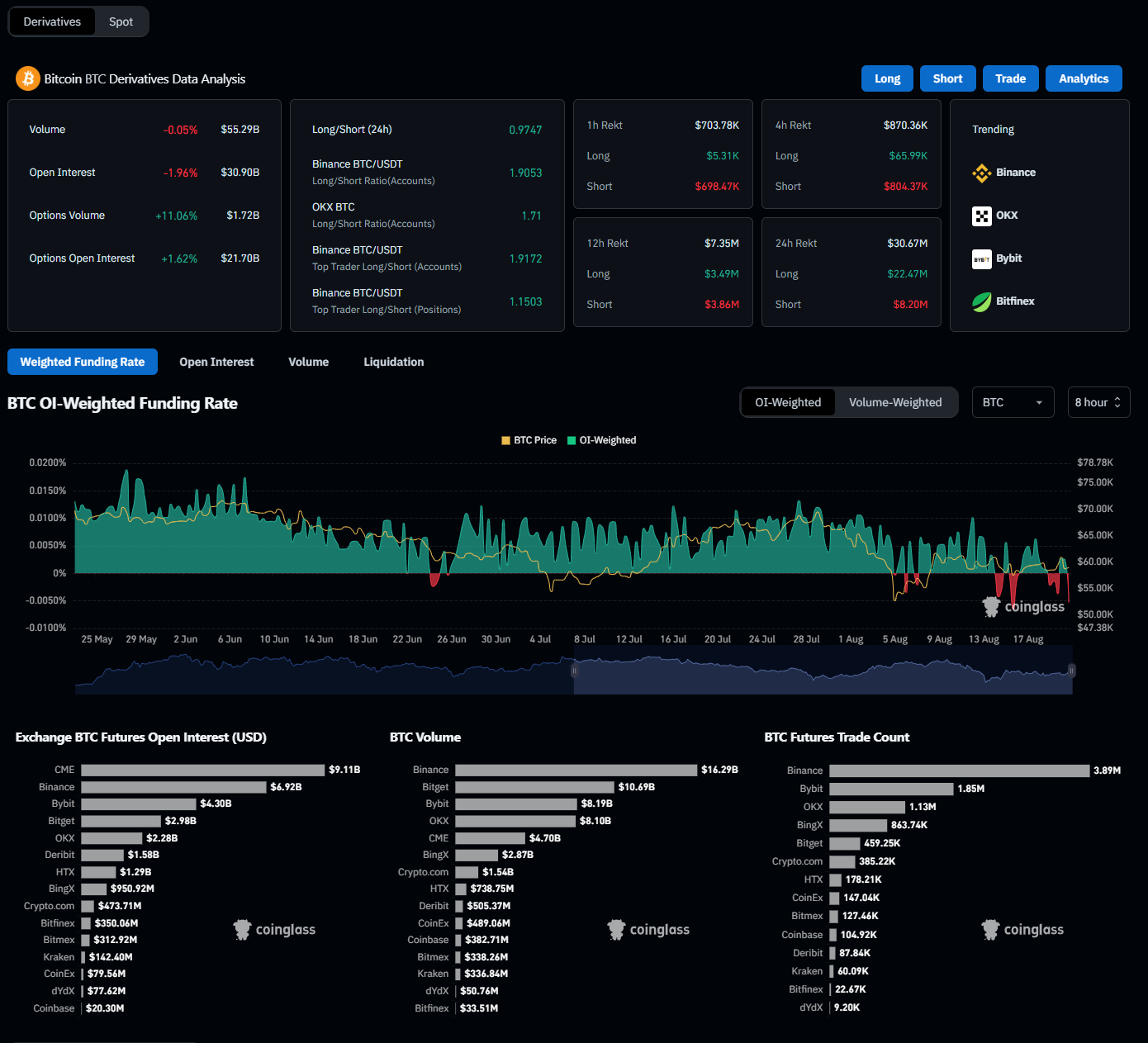

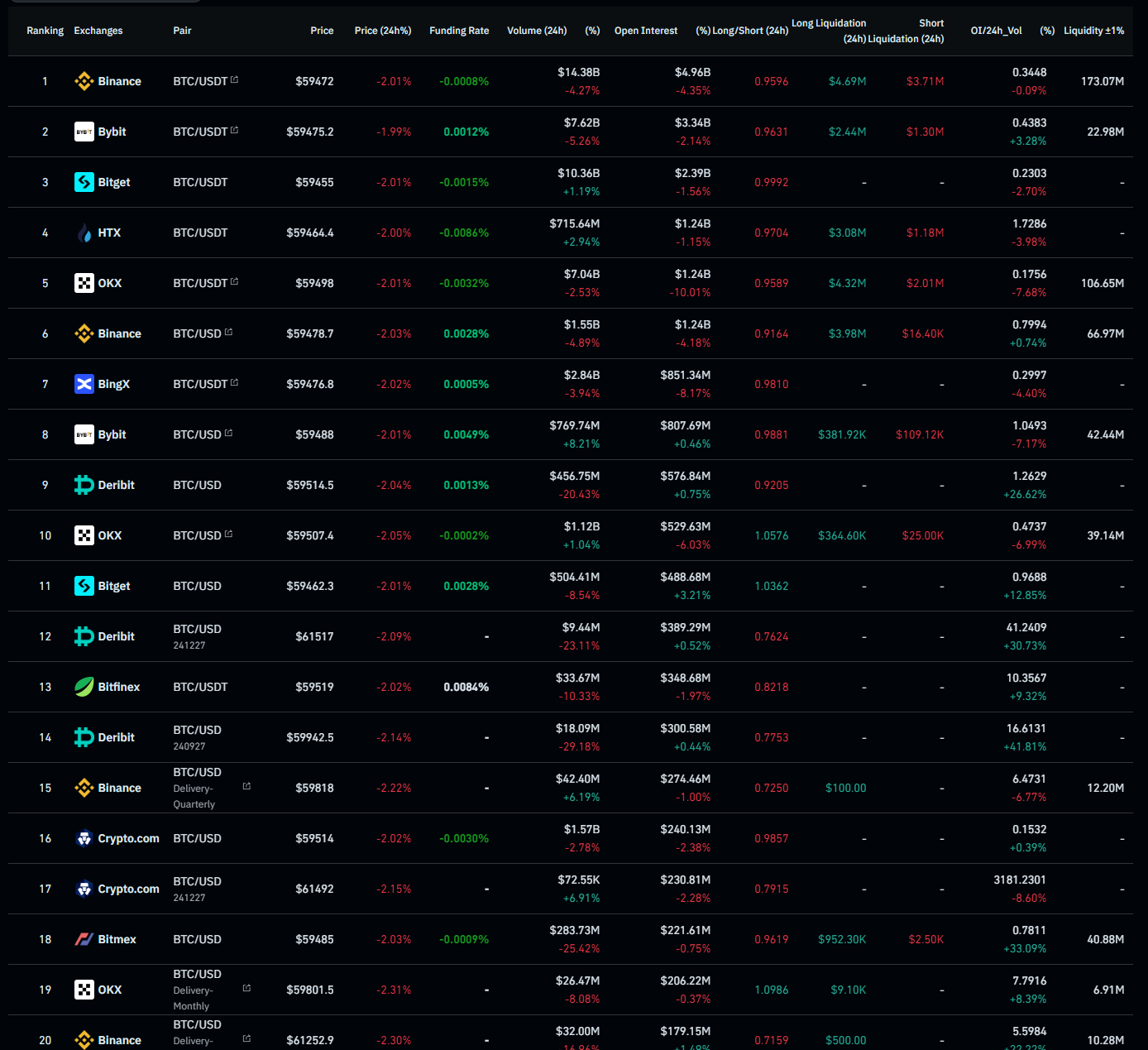

2. Futures Data Analysis

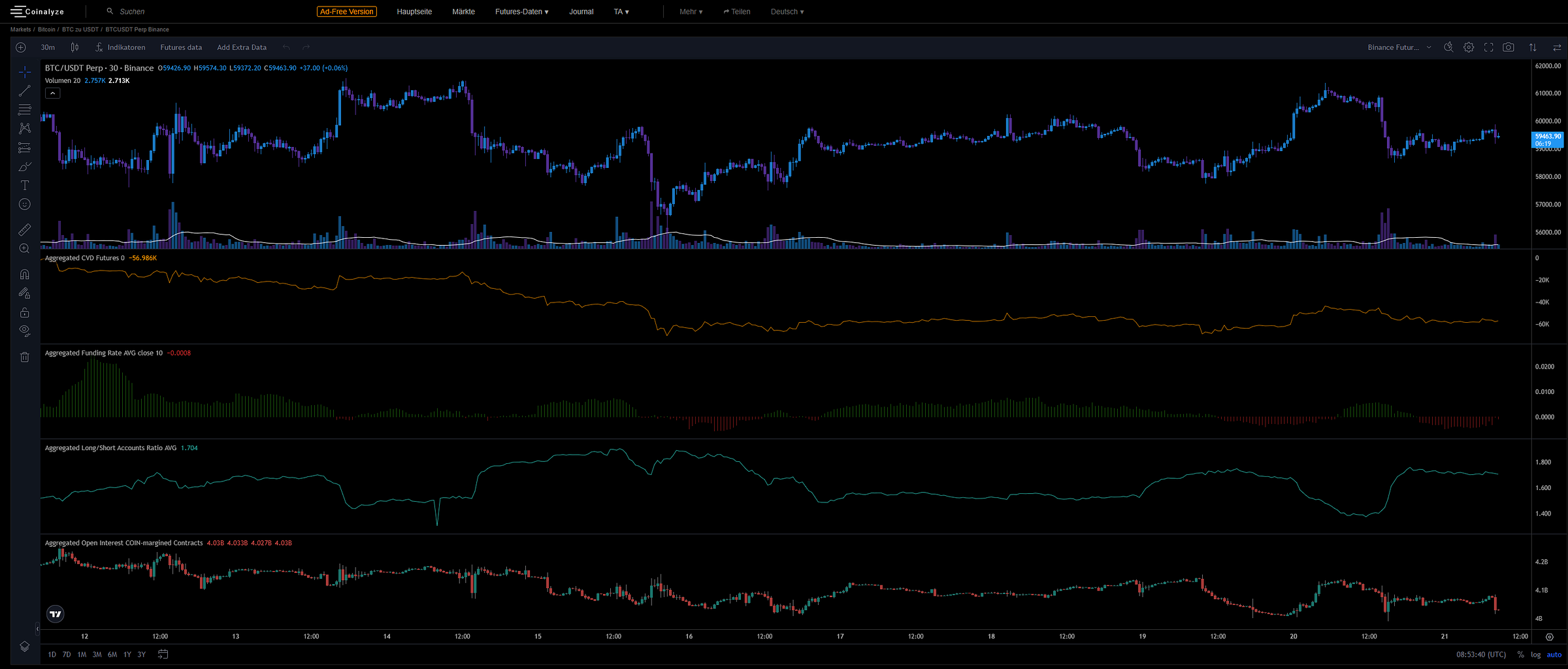

Funding Rates and Open Interest: The weighted funding rate across major exchanges shows a slight negative trend, indicating that short positions are being favored. This bearish sentiment is supported by decreasing open interest, suggesting that some positions are being closed, possibly in anticipation of further price drops.

Volume and Trade Count: A reduction in futures trading volume and trade count might indicate market indecision or a wait-and-see approach as traders anticipate upcoming events like the FOMC meeting.

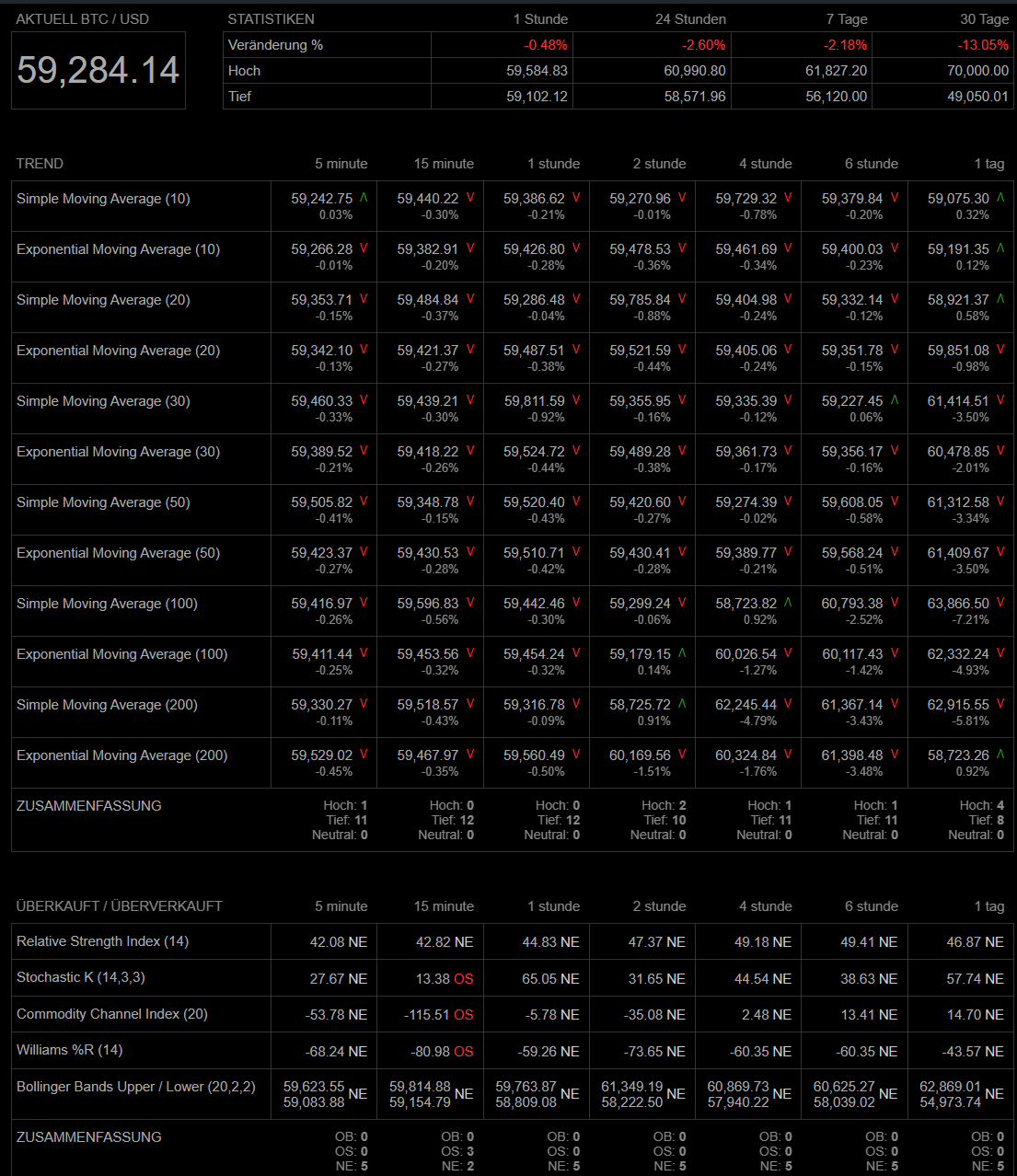

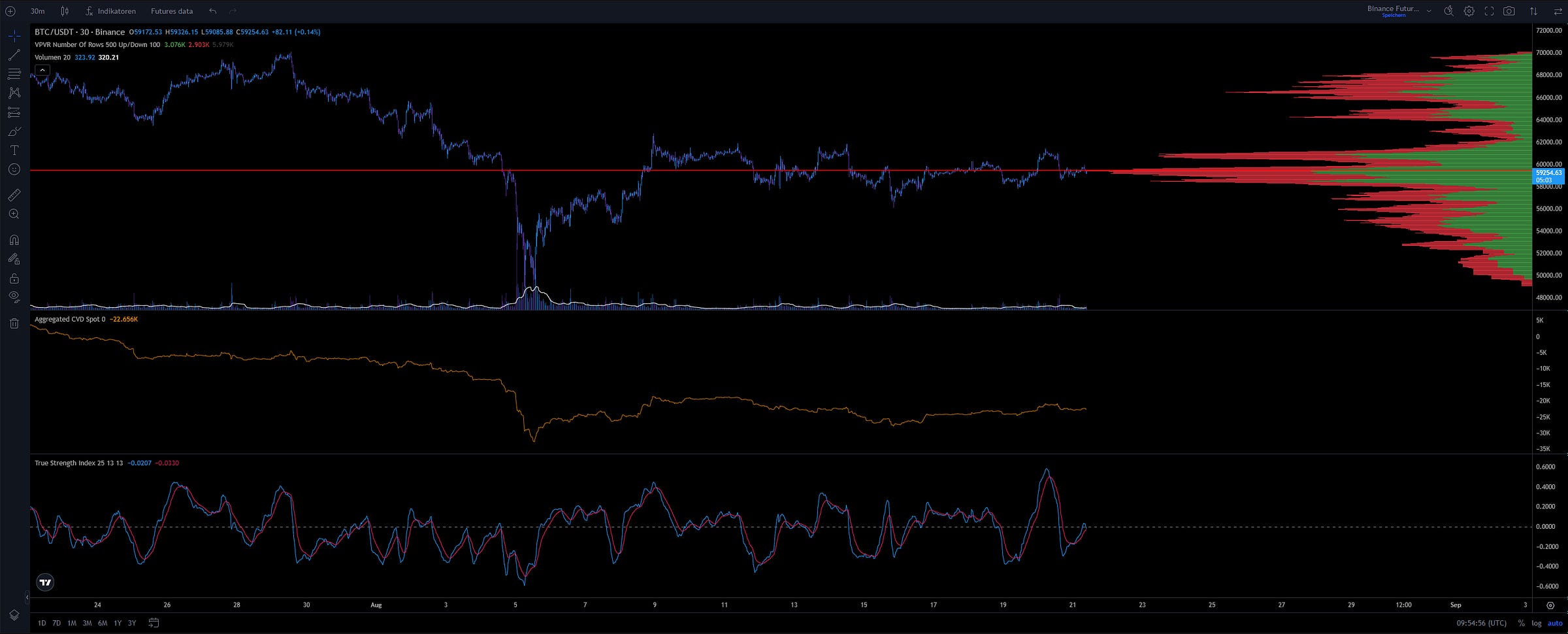

3. Technical Analysis (TA)

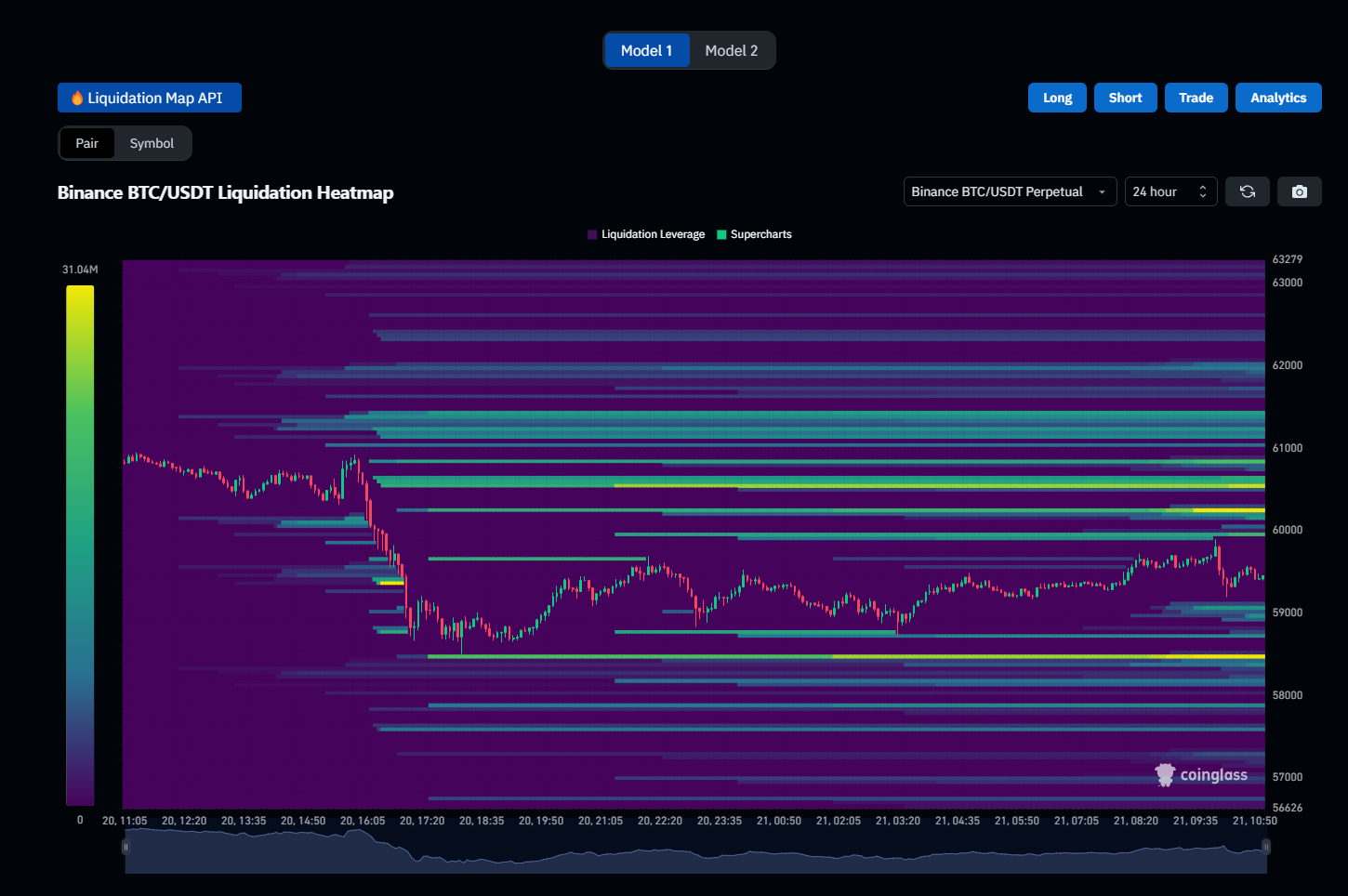

Resistance and Support Levels: Key resistance remains at $60,500, a level that has been tested multiple times without success. The support is currently around $59,000, which has held up amid recent volatility. The presence of a large sell wall at $61,000 further solidifies this as a significant resistance zone.

Indicators: Technical indicators, including RSI and MACD, suggest a weakening momentum. The bearish divergence on these indicators aligns with the broader market sentiment indicated by the options and futures data.

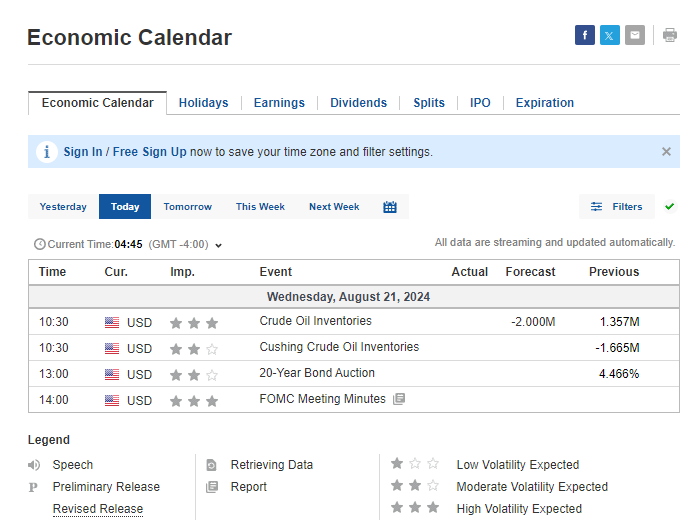

4. Economic Calendar Events

FOMC Meeting Minutes: The release of these minutes later today could introduce additional volatility, especially if there are surprises in terms of future interest rate expectations. This event is likely to impact both traditional financial markets and cryptocurrencies, potentially leading to sharp price movements.

Crude Oil Inventories and Bond Auctions: While these are less directly impactful on Bitcoin, any significant deviations from expectations could influence broader market sentiment, indirectly affecting BTC prices.

Price Outlook

Next 24 Hours

Bearish Bias: Given the current market setup, there's a higher probability of a downside move, particularly if the $60,500 resistance holds. The most likely scenario is a retest of support around $59,000, with a potential dip towards $58,000 if bearish momentum increases.

Rest of the Week

Range-Bound with Downside Risk: Bitcoin is likely to trade within a range of $58,000 to $60,500, with any breakouts dependent on macroeconomic factors, particularly the FOMC minutes. If resistance at $60,500 continues to hold, we might see a further decline towards $57,000, especially if market sentiment remains negative.

Conclusion

The current analysis indicates a bearish sentiment in the Bitcoin market, with a strong resistance around $60,500. Option data reveals high volatility and increased selling pressure, while futures data shows a decline in open interest and funding rates, suggesting a lack of confidence among traders. The technical analysis confirms the challenge in breaking through key resistance levels. Economic events, such as the upcoming FOMC minutes and bond auction, could introduce further volatility. Overall, Bitcoin may face downward pressure in the short term, with potential for further declines if key support levels are breached.

Based on the current analysis of options, futures, and technical indicators, I would rate the market sentiment for Bitcoin at 3 out of 10 (0 extreme bearish vs. 10 extreme bullish) for the next 24 hours. This suggests a moderately bearish outlook, reflecting significant resistance levels, downward pressure, and potential volatility from upcoming economic events.

Fantastic analysis. Thank you!